Blog

Technology Synergy Drives M&A Spike in the Banking and Financial Services Industry

Technology used to be an enabling strategic pillar for banks and financial services (BFS) organizations. Now, it is the core of these firms’ value creation playbooks. Indeed, BFS firms are building digital capability platforms using modern technologies to create what we have named SUPER — or Secure, Ubiquitous, Personalized, Easy, and Responsive — banking experiences and optimized operations.

This move to digital would require BFS firms to invest disproportionately in building these industry platforms at speed and scale. M&As (merger and acquisitions) are helping BFS firms trigger this transformation agenda by siphoning off cost synergies from mergers and investing in technology rationalization, modernization, and innovation.

Bloomberg estimated that more than US$500 billion worth of BFS M&A deals happened in 2020. That magnitude is the second highest since the 2008 financial crisis and only lags 2019 by a razor-thin margin due to the pandemic induced slowdown. Our recent analysis found that eight out of ten of the largest M&As in the BFS industry in 2020 mentioned technology synergy as one of the key drivers for the transaction.

Traditionally, acquisitions served as an opportunity to enter new product lines and/or geographies, gain new capabilities, and achieve cost savings and operational efficiencies via technology modernization and streamlining processes and systems. The recent acquisitions in the BFS space have focused additionally on technology synergy and the ability to weaponize the combined technology estate. Technology synergy is achieved in these M&A transactions by:

- Acquiring digital capabilities and solutions

- Achieving scale that makes economic sense to invest in building industry platforms using cloud, APIs, and data & analytics technologies

- Acquiring digital skills

- Combining discrete technology components of merged entities to create industry platforms.

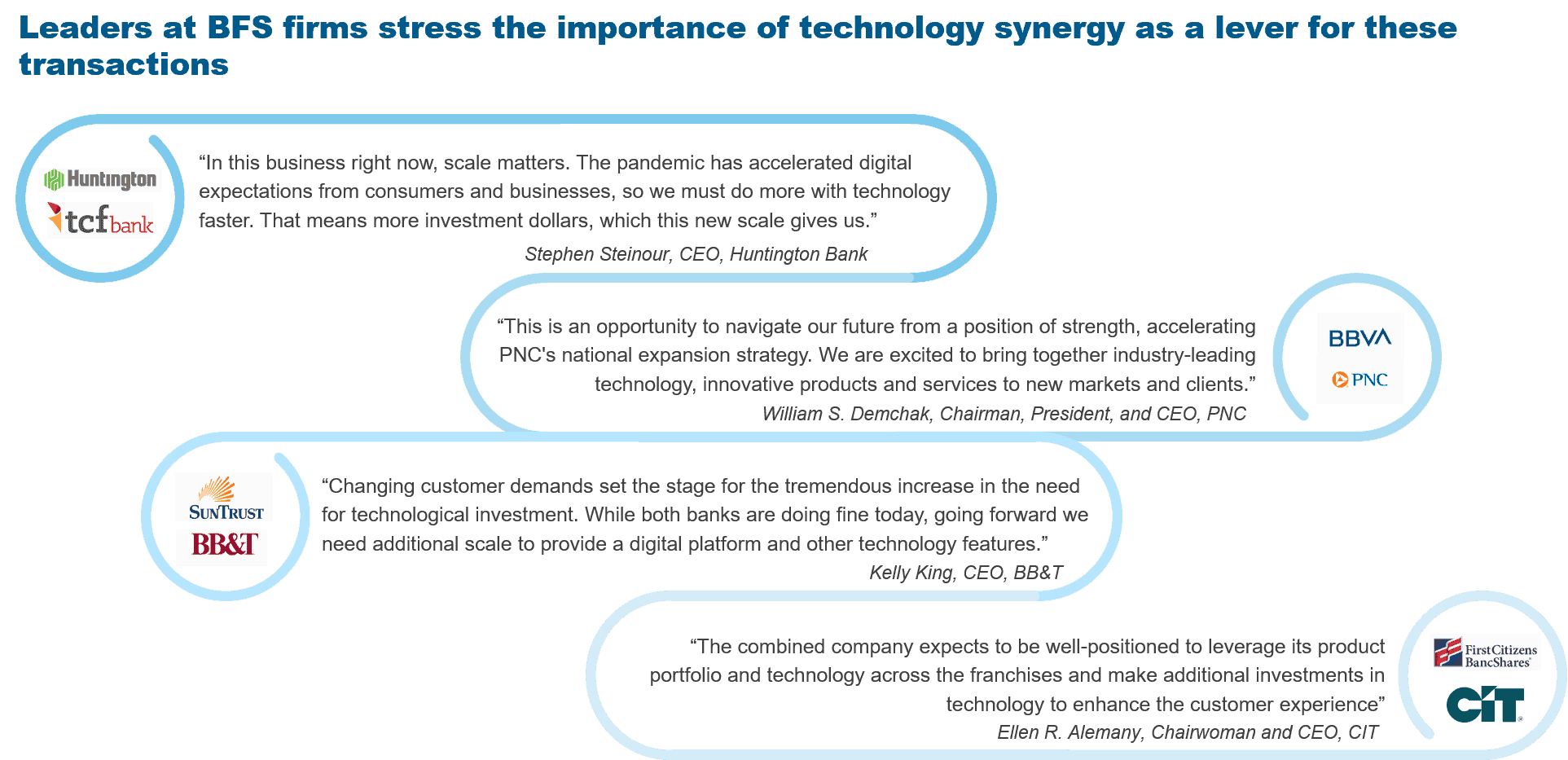

As mentioned in the image below, leaders at BFS firms undergoing such M&As stress the importance of digital as a lever for these strategic acquisitions. For instance, in the merger of First Citizens BancShares, Inc. and CIT Group, Ellen R. Alemany – Chairwoman and CEO of CIT, who will assume the role of Vice Chairwoman of the combined entity – highlighted how well-positioned the two firms will be to leverage their product portfolio and technology across the franchises, and make additional investments in technology to enhance the customer experience.

Expansion of the IT estate to build digital capability platforms has created a paradigm shift in business cases for M&As. The platform-based economy not only enables new businesses and systems but also facilitates rapid integration across merged entities.

A notable example is S&P Global’s bid to buy IHS Markit in December 2020, which serves as an example of a technology-driven merger in the financial information and credit rating space. It has created an opportunity for the two firms with unique and harmonizing assets to create a formidable data and technology offering. IHS is the industry frontrunner in leveraging platforms for underwriting corporate stock and bonds and trade processing. The combined entity will become a data powerhouse for complex financial products, and this will directly funnel exponential growth for S&Ps credit rating service, which comprises 40-50 percent of its revenue.

Skill acquisition is gradually gaining popularity across multiple deals. Aspects like digital identity and security are addressed in Moody’s purchase of Regulatory DataCorp (RDC), a provider of KYC/AML data services, and Mastercard’s acquisition of RiskRecon for cybersecurity services. In the platforms/technology space, Charles Schwab acquired the technology and intellectual property of a fintech, Motif. And customer experience took centerstage in Goldman Sachs’ acquisition of United Capital, with a focus on scaling up its UI/UX products. Talent acquisition is another factor that is gaining ground across some of these mergers.

In November 2020, PNC Financial Services acquired the US Operations of the Spanish lender BBVA. And most recently, Huntington Bancshares acquired TCF Financial. The banks are not only increasing their asset size and market reach but also gearing up to save costs by optimizing their IT estate and branch networks. These cost savings are being funneled to build better digital experiences as more customers are opting for online and mobile services for their banking needs.

Similarly, significant deal activity is expected in the asset management space. For example, Macquarie Group is set to buy Waddell & Reed for US$1.7 billion. This traction in asset management is driven not just by pressure on fees and revenue but also by increased costs attributed to technology and digital spending. Asset management firms with deep pockets are already betting heavily on the success of platform- and data-based niche firms. For instance, BlackRock recently purchased minority stakes in the platform-based alternative wealth management firm iCapital Network and the robo-advisor Envestnet.

Our analysis suggests that the M&A trend will pick up for regional and community banks in a bid to gain scale. This is critical to compete with larger players as customer intimacy and relationships move from physical to digital. They will be better equipped to build new capabilities in robotics, AI/ML, and advanced analytics as banking increasingly digitizes. The combined entities will also have a larger pool of resources wherein better skill-to-talent match can be achieved.

BFS M&As will be a boost to the consulting and IT services industry

M&A’s will entail increased spending in post-merger integration and consulting expenditures in the short term. BFS firms will need partners that can create a modernization roadmap for the combined entity. The merged entities can gain significant cost synergies by rationalizing their vendor portfolio and IT estate, as several applications and platforms will become redundant. Hence, a modernization roadmap will enable value creation in the long run.

Of course, the merged entities must also make rapid changes in their working models, delivery strategies, and sourcing decisions to thrive in the new normal. Investments in some specific technologies/tools will ensure growth and continuity of operations. Digital acquisition is thus becoming a table stake as firms determine the right valuation even before they formulate the integration strategy.

Large BFS firms are looking at targets that help them create a digital service model for the future. We are already seeing increased M&A activity among regional banks, asset management firms, and brokerage houses. As we inch closer – hopefully – to the end of the pandemic, BFS firms will be eyeing M&A opportunities that deliver technology synergy and associated business transformation benefits. Picking the right segment, target, and timing of these initiatives will be crucial.

Discover even more insights in the BFS industry in our recent research and reports:

- Blog: How COVID-19 Will Impact IT Services in the Banking and Financial Services (BFS) Industry

- Report: Banking IT Services State of the Market Report 2020: Hyper-segmentation Strategy Enabled by Digital Capability Platforms and Data Exchanges

- Report: Capital Markets State of the Market Report 2020 – Automation, Data, and Cloud Trends for Buy-side Firms

- Report: Life & Annuities (L&A) Insurance State of the Market 2020: Platform-first Model to Simplify and Rationalize Systems for Rapid Cost Take-out

Or if you would like to understand more about the impact of the increased M&A activity in the BFS industry, please reach out to us at [email protected] and [email protected].