GBS Change Management Strategies: Lessons Learned from 60 Leading GBS Organizations | Blog

Change management is viewed as critical by 75% of GBS organizations, but only 16% manage change as an essential component of GBS initiatives, a new Everest Group study found. Read on to learn best practices and key findings from this first-of-its-kind change management research.

Insights can also be found in our webinar, Why GBS Change Management is the Key to Added Value and ROI, as Everest Group experts discuss effective change management practices gathered from the research.

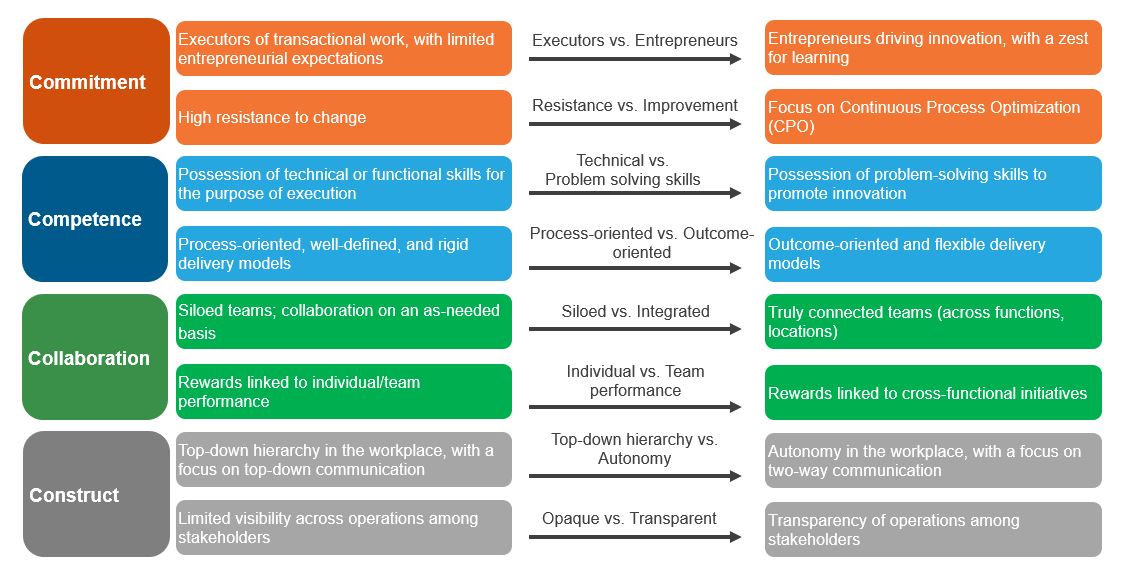

Change management is essential for any Global Business Services (GBS) organization, yet it is also one of the more challenging feats to grasp and implement. Change for GBS is a constant occurrence, whether it’s new technology adoption, stakeholder gains and losses, or evolving roles within the enterprise.

Strategic and systematic change management gives GBS organizations more control over transformation projects of all sizes. It allows for adaptation and the opportunity to discover where more value and return on investment can be found.

In this first-of-its-kind research, Everest Group surveyed 60 leading GBS organizations across the globe and conducted in-depth interviews to better understand change management strategies within GBS organizations. The results of this study are in our report, State of Play in GBS Change Management, which provides an analysis on what GBS organizations across the globe are doing today and the steps to achieve an end-to-end change management model.

How do GBS organizations carry out change management strategies today?

From the study, we discovered that one-third of the respondents don’t have a change management model in place; however, 75% of GBS organizations see change management as critical. Watch our latest LinkedIn Live Conversations with Leaders series based on this research where GBS experts from various organizations joined our analysts to define effective change management.

Currently, change management is not part of the strategic GBS design. GBS organizations typically wait for a transition or change that needs to be communicated, and then react and invest in change management at some level rather than proactively setting up processes.

In many cases, change management is deployed within transformation projects, with roles often divvied up between a mix of sourced and in-house staff rather than being adopted from the top and then applied throughout the organization. Organizations need a thorough method to test change management from project to project, and then alter or build on it to make the model more efficient.

Where does change management show up the most?

The research showed that larger, older GBS organizations tend to invest more substantially and systematically in change management. Mature global organizations with greater scope and evolved delivery operations are more likely to prioritize change management, include it in planning stages, and have more dedicated responsibilities and capabilities.

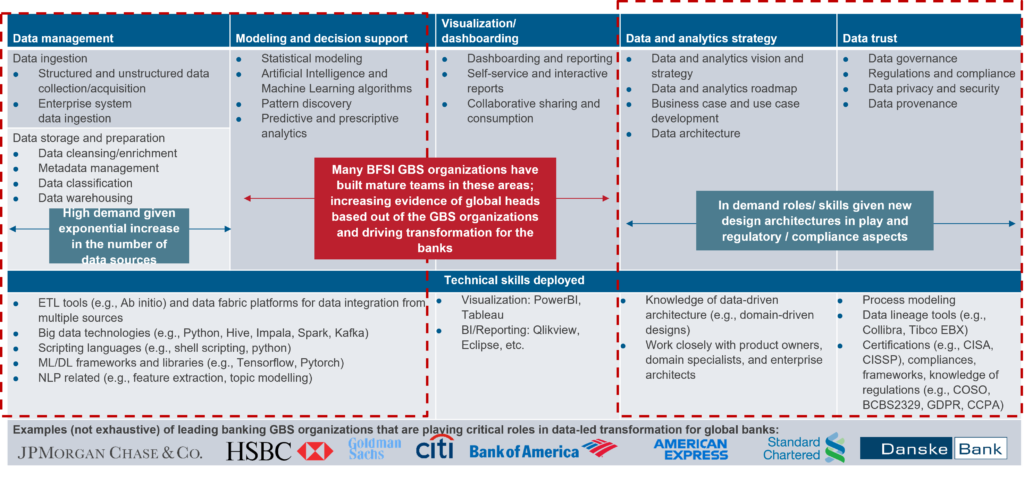

The study revealed that most change management is embedded in projects that revolve around digital transformation efforts, such as transitioning to a new delivery model or moving to end-to-end processes. GBS organizations that embrace digitization at greater rates tend to realize the importance of change management. Seventy percent of organizations that are moving to digital are also advancing their change management approaches.

Geographically, 40% of GBS organizations in Europe view change management as having more of a strategic role in transformation, compared to 30% in North America. By segment, banking financial services (BFS) and life sciences GBS organizations incorporate change management in business transformation. However, consumer packaged goods (CPG) and 75% of manufacturing GBS organizations still consider it a communications function.

How can GBS organizations address change management?

Moving to a GBS platform creates substantial change and can impact processes, policies, technology, and even relationships. Based on our research, we recommend the following five best practices for GBS organizations to map and evolve their change management models:

Embed it from the start: One of the most significant takeaways for successful change management implementation is adding it into processes from the start and making it part of everything a GBS organization does. This helps to define roles, structure the roadmap, and determine how to measure project outcomes.

It doesn’t stop: Change management is not a one-time instance. For a strategy to garner real value and incorporate lessons learned, change management should be considered an ongoing journey for the organization and its employees. A change management framework must be consistent and tailored to the enterprise.

All hands on deck: When managed at or near the top of the organization, change management becomes a higher priority that is consistent across all change management projects. A top-down management strategy with buy-in from internal GBS teams helps to embed change management into the entire organization and negate any resistance from teams. Almost 50% of respondents said getting the internal team on board was a critical success factor.

Invest in roles and careers: GBS organizations must consider whether involving contractors or those in outsourcing roles will ultimately help or hurt the process. Cross-training and rotating team members through a change process is a very effective way to get the right team in place and break down internal resistance. To instill a regular change management model, GBS can set up a fixed set of roles that serve as pillars and variable roles for when the function has shifted. Further, to attract and retain these talent resources, establishing career paths so talent will see a future in the role and stay with the organization is essential.

Change is more than communication: GBS organizations also should understand that the buck doesn’t stop at communicating change to the enterprise. Communication is a necessary and important step, but it’s just a piece of a comprehensive change management strategy.

Where is your GBS organization on its change management journey?

To begin the change management journey, it’s important for organizations to know their starting point. From the interview responses, we identified the following four personas to set GBS organizations on the right path as they structure their change management strategy:

- Headshakers are yet to establish any change management competency

- Crawlers are slowly moving in the right direction

- Game changers view change management as a necessity and are aggressively pursuing it

- Institutionalists firmly believe in and have invested in a GBS change management program

What’s the impact of change management?

GBS organizations that don’t have a change management model, or are reactively deploying change management, could ultimately lose money and incur costs when projects are delayed or benefits are realized slower.

GBS organizations must go beyond merely communicating change to developing a managed program that considers stakeholders, capabilities, and the full impact from strategy to execution. Change management should be regarded as an investment with a clear ROI.

GBS organizations are successful based on how they respond to their stakeholders, and effective change management allows GBS to meet the enterprise at any turn.

To view our change management persona diagram and determine where you are on the change management journey, and learn the 12 steps to develop a dedicated program, download the full report: State of Play in GBS Change Management.

To discuss change management strategies further or ask questions, reach out to Rohitashwa Aggarwal at [email protected]. And don’t miss our upcoming webinar, Why GBS Change Management is the Key to Added Value and ROI, for direct insights from this study into change management strategies from GBS practitioners.