Blog

RCM Outsourcing at a Crossroads: Is the Advent of Agentic AI Ushering in RCM 3.0?

Healthcare providers have long navigated a complex web of operational and financial pressures, from rising administrative costs and chronic workforce shortages to fragmented revenue cycle processes.

But a new layer of volatility is pushing the ecosystem to a potential inflection point. Recent developments, such as the US$1 trillion Medicaid reimbursement cuts under the “One Big, Beautiful Bill,” evolving regulatory mandates, and the ripple effects of imposed tariffs, are exacerbating long-standing challenges for healthcare providers by impacting the top and bottom line simultaneously.

At the same time, the advent of generative AI (gen AI) and agentic Artificial Intelligence (AI) is reshaping the Revenue Cycle Management (RCM) landscape. While it offers the potential for efficiency and insight, it is also pushing enterprises to rethink how they integrate technology into core operations, especially in light of the fast-evolving pressures.

As a result, traditional outsourcing models centered on labor arbitrage or transactional efficiency are likely to lose relevance, making way for integrated, outcome-driven models that combine technology and services, suggesting the dawn of a new paradigm with RCM 3.0.

Reach out to discuss this topic in depth.

Is a new sourcing paradigm emerging in RCM?

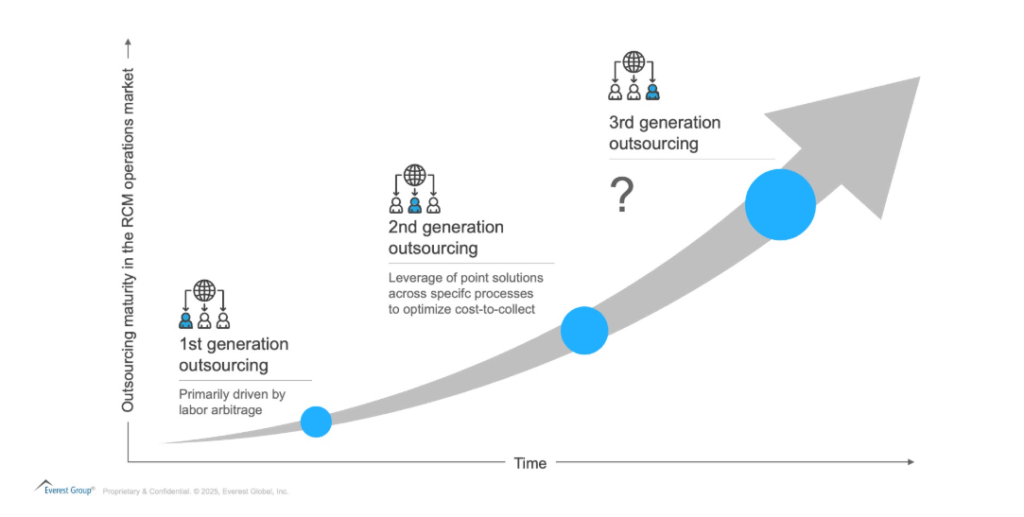

While RCM outsourcing is not new, it has evolved over time. In its first iteration, the focus was on scale and labor arbitrage. The second wave, often referred to as RCM 2.0, focused on the increasing use of point solutions across specific RCM processes to optimize cost-to-collect.

Now, a new phase, RCM 3.0, appears to be taking shape.

The anatomy of RCM 3.0: From siloed operations to intelligent orchestration

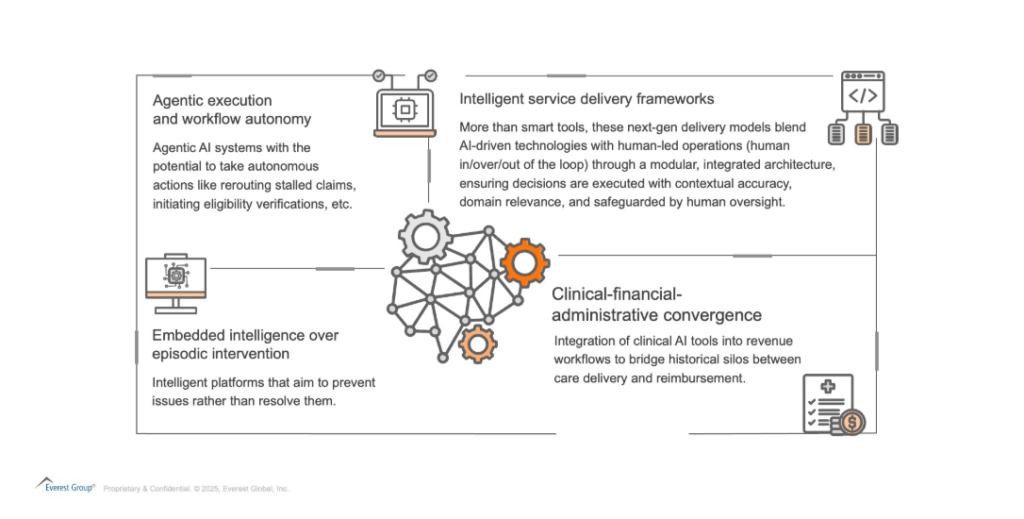

While RCM 3.0 is still an evolving framework, several defining characteristics are beginning to surface:

Together, these elements are hinting toward a break from past paradigms, recasting RCM as a strategic enabler through the complex challenges surrounding providers.

From concept to market: Early signals of RCM 3.0

While RCM 3.0 remains an evolving construct, several developments across the market suggest that elements of this next-generation model are beginning to take shape in practice.

-

- The recent formation of Smarter Technologies, through the merger of Access Healthcare, Thoughtful.ai, SmarterDx, and VerdureRCM, backed by New Mountain Capital, has drawn considerable industry attention. From an architectural standpoint, it offers a compelling vision: integration of AI-powered automation, clinical revenue integrity, agentic AI agents, and scaled RCM domain into a cohesive service delivery engine

-

- The partnership between Ensemble Health and Solventum brings together Ensemble’s RCM delivery infrastructure with Solventum’s clinical NLP and autonomous coding capabilities to address one of the most resource-intensive areas of the revenue cycle: inpatient coding. The collaboration reflects a growing push to embed clinical intelligence into core revenue workflows, with the intent to improve speed, accuracy, and consistency across coding operations

-

- The investment by Infinx in Maverick AI combines Infinx’s RCM platform and services with Maverick’s purpose-built AI agents for real-time autonomous coding. This integration enables coding directly from clinical documentation at the point of care. Together, the two companies bring advanced AI into coding workflows with the aim of reducing manual effort, supporting compliance, and improving the timeliness of revenue capture.

-

- The launch of Optum Integrity One, a new AI-powered revenue cycle platform, reflects an effort to consolidate and automate key RCM functions through a unified, intelligence-led interface. The platform integrates tasks from the point of care through final coding with the goal of improving accuracy and reducing administrative burden. By offering both fully and partially autonomous coding, with human oversight for complex cases, the platform exemplifies a shift toward operational scalability without compromising clinical nuance

-

- The Blackstone bid for AGS Health reflects how private equity investors are seeking to build next-generation RCM enterprises anchored in both scale and analytics. The investment would combine AGS’ existing delivery capacity with additional capital to expand the use of automation and analytics in large-scale RCM, supporting more standardized and data-driven RCM services

-

- The Carlyle Group’s majority stake acquisition of Knack Global highlights how private equity is driving consolidation of mid-sized RCM providers into scaled cross-shore platforms. By coupling global workforce depth with institutional capital, these entities are poised to deliver standardized, cost-efficient RCM services at scale, accelerating the industry’s shift toward platformization

Collectively, these developments signal a meaningful evolution in how RCM capabilities are being designed, delivered, and scaled. Whether through full-stack integration, targeted clinical automation, or productized platform delivery, leading players are reconfiguring their models around intelligence, configurability, and outcomes. While the sustainability and scalability of these approaches remain to be tested, they offer an early indication that integrated, AI-enabled delivery architectures may set new benchmarks for performance and differentiation in the revenue cycle space.

What this means for the market: Competitive shifts and industry signals

As RCM 3.0 transitions from concept to market, it may drive cascading shifts in how healthcare providers prioritize and adopt next-generation revenue cycle solutions, how vendors build, compete, and sustain relevance, and how investors allocate capital across the healthcare revenue ecosystem.

For healthcare providers: A potential reassessment of the vendor landscape

-

- Unified sourcing strategies across Information Technology (IT) and operations: Chief Financial Officers (CFOs), Chief Information Officers (CIOs), and Vice President (VP) of RCMs of healthcare provider organizations will likely move away from siloed planning of IT and operations outsourcing. As integrated RCM platforms gain traction, providers will need to coordinate technology investments and operational spend under a unified strategy. The focus is likely to shift toward partners that offer tech and services in a blended fashion to overcome the friction within existing models

-

- Elevated focus on compliance and governance: As AI-powered RCM platforms assume more autonomous control over coding, documentation, and claims workflows, providers will reassess vendors through a regulatory and risk lens. Capabilities such as auditability, explainability, and data governance will become critical differentiators

-

- Rethinking commercial constructs: This shift is also likely to influence commercial models. Rather than transactional or outcome-based pricing, providers may begin to gradually explore subscription-based, tiered, or hybrid commercial models that align better with continuous value realization. These models could offer more predictable cost structures while incentivizing vendors to demonstrate sustained performance and innovation over time

For the supplier ecosystem: A call to accelerate and differentiate

-

- Acceleration of consolidation: The market is likely to see increased Merger & Acquisition (M&A) activity, vendors lacking either proprietary technology or deep domain orientation will face growing pressure to merge into platform models or pivot toward niche solution plays with defensible market position

-

- Platform-enabled service model evolution: Traditional service providers will need to evolve their business models. Simply offering labour-driven services is no longer enough. To remain relevant, vendors must embed next-gen technology capabilities into their delivery models and align more closely with enterprise goals. Success will depend on delivering a seamless blend of technology and services that drive tangible outcomes for healthcare providers

-

- Expansion of the competitive perimeter: As next-gen RCM architectures increasingly blur the boundaries between technology and service delivery, the space may begin to attract interest from IT-heritage players, AI-native startups, and analytics-led firms that bring configurable, intelligence-first architectures. These players may find new relevance by addressing previously underserved parts of the revenue cycle, offering modular tools, or partnering to embed domain expertise into their solutions

For Investors: A signal and a catalyst

-

- Thesis-Driven M&A: Private Equity (PE) firms may increasingly take a capability-mapping approach to M&A, proactively assembling assets that support modular integration and strategic convergence within the RCM value chain

-

- Increased value placed on API-first delivery models: Interoperability is becoming a strategic lever. Investors will likely favour platforms built on modular, API-first architectures that enable seamless integration with provider systems and partner ecosystems, supporting plug-and-play innovation and futureproofing

-

- Stronger monetization prospects: Assets with integrated architectures, scalable operating models, and demonstrated performance across complex RCM workflows are likely to be better positioned for value realization through premium valuations

Conclusion: An inflection point for RCM outsourcing

RCM 3.0 reflects a market in transition, from tactical outsourcing toward strategic orchestration. As the need for integrated, outcomes-driven solutions grows, platforms that combine services, software, and automation are becoming more relevant.

While this next phase is still unfolding, it’s increasingly clear that successful RCM models will be defined not just by operational efficiency but by how effectively vendors align people, process, and technology to alleviate at scale the systemic challenges surrounding healthcare providers.

If you found this blog interesting, check out our The RCM Gold Rush: Unlocking Value For Healthcare Providers, Vendors, And Investors | Blog – Everest Group, which delves deeper into the global services industry regarding RCM in the Healthcare industry.

If you have any questions or want to discuss RCM in more depth, please contact Aastha Malik ([email protected]), Ishita Aggarwal ([email protected]) and Abhishek AK ([email protected]).