Wipro Acquires Capco Creating End-to-End Digital Consulting Services | Blog

Since Wipro’s March 4, 2021, announcement to acquire Capco, the London-based global management and technology consultancy that provides digital, consulting, and technology services to financial institutions, for US$1.45 billion, reaction has been mixed as to whether it will deliver the synergies and earnings growth Wipro expects. However, Wipro’s consulting-led offerings matched with Capco’s digital capabilities appear to be poised to deliver a powerful, end-to-end service for clients.

Here’s our take.

What’s in it for Wipro?

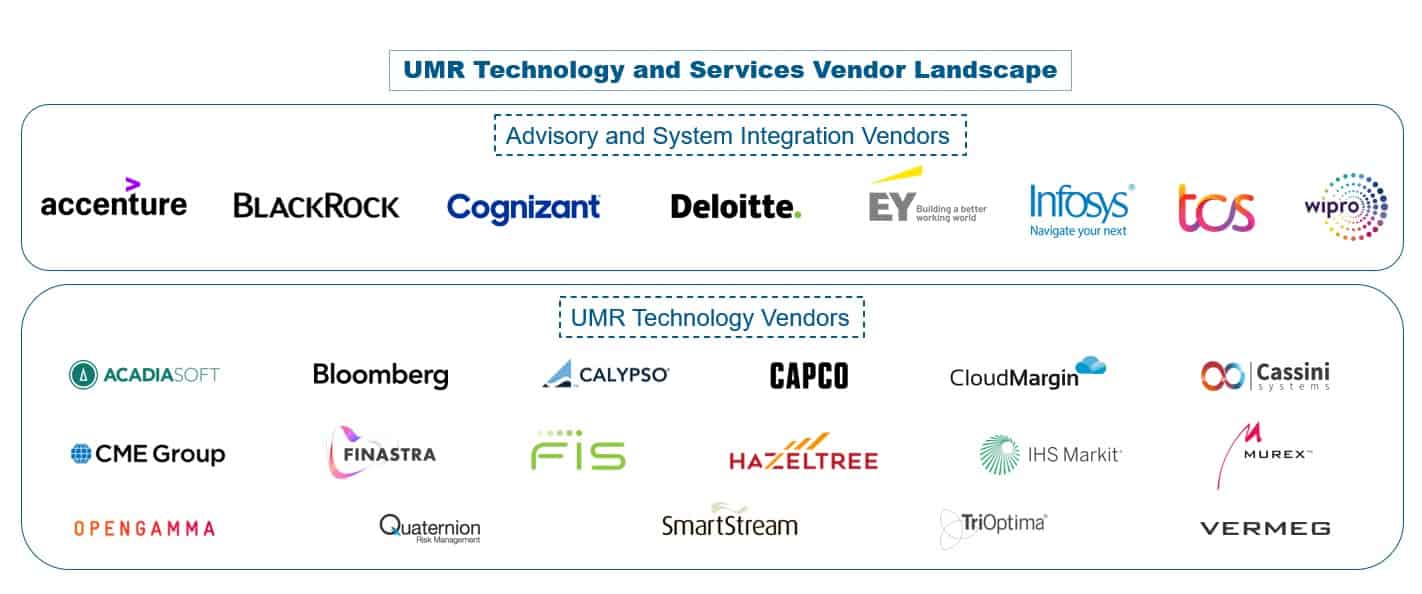

Wipro, a leading, India-based global IT, consulting, and business process services company, has acquired numerous companies in the last few years, such as Appirio for cloud services, Opus CMC for the mortgage industry, Designit, Syfte, and Cooper for design thinking and strategy, and International TechneGroup (ITI) for its industrial and engineering services. The Capco deal, which is expected to close at the end of June, stands apart from the other acquisitions not only because it’s Wipro’s largest to date but because it will greatly improve Wipro’s digital offerings in the BFS space, Wipro’s largest business unit. This will narrow the gap between Cognizant, Infosys, and TCS, Wipro’s three biggest competitors in the BFS arena.

Also, in 2020, digital contributed to nearly 40 percent of Wipro’s total revenue, making Capco’s digital capabilities integral in positioning Wipro as one of the market leaders.

The Wipro/Capco acquisition will deliver improved benefits to clients, including:

- Superior capabilities in consulting and advisory: With this deal, Wipro will join a small group of service providers that bring integrated end-to-end solutions at scale to their customers. Wipro and Capco’s collective capabilities include high-value, upstream activities like consulting and advisory, and design and build, as well as downstream activities such as implement and manage

- Better access to newer geographies and clients: With more than 40 percent of Capco’s US$700 million revenue coming from Europe, this acquisition will help Wipro strengthen its foothold in that market. In addition to the larger strategic benefits that the deal aims to provide, it will also add 30 new BFS logos to Wipro’s portfolio and could bring in more business from the company’s existing clients

- Balanced shoring mix: Capco’s high leverage of onshore and nearshore delivery centers nicely complements Wipro’s offshore-heavy delivery footprint, which will give Wipro the opportunity to handle judgment-intensive work for onshore-heavy clients

- Technology synergies: A blend of Capco’s multiple point solutions and Wipro’s digital investments will help Wipro strengthen its asset management, custody, and prime brokerage offerings, and develop niche, targeted next-gen solutions for its client base

- Domain depth: Capco will deepen Wipro’s capabilities in digital banking and payments, as well as the asset management, custody, and prime brokerage spaces. This is critical at a time when financial services firms are looking to engage with providers with more domain depth

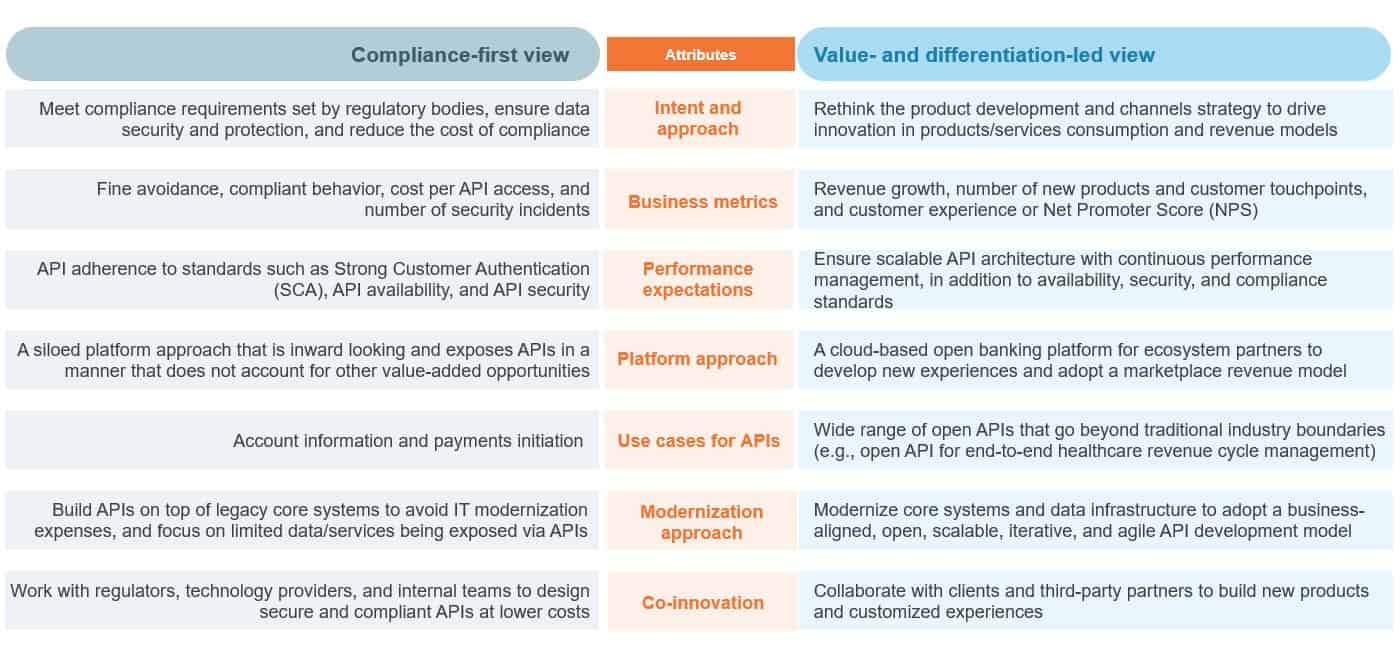

- Augmented risk and compliance offerings: Wipro will be able to augment its current risk and regulatory compliance offerings on its Wipro Holmes™ platform by leveraging Capco’s extensive Finance, Risk, and Compliance (FRC) offerings and solutions portfolio

Large-scale acquisitions are not new to Wipro or the BFS industry; however, success from such high-value acquisitions are not always guaranteed. It is, therefore, no surprise that this announcement was received with mixed reactions and speculation from the market as to whether it will deliver the synergies and earnings growth that Wipro has promised.

Overall, we remain optimistic about the deal and believe this acquisition will equip Wipro to better solve BFS clients’ challenges through Capco’s future-ready digital capabilities. Most importantly, the acquisition is complementary in nature and will help Wipro gain scale, speed, and stature.

How will unities like consulting and digital end-to end services affect the broader BFS market?

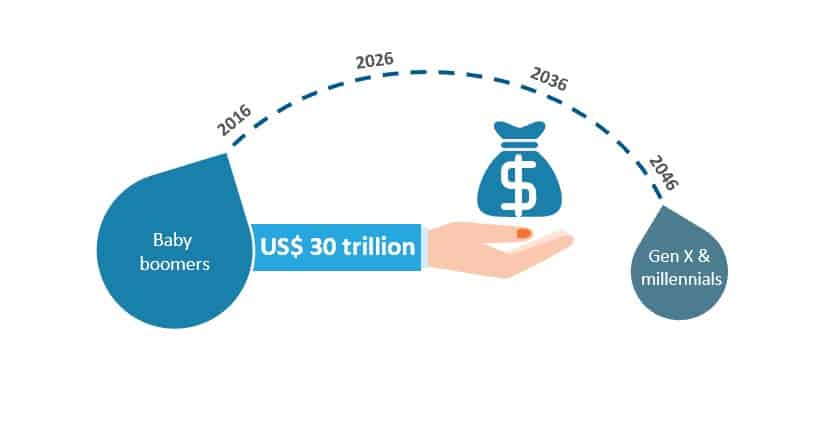

Wipro’s consulting-led services, together with Capco’s digital capabilities, will provide more meaningful end-to-end long-term support to clients. It would not be surprising to see similar deals coming up across various segments of BFS with the aim of providing bundled offerings, as products lose their charm when offered on a standalone basis. Complementing service offerings with consulting-led delivery capabilities is being seen across various BFS industries, including mortgage and FCC. These capabilities are being acquired not just through acquisitions but also through partnerships, such as the recent one between Genpact and Deloitte in the financial risk and compliance domain.

Though this trend witnessed a slow start, especially for the Indian IT firms, it looks promising and rewarding in the long run and is only expected to gain momentum. Through end-to-end consulting and digital service offerings, enterprises get access to a compelling combination of digital talent at scale with a consulting-led delivery approach, which helps achieve greater business value and gains.

Success hinges on successfully executing consulting-led digital transformation

Generally, the value addition to enterprises entirely depends on the speed at which service providers can utilize the enhanced breadth and depth of their offerings post-acquisition. Having said this, the key to achieving significant value addition for both Wipro and Capco’s clients would eventually lie on smooth integration and flawless execution.

For the returns to outweigh the risks, a superior execution policy needs to be in place. The key to inspiring its BFS clients will be to align consulting, design, build and operate capabilities around solving some of the industry’s biggest challenges. For BFS clients, this is namely modernizing legacy systems, providing innovative product and service offerings, ensuring a delightful customer experience, and effectively managing the ever-evolving regulatory landscape. For Wipro’s enhanced capabilities to be successful, it should help reinvent the client’s journey through a rare combination of consulting-led digital transformation.

We would love to hear your thoughts on this acquisition and or others that are following the same trend, reach out to [email protected].