The RCM Gold Rush: Unlocking Value for Healthcare Providers, Vendors, and Investors | Blog

The Revenue Cycle Management (RCM) space has become a top target for investors, fueled by a series of high-profile transactions in the last few years.

Although RCM has always been a cornerstone of healthcare operations, its importance is becoming more pronounced than ever as healthcare providers face gravely thin margins and are compelled to evaluate innovative ways to solve these falling margins in the wake of persistent workforce management issues, rising inflation, evolving care delivery demand trends and rising consumerism in healthcare.

However, as RCM takes center stage, the ultimate question remains, how big is the potential of this market and what opportunities can RCM vendors seize to enable better collaboration and outcomes for healthcare providers?

Reach out to discuss this topic in depth.

Quantifying the prize: how big is the US RCM operations market?

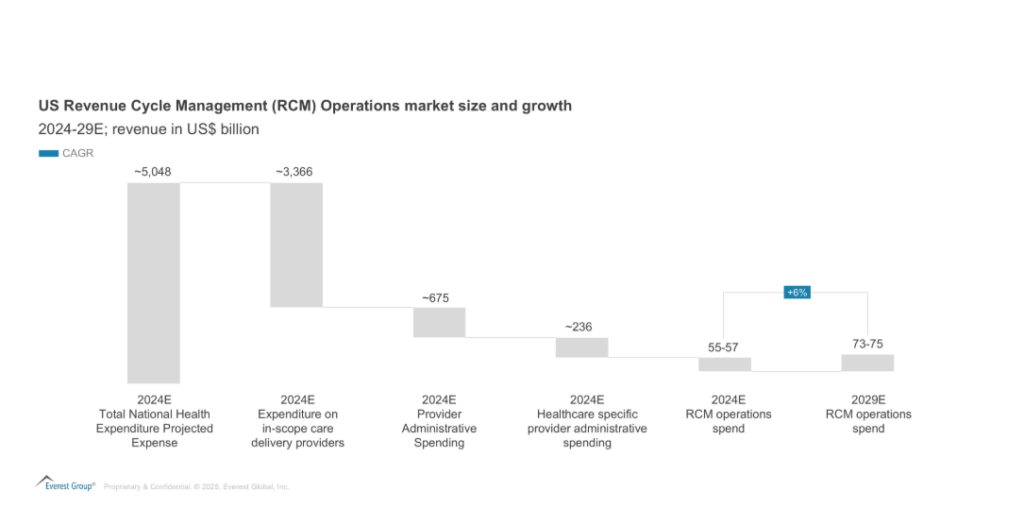

To estimate the potential of the US RCM operations market, Everest Group has analyzed National Healthcare Expenditure (NHE) data from the Centers for Medicare & Medicaid Services (CMS).

Based on Everest Group’s assessment of the demand and supply side, the RCM operations spending in the US stood at approximately US$55-57 billion in 2024 and is expected to reach US$73-75B by 2029.

The rest of the healthcare-specific provider administrative spend, cumulatively estimated to be approximately US$180 billion, is attributed to healthcare technology and care management areas.

However, it is imperative to understand and solve the challenges healthcare providers face to capture the biggest chunk of this over US$50 billion price.

Understanding the provider peril

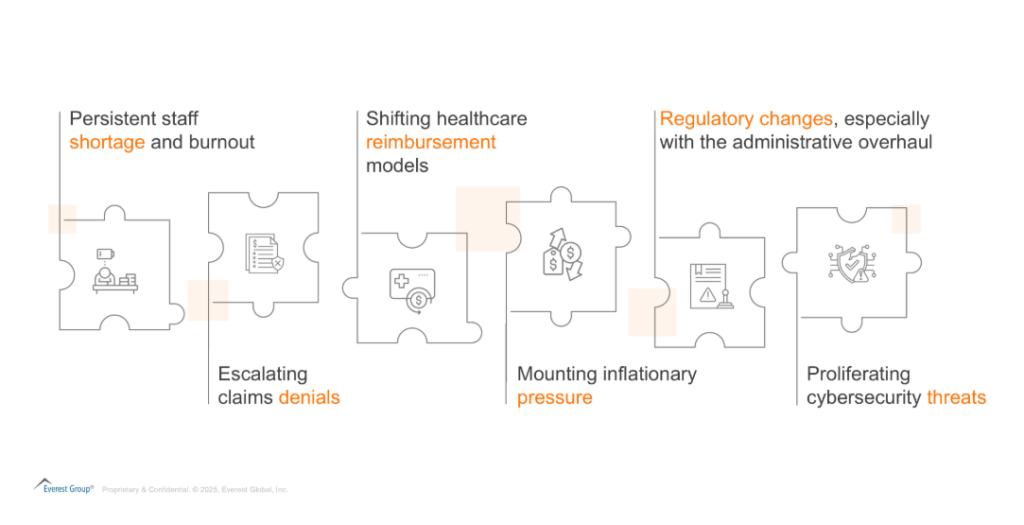

While hospital margins are witnessing a stabilizing trend compared to 2022 and 2023, with Calendar-Year-To-Date (CYTD) Operating Margin reaching 4.6% in November 2024, healthcare providers continue to face a whirlwind of challenges.

Research shows that in 2024, about 73% of providers struggled with increased claims denials. On top of increasing denials are the pain of continuous staff shortage and burnout, inflation, shifting dynamics of healthcare reimbursement models, cyber-attacks, and potential regulatory changes with the administrative overhaul.

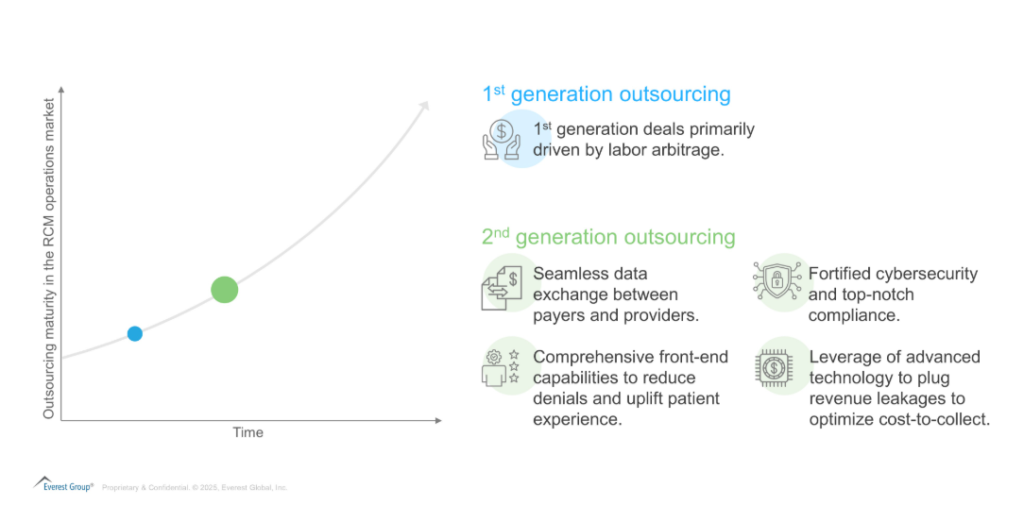

To alleviate these challenges and maintain healthy margins, healthcare providers are increasingly looking at 3rd party support for these RCM operations. However, the outsourcing paradigm, in line with provider expectations and challenges, is evolving beyond delivering labor arbitrage benefits.

RCM 2.0: The next era of outsourcing – moving beyond labor arbitrage

As healthcare providers seek 3rd party vendors to optimize revenue cycle functions, outsourcing has bloomed into second generation deals with the focus extending beyond traditional levers such as cost reduction, scalability, quality, and process improvement to levers such as impact on top-line growth, access to advanced technology, and enhancing patient experience.

Exponential value creation now centers on comprehensive front-end capabilities to reduce denials, technology leverage to plug revenue leakages to optimize cost-to-collect, and seamless data exchange between payers and providers, all the while offering fortified cybersecurity and compliance.

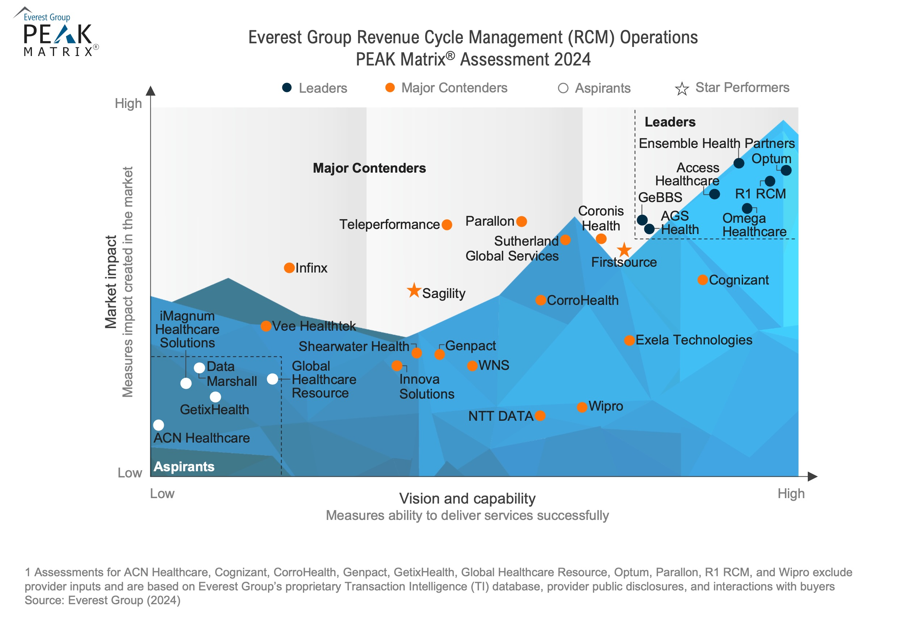

To maximize growth in the RCM outsourcing wave and to drive exponential value for healthcare providers, RCM vendors have made organic and inorganic investments to enhance their technology arsenal and plug gaps in their services portfolio.

Everest Group conducted a comprehensive assessment on the market impact and the vision and capability of the leading RCM operations vendor operating in the space. Below is how the vendors ranked in the 2024 edition of the assessment.

Everest Group Revenue Cycle Management (RCM) Operations PEAK Matrix® Assessment 2024

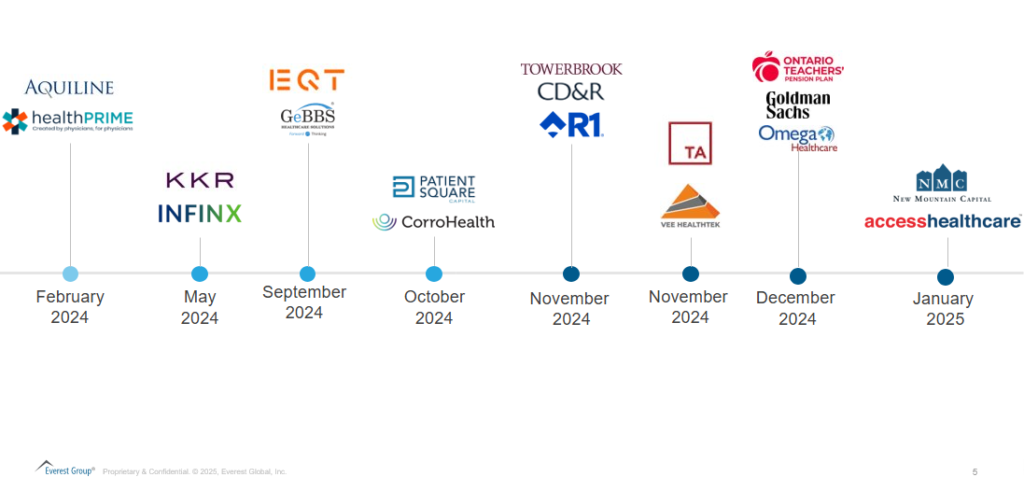

As vendors scale up and the competition intensifies, Private Equity (PE) firms continue to actively scout for investment opportunities in the space.

Some PE investors have already seized prime opportunities, while others are still searching for the next big win

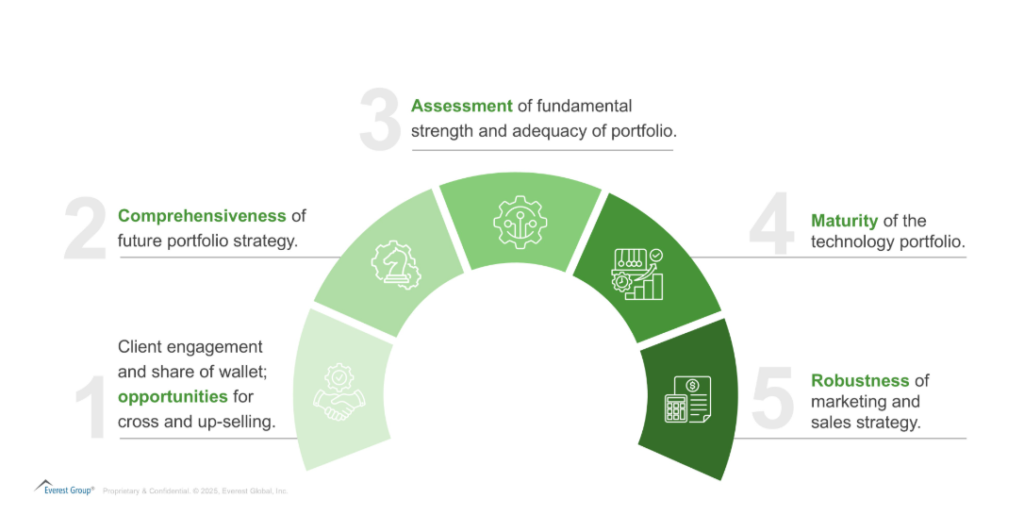

When evaluating their RCM bet, PE firms go beyond evaluating financials and talent and take a broader view and assess several key factors that influence long-term potential. These include:

While a lot of PE investments have been made in the recent past, according to a research report, only about 30% of the firms listed on Becker’s list of “RCM firms to know” were owned by private equity, as of October 2024. With significant headroom for growth, the opportunity is ripe to invest in this space.

However, as RCM vendors become PE-backed and get access to fresh capital, the focus of RCM vendor shifts to unlocking the next-era of growth to deliver value to investors and healthcare providers alike.

Fueling the future: how will RCM vendors drive the next era of growth?

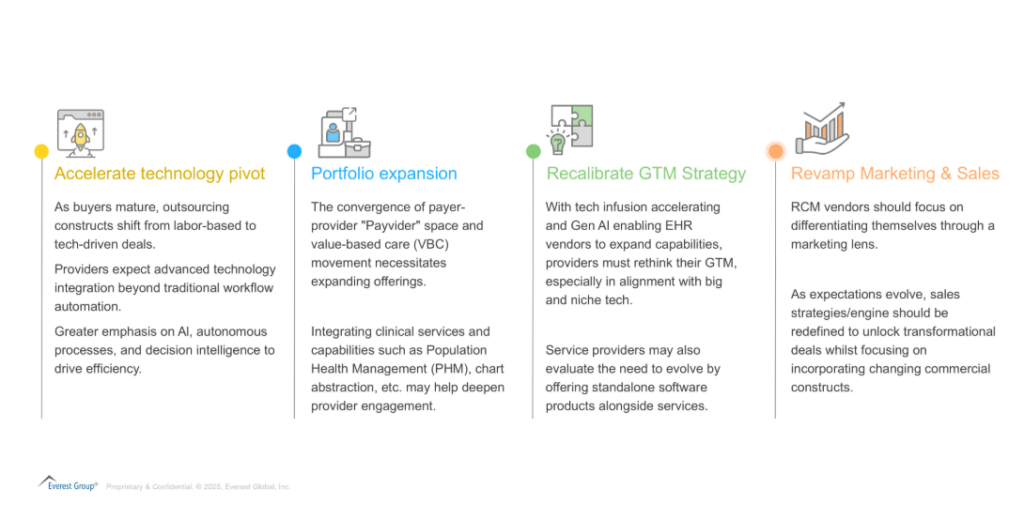

While traditionally RCM vendors, particularly offshore RCM vendors, fueled growth by streamlining administrative tasks and leveraging labor arbitrage opportunities through offshore operations and streamlined workflows. However, as healthcare evolves, these strategies alone are no longer enough to sustain competitive advantage. To unlock the next era of growth, RCM vendors should focus on:

Looking ahead: the future of RCM

With healthcare providers demanding more value, vendors racing to innovate and grow in a hyper-competitive market, and investors working to identify the star assets of tomorrow, the future of the RCM market is promising.

The ability to deliver strong measurable impact—through enhanced patient outcomes and enabling better margins through innovative constructs—will determine which vendors rise to the top.

If you found this blog interesting, check out our latest RCM Operations PEAK Matrix Assessment – link, which delves deeper into this topic.

To discuss the Revenue Cycle Management outsourcing market, contact Abhishek AK ([email protected]) and Aastha Malik ([email protected])