Catch Everest Group’s Nitish Mittal in this episode of DigitalTransformationTalk who will discuss issues that affect your industry including:

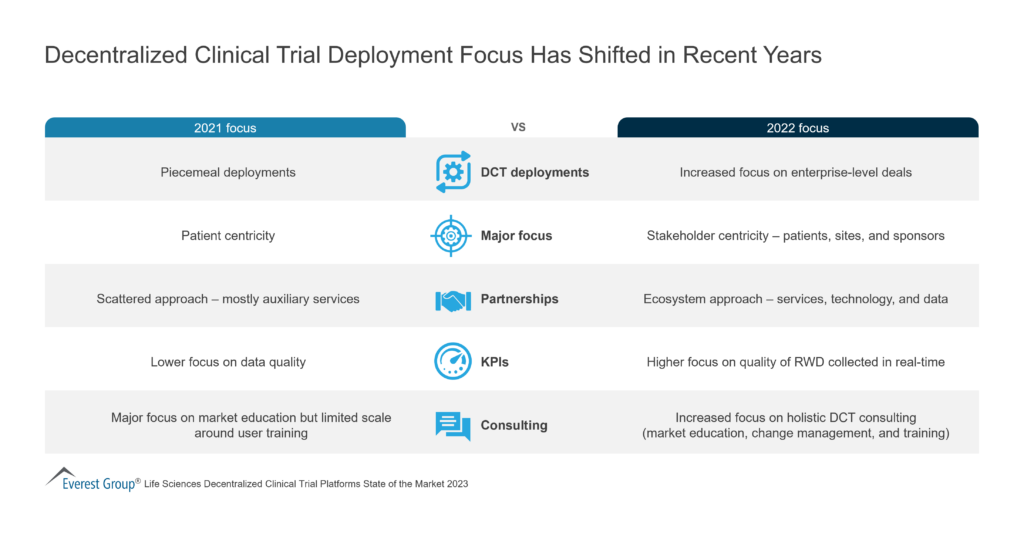

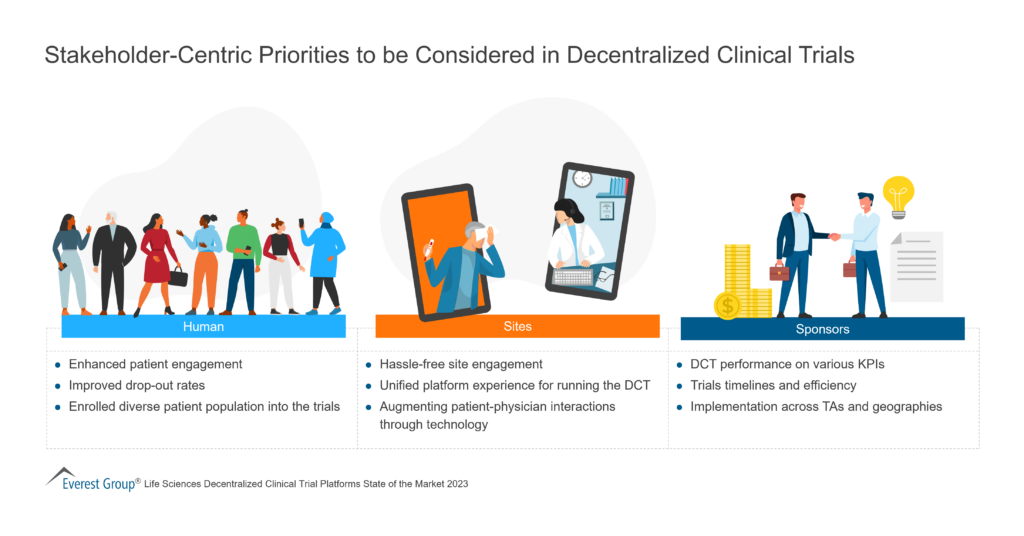

Decentralized Clinical Trial

Decentralized Clinical Trials

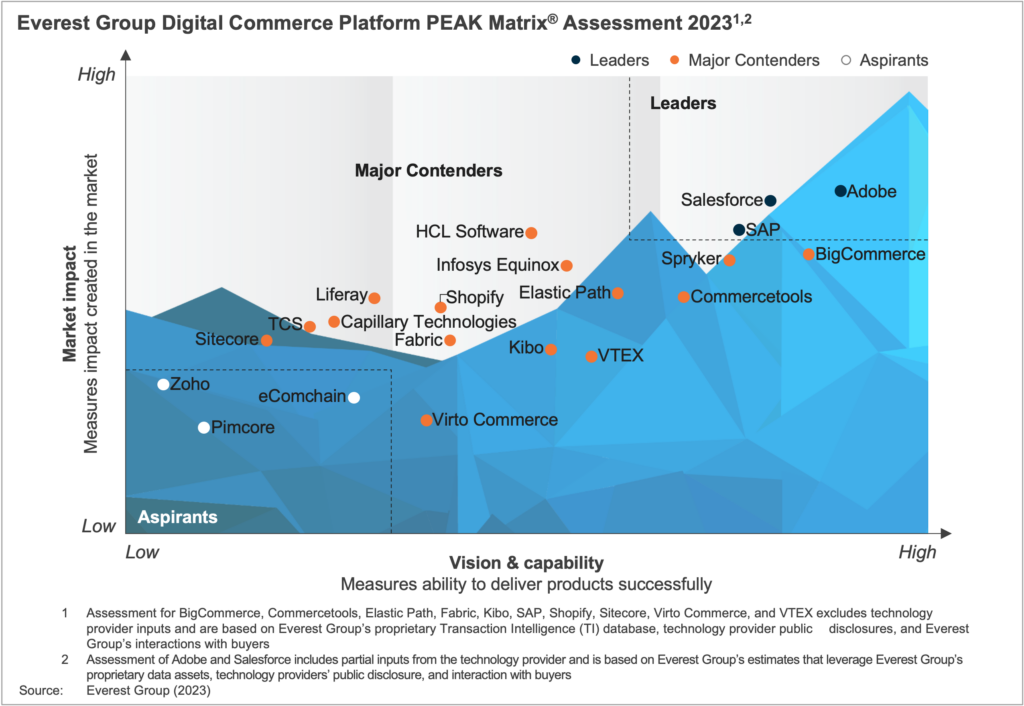

The pandemic caused a massive spike in the demand for digital commerce, especially from small and mid-size enterprises that revamped their online presence strategy. The post-pandemic world continues to experience a rise in this demand. As customer touchpoints increase and customer purchase journeys become more complex, digital commerce platform providers are evolving their offerings to meet evolving enterprise expectations.

Digital commerce platform providers are offering more flexibility and agility to enterprises and supporting key business models on a single platform. This is driven by the shift toward a more composable and modular architecture based on the MACH principles. Furthermore, technology providers are leveraging next-generation technologies, especially generative AI and AR/VR, to solve more complex use cases in the e-commerce value chain and incorporate them into the core of their platform offerings. Thus, to evaluate the overall capabilities of digital commerce platforms, Everest Group provides an in-depth analysis of the leading players.

In this report, we assess 21 technology providers on the Digital Commerce Platform PEAK Matrix® and categorize them as Leaders, Major Contenders, and Aspirants based on their capabilities and offerings. The research will help buyers select the right-fit technology providers for their needs and enable providers to benchmark themselves against each other.

In this report, we:

Scope:

DOWNLOAD THE FULL DIGITAL COMMERCE PLATFORM PEAK MATRIX® ASSESSMENT 2023

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

The global macroeconomic environment has experienced considerable ups and downs. Europe and the UK&I (UK and Ireland), in particular, are facing the trifecta of uncertain economic growth: high inflation, geopolitical tensions, and talent tightness – and these are just a few of the disruptions hitting the region.

Our European expert panelists will discuss how a comprehensive approach focusing on technology, business process, locations strategy, and future operating models can help your organisation navigate this crisis.

The panelists will share emerging best practices from leading organisations that are accelerating through the economic disruption and share guidance on how to plan for the future of sourcing.

Who should join the panel?

• CEOs, CIOs and CTOs

• Leaders across Europe/UK&I

• IT/BPO strategy heads

• IT/BPO department heads

• Heads of outsourcing

• Procurement managers

• Global sourcing managers

• Vendor managers

Related Content

The biggest advocates for information technology transformation can come from inside your organization. Internal IT innovators can spark business growth and evolution. Learn how having employees as innovation champions can benefit your company in this blog.

With companies increasingly relying on IT post-pandemic and through the current macroeconomic headwinds, innovation is vital to continue pushing the business world forward. Having employees as IT innovation advocates can help your company attract talent and optimize efficiency. While it may seem like a big undertaking to tackle, let’s explore how employees can play this important role in organizations.

Leadership alignment and buy-in can inspire innovation and make IT organizations more effective. Technology should enable and act as the catalyst for business objectives – not the end state. Organizational leadership should align on objectives. Executives responsible for IT and digitalization who report to the board and executive committees, such as CIOs and CTOs, should sponsor innovation initiatives.

Implementing contextual metrics for progress is another focus of innovation. Because IT organizations often are viewed as cost centers, they are typically measured on efficiency and policy only. As technology fundamentally enables new business models, organizations need to ensure they are using purpose-led metrics. Everest Group recommends using different metrics based on the objective, such as time to implement systems, improvement in customer onboarding scopes, and automating back-office processes that measure efficiency, and customer experience and new business model innovation that track growth. We believe IT is becoming an enabler for growth, through Systems of Growth thinking, Agile governance also drives innovation in IT organizations. Given the rapid technological change and disruption, IT organizations cannot be static. A cross-functional leadership team should re-examine IT organizations frequently to ensure they remain aligned to their “North Star” and quickly learn from mistakes and course correct.

Innovative-driven IT organizations benefit in three main ways. First, organizations can respond to customer needs faster. More and more, an organization’s ability to use technology determines its success in a fast-changing environment as customer preferences and consumption patterns evolve.

Second, IT innovation improves the ability to attract the right talent. As Gen-Z (and beyond) become the primary workforce that organizations try to attract, they must provide the right tools and infrastructure to make the employee experience a key part of their value proposition. This is also the key to managing attrition and creating belonging in the workplace.

Lastly, IT innovation allows organizations to stay ahead of compliance and security needs. With the ever-evolving regulatory environment, using purpose-built technology can help organizations become resilient and secure. As a result, organizations can avoid brand, reputation, and financial loss.

Creating internal advocates and champions is vital to IT innovation. IT should seek greater feedback from internal and end users to create a distinctive business case. Beyond that, individuals can start promoting IT innovation.

The first way is to speak the language of business. IT enables business growth and innovation — thus, it needs to be referenced in the same context. Framing technology investments as anchored to growth, efficiency, and resilience will enable a wider cross-section of organizational counterparts to understand its impact.

Another avenue to garner support for IT innovation is to regularly report results. IT leaders shouldn’t wait for end-of-year results or budgeting cycles to showcase progress. They should do this quarterly or more frequently, so leaders see the impact and value.

The IT department shouldn’t be an isolated team but instead, plug into a company’s DNA and morph as the company changes. By collaborating with multiple sectors of the company, IT innovation can be built into the organizational framework. This will ensure the IT team is not at odds and can more easily assist their company by continuously adapting to changing markets.

For more information or to discuss how to implement innovation into your IT team, reach out to Nitish Mittal at [email protected].

You can also discover how technology, processes, and business networks will evolve in our webinar, What’s Ahead After a Decade of Digital Transformation?

Access the on-demand webinar, delivered live on October 11, 2022.

In 2013, the term digital transformation gained dominant mindshare across leading companies and has since been a priority for over a decade. The next decade promises to be dramatically different – with exciting new opportunities and critical challenges that enterprises will need to deeply understand, as they rethink their digital transformation strategies.

Join this webinar as our analysts share perspectives on what’s in store for the digital transformation industry and provide recommendations and best practices on how to keep pace with exponential technologies such as web 3.0, metaverse, and quantum computing.

What questions will the webinar answer for the participants?

Who should attend?

Europe and the UK (among other major markets) are increasingly looking at the sovereignty and environmental sustainability of their cloud transformations. Sovereign cloud initiatives have been accelerated by cybersecurity concerns from the Russian invasion of Ukraine and ongoing programs such as GAIA-X and Cloud de confiance in France, while sustainability and the carbon footprint of digital transformation initiatives are now a board-level agenda.

Europe and the UK (among other major markets) are increasingly looking at the sovereignty and environmental sustainability of their cloud transformations. Sovereign cloud initiatives have been accelerated by cybersecurity concerns from the Russian invasion of Ukraine and ongoing programs such as GAIA-X and Cloud de confiance in France, while sustainability and the carbon footprint of digital transformation initiatives are now a board-level agenda.

Based on Everest Group’s close tracking of the Europe and UK technology landscape, this webinar will focus on how organisations in this region are embracing sovereignty and sustainability and the opportunities that exist for technology and service providers.

What questions will the webinar answer for the participants?

Who should attend?

The Ukraine-Russia War has hindered the progress of nations and businesses toward achieving global sustainability goals. Along with its humanitarian and economic consequences, the crisis has altered investment in energy, defense, and autocratic states. Can the enthusiasm the world felt just seven years ago about reaching Sustainable Development Goals (SDGs) be recaptured, and what does the future hold for sustainability enablement service providers? Read on to find out.

The optimism around achieving SDGs, also known as the Global Goals, has waned since its adoption by the United Nations in 2015 with the promise of improving people’s lives and preserving natural resources.

Global sustainability initiatives have been impacted by the Ukraine-Russia War, the pandemic, and supply chain issues. According to the UN, income for about 60% of the global workforce declined during the pandemic. Supply chain issues further exacerbated the economic contraction and humanitarian losses by inflating food and fuel prices.

The war is impacting progress in accomplishing SDGs, directly through its humanitarian and economic consequences, and indirectly through its effect on Environmental, Social, and Governance (ESG) investments.

The following three major challenges have emerged due to changing perceptions about ESG investments in light of this crisis:

The Ukraine-Russia war has slowed down the global energy transition to renewables in two ways:

Increased metal and gas prices slowing renewable technology investment – The region is a leading supplier of “energy transition metals” like nickel, palladium, copper, and lithium. Russia accounts for 7% of the world’s mined nickel and 33% of the world’s mined palladium, which are used in electric vehicle batteries and to reduce automobile emissions, respectively. Ukraine is the largest supplier of noble gases like krypton, which is used in renewable technologies. The war has reduced the already sluggish rate of renewable technology investment by increasing the prices of these metals and gases.

Ramped up coal production and fossil fuel investment – Russia accounts for 17% of the world’s natural gas supply, which is perceived as a transition fuel globally. Before countries develop sustained sources of renewable energy, natural gas is replacing fossil fuels due to its lower carbon emissions. The issue is more pronounced in Europe, as about 80% of Russia’s natural gas is exported to Europe, fulfilling about 40% of Europe’s gas demand. The war has inflated gas prices. Although the US has agreed to supply more gas to the region, this raises the question of sustained gas supply and puts pressure on European governments to accelerate their net-zero strategies. The market is optimistic that Europe will transition to clean energy faster than expected because it needs to become energy self-reliant.

Slow investment in renewable energy has further dipped since 2018. While renewable energy requires patient and risk-tolerant investors, fossil-fuel investment generates considerable returns quickly due to the massive existing hydrocarbon infrastructure. In the war’s wake, fossil fuels are seeing an investment frenzy, with Canada, the US, Norway, Italy, and Japan increasing production. Many countries across Europe again are ramping up coal production to avoid depending on Russian gas. In the short run, it seems that the world has taken steps back on global warming

Before the war, steering away from investing in arms and ammunition was considered prudent and ESG conforming. However, the war has brought back fears of traditional warfare. Now, many nations have started taking a U-turn from this narrative by categorizing defense investment as sustainable for national security and global alliances. Many global defense suppliers’ share prices spiked upward the first day Russia invaded Ukraine.

Many European nations, including Germany, Poland, and Sweden, have announced increases in their defense budgets. SEB Investment Management, a leading asset-management firm in the Nordics, has revised its sustainability policy to allow some of its equities and corporate bonds to be invested in the defense sector. With skepticism associated with traditional warfare restored, investors and governments are bound to pump more money into arms and other defense products.

Investors are facing heightened reputational risks for associating with authoritarian regimes. The boundary between investing in government bonds of an autocratic state and investing in companies conducting business in/with the autocratic states is now blurred for investors. Western investors are striking Russia off their investment list, especially if the investment is ESG-compliant. This can dampen investments in other autocratic states and the businesses associated with them.

The war has temporarily derailed the uptake of renewable energy investments. To start, this will impact enterprises’ Scope 2 emissions reduction goals. Scope 2 emissions are generated from purchased electricity, and reducing these emissions requires enterprises to turn towards renewable electricity sources.

The sustainability enablement technology industry also will experience a short-term supply crunch of semiconductor chips, which is an important input in producing sustainability technologies.

To deal with these choppy waters, organizations will need help from consulting and technology providers to shift their sustainability mix to access net-zero strategies to still achieve their committed targets for global sustainability initiatives.

Moreover, as the sustainability ecosystem matures, forward-looking investments in scaling undertakings such as enhancing trust in data and reporting (avoiding greenwashing claims), scaling operations to accelerate net-zero targets, and creating persistent governance systems will continue to create momentum.

To further discuss global sustainability initiatives, contact [email protected], [email protected], and [email protected]

You can read more about the impacts of Russia’s military action in Ukraine on services jobs and global sourcing in our blog, “Will Ukraine’s Invasion Have a Domino Effect on Other Geopolitical Equations?”

View the event on LinkedIn, which was delivered live on July 21, 2022.

Analyst relations (AR) professionals face daily questions from colleagues and internal stakeholders regarding the RFIs they oversee. Each research firm has its own data collection methods and tools; some overlap, but most aren’t consistent across the board. 🤯

📢 Join this session for a deep dive into Everest Group’s RFI process. Our speakers will highlight upcoming changes, answer questions we often hear from AR, and offer tips on best practices that will ease the stress associated with RFIs in general.

Key questions our speakers will explore:

➡ Why are Everest Group’s RFIs longer and more detailed than other research firms?

➡ Why can’t you use one RFI for multiple studies?

➡ Is there a way to streamline buyer interviews and input?

➡ What are some key best practices for completing Everest Group RFIs?

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields