January 28, 2019

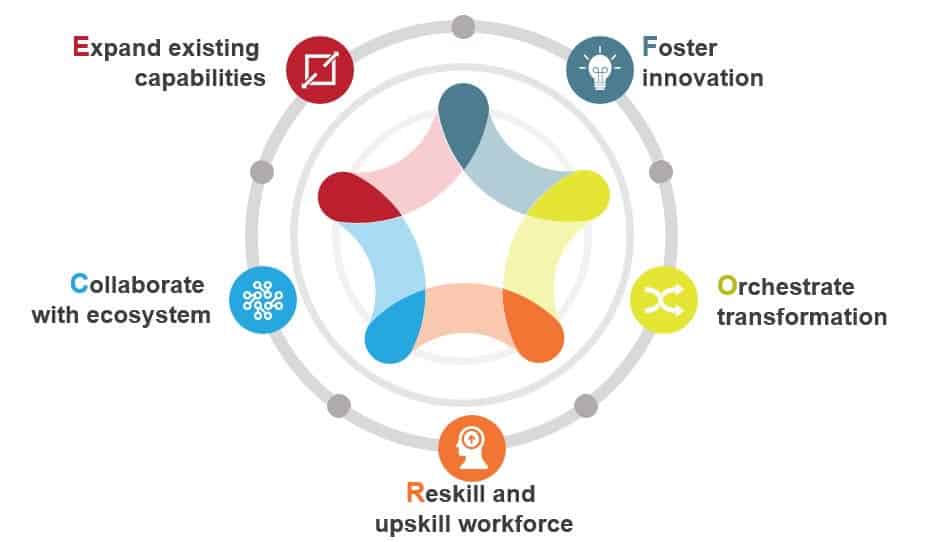

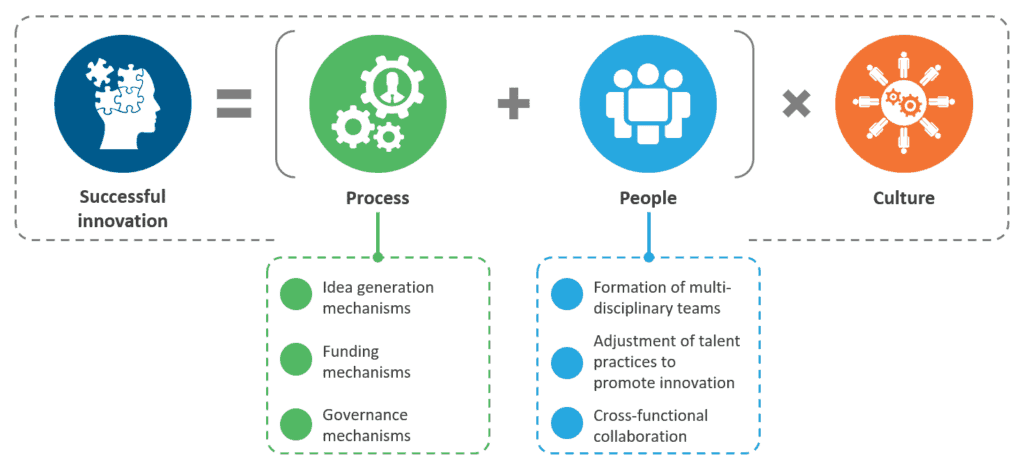

Supporting enterprises’ innovation agendas is no longer simply an opportunity for in-house shared services centers – what we call global in-house centers (GICs); it’s fast becoming a competitive imperative. And, contrary to popular perception, cracking the innovation code requires much more than just novel ideas. Success entails boarding the right people on the bus, gearing them up with the right mechanisms to drive agile decision making, and reengineering the organization’s cultural DNA to foster innovation. We’ve developed a simple approach that will help you solve this complex problem.

Let’s take a look at the three components.

Process

Innovation is not the product of logical thought, although the result is tied to logical structure – Albert Einstein

The first element is formulation of the right mechanisms to evangelize innovation initiatives. It requires the right idea generation mechanisms to harness unique ideas from both internal (GIC and parent company stakeholders) and external (including startups, academia, and service providers / specialists) ecosystems. A critical part of this is evaluating the strategic rationale for the partnership. While some shared services centers partner with third-party providers and start-ups for talent augmentation and skill acquisition, others leverage the connections to develop domain expertise or increase the speed of innovation.

Another essential component, specifically for GICs, is the right funding mechanism. While we see most shared services centers carving out a separate fund for innovation (which is part of the overall GIC CEO budget), we are increasingly seeing them push for a global/centralized fund where the innovation team within the center operates as an extension of the global innovation team(s), and is funded by centralized global venture funds / programs. For select initiatives, we have also seen GICs securing funding from business units and driving project-based innovation initiatives.

The third component here is timely deployment of robust governance mechanisms. Shared services centers need to adopt a disciplined approach to rigorously track performance and incorporate remedial feedback on a continual basis. This not only helps to assess the effectiveness of activities, but also guides allocation process for resources, and helps assign accountability for actions/responsibilities.

People

Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It’s not about money. It’s about the people you have and how you’re led – Steve Jobs

Involving the right people in the right team structure is the second critical component. Leading GICs involve stakeholders from different parts of the organization, i.e., functional and business teams, central innovation groups, R&D departments, and corporate teams to invest time in exploring adjacent and transformational opportunities. This helps in cross-pollination of teams and enables development of a holistic solution in an accelerated go-to-market timeframe. While we have seen varied designs for innovation teams (based on organizational fit and business alignment), the common thread is the focused top-driven approach to creating structural changes, supplemented by continuous support from middle management to ensure smooth implementation.

Another key initiative leading centers are taking is remodeling their existing talent practices. They are now shifting their focus from hiring for specific “skills” to hiring for “learnability” / “thinking skills”, i.e., the ability to innovate. They are incentivizing innovation, and providing special recognition for outside- the-box thinking. We are also seeing strong innovators recalibrate their existing performance measurement metrics to align with the impact generated against the business objectives.

Culture

“Innovation is not something you do for one afternoon a week, it’s got to be in your DNA” – Jasper de Valk and James van Thiel, Google

The third principal tenet to ensuring foundational success on the innovation journey is dedicated investment in developing a customer-centric culture with active CXO-level participation. Shared services centers are deploying multiple tools to reengineer their DNA and develop a culture that breeds innovation. Most successful examples include: gamification of programs and distinctive recognition for positive reinforcement; stimulation of an experimentation mindset and instillation of risk appetite; and adoption of flexible employment models, including remote working, crowdsourcing, and open innovation.

Although new technologies are path-breaking, we believe that the key to a GIC’s success is incremental innovation. They should keep testing small-scale POCs to demonstrate end-client value and build credibility. Successful implementation of pilots can help them instill confidence among parent stakeholders, and ensure adequate support and funding for much larger scale initiatives. This process also presents centers with an opportunity to course-correct early and drive/lead enterprise-wide digital initiatives.

If you’d like detailed insights and real-life case studies on how GICs have effectively driven the innovation agenda for their enterprises, please read our recently published report – Leading Innovation and Creating Value: The 2019 Imperative for GICs. And feel free to reach out to us at [email protected] to explore this further. We will be happy to hear your story, questions, concerns, and successes!