Blog

The Importance of Integrating Environmental, Social, and Governance (ESG) Mandates into BFSI Enterprises’ Operations

Banking, Financial Services, and Insurance (BFSI) firms are under increasing pressure to operate more sustainably, mindful of their economic, social, and environmental impact. This implies conforming to Environmental, Social, and Governance (ESG) regulations, which mandate enterprises to be conscious of: their impact on the environment; their relationship with employees, suppliers, clients, and communities; and robust standards on company leadership, risk management, and stakeholder rights. Further, voluntary guidelines such as the Equator Principles, UN Principles for Responsible Investment (PRI), and recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) are forcing banks to incorporate ESG as part of their lending, investment, and financing decisions. We strongly believe that today’s voluntary commitments will soon be replaced by hard regulations, and, hence, organizations that embrace these mandates sooner will be ahead of the game, if that comes to pass.

Three aspects drive ESG integration in BFSI operations today: 1) reputation, marketing, and public relations; 2) growing client demand for ESG-conscious investment practices; and 3) regulatory burden. ESG enhances BFSI firms’ brand perception for all stakeholders, including millennial talent, which is more attracted to brands that take firm actions around ESG mandates. Advances in technology and the use of AI / big data / ML are further helping combat challenges related to ESG measurement.

However, these drivers fail to factor in the significant potential to generate long-term risk-adjusted returns through ESG compliance. Our research suggests that firms that can better navigate environmental and social disruptions, while incorporating good governance practices, will be able to mitigate risks and create long-term value.

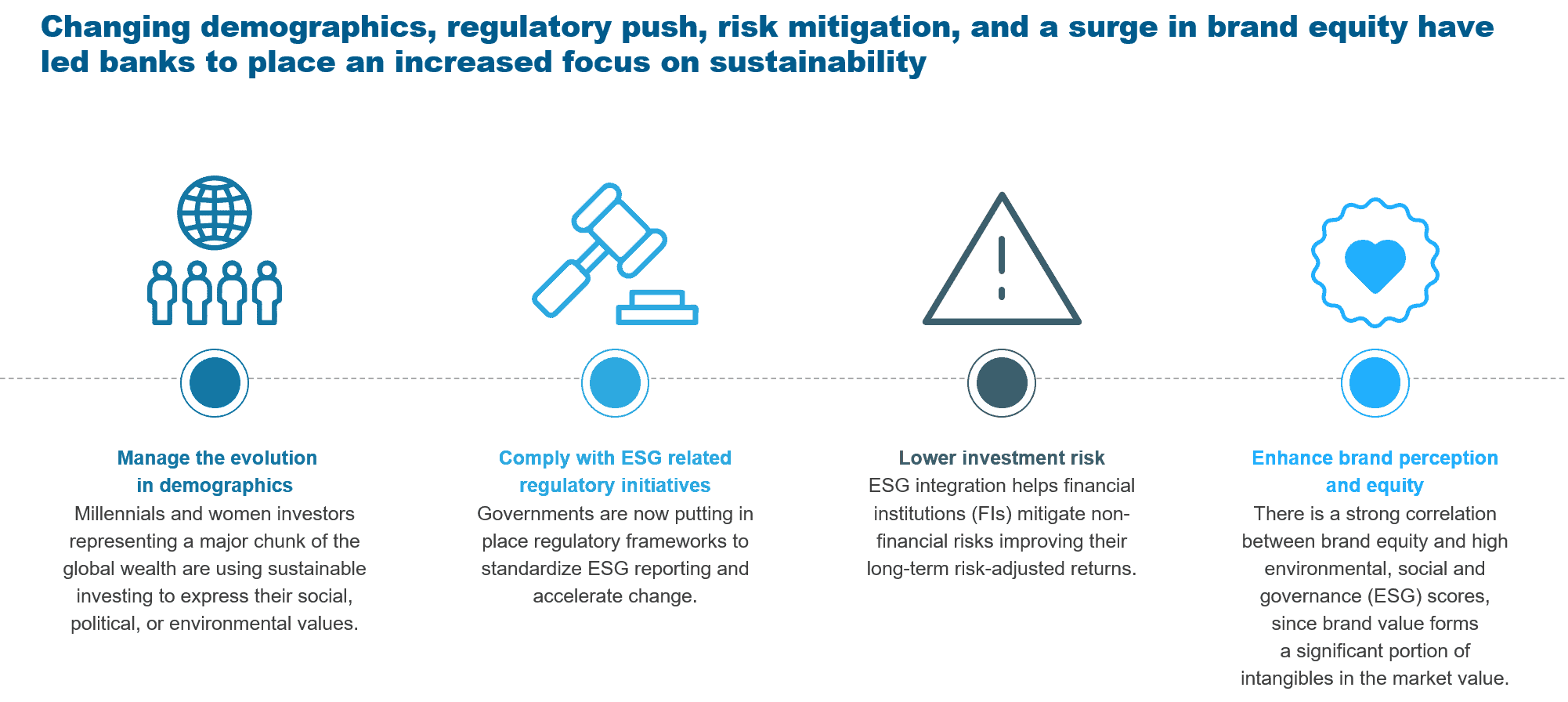

The exhibit below highlights the various factors contributing to banks’ increased focus on sustainability or ESG.

Exhibit: Factors driving banks’ increasing emphasis on sustainability

The push of the pandemic

The COVID-19 pandemic served as the first real proof point that ESG investing can future-proof investments and boost returns even in uncertain times, with sustainable funds outperforming their more conventional counterparts. Consequently, ESG investing solidified its position as a dominant feature across the financial services landscape in 2020, with investments in sustainable funds in the US almost twice the previous year’s total.

Leading credit rating agencies such as S&P and Moody’s have indicated that innovative ESG initiatives will help BFSI firms improve financial performance, in turn providing the monetary resources to further enhance their ESG strategies. Further, large fund management firms such as BlackRock Inc., Vanguard Group, and State Street Global Advisors, are making ESG-focused investments. In February 2021, Vanguard appointed Fong Yee Chan as the firm’s first head of ESG strategy for the UK and Europe.

BFSI firms that can swiftly integrate a comprehensive ESG strategy into their investment plans will be able to capture a greater share of ESG asset flows. Such a comprehensive strategy would comprise five aspects:

- Developing the ESG strategy

- Engaging with different stakeholders across the ESG landscape

- Launching new products for the growing demand for ESG investing

- Creating the right ecosystem of data providers, requisite frameworks, and technologies

- Switching to responsible practices.

Asset managers should therefore think fast and come up with dedicated strategies to capitalize on the opportunities and gain competitive advantage in the long run.

Partnering with technology vendors to navigate the ESG space

Traditionally, ESG was incorporated through exclusionary screening, in which investments that did not align with an enterprise’s beliefs and values were dropped. Later, practices such as thematic investing (supporting a particular ESG area), impact investing (focusing on creating a positive change rather than only financial returns), and best-in-class selection (selecting investments with positive ESG performance relative to industry peers) emerged. Gradually, we are moving toward a comprehensive ESG integration model, wherein investors are systematically and deliberately including ESG-related factors into their complete financial analyses.

However, the lack of a standard taxonomy to capture ESG performance, low quality ESG reporting by companies, and the deficiency of robust ESG data pose major challenges to this integration. Technology vendors in the BFSI space can help enterprises understand ESG processes, ensure compliance, and generate optimal value. These partnerships are increasingly important at a time when corporate ESG disclosures are dramatically improving – 80% of the world’s largest corporations use Global Reporting Initiative (GRI) standards today. Further, the number of signatories to the PRI has increased from 63 investment companies in 2006 to more than 1,700 signatories with US$81.7 trillion in Assets Under Management (AUM) today. In recent times, the International Integrated Reporting Initiative (IIRC) and Sustainability Accounting Standard Board (SASB) frameworks have also been gaining enterprise attention.

We would like to hear your thoughts on ESG and its increasing importance in the BFSI industry. Please reach out to us with your inputs at [email protected], [email protected], or [email protected].

This is the first blog in this series that explores the ESG space; read the second and third blogs for more insights.