Blog

How the Recent Seize of First Republic Bank and the UBS Takeover of Credit Suisse Will Impact the BFS IT Services Market

The recent seize of First Republic Bank and UBS’ takeover of longtime rival Credit Suisse in a rushed, deeply discounted deal has reverberations across the banking and financial services (BFS) IT services market and on service providers. Read on to learn the looming risks and what to pay attention to in this blog.

The aftershocks of the collapse of SVB and Signature Bank, followed by the UBS-CS deal, are still being felt by the banking industry. The recent seize of First Republic Bank by JPMorgan with warning bells around PacWest has brought back memories from the 2008 financial crisis of whether this will be a one-off event or end up spreading like a contagion to the banking sector, especially the mid-market banking sector in the US. The stock of First Republic Bank had been steadily losing value in the last few weeks, and the massive deposit outflows put the bank at risk of failure. In a hurried weekend bidding, JP Morgan was the winner, while others like PNC and Citizens were unsuccessful. Right after the rescue by JP Morgan, shares in other mid-market banks started to see a slide. Commercial real estate loans have emerged as one of the main culprits pulling down loans value.

One thing that is becoming abundantly clear from these events is that customer confidence in their bank’s ability to protect their uninsured deposits is waning. It is when quarterly earnings are reported that the full picture is coming up on deposit outflows. While technology advancements have helped the banking industry, digital banking has only shown how fast deposits can be moved, which, coupled with social media panic, can accelerate a bank run. The implications for the overall banking sector, along with the technology and services industry, are multi-fold.

Implications for the BFS IT services market:

- The market will see the return of large deals as bank consolidation will see the larger acquiring entity consolidate the supplier portfolios

- Higher regulatory scrutiny, especially on mid-market banks, coupled with plummeting stock value, will put a dent in banks’ IT spend in the near-term

- Cost-saving measures will be put in place, leading to job cuts and even branch rationalizations in the short term; job openings have already slumped to 6-month lows in the US

Interestingly, it raises the question of whether large banks are becoming too big to fail, leading to an even higher concentration risk for the banking sector. While the takeover of First Republic Bank is expected to bring gains to JP Morgan in the wealth management business, will banking get consolidated in the hands of a few? This will have repercussions on technology spend and the competitive nature of the industry. Already, the US was behind the curve on open banking adoption. The added risk of bank failures may halt these initiatives for some time.

The rescue by UBS of Credit Suisse marks the latest explosion across global financial markets in the ongoing banking troubles sparked by the collapse of Silicon Valley Bank and Signature Bank in the US, as we covered in our last blog.

Let’s take a look at the factors leading up to the Swiss brokered last-minute emergency takeover of Credit Suisse at a 60% discount.

Impact of the UBS-CS transaction

Credit Suisse was already battling concerns when its biggest annual loss since 2008 exacerbated the situation. Falling investor confidence eroded its share price to an all-time low, and top investors refused to give the bank more money citing liquidity concerns and regulatory hurdles.

Because Credit Suisse is considered one of the global systemically important financial institutions (SIFI), concerns about its future existence were particularly troubling. While the deal was made to prevent further meltdowns and stabilize the banking industry, risks of further blight spreading exist.

The merger of the two giants will have ripple effects on the BFS market, including:

- Slowed growth in Europe: If the crisis trickles down to other banks and lasts long, revenue growth in the banking, financial service, and insurance (BFSI) segments will be impacted in the near to mid-term. Other related sectors (such as retail and telecom) also can be affected as seen during the Great Financial Crisis of 2008

- Hits to other business segments: Areas such as asset and wealth management will be impacted by UBS’ decision to exit its wealth management business in some markets. Also, the move to wipe out the holdings of Credit Suisse bondholders has damaged Switzerland’s global reputation as a stable, predictable international asset manager

- IT consolidation: With duplicating technology platforms and applications, the new entity will have to rationalize vendor portfolios and IT estates to realize significant cost synergies. Merging the two banks will require increased short-term spending on integration activities and consulting. Partners that can create modernization roadmaps for the combined entity also will be needed to drive long-term value

- Job loss: UBS’s rescue plan for Credit Suisse may result in the loss of thousands of jobs at a time when the Swiss financial sector is already under tremendous stress due to the sudden takeover. The bank has slashed 4,000 positions so far this year

- Robust risk controls: Credit Suisse’s risk management practices will need a major revamp given its troubled history of scandals and management controversies (Archegos and Greensill scandals in 2021) that led the Swiss Financial Market Supervisory Authority (FINMA) to order remedial action. The required measures include periodic executive board-level reviews of the most important business relationships for counterparty risks

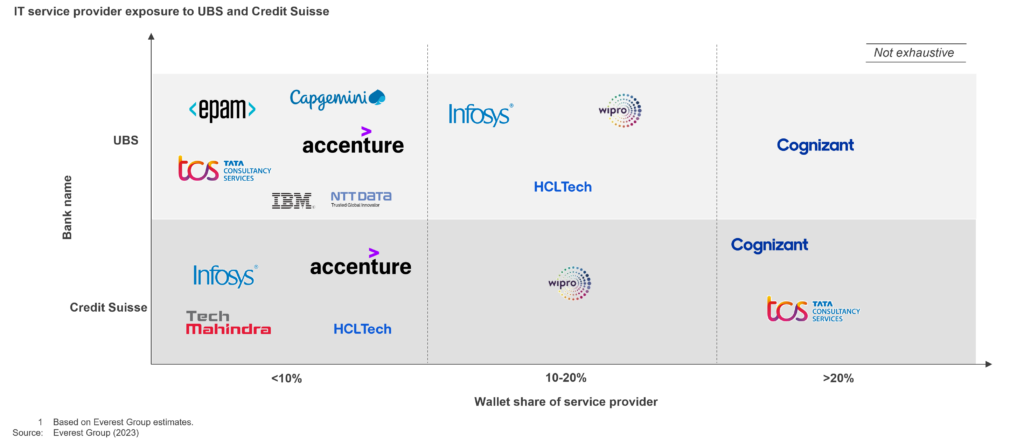

Additionally, suppliers in UBS and Credit Suisse’s IT portfolio should brace for an impact when these mammoths consolidate.

UBS-CS impact on service providers

Traditionally, UBS and Credit Suisse have been huge outsourcing shops, with two or three major service providers controlling most of the work. Both banks have actively been reducing their outsourcing headcount and shifting their focus to insourcing and building capabilities in-house over recent years. This direction, coupled with the dynamics of the takeover, will lead to a rebalancing in the overall service provider portfolio across both banks. Here’s a look at the current landscape:

Typically in mergers, providers that have big contracts with both entities stand to lose revenue because the spending by the merged entity will not be as large as it was under the separate relationships, unless they gain wallet share from competitors.

Suppliers that only provide services to Credit Suisse are at risk of having their portfolio consolidated and moved to UBS. However, providers who bring intellectual property or a niche capability to the table may be able to maintain the business through the consolidation.

We are closely watching how the events will unfold in the next few weeks. UBS has a stronger balance sheet and is insured against any losses by the Swiss Treasury, which should lead to stability but settling cultural, and IT alignment will take time.

How Credit Suisse’s wealth management business shapes up is another element to consider. Already clients and asset outflows have begun, with competitors trying to take a piece of this pie.

BFS market outlook

The road ahead will be marred by the following challenges:

- Banking industry consolidation: While the sudden implosion of SVB delivered a deep blow to a mid-market sector, the Credit Suisse collapse may have further repercussions across continental Europe and lead to further industry consolidation and mergers. This also will impact the technology sector, which is already reeling from layoffs, falling stock prices, and diminishing funding for startups

- Business segments and markets reprioritization: Providers will need to reprioritize their efforts and pivot their go-to-market focus on high-growth segments. A critical need exists to align with growth segments across lines of business, marquee clients, and the partner ecosystem

- Margin resilience: Our initial hypothesis indicates that service provider contract pricing should remain stable. However, revenue realizations could come under pressure with a lag due to portfolio shifts and the heightened competitive intensity. The US dollar has strengthened in past cycles in relation to the Indian Rupee so the cross-currency impact should be positive for margins

For more insights on the BFS technology and IT services market or to discuss the UBS-CS deal, please reach out to Ronak Doshi, Kriti Gupta, or Pranati Dave.