Wealth Management Technology

Wealth Management

Capital One’s planned US$35.3 billion acquisition of Discover Financial Services would combine two of the largest credit card companies, creating the most dominant US credit card firm. This deal holds the potential to significantly impact the banking and financial services (BFS) IT services market and providers. Read on to learn the looming risks and what to pay attention to.

Contact us to discuss the topic further.

Acquiring Discover would give Capital One access to a credit card network of more than 300 million cardholders. If the Capital One merger clears antitrust regulations, the combined entity would become the sixth-largest US bank by assets and a leading card issuer and network provider for the US payments market.

Let’s explore the following four implications of the Capital One merger on the BFS technology and IT services sectors.

Macroeconomic uncertainty and rising interest rates slowed financial services dealmaking in 2023. However, S&P predicts regional and community banks will be interested in mergers of equals this year. In these challenging times, banks want to understand the potential synergies of the merged entities clearly. They also require deeper due diligence than in the past, as exemplified by the failed merger of TD Bank Group and First Horizon.

Traditionally, acquisitions were an opportunity to enter new product lines and geographies, gain new capabilities, and achieve cost savings and operational efficiencies through technology modernization and streamlining processes and systems.

Recent banking sector acquisitions underscore a clear strategic focus on directing resources to targeted areas. Banks are divesting or seeking partners for non-core or insufficiently scaled units that lack a distinct competitive edge and demand substantial investment.

Our analysis indicates that merger and acquisition (M&A) activity among regional and community banks will increase, driven by the need to achieve greater scale. This strategic move is essential for these financial institutions to compete effectively with larger players, particularly as customer engagement transitions from physical to digital platforms.

By joining forces, these banks will be better positioned to develop new competencies in data management, AI/ML, open application programming interfaces (APIs), and advanced analytics, aligning with the growing digitalization of banking services. The merged entities will benefit from larger resource pools, facilitating improved alignment between skills and talent.

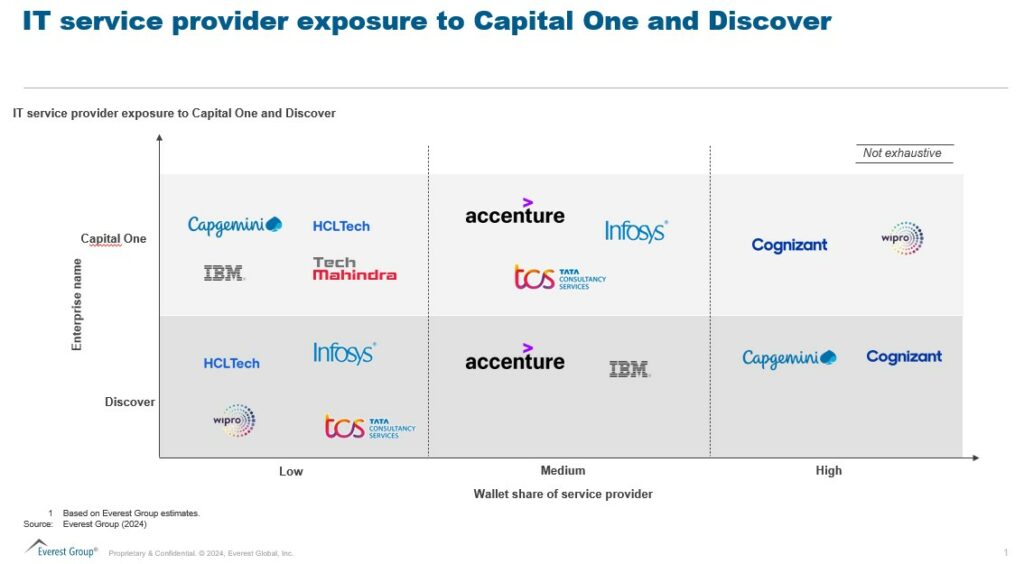

Discover and Capital One have traditionally relied heavily on outsourcing to two or three major service providers. In mergers, providers with significant contracts with both entities typically stand to lose revenue because spending by the merged entity will not be as large as it was under the separate relationships unless they gain wallet share from competitors.

Suppliers that solely provide services to Discover are at risk of having their portfolio consolidated and moved to Capital One. However, providers who bring intellectual property or a niche capability may maintain the business through the consolidation.

Discussions about increased regulatory scrutiny are emerging, as even the regional banking market is at the cusp of such transactions. Moreover, this transaction can potentially increase competition for giants Mastercard and Visa.

M&As spur increased short-term spending on post-merger integration and consulting services. By rationalizing vendor portfolios and IT infrastructures, merged entities can substantially cut costs by eliminating redundant applications and platforms. BFS firms will need partners to devise modernization roadmaps to create long-term value.

Merged entities must swiftly adapt their operational models, delivery strategies, and sourcing decisions to excel in the evolving landscape. Investing in specific technologies and tools is essential to foster growth and ensure operational continuity. Emphasizing core operations becomes a prerequisite as firms assess the appropriate valuation before crafting their integration strategy.

The road ahead for the Capital One merger

Richard Fairbank, founder, chairman, and CEO of Capital One, has emphasized that the merger with Discover presents a unique opportunity to unite two highly successful companies with complementary strengths and franchises.

The Capital One merger aims to establish a payments network capable of rivaling the industry’s most extensive networks and companies. However, the potential impact of increased market concentration from this combination will face regulatory scrutiny.

Providers should closely monitor system integration opportunities, as Capital One plans to expand its 11-year technology transformation initiative to encompass all of Discover’s operations and network.

The new entity will invest in growth initiatives, including faster time-to-market, innovative products and experiences, and personalized real-time marketing efforts. Operationally, underwriting, efficiency, risk management, and compliance enhancements will drive data and technology investments.

We are closely watching the market and regulatory actions. To discuss the Capital One merger and its impact on the US banking landscape, reach out to Ronak Doshi, [email protected], Kriti Gupta, [email protected], or Pranati Dave, [email protected].

Join this webinar to hear our analysts discuss Global Services Lessons Learned in 2023 and Top Trends to Know for 2024.

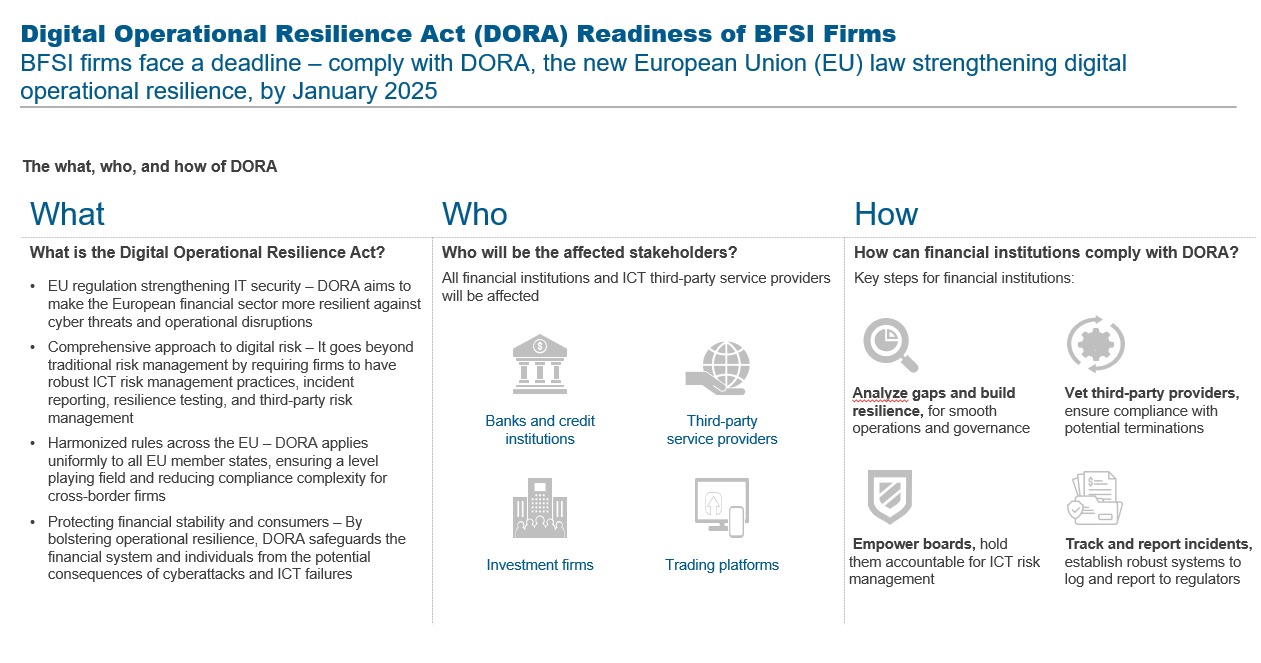

With the deadline for the European Union’s Digital Operational Resilience Act (DORA) less than a year away, financial entities and service providers need to begin acting to reach compliance. Learn the steps organizations should take to prepare now and discover how the new DORA regulations will strengthen digital operational resilience.

Financial institutions’ reliance on information and communication technologies (ICT) for core operations brings immense opportunities in today’s digital world but also exposes banks, investment firms, insurers, and other financial entities to significant cyber threats and operational risks. To address these growing vulnerabilities, the EU has enacted DORA.

The DORA regulations are expected to significantly enhance the digital resiliency of the EU’s financial sector and foster greater stability, consumer protection, and trust. Financial institutions and authorities are working toward meeting the implementation deadline of January 17, 2025. Let’s explore this further.

DORA addresses two critical concerns:

DORA will impact all financial institutions and ICT third-party service providers. This includes banks and credit institutions, investment firms, trading platforms, and providers delivering critical services like cloud computing, data centers, credit ratings, and data analytics. It applies to over 22,000 financial entities in the EU and ICT infrastructure support outside the EU.

DORA establishes a comprehensive framework for managing digital operational resilience across the financial sector. Some key provisions include:

DORA requires third-party providers to maintain robust cybersecurity measures and operational resilience capabilities to mitigate risks from potential vulnerabilities and disruptions. Moreover, financial institutions must ensure their current and future contracts with providers are compliant.

DORA focuses on five strategic pillars centered around data: risk management, third-party risk management, incident reporting, information sharing, and digital operational resilience testing. However, financial institutions still have many technology legacy systems that could create obstacles to data management.

Immediate next steps financial institutions should take to prepare for the January 2025 deadline include:

By leveraging their deep understanding of enterprise technology footprints, providers should proactively assist enterprises in meeting the regulatory deadline. We recommend providers take the following actions:

In the near term, we foresee the banking, financial services, and insurance (BFSI) industry in the EU being impacted in the following ways:

With the deadline fast approaching, enterprises and providers cannot afford to wait for the regulatory process to conclude and must begin to take these recommended steps to reach compliance by 2025.

To learn more about the Digital Operational Resilience Act and how to achieve compliance with the DORA regulations, contact Kriti Gupta, [email protected], Pranati Dave, [email protected], and Laqshay Gupta, [email protected].

To learn about Global Services Lessons Learned in 2023 and Top Trends to Know for 2024, don’t miss this webinar.

FinTech Partners

VIEW THE FULL REPORT

The payments landscape is changing rapidly. Today, consumers have more payment options than ever before. This is primarily due to the unprecedented rise of FinTechs, PayTechs, and neo-banks, which introduce faster, innovative, and convenient transaction methods such as Buy Now Pay Later (BNPL), digital wallets, Request to Pay (R2P), embedded payments, and digital currencies. The increasing prevalence of digital payments and the consumer demand for seamless instant transactions are driving the adoption of real-time payments systems.

New regulations and standards, such as ISO 20022, are paving the way for faster and more efficient payments. These new data standards create numerous opportunities for data monetization. Financial institutions are investing in modernizing payment infrastructure to support instant payments, leverage monetization opportunities, provide alternative payment methods, and launch digital currencies.

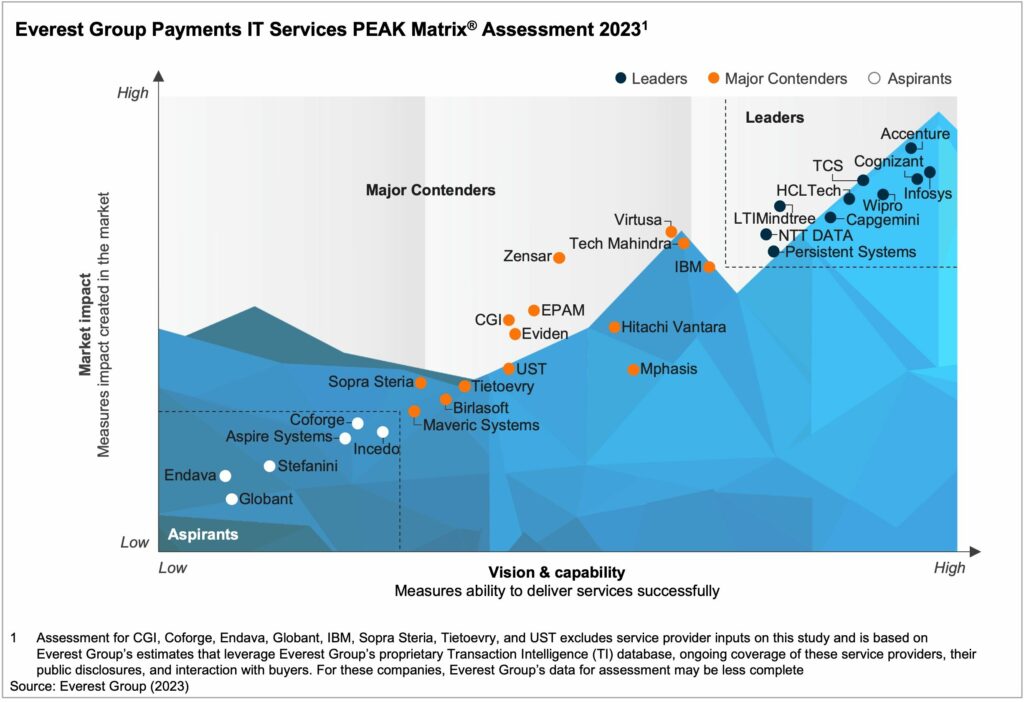

In this report, we examine the vision and capability and market impact of 30 payments IT service providers and position them on Everest Group’s proprietary PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants.

In this report, we:

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

The Asia Pacific (APAC) macroeconomic environment has experienced considerable ups and downs; additionally, banking and financial services (BFS) firms are up against the dual challenge of bringing in cost efficiencies while staying current with the latest technologies.

Amid these ongoing challenges, the paradigm of modernization is shifting from a point-in-time activity to continuous evolution.

In this webinar, our experts will discuss how, in an era where cost savings is critical, continuous modernization for BFS firms is key.

Our speakers will discuss:

Who should attend?

The recent seize of First Republic Bank and UBS’ takeover of longtime rival Credit Suisse in a rushed, deeply discounted deal has reverberations across the banking and financial services (BFS) IT services market and on service providers. Read on to learn the looming risks and what to pay attention to in this blog.

The aftershocks of the collapse of SVB and Signature Bank, followed by the UBS-CS deal, are still being felt by the banking industry. The recent seize of First Republic Bank by JPMorgan with warning bells around PacWest has brought back memories from the 2008 financial crisis of whether this will be a one-off event or end up spreading like a contagion to the banking sector, especially the mid-market banking sector in the US. The stock of First Republic Bank had been steadily losing value in the last few weeks, and the massive deposit outflows put the bank at risk of failure. In a hurried weekend bidding, JP Morgan was the winner, while others like PNC and Citizens were unsuccessful. Right after the rescue by JP Morgan, shares in other mid-market banks started to see a slide. Commercial real estate loans have emerged as one of the main culprits pulling down loans value.

One thing that is becoming abundantly clear from these events is that customer confidence in their bank’s ability to protect their uninsured deposits is waning. It is when quarterly earnings are reported that the full picture is coming up on deposit outflows. While technology advancements have helped the banking industry, digital banking has only shown how fast deposits can be moved, which, coupled with social media panic, can accelerate a bank run. The implications for the overall banking sector, along with the technology and services industry, are multi-fold.

Implications for the BFS IT services market:

Interestingly, it raises the question of whether large banks are becoming too big to fail, leading to an even higher concentration risk for the banking sector. While the takeover of First Republic Bank is expected to bring gains to JP Morgan in the wealth management business, will banking get consolidated in the hands of a few? This will have repercussions on technology spend and the competitive nature of the industry. Already, the US was behind the curve on open banking adoption. The added risk of bank failures may halt these initiatives for some time.

The rescue by UBS of Credit Suisse marks the latest explosion across global financial markets in the ongoing banking troubles sparked by the collapse of Silicon Valley Bank and Signature Bank in the US, as we covered in our last blog.

Let’s take a look at the factors leading up to the Swiss brokered last-minute emergency takeover of Credit Suisse at a 60% discount.

Credit Suisse was already battling concerns when its biggest annual loss since 2008 exacerbated the situation. Falling investor confidence eroded its share price to an all-time low, and top investors refused to give the bank more money citing liquidity concerns and regulatory hurdles.

Because Credit Suisse is considered one of the global systemically important financial institutions (SIFI), concerns about its future existence were particularly troubling. While the deal was made to prevent further meltdowns and stabilize the banking industry, risks of further blight spreading exist.

The merger of the two giants will have ripple effects on the BFS market, including:

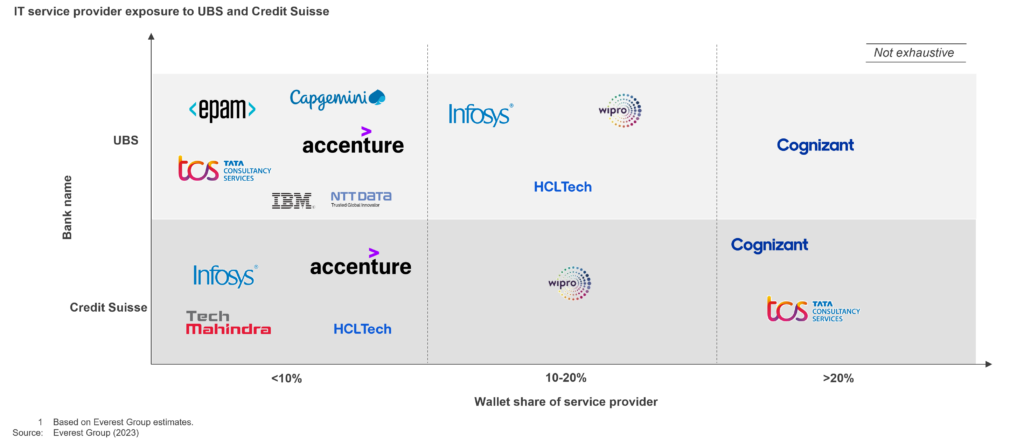

Additionally, suppliers in UBS and Credit Suisse’s IT portfolio should brace for an impact when these mammoths consolidate.

Traditionally, UBS and Credit Suisse have been huge outsourcing shops, with two or three major service providers controlling most of the work. Both banks have actively been reducing their outsourcing headcount and shifting their focus to insourcing and building capabilities in-house over recent years. This direction, coupled with the dynamics of the takeover, will lead to a rebalancing in the overall service provider portfolio across both banks. Here’s a look at the current landscape:

Typically in mergers, providers that have big contracts with both entities stand to lose revenue because the spending by the merged entity will not be as large as it was under the separate relationships, unless they gain wallet share from competitors.

Suppliers that only provide services to Credit Suisse are at risk of having their portfolio consolidated and moved to UBS. However, providers who bring intellectual property or a niche capability to the table may be able to maintain the business through the consolidation.

We are closely watching how the events will unfold in the next few weeks. UBS has a stronger balance sheet and is insured against any losses by the Swiss Treasury, which should lead to stability but settling cultural, and IT alignment will take time.

How Credit Suisse’s wealth management business shapes up is another element to consider. Already clients and asset outflows have begun, with competitors trying to take a piece of this pie.

The road ahead will be marred by the following challenges:

For more insights on the BFS technology and IT services market or to discuss the UBS-CS deal, please reach out to Ronak Doshi, Kriti Gupta, or Pranati Dave.

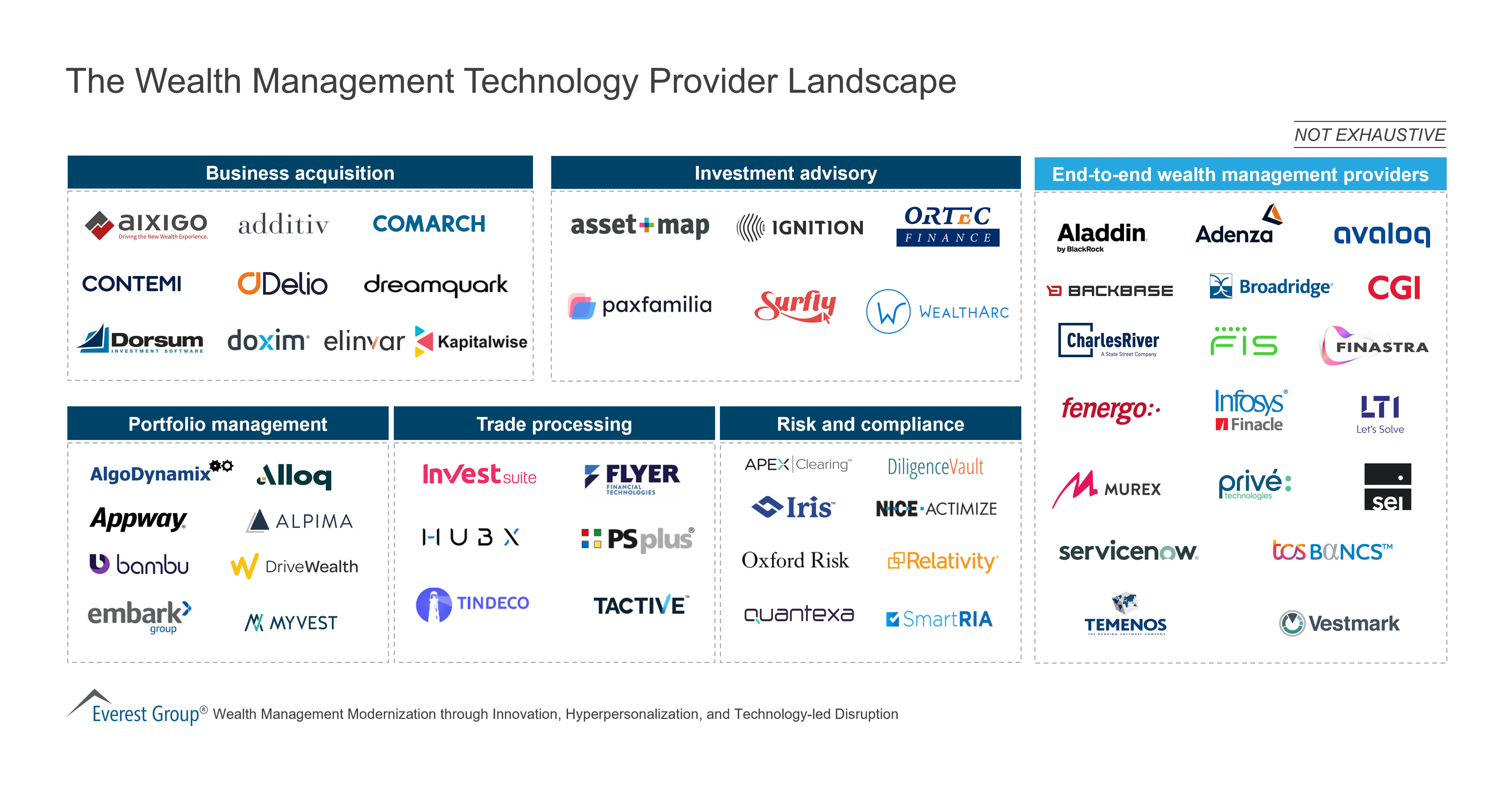

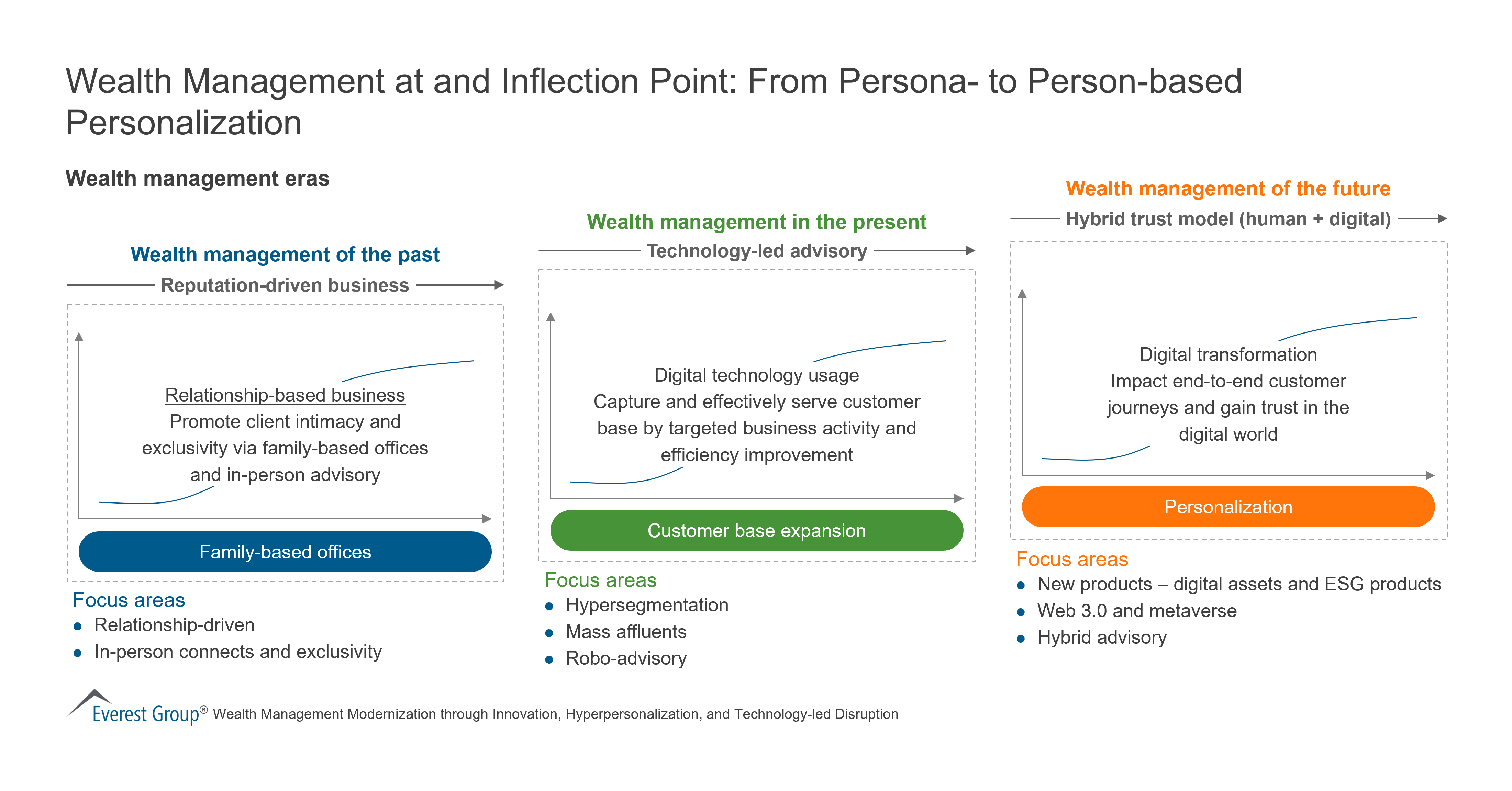

With the economy headed for slower growth, technology is more important than ever to enable companies to better serve customers by providing hyper-personalized experiences. Read on to learn how the disruptions will impact the wealth management industry and the role technology and service providers can play to help wealth managers navigate the choppy waters ahead.

In light of changing investor preferences, mounting regulatory pressures, and a looming economic slowdown, the wealth management industry is at the cusp of change. While the industry has demonstrated good resiliency and recovery post-pandemic, signs point to subdued growth in the next few years.

The wealth management industry has been experiencing one of the longest periods of market growth and economic stability in recent history. Financial support by governments, lower interest rates, and limited consumption opportunities have contributed to rising household wealth, generating increased revenues for wealth management companies from more fees and advisory support.

But the rapid rise in interest rates and fear of an economic slowdown will put pressure on this industry in 2023. Let’s look at the factors disrupting the wealth management industry in the first of our two-part series.

The industry is seeing structural changes in ecosystem participants. Traditional wealth managers are no longer the only players offering wealth management services and products. Challenger banks, pension providers, insurance firms, super-apps, nonbank financial companies (NBFCs), and nonbank financial institutions (NBFIs) are entering the market and creating competition.

These emerging segments already have access to a large customer base supplemented by data insights on demographics and buying patterns. This enables them to remove silos for customers and simultaneously improve income streams by reducing churn risk.

Customers now can access investment services within an umbrella of existing offerings. While this is a win-win for both parties, it is making wealth managers apprehensive as they realize the critical importance of retaining and more effectively serving their current customers.

While the pre-pandemic era was all about expanding and tapping into new customer segments, the strategy for serving various customer bases has significantly shifted. With the changing market dynamics, the focus has morphed from expanding and tapping into newer segments to building trust with existing customer segments and enabling hyper-personalized experiences.

A potential economic slowdown would have ripple effects on the wealth management industry. The focus on rapid growth would take a backseat as enterprises pivot their attention to reducing costs and improving profitability. This would directly impact tracking advisor productivity, improving advisor-to-client ratios, and enabling hyper-personalized experiences.

At the same time, providing access to emerging themes like Environmental, Social, and Governance (ESG) and digital assets will prove to be differentiators in the long run. Regulatory activity is heating up in the ESG space and will lead to corresponding technology implications for wealth managers’ IT estate, as previously discussed in our blog, New Sustainability and ESG Investment Regulations will Spur a Second Digitalization Wave in Wealth Management.

The wealth management technology estate traditionally has been characterized by multiple disparate systems siloed by products or functions, fracturing the customer experience. At its core, wealth management grapples with a massive data problem – how to effectively analyze customer data, understand their journeys, and identify better cross-sell/upsell opportunities.

Wealth managers need an IT estate that is flexible enough to accommodate these hyper-segments and different products, and their underlying data to address these evolving demands at speed and scale.

Identifying the right platform partner, enabling product expansion via ESG and digital asset offerings, and quickly disseminating this information to advisors will be key priorities for wealth managers as they assess their technology estates.

Identifying the ecosystem strategy for system integrators and other technology companies to improve fractured customer experiences will be equally important for technology providers. At the same time, service providers also will need to orchestrate and assemble best-of-breed solutions for wealth management clients by building a robust partnership ecosystem.

As wealth managers grapple with these market changes, technology has never been more important to help them better prepare and tackle the potential challenges coming their way.

The key questions that need to be answered include:

We are interested in hearing how wealth managers are preparing and tackling these market dynamics, and how this is manifesting in the conversations technology and service providers are having with clients. Please reach out to [email protected] or [email protected] to share your thoughts. In our next blog, we will look at the future state of the wealth management industry and provide a technology architecture blueprint for this space.

Learn more about how to deliver better customer experiences in our LinkedIn Live session, Frictionless Customer Experiences: The Key to Unlocking Satisfaction.

With the recent banking implosion, the global financial services industry, technology companies, and service providers will be hit in different ways. Let’s explore the reverberations of these concerning banking trends.

The failure of Silicon Valley Bank (SVB) along with Silvergate and Signature Bank raises the question: Are these isolated incidents or signs of greater trouble in the financial services industry signaling a recession in the US? We believe this will start a domino effect impacting banking regulations, profitability, and technology spend.

The recent collapse of the banks will have repercussions across the financial services system and may trigger the following aftermaths:

After the dust settles, these bank collapses can bring about the following two key learnings in the long term:

As the events played out, Moody’s downgraded its view on the US banking system from stable to negative, citing a rapidly deteriorating operating environment. Banks with sector-specific concentration risks, specializing in two or three sectors, have grown deposits in the last couple of years and also have a higher percentage of customers with average deposits exceeding the FDIC-insured limit, putting them at higher risk.

These banks will need to assess their portfolios and provide assurance to their customers. Even with these guarantees, customers still may decide to change their banking partners and seek traditional large banks that have more liquidity, impacting regional and smaller banks’ growth.

Declining customers and subsequent deposits will also affect other banking portfolios, and digital and technology transformation spend may take a hit. Banks’ risk management functions also will be scrutinized again. For example, only one of the seven members of SVB’s Risk Committee had risk management experience.

The global financial services industry also could be impacted. Other geographies like Japan and the UK are showing signs of distress with banks of similar portfolios and exposures.

The bank failures could have a lasting impact on the sector as the financial services industry restructures and implements new processes to avoid similar scenarios, including:

Here are our recommendations on how technology and service providers can capitalize on these new banking trends:

We expect an increase in offshoring intensity and a push for captive setup conversations through a build-operate-transfer (BOT) model approach. Service providers should watch the direction of US dollar prices as commercials will need to be revised for the foreign exchange (FX) impact (the double impact of potential rate reversal and wage inflation)

Looking ahead, BFS firms will cautiously approach technology and outsourcing spending, resulting in another quarter of soft demand. We also expect increased medium-term regulatory actions leading to spending increases across risk and compliance functions for non-SIFIs.

The recent bank failures have an underlying mix of bank-specific (micro) and macro-economic factors in play. The macro factors have the potential to increase fear in the markets (and depositors) as government bond yields have shown signs of reversing their course, and the added factors of slower economic recovery, inflation, high-interest rates, and the resulting layoffs in specific sectors add further pressure.

Credit Suisse saw a 20% fall in share price on fears of a liquidity crunch on March 15. This also impacted shares of other European banks, such as BNP Paribas, Societe Generale, Commerzbank, and Deutsche Bank falling between 8% and 10%.

We are closely observing the market and regulatory actions and are available for any questions you or your teams might have about the impact of these latest banking trends. Please reach out to Ronak Doshi, [email protected], Kriti Gupta, [email protected], or Pranati Dave, [email protected].

Learn about key trends and the outlook for the global services market in 2023 in our webinar, Global Services: Lessons from 2022 and Key Trends Shaping 2023.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields