Current and Future Investment Trends in Clinical Development Platforms | Market Insights™

Clinical Development Platforms

VIEW THE FULL REPORT

Clinical Development Platforms

VIEW THE FULL REPORT

Clinical Value Chain

VIEW THE FULL REPORT

As we approach the end of 2023, a year where uncertainty continued unabated, companies are beginning to think about annual planning, which for many, kicks off months before the year ends. Service providers, in particular, need to consider how the demand for their offerings will evolve in 2024 and where they should focus their time, attention, and investments to best serve this demand.

Watch this on-demand webinar to hear key analyst perspectives on the nature of the services market, what service providers may expect in the upcoming year, and how they can plan ahead.

What questions will the on-demand webinar answer for the participants?

Who should attend?

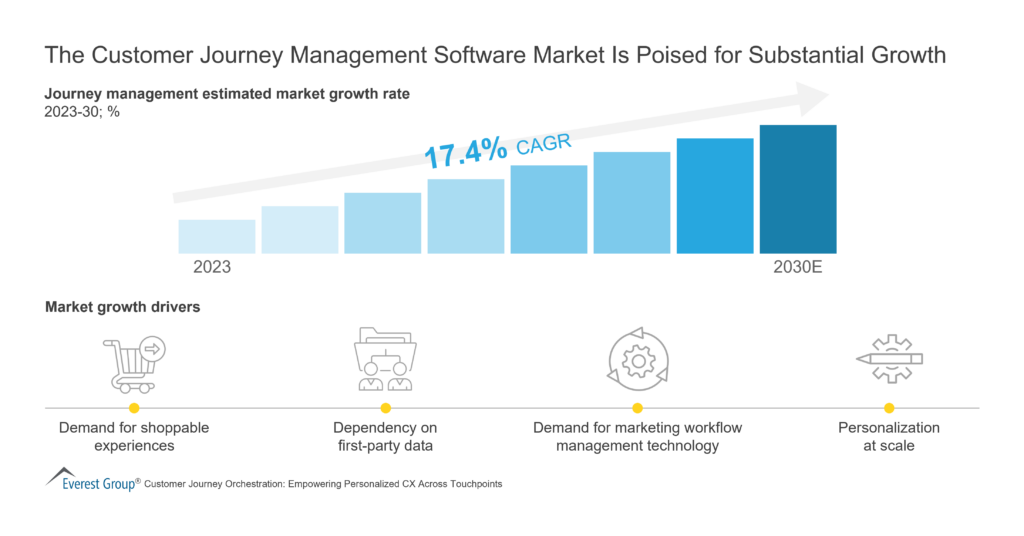

Customer Journey Management Software

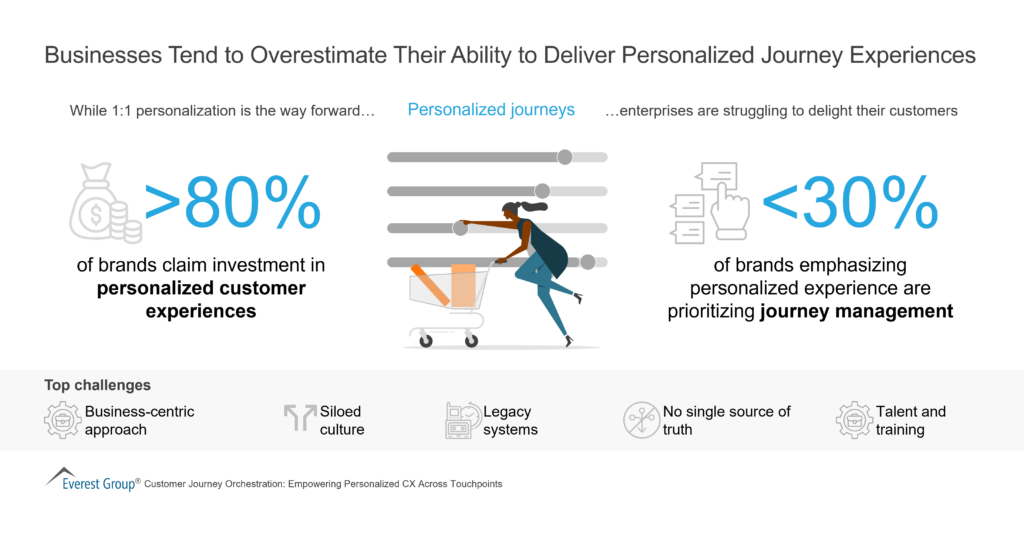

Personalized Journey Experiences

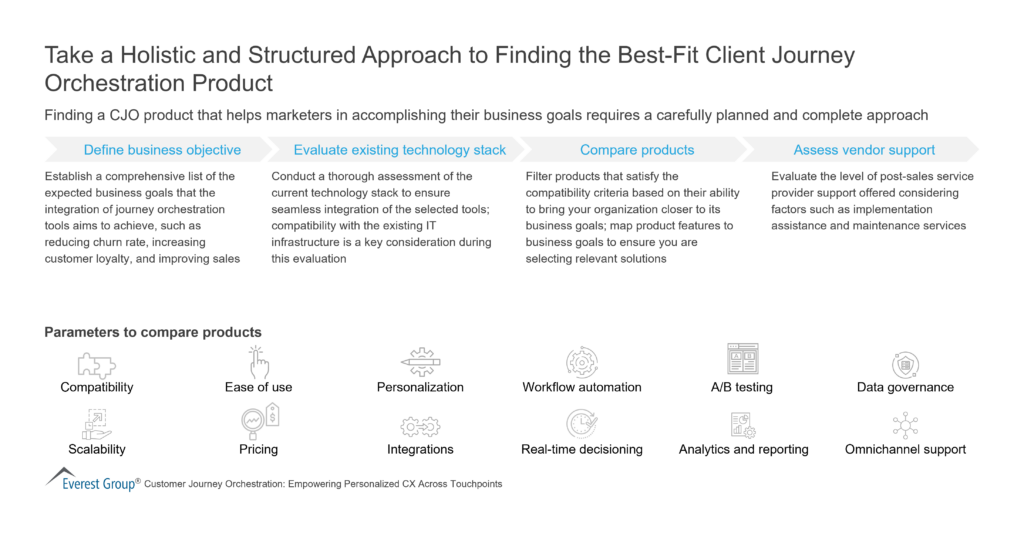

Best-Fit Client Journey Orchestration Product

Digital transformation consulting has become pivotal as enterprises progress on their digital transformation journeys. Enterprises are finding that bringing digital transformation consultants into the initial transformation phases – before digital landscapes become too complex – can significantly increase value and visibility.

Enterprises are more motivated than ever to make strides in their digital transformation efforts, despite the current macroeconomic environment, creating heightened demand and a booming market for digital transformation consulting.

Watch this webinar as our experts present digital transformation consulting market trends and the current landscape. They offer advice to service providers on ways to improve their offerings as enterprises look for end-to-end services.

What questions does the webinar answer for the participants?

Who should attend?

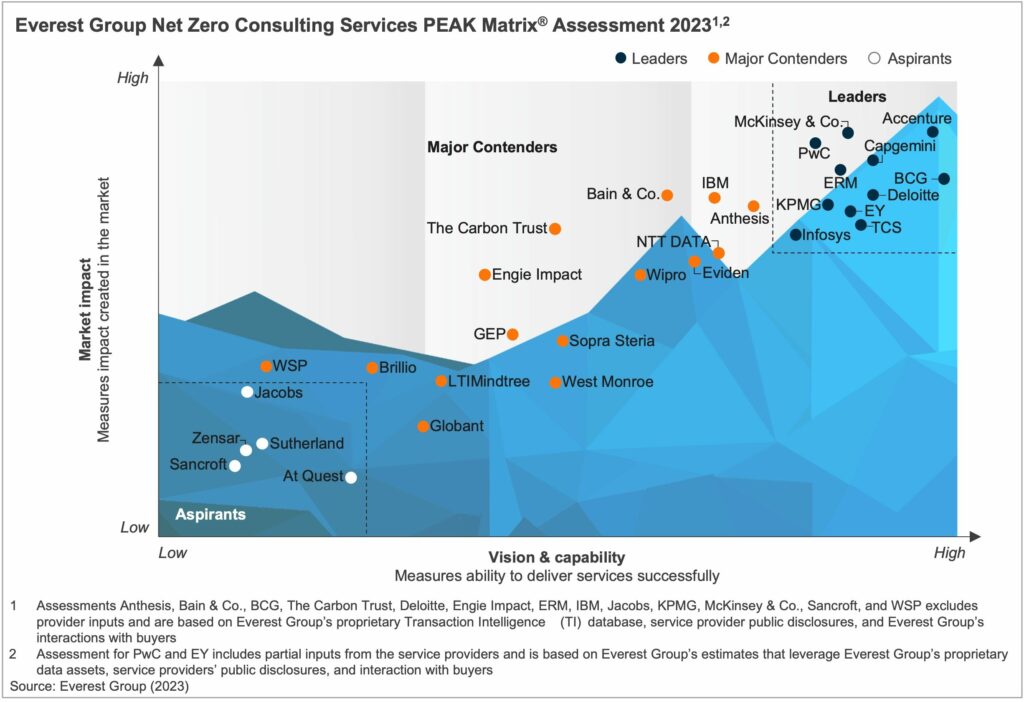

Climate change is the paramount problem of the decade, demanding urgent attention and action. Communities worldwide feel the consequences, such as rising sea levels, extreme weather events, ecological disruptions, and health risks. This underscores the need for immediate and concerted efforts to mitigate and adapt to this unprecedented crisis. In response, enterprises increasingly recognize the importance of embarking on their net-zero journey to address the climate crisis.

However, many enterprises face challenges that hinder their progress, such as limited resources, unclear roadmaps, siloed Environmental, Social, and Governance (ESG) data, and the complexity of transitioning their operations and supply chains to low-carbon alternatives. Additionally, boardrooms are divided between short-term budgetary constraints and long-term net-zero commitments and compliance mandates due to macroeconomic uncertainty and geopolitical tensions.

Net-zero consulting service providers play a vital role in helping enterprises navigate these challenges. They offer innovative data-backed solutions and technologies, such as AI, ML, blockchain, and IoT, to contextualize sustainability and drive maximum value. Furthermore, they assist enterprises in achieving the necessary behavioral shift through change management efforts.

This report captures the current state of the net-zero consulting services market, exploring trends and key drivers shaping the demand-supply dynamics. The report also provides a detailed view of the net-zero consulting capabilities of 31 providers based on their service focus, key Intellectual Property (IP) / solutions, domain investments, and demonstrated market proof points.

In this report, we:

Scope:

All industries and geographies

This assessment is based on Everest Group’s annual RFI process for the calendar year 2023, interactions with leading net-zero consulting service providers, client reference checks, and an ongoing analysis of the sustainability services market

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

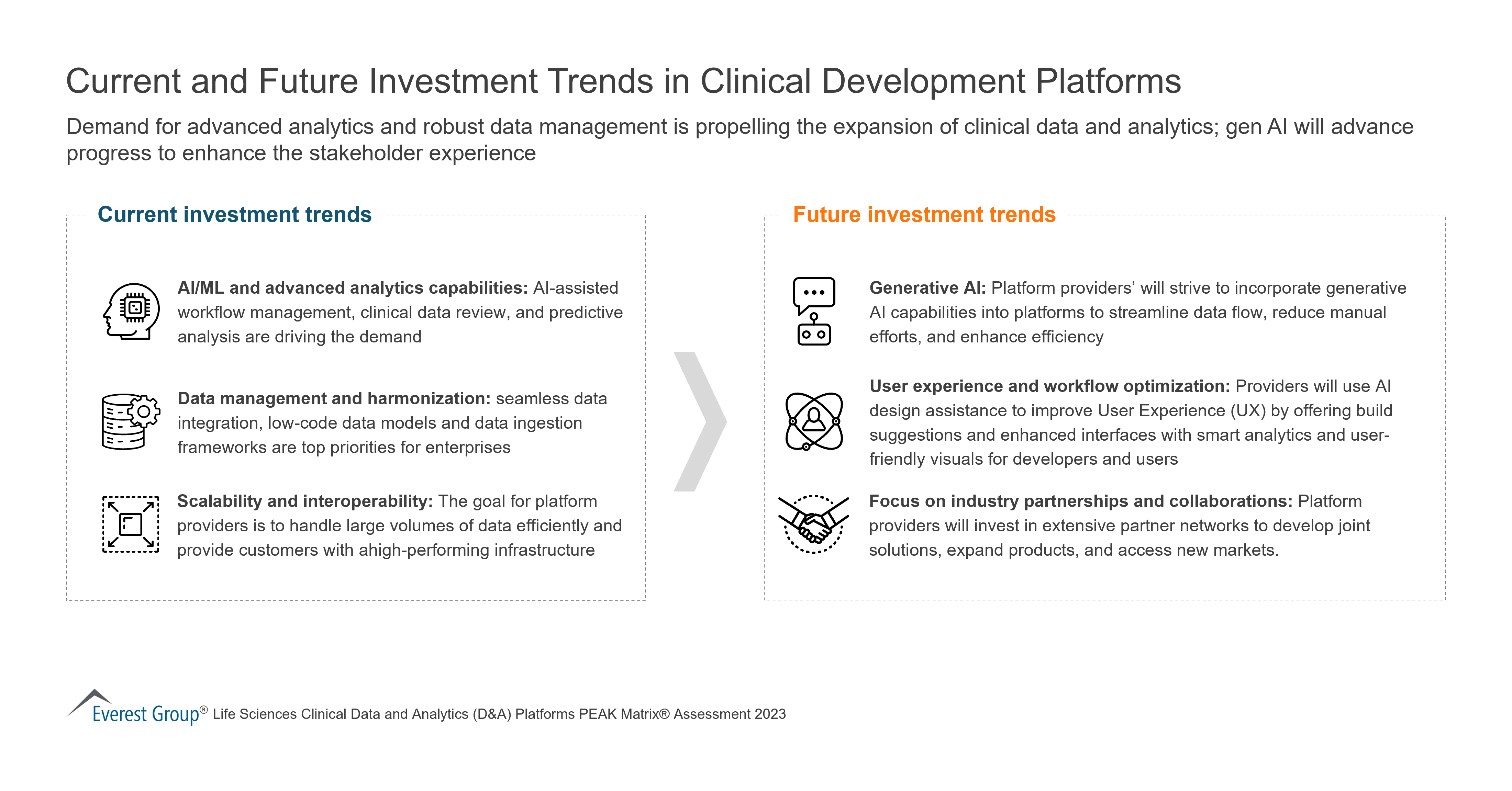

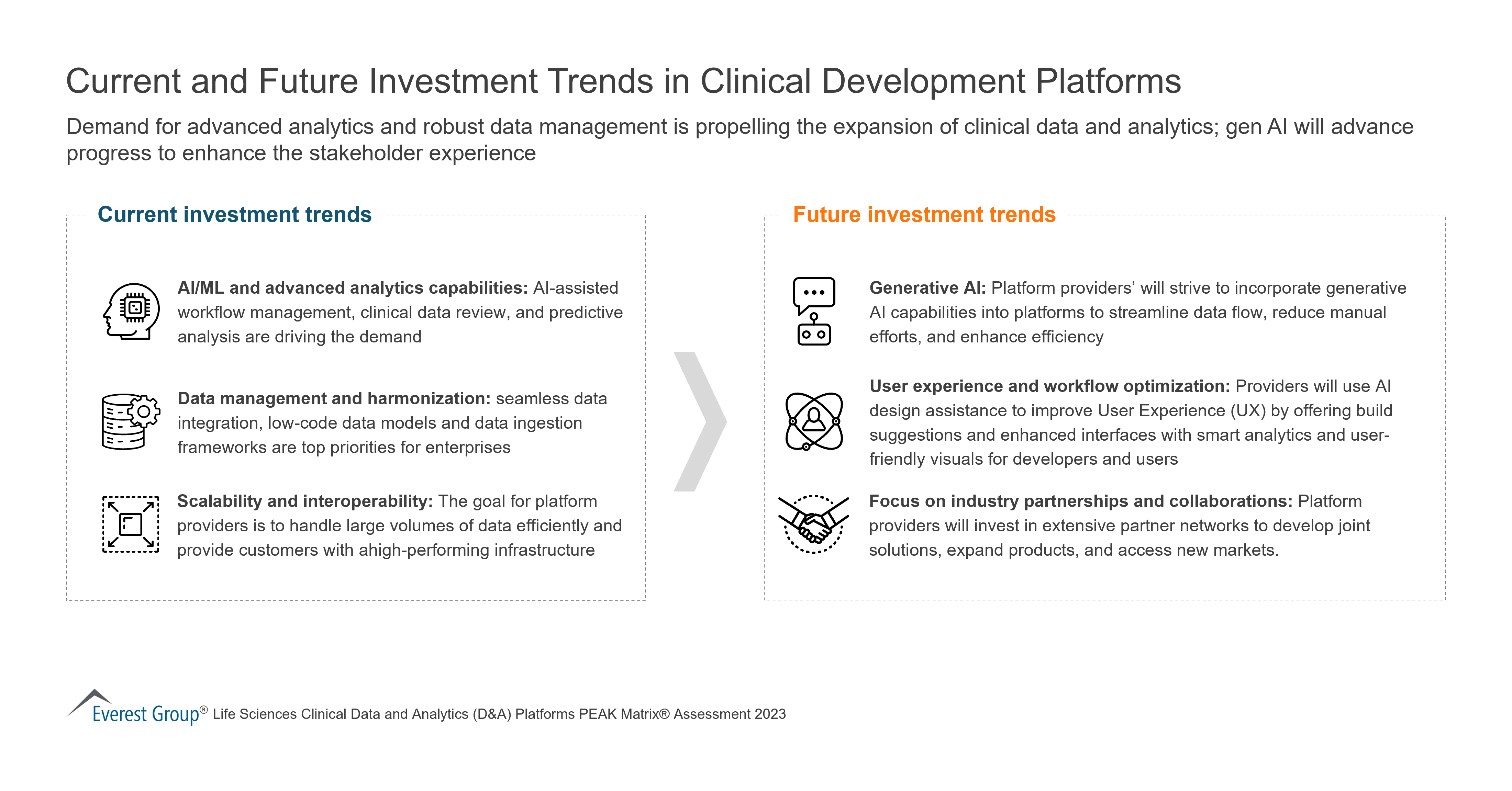

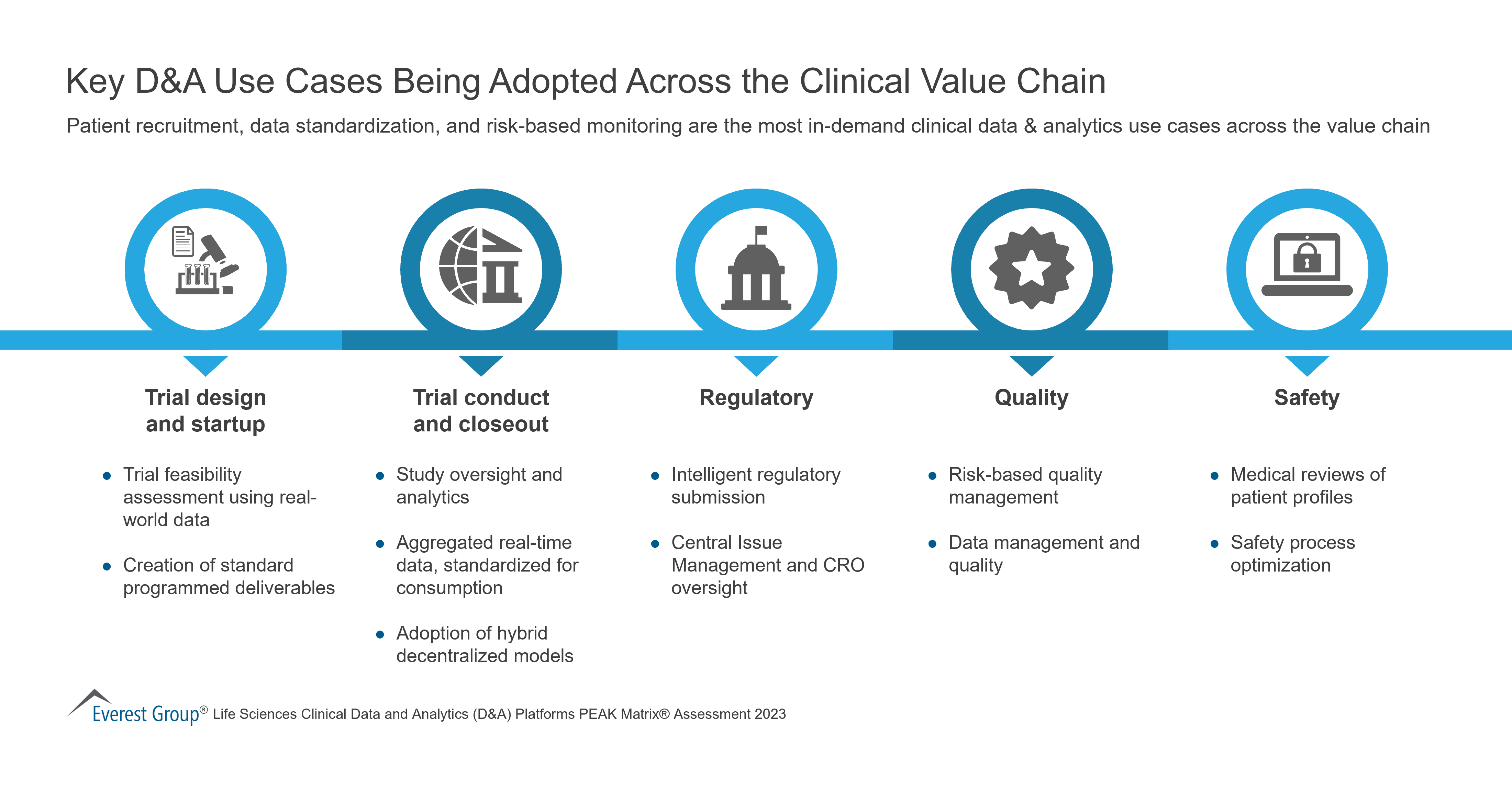

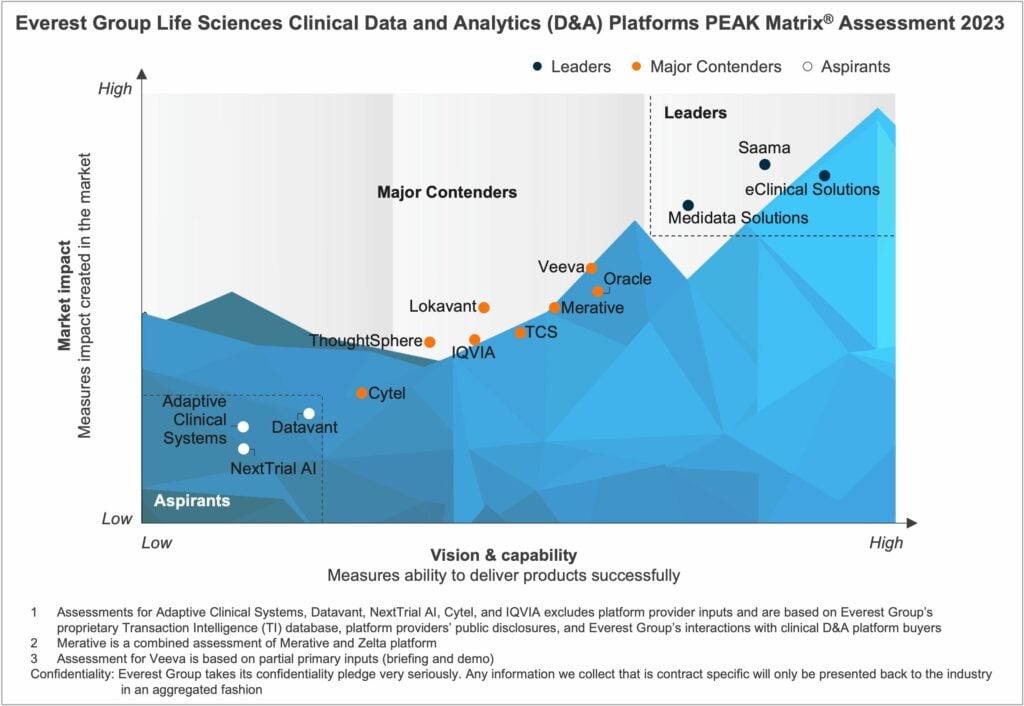

The pandemic accelerated the need to extract value from data as it led to a substantial increase in data generation from various clinical sources, characterized by high veracity, variety, and volume. As a result, there has been a notable surge in the adoption of clinical data and analytics platforms in clinical development. This has sparked considerable interest in assessing their impact on clinical trials, patient care, treatment outcomes, and health system efficiency. Currently, the industry faces a significant challenge in integrating complex clinical data sources, including Electronic Health Records (EHR), Electronic Medical Records (EMR), laboratory data, Clinical Trial Management Systems (CTMS), connected devices, and Real-world Data (RWD).

Clinical data and analytics platforms offer significant benefits in the realm of clinical development. These platforms enhance data management by facilitating centralized and standardized data collection from various sources, resulting in improved data quality and integrity. Real-time monitoring capabilities enable stakeholders to track trial progress, identify potential issues, and make informed decisions promptly. Advanced analytics tools help uncover patterns, trends, and correlations within the data, providing valuable insights for optimizing trial protocols and treatment strategies.

In this report, we assess 14 clinical Data and Analytics (D&A) platform providers. The providers are positioned on Everest Group’s PEAK Matrix®, a composite index of a range of distinct metrics related to the providers’ capabilities and market impact. The study will enable buyers to choose the best-fit provider based on their sourcing considerations, while providers will be able to benchmark their performance against each other.

In this report, we:

Scope:

Industry: life sciences

Geography: global

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

Generative AI (GAI) technology has been around for nearly half a century. But recent developments in the maturity of AI models, faster computation power of systems, and availability of high-quality training data are redefining the technology in 2023.

While tech giants like Microsoft, Google, and Meta fight to dominate the GAI landscape, leading experience providers like Adobe, Salesforce, and Oracle are entering the market with significant investments.

In this on-demand webinar, Everest Group’s experts will highlight the use cases and potential of GAI technology in crafting experiences, its limitations and risks in terms of full-fledged commercial adoption, and the industry’s predicted response.

Our speakers discuss:

Who should attend?

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields