Building Global Centers of Excellence (CoEs) in GBS Organizations to Drive the CEO Agenda

The Global Business Services (GBS) market has witnessed improvement in performance, enhancements in role, and growth across verticals and functions over the years. In fact, the pandemic served as a catalyst for GBS organizations to step up and deliver higher value-add services, becoming a pillar for enterprises to evolve at a much faster rate. However, as the world evolves, GBS organizations need to remain agile to keep up with advancing technologies, navigate the recent talent shortage, and maintain cost competitiveness and accelerate innovation to help drive the CEO agenda.

To achieve these multiple priorities, many GBS organizations are building Centers of Excellence (CoEs), which further facilitate collaboration and speed-up transformation and delivery for the enterprise. CoEs are entities that work across business (BU)s units, or product lines within a BU, and provide leading-edge knowledge and capabilities in targeted areas. CoEs have proven instrumental for GBS organizations to drive initiatives and deliver access to high-demand skills and competencies, accelerating improvements and pushing efforts forward for faster execution.

The five types of CoEs that drive the CEO agenda

The role of the GBS organization needs to pivot toward creating strategic impact for the CEO. CoEs and competency centers within GBS organizations are designed to streamline and set actionable steps for the CEO’s agenda and critical priorities. The following five types of CoEs help enterprises to drive stronger business performance.

Core operations and corporate services CoE: This CoE focuses on developing expertise for multiple departments within the enterprise, including reporting, finance, marketing, customer onboarding, and core operations

Next-generation IT and digital technologies CoE: This CoE targets the development and management of new skills and technologies, such as AI, analytics, cybersecurity, blockchain, and testing

Talent CoE: The talent CoE develops the strategic services, capabilities, and best practices for staffing, e-learning, and employee onboarding

Automation and/or innovation CoE: Today’s strategic CEOs are looking to quickly advance their organizations’ automation and innovation maturity. This CoE is dedicated to cultivating these initiatives within the enterprise and deploying and scaling technologies like robotic process automation (RPA) and intelligent automation (IA)

Global sourcing and vendor management CoE: The goals of global sourcing and vendor management within organizations are often changing to keep up with market trends. This CoE provides CEOs with needed processes, insight, and agility to manage their sourcing and vendor models as market trends fluctuate

Going into 2022, these five types of CoEs, built within GBS organizations, can advance and strengthen enterprises and push strategies toward next-generation digital technologies, automation, and innovation. We covered this in more detail in our webinar, 5 Success-driving Actions GBS Organizations Need in 2022.

Why GBS organizations are the right candidates for building CoEs

Multiple factors play into why GBS organizations are good candidates for building CoEs and ultimately offer significant benefits to enterprises and the CEO agenda. These include:

- Deep process, domain, and technology expertise, providing a superior overall experience for the enterprise

- Access to next-generation and niche skills at competitive costs, which accelerate enterprises’ digital transformations

- Through a microcosm effect, offering high cross-functional and regional impact, the GBS-built CoE improves new product and services development

- The ability to drive fast-paced, low-cost innovation enables top-line growth throughout the enterprise

- Alignment with organizational culture and business goals improve overall productivity

How to develop an effective CoE

The various aspects of developing an effective CoE should be charted out to accelerate enterprise-wide adoption. Setting up a CoE is the first step for a GBS to embark on excellence, but it needs to ensure that it takes the right actions to establish success.

- The first step is to map out a vision and strategy, think through possible risks, and mitigate them

- Defining a governance and engagement model between the CoE and the enterprise is paramount to ensure that those goals and strategies are communicated, carried out, and met

- GBS organizations will also need to design a talent model structured around growth and establish funding and financing mechanisms to initiate the process. Once the team is structured and goals are set, GBS organizations should incorporate a way to measure success through performance metrics and KPIs to collect the best data on impact delivered

Best practices for setting up a CoE

CoEs are designed to bring expertise and forward-thinking guidance, which often means taking risks and adapting; however, here are a few best practices to keep in mind when setting up CoEs:

Clearly articulate the “why”: If there is not enough clarity, the CoE is unlikely to deliver results aligned with the enterprises’ strategy

Take an entity-wide view: Combine the business case with an internal assessment of the company’s vision and strategy, requirements, and capabilities to identify concrete opportunity cases

Clearly define the governance and organizational model: The CoE should articulate the governance mechanism, reporting model, roles and responsibilities, and business units supported, so all parties are aware

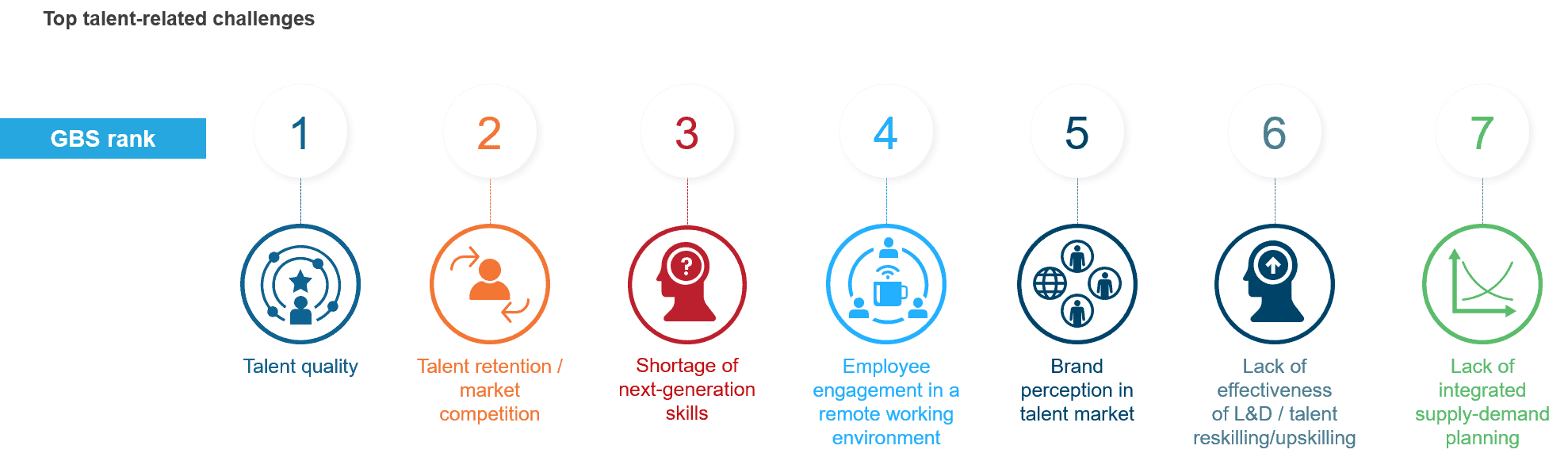

Talent is the most critical success enabler: Leadership and team skills are often the most critical factor for a CoE’s success. Consider collaborating with external partners such as startups and academic institutions to fill gaps

Aim for quick wins in the initial stages to gain visibility and confidence: Select early use cases that allow the enterprise to develop confidence in the CoE

Ensure strong engagement and precise stakeholder management: Secure the right sponsorship at the right time, preferably in the early stages

For more information on how GBS CoE’s can drive the CEO agenda, watch our webinar, 5 Success-driving Actions GBS Organizations Need in 2022.