Seven Key Global Services Market Developments in 2019 and the Outlook for 2020 | Blog

The global services industry saw a dramatic shift in 2019 across multiple dimensions, described in detail in our Market Vista™ Annual Report, which is based on an assessment of 1,800+ annual outsourcing deals, 550+ new delivery center setups, GIC market activity, trends in digital adoption, and other developments across 30 leading service providers.

Our research identified seven key global services market developments in 2019.

- After a significant uptick in 2018, the number of outsourcing deals declined marginally in 2019, primarily driven by a decrease in IT outsourcing. Business Process Outsourcing (BPO) deals grew.

- Short-term deals rose as a percentage of overall deals, driven by growth in outsourcing among small companies, an increasing share of digital services-focused deals, and global uncertainty resulting in apprehensions among buyers who are now signing smaller contracts.

- Global Business Services (GBS) center setups hit an all-time high, driven largely by an increase in setups by small and mid-sized enterprises. We also saw a lot of activity in R&D/engineering center setups.

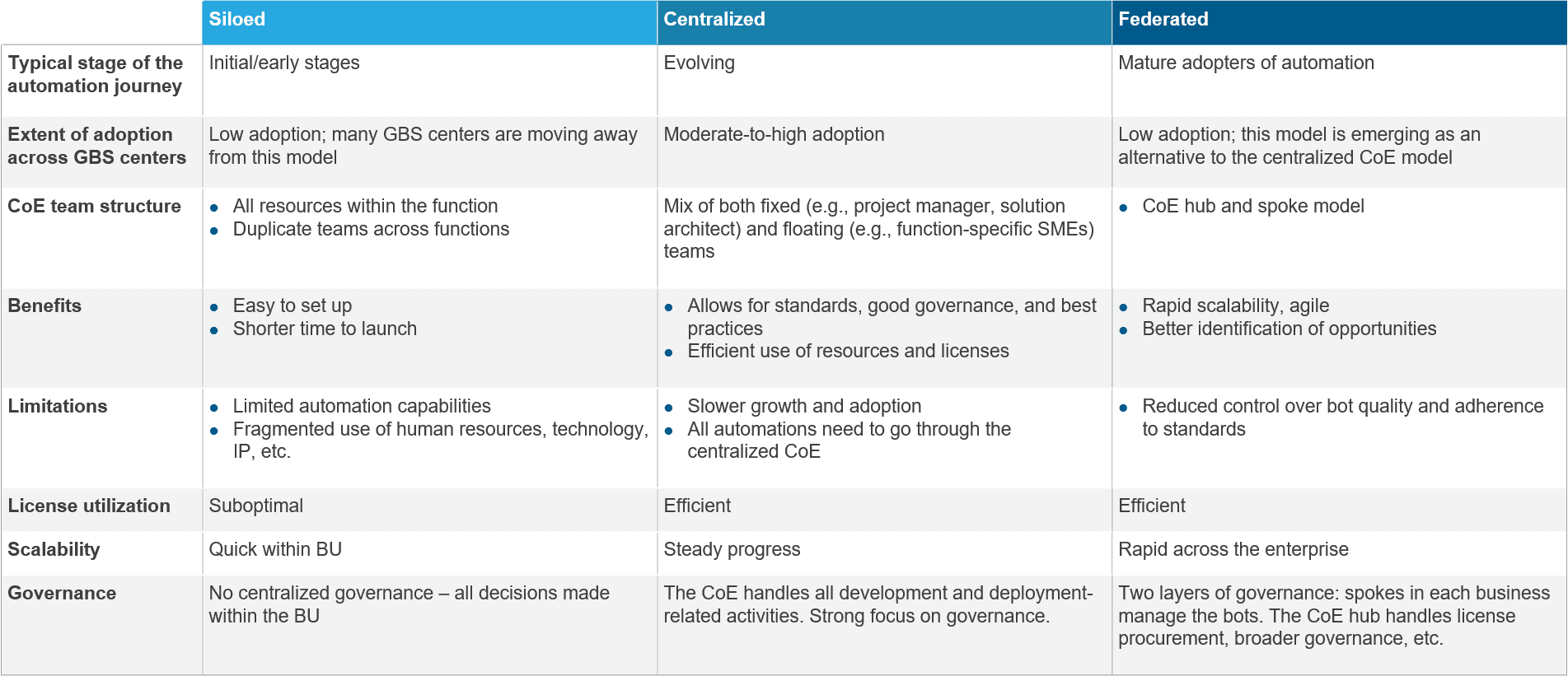

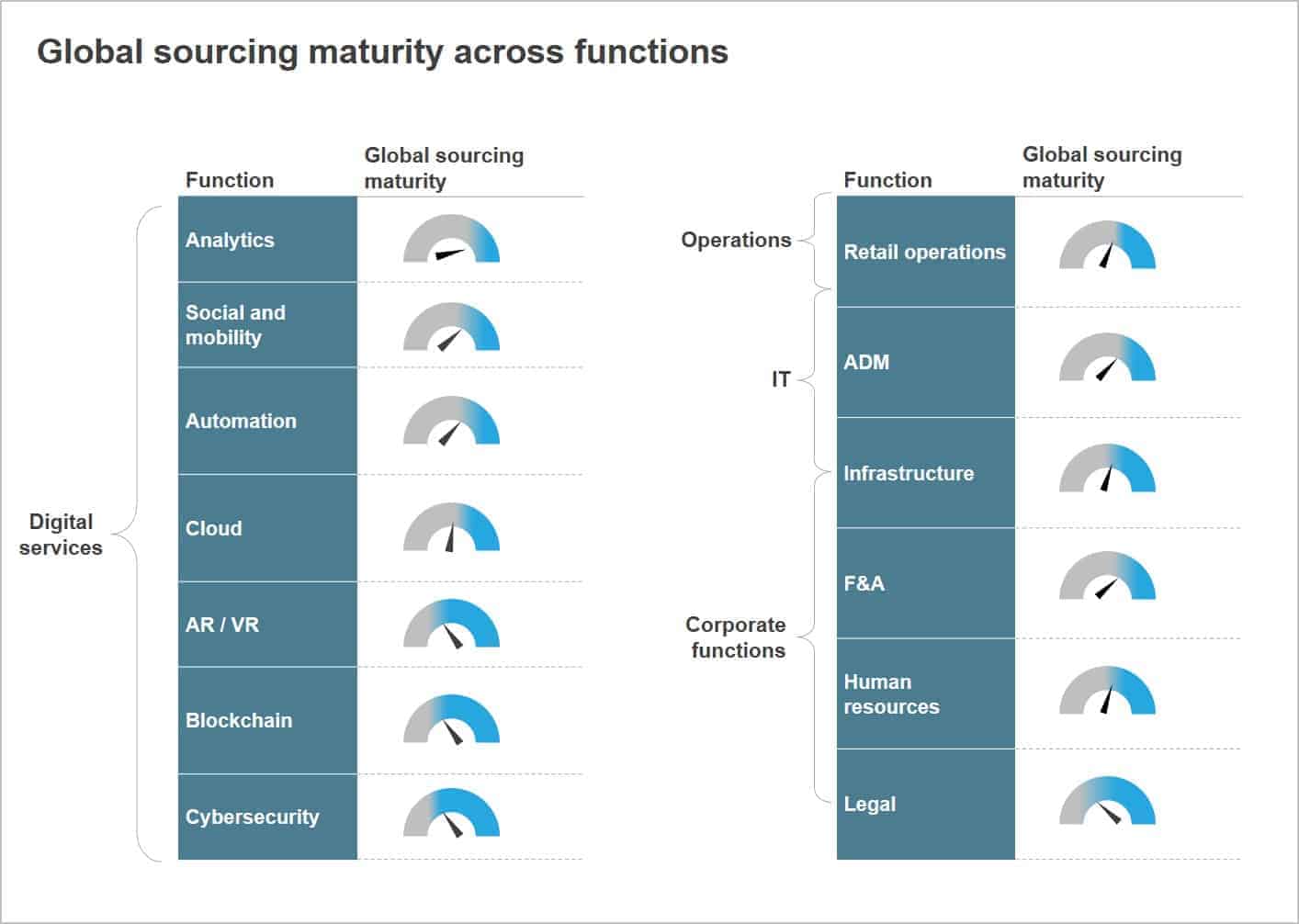

- The share of digital-focused outsourcing deals far exceeded pure traditional services deals, with strong demand for cloud and automation services. GBS center set-up activity was also driven by digital services with automation, analytics, and IoT being the most dominant.

- We saw an increase in onshore delivery center set-ups by both enterprises and service providers. While the Asia Pacific region continues to lead in offshore and nearshore location activity, the Middle East and Africa saw significant activity growth.

- Tier-2/3 locations experienced rising activity, as both GBS centers and service providers increasingly explore smaller cities, especially in mature markets.

- Offshore-heritage service providers saw higher revenue and employee headcount growth than did global service providers.

Turning our attention from the past to the future, let’s take a look at what these shifts may mean for the global services industry – and your organization – in 2020.

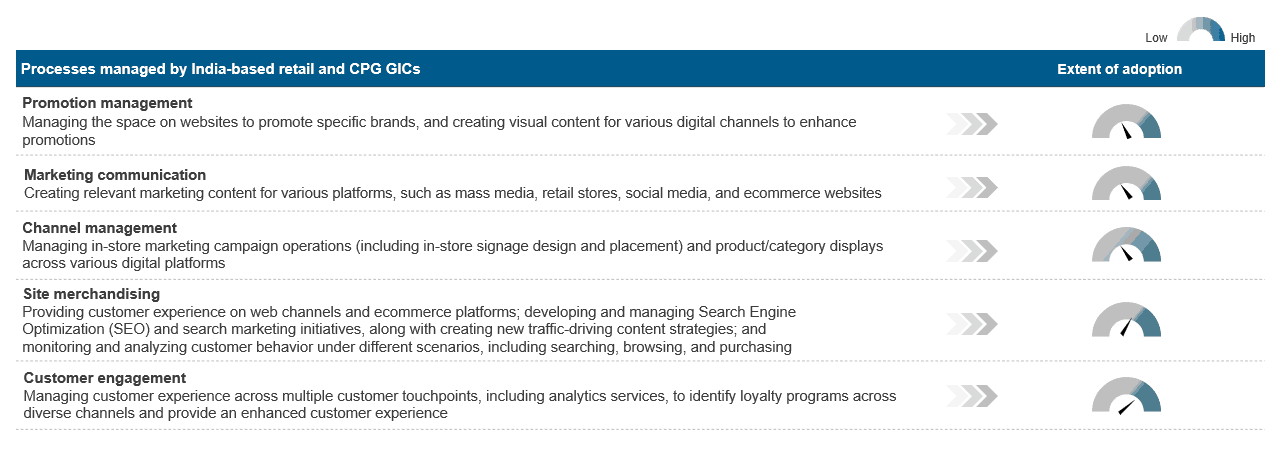

- Uncertainty will rule in 2020 driven by environmental changes, geopolitical and macroeconomic concerns, business model disruptions, rapidly emerging technologies, and, most importantly, the impact of COVID-19. This uncertainty will require organizations to be increasingly agile in order to be able to respond quickly to changes. Driving agility will require a comprehensive shift across multiple dimensions, such as organization culture and people strategy, and a deliberate change to operating models.

- The economic slowdown caused by COVID-19 disruptions will have multiple implications for the global sourcing industry:

- Weakening financial performance resulting in significant cost pressures across organizations. Rapid and radical cost takeout will become a top priority for enterprises.

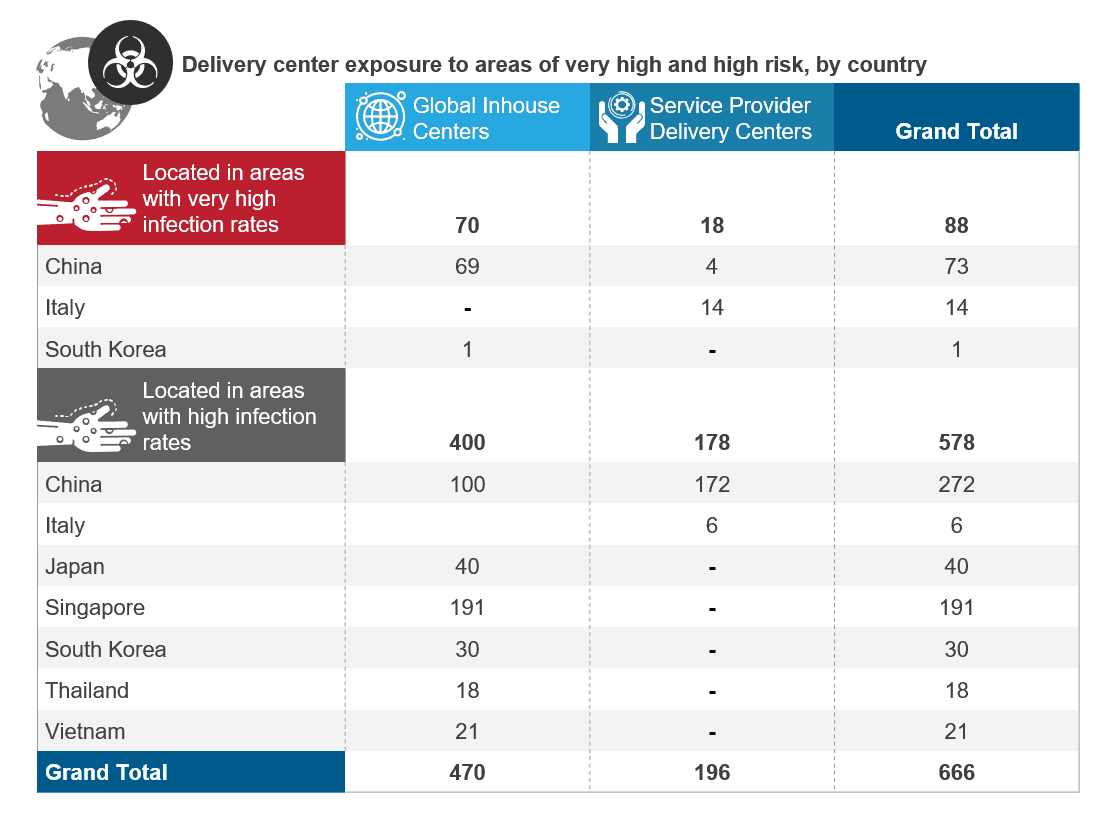

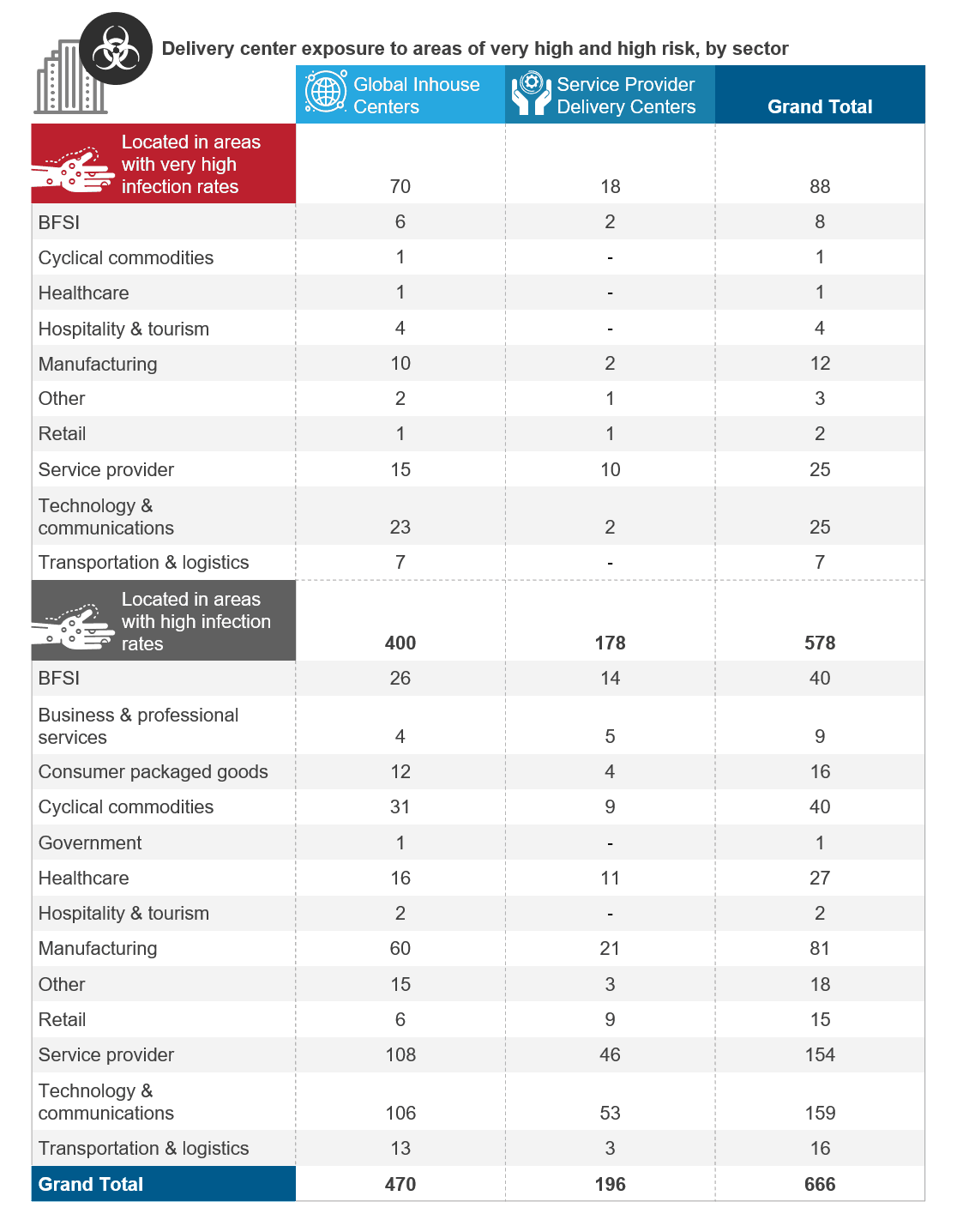

- A new focus on risk, which will force enterprises to reassess their global sourcing strategies and service provider portfolios.

- Accelerated technology adoption to unlock the next wave of cost savings and drive resiliency.

- An evolving role for GBS to provide higher value-add services to help mitigate the impact of recession. Simultaneously, financial pressures will result in divestitures of GBS centers that operate as a typical service provider.

- The global services market outlook remains uncertain across locations, driven by global macroeconomic and geopolitical concerns and the COVID-19-caused slowdown.

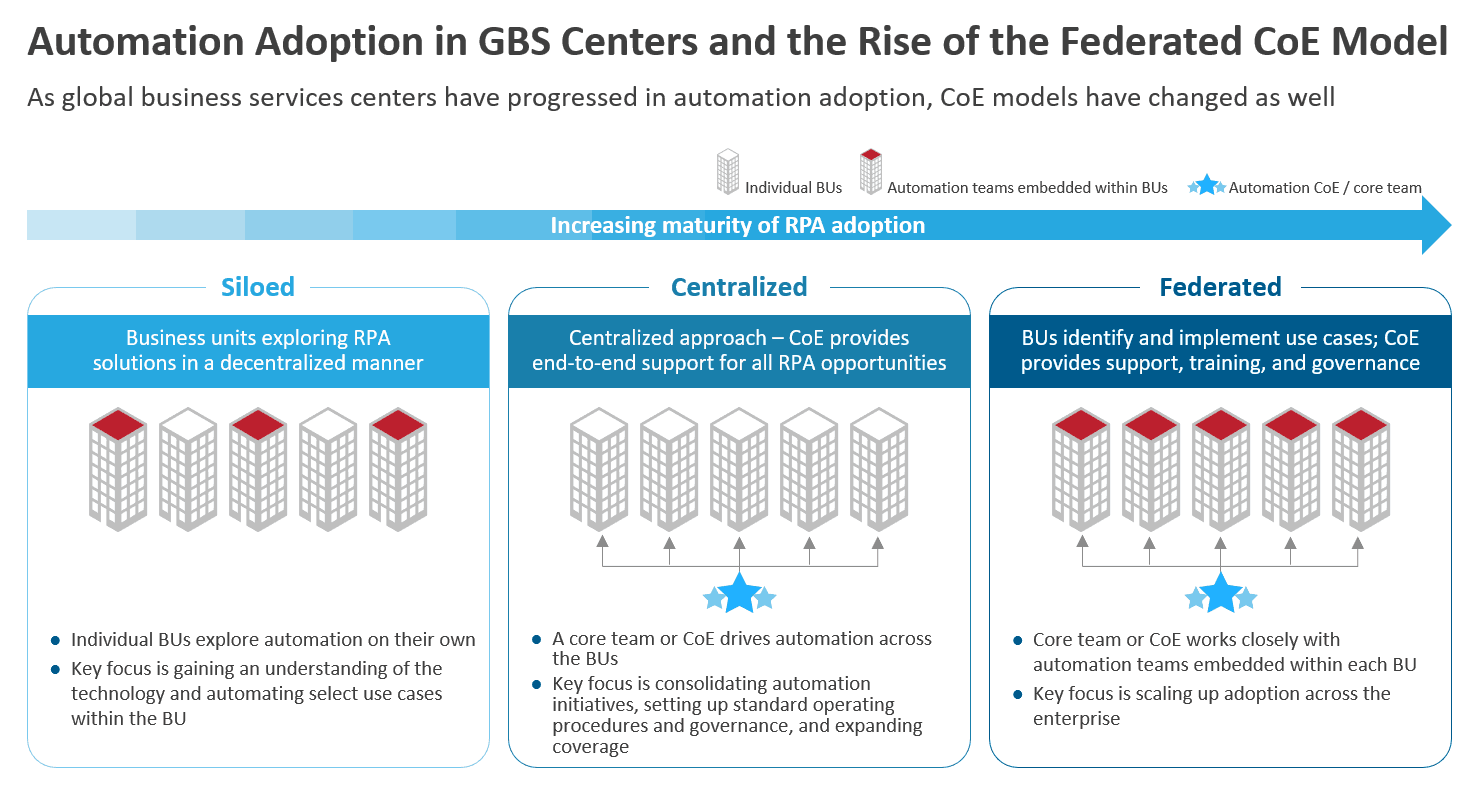

- The Center of Excellence (CoE) model will grow within GBS centers as they focus intentionally on building depth versus merely expanding breadth of services. Further, CoEs will act as powerful enablers to revise and execute the required shift in the GBS-parent relationship and help blur the boundaries between the parent and GBS.

- As organizations increasingly realize the benefits of various strategies such as offshoring, cost optimization, and automation, they will need to boost their focus on workforce productivity. There are multiple levers organizations can pull to enhance workforce productivity, such as optimizing active time, increasing efficiency, and improving effectiveness/quality.

- Customer experience is a key priority for both enterprises and service providers, and they plan to invest in technologies and capabilities to improve customer experience, even during the economic downturn.

For more details on these developments and the 2020 outlook – and to understand the implications for your organization – please see our report Market Vista™: 2019 Year in Review and Outlook for 2020.