The Battle over Healthcare: Round One Ends with a Whimper and Uncertainty | Sherpas in Blue Shirts

Healthcare reform has become a political slugfest, casting a spell of ambiguity as the world’s largest healthcare economy attempts to fundamentally transform itself.

Consequently, the global services industry is waiting with baited breath to see how this upheaval pans out. For context, healthcare has been a saving grace, growing at three times the rate of the overall IT-BPO market, which is facing challenging times of its own.

On March 6, Republicans unveiled their plan to repeal the Affordable Care Act, or ACA, popularly known as Obamacare. The ACA, which was signed in March 2010 and came into effect during latter half of 2013, was the most significant regulatory overhaul to expand coverage since the passage of Medicare and Medicaid (Social Security Amendments) in 1965. One of the key highlights of President Trump’s campaign was to repeal and replace the ACA, which he dubbed “broken.” Soon after he took over the Oval Office, he realized that complete overhaul of the law would be a lengthy and complex process, contrary to his promise of quickly instituting a completely new health law. Despite the significant advantage of Republicans controlling both House and Senate, President Trump’s bid to replace the ACA with the American Health Care Act, or AHCA, (essentially a variant of Speaker of the House Paul Ryan’s health plan), failed to see the light of day, with Ryan conceding defeat on March 24.

What went wrong with the American Health Care Act

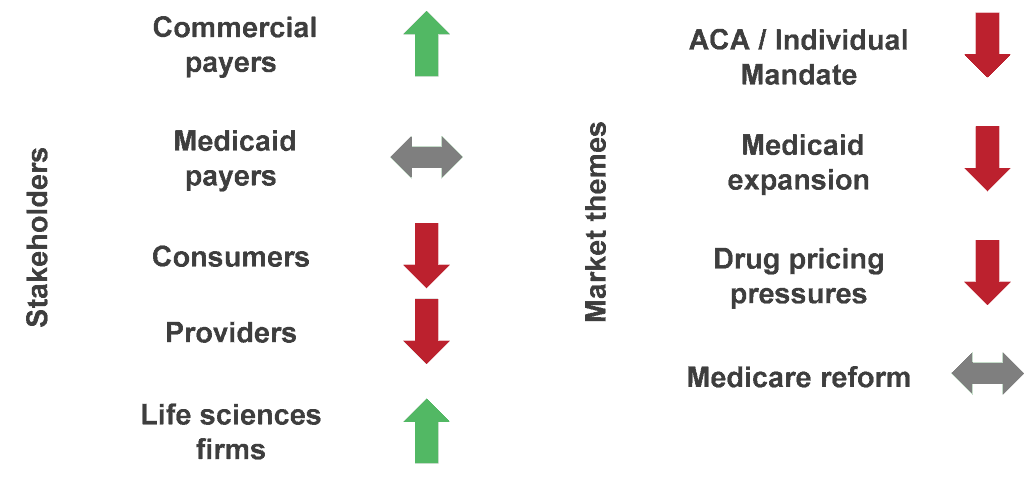

The principal problem with the AHCA was that it was nowhere close to the promised repeal and replacement of the ACA, but essentially a stop gap plan. It was a contentious bill, which lacked widespread appeal. Key stakeholders and their objections included:

- Almost all the large payers (except Anthem) were opposed to this law, as it would significantly reduce their enrollment base and, in turn, impact their top-line

- Healthcare provider associations (such as the AHA, AMA, and American Nurses Association) also opposed AHCA, as it would put extra pressure on providers who are already reeling with bottom-line and revenue problems

- Various consumer groups, including the American Association of Retired Persons (AARP), expressed concerns as the bill was not in favor of the sick and older populations that require healthcare services the most

- Conservative Republican lawmakers (i.e., The Freedom Caucus) dubbed it Obamacare-lite.

The uncertain future for healthcare payers, providers, consumers, and IT-BPO service providers

The currently regulatory limbo has a cascading impact on each stakeholder group.

Healthcare payers

Health insurance companies are left with little clarity on their participation in the healthcare exchanges, which have become value-dilutive, and appear even shakier given the current administration’s disdain of the ACA. Large payers, including such as Aetna, Anthem, Cigna, Humana, and UnitedHealth have threatened to pull out of the exchange markets if the uncertainty is not resolved soon. There are theories that the executive branch could act independently of Congress to improve functionality of the individual insurance exchanges.

Healthcare providers

Failure of passage of the AHCA resulted in an increase in some of the leading hospital networks’ stock prices. This was primarily driven by the fact that the decline in enrollment, especially around Medicaid patients, has been delayed. Most of these hospitals improved their bad debt when their respective states expanded Medicaid, as hospitals became eligible for payments for patients who could not afford healthcare. While providers are relieved right now, uncertainty remains. They have struggled with high operating costs, thin margins, and talent issues, and these are only going to intensify.

Healthcare consumers

With the June deadline for submittal of initial rates for exchange plan fast approaching, some consumers may be left with limited health plan options, as some of large payers are hedging on exchange participation. At the same time, ACA plans have witnessed a resurgence in popularity.

Healthcare IT-BPO service providers

Service providers will have to deal with spending decision delays from both payers and providers as they look towards the new healthcare bill. We have already seen leading vendors face revenue headwinds. For example, Cognizant’s healthcare revenue grew by just a mid-single digit in CY2016 after a stellar performance in CY2015. Any new decisions around outsourcing will most certainly be deferred for now, whereas existing keeping-the-lights-on spend is expected to continue. Deal renewals are expected to be for shorter duration as buyers (both payers and providers) wait for veil of uncertainty to be lifted.

The road ahead for healthcare and global services

After this initial bruising, the Republicans are unlikely to give up without a fight. Speaker Paul Ryan recently mentioned that House Republicans will resume work on healthcare reform, but offered no timeline. This will be easier said than done, as GOP leaders need to overcome the deep divisions that ultimately led to the failure of the bill.

Healthcare policy requires hard work, and rushing through a half-baked plan such as the AHCA just won’t cut it. Obama spent over a year on garnering support for the ACA, and the new administration’s heavy handed attempt reiterates that there are no real shortcuts to the process. The GOP should regroup and take a fresh look at the problem statement.

The outcomes might have even greater implications on the global services market. Until then, buyers are likely to twiddle their thumbs and delay key decisions amidst the tremendous uncertainty.