Blog

Uncleared Margin Rules (UMR) as a Catalyst for Change – from Spreadsheets to Digital Compliance Driven by Data and Cloud

In the wake of the 2008 financial crisis, leaders of the G20 summit laid out the Uncleared Margin Rules (UMR) as part of the financial regulatory reform agenda. The goal of these rules was increasing transparency and reducing the credit risk posed by major participants in the Over the Counter (OTC) derivatives market. UMR introduced fully bilateral Initial Margin (IM) rules based on theoretical loss, to protect one party against the other party’s default.

The UMR have been rolled out in phases since 2016, and approximately 60 of the largest firms (by assets under management) currently comply with IM rules. Before the onset of COVID-19, 200+ firms were expected to come under the rules’ purview by September 1, 2020, but regulators pushed the timelines to help pandemic-impacted firms focus their resources on managing risks associated with market volatility.

An estimated 1,100 counterparties are expected to come under the combined purview of Phase 5 and Phase 6, which will be rolled out in September 2021 and September 2022, respectively. It is thus inevitable that the significant increase in Newly In-Scope Counterparties (NISCs) will create overwhelming demand on market resources across participants and service providers. To address this demand rush, significant operational and technology-led solutions must be implemented, and most firms plan to engage with external partners to reduce the burden of the additional contractual agreements that must be put in place.

The new rules involve the following major changes across operational processes and legal agreements:

- Both swap dealers and funds will be required to exchange IM with one another

- IM must now rest with third-party custodians

If not done in a timely manner, NISCs will not be able to trade in non-centrally cleared derivatives, limiting their options for both taking on and hedging risks, potentially impacting liquidity in the derivatives markets.

Time for change – fighting the legacy

Firms have historically relied on spreadsheets and siloed legacy technology systems to assess their collateral needs, access valuations, and communicate them to counterparties – a cumbersome method that makes the task of UMR compliance all the more difficult.

Though the rules only apply to new transactions, they may, in fact, create multiple workflows for monitoring both new and legacy transactions. Beyond operational updates, firms will need to negotiate and enter into new legal agreements and modify existing ones. In some cases, they may need to alter their trading strategies and operations to mitigate or steer clear of the rules by using portfolio compression or by simply reducing their use of uncleared products.

Thus, to avoid getting caught in a regulatory bottleneck, firms must act now to:

- Determine whether the rules apply to them by calculating the Aggregate Average Notional Amount (AANA) of non-cleared derivatives

- Identify their IM requirements

- Set up a data infrastructure for enhanced transparency and analysis

- Choose service providers in the areas of custody, monitoring, and legal services

- Create a modern architecture and digital roadmap for UMR or adopt technologies from third-party technology vendors that can be integrated easily into a wide range of asset classes that require IM calculations

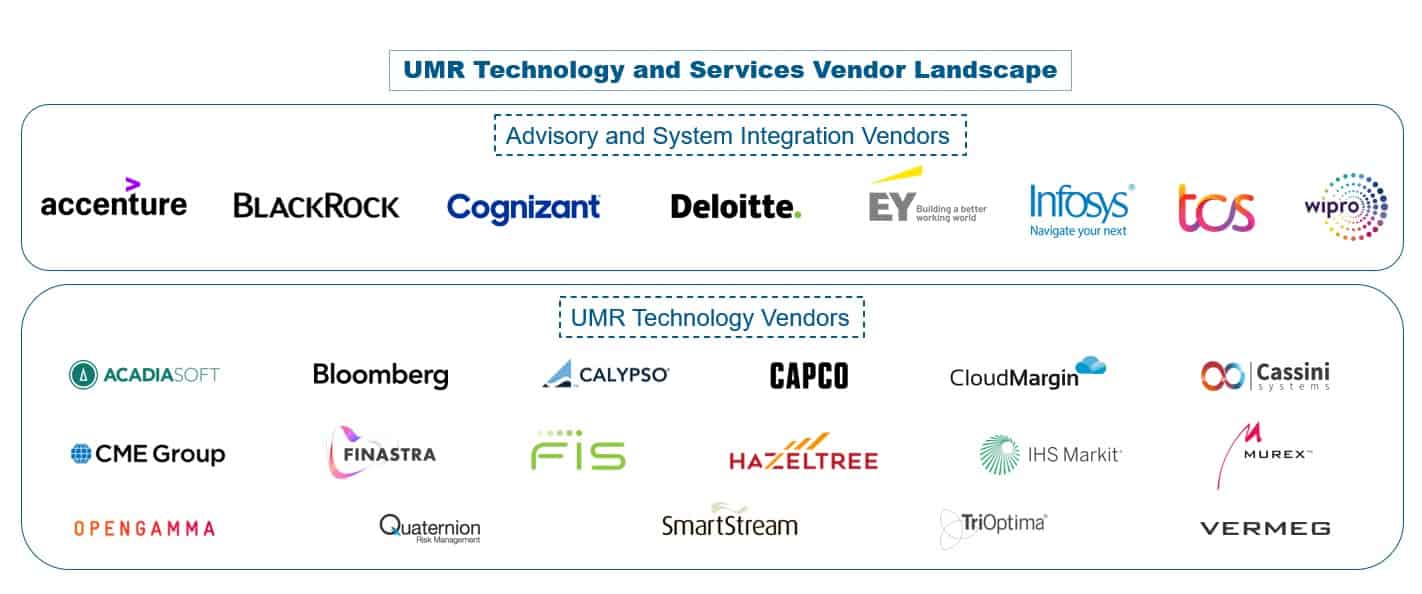

Engineering and system integration complexity is bound to increase with legacy systems (which need to be modernized) and the operational changes needed to meet the regulatory guidelines. Thus, firms need to choose the right set of technology vendors and system integration and consulting partners to support them on their compliance journeys. In fact, even firms that do not cross the US$50 million IM threshold will need systems to monitor their IM thresholds regularly, thereby creating a market for cost-effective technology solutions.

Several technology vendors are increasingly building a strong data and cloud technology infrastructure and value-added digital technologies, such as cognitive technologies and interactive visualization, to help optimize costs and better comply with the rapidly changing regulatory landscape. For example, Finastra and CloudMargin have partnered to deliver an integrated collateral and margin management solution to enterprises of all sizes through a SaaS model, facilitating end-to-end straight-through processing of derivatives transactions and all associated collateral management workflows, from trade booking through settlement.

RegTechs providing a helping hand

AcadiaSoft is leading the way in the regulatory technology market with its UMR Collateral Suite and extensive partnerships with technology and data vendors, such as Bloomberg, Cassini Systems, Capco, Calypso Technology, HazelTree, IHS Markit, Murex, and TriOptima, to support organizations in their UMR compliance journeys. AcadiaSoft and TriOptima have partnered for a Phase 5 soft launch aimed at avoiding a compliance crunch near the deadline. More than 30 firms falling under IM Phase 5 have successfully joined the initiative, while another 25 are scheduled to join before the end of 2020.

IT service providers can tap into such opportunities by collaborating with technology vendors to help create a packaged solution, providing the much-needed implementation and deployment support layered with domain advisory capabilities. A notable case in point is the launch of Wipro’s Standard Initial Margin Method (SIMM) in a box solution in collaboration with Quaternion Risk Management.

Embracing the change

New workflows and requirements are set to be introduced as organizations embark on the journey to become UMR compliant. Rather than considering UMR as an additional regulatory burden, firms should leverage this opportunity to reevaluate and reimagine their existing workstreams and use UMR as a catalyst for change to holistically automate and streamline their collateral management.

If you’d like to share your observations or questions on the fast-evolving technology and services landscape for UMR compliance solutions, please reach out to [email protected], [email protected], and [email protected].