General Electric and the Harsh Realities of Digital Transformation | Sherpas in Blue Shirts

Last week, General Electric (GE) replaced CEO John Flannery (after just 13 months in the top seat) with former Danaher chief Lawrence Culp, in response to Flannery’s slower-than-expected turnaround efforts.

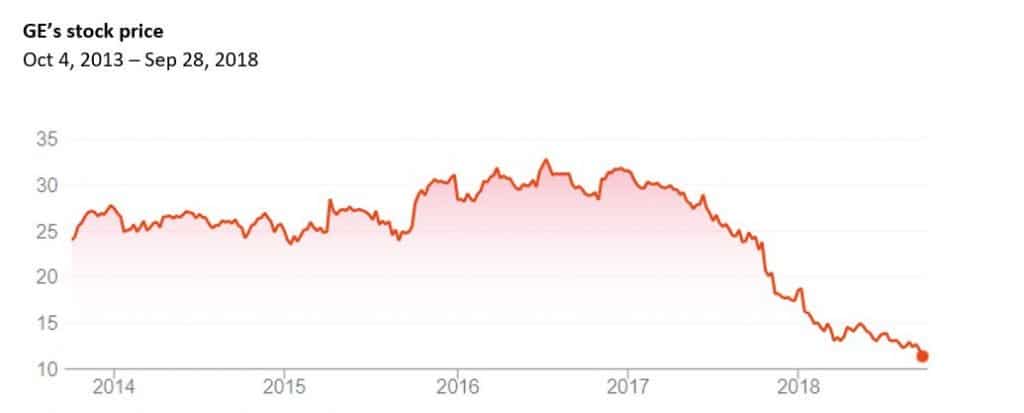

GE has been a lynchpin of the American economic narrative, having pioneered the light bulb and the jet engine. During its vast and distinguished history, it has survived the Great Depression, the dot-com bubble, and the 2008 financial crisis. It was one of the original components of the Dow Jones Industrial Average, and had the longest continuous presence on the index before being removed from the index in June 2018. GE’s shares recently nosedived to fall below the $100 billion market cap threshold, effectively wiping out US$500 billion in value since its peak market cap of ~US$600 billion in August 2000. For such as iconic enterprise, the fall could not have been more dramatic.

How Did We Get Here?

While much of the market commentary has tried to blame GE’s decline on everything from short-sighted leadership (even under the legendary Jack Welch), expensive (and often inexplicable) M&A deals, and poor cash deployment, the truth is that it has suffered from a not-so-uncommon problem… lack of a future-proof digital operating model.

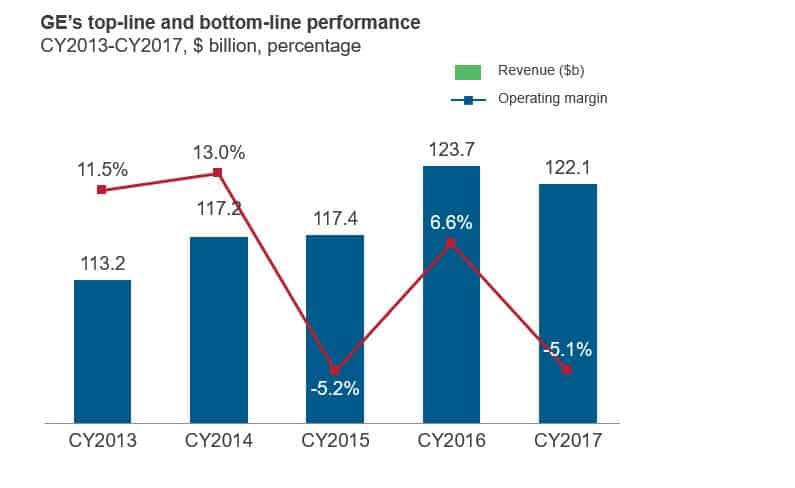

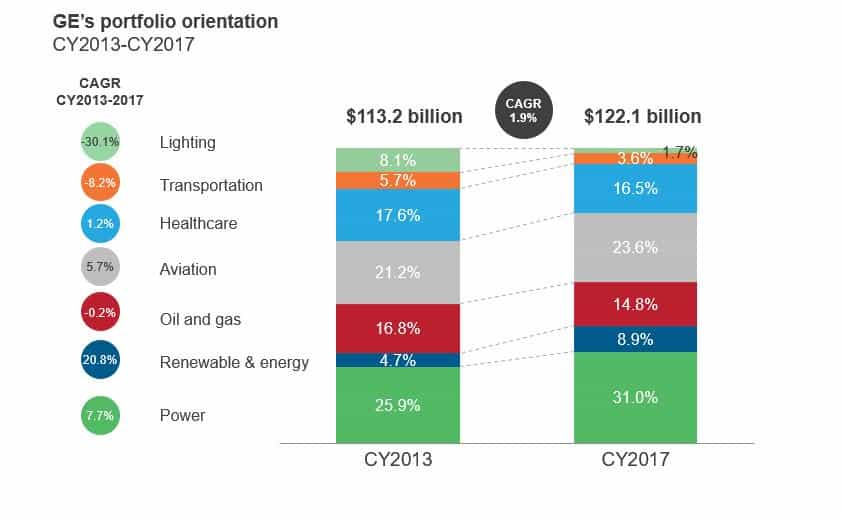

The company has struggled to reorient its portfolio in time, something for which Welch, Immelt, and Flannery were criticized. It has witnessed sluggish growth, despite divesting what it perceives are “non-core” businesses. Over the years, it overpaid for assets in “legacy” businesses – a typical sign of hubris – e.g., its US$9.5 billion acquisition of Alstom, which represented a doubling down on fossil fuels.

A combination of these short-sighted decisions has led to sluggish growth in emerging areas, such as healthcare. Its healthcare unit is now looking to spin out into a separate and independent company by 2019, despite being an important profit center with US$3.4 billion, or 18 percent in profit, in 2017. Essentially, it accounted for 16 percent of GE’s sales, but ~50 percent of its operating profit in 2017, which is a prime example of the misplaced bets GE has made over the years.

This not to say that GE has failed invest in upping its digital game. It has positioned itself as an industrial leader of the digital revolution, with major bets in software players and the Predix industrial IoT platform.

Digital is still a US$4 billion business for GE, but its aspirations seem dramatically cut short. Former CEO Jeff Immelt established the GE Digital business in 2015 as a part of a grand vision to transform the conglomerate into a “digital industrial” company. And yes, invested US$4 billion into the unit. After Immelt’s resignation last year, Flannery has scaled back these ambitions to focus on what it considered the “core” businesses. As of July 2018, GE was reportedly looking to hive off its digital assets, including Predix.

But is GE Alone?

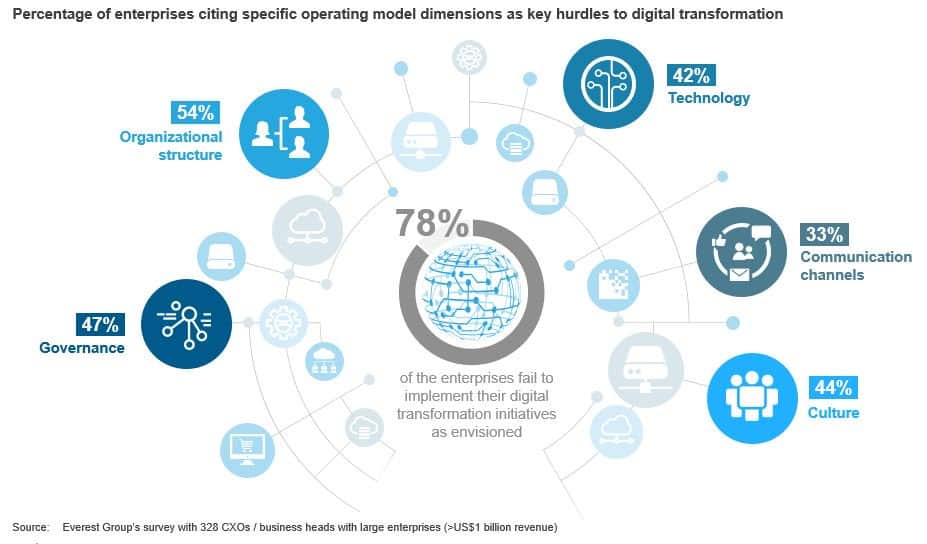

Not really. Our recent research on the evolving digital services market reveals that three in four enterprises have failed to realize sustained returns on their digital investments. Leading enterprise executives singled out the operating model – or lack thereof – as the most important crucial determinant of success in this journey. Amongst various issues, 69 percent of enterprises consider organization structure a barrier while scaling up their digital initiatives.

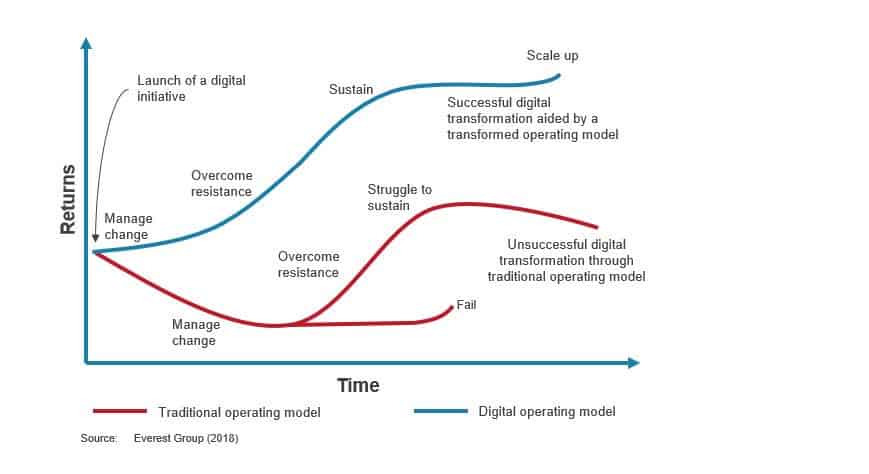

Enterprises that do not meaningfully reimagine their operating models cannot sustain digital transformation initiatives. Most organizations take a half measure by just focusing on digital strategy. If the enterprise operating model is not aligned with the digital strategy and business model, the desired returns from a transformation initiative cannot be achieved.

A Future-Proof Digital Operating Model

Enterprises need to focus on five key areas to evolve their digital operating model and sustain transformation initiatives:

- Organization structure: Leaner organizational structure aligned with the business model and digital strategy

- Organizational culture: Ownership-driven culture with focus toward experimentation to reduce the fear of change

- Communication channels: Decision-making aided by 360° communication involving internal and external stakeholders

- Technology: Broader scope of technology adoption involving the entire value chain

- Governance: Portfolio-based technology investments with aggregate business benefits such as ROI.

Adding F.I.R.E. to Scale

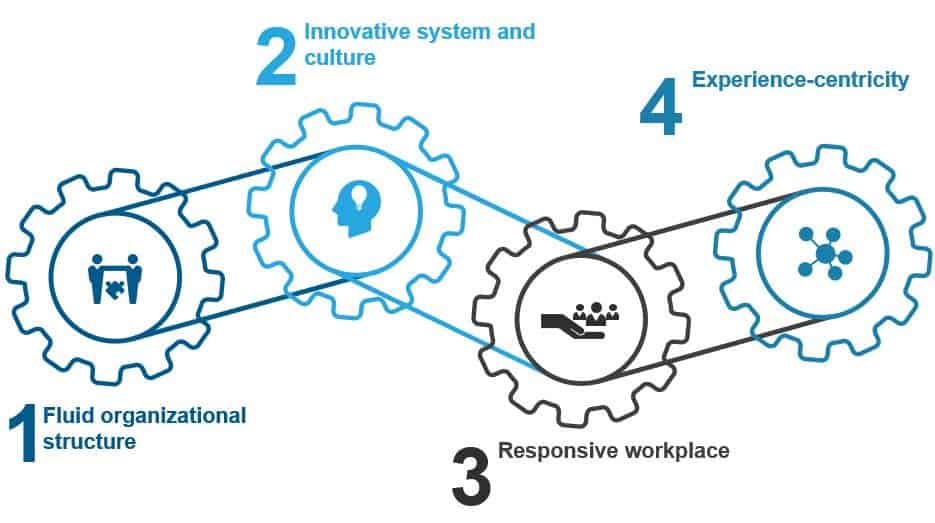

To achieve digital-first success, enterprises should embrace a F.I.R.E. operating model framework that defines a blueprint to scale up their digital initiatives:

- Fluid organizational structure: Simplifying the organizational structure and its processes in selected pockets of the organization that require agility

- Innovative system and culture: Redefining existing processes needs a culture that is driven by innovation and experimentation

- Responsive workplace: Creating a workplace aided by intelligent automation and collaboration practices can act as a foundation for any transformation project

- Experience-centricity: Moving beyond customer-centricity to focus on the experience of the ecosystem.

Related: Learn more about our digital transformation analyses

Enterprises need to stop looking at digital transformation as an end-goal in and of itself. Rather, it’s a means to an end. When undertaken for short-term incentives and playing buzz word bingo, digital initiatives are more often than not doomed for suboptimal returns if not outright failure. Enterprises need to define the objective functions, and work backwards to establish a resilient and nimble operating model in order to stay relevant and thrive.

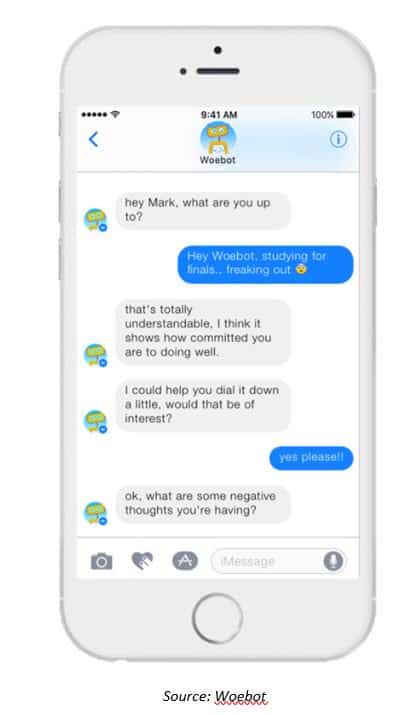

Thus, it’s not surprising that a few players have already begun to delve into this space. Woebot is a software chatbot that delivers a mood management program based on Cognitive Behavior Therapy (CBT). AI luminary Andrew Ng is on the company’s board of directors. Randomized controlled trials at Stanford University have shown that Woebot can help reduce symptoms of depression and anxiety in two weeks.

Thus, it’s not surprising that a few players have already begun to delve into this space. Woebot is a software chatbot that delivers a mood management program based on Cognitive Behavior Therapy (CBT). AI luminary Andrew Ng is on the company’s board of directors. Randomized controlled trials at Stanford University have shown that Woebot can help reduce symptoms of depression and anxiety in two weeks. Another example is Tess, a psychological AI that communicates via text, administers highly personalized psychotherapy, psycho-education, and delivers on-demand health-related reminders, when and where a mental health professional isn’t available. It can hold conversations with the patient through a variety of existing technology-based communications, including SMS, WhatsApp, and web browsers. More recently, Facebook started using AI to help predict when users may be suicidal.

Another example is Tess, a psychological AI that communicates via text, administers highly personalized psychotherapy, psycho-education, and delivers on-demand health-related reminders, when and where a mental health professional isn’t available. It can hold conversations with the patient through a variety of existing technology-based communications, including SMS, WhatsApp, and web browsers. More recently, Facebook started using AI to help predict when users may be suicidal.

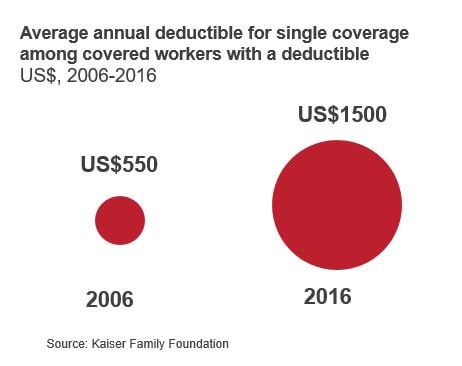

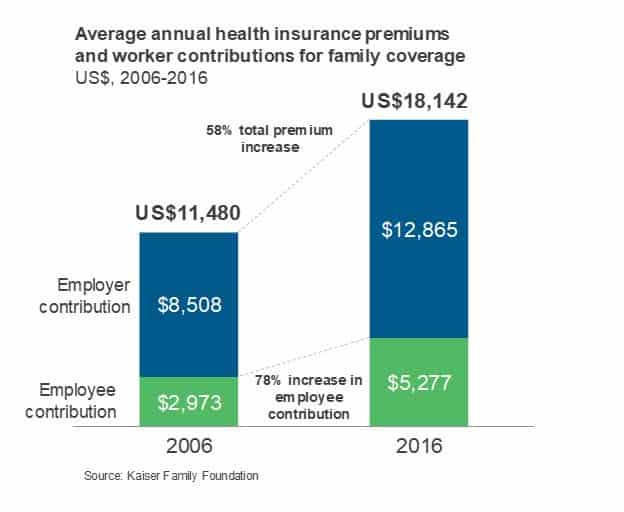

Employers are moving towards programs with narrower networks. And if employees choose to visit a doctor outside the network, they have to spend more out of their own pocket.

Employers are moving towards programs with narrower networks. And if employees choose to visit a doctor outside the network, they have to spend more out of their own pocket.