The payments landscape is changing rapidly. Today, consumers have more payment options than ever before. This is primarily due to the unprecedented rise of FinTechs, PayTechs, and neo-banks, which introduce faster, innovative, and convenient transaction methods such as Buy Now Pay Later (BNPL), digital wallets, Request to Pay (R2P), embedded payments, and digital currencies. The increasing prevalence of digital payments and the consumer demand for seamless instant transactions are driving the adoption of real-time payments systems.

New regulations and standards, such as ISO 20022, are paving the way for faster and more efficient payments. These new data standards create numerous opportunities for data monetization. Financial institutions are investing in modernizing payment infrastructure to support instant payments, leverage monetization opportunities, provide alternative payment methods, and launch digital currencies.

-

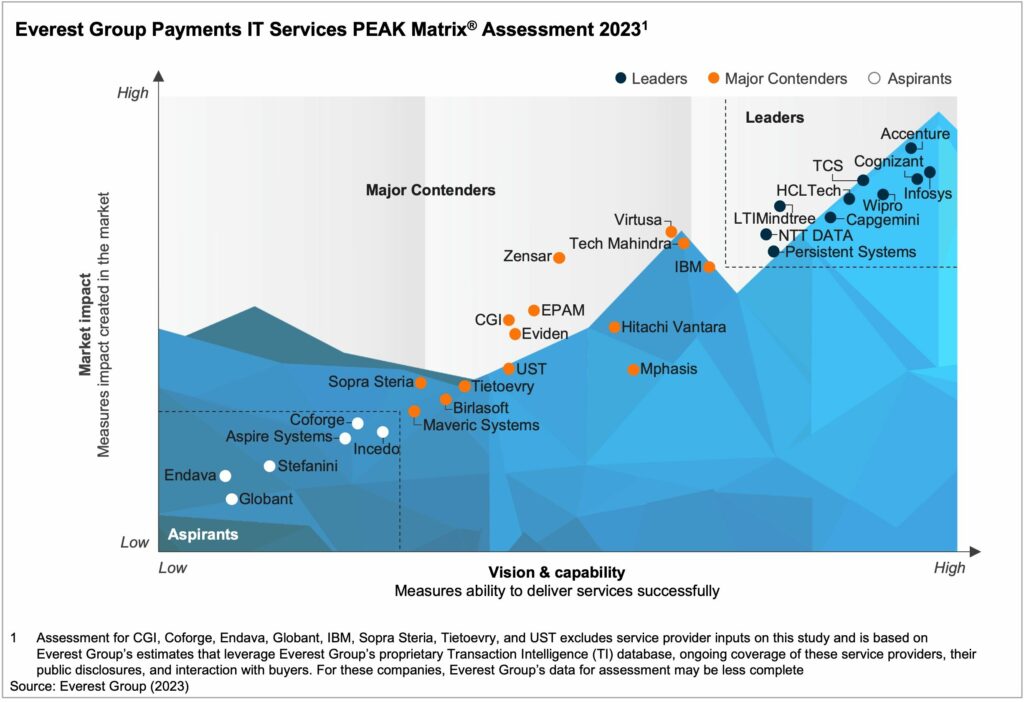

Payments IT Services PEAK Matrix® Assessment 2023

What is in this PEAK Matrix® Report

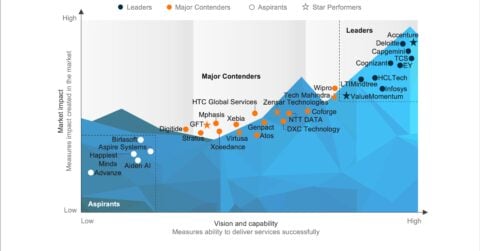

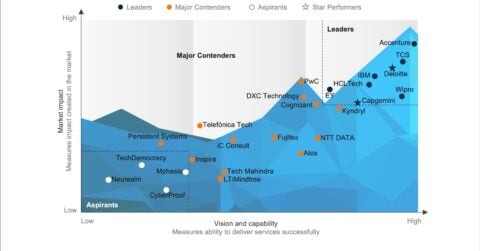

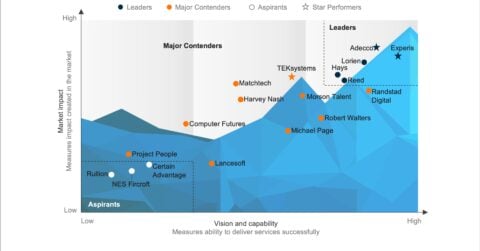

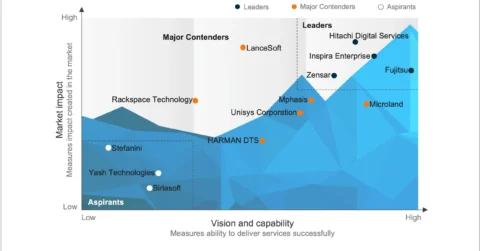

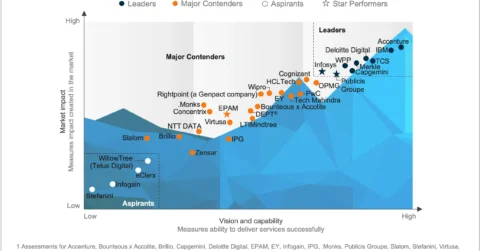

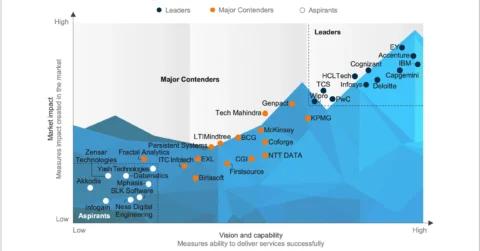

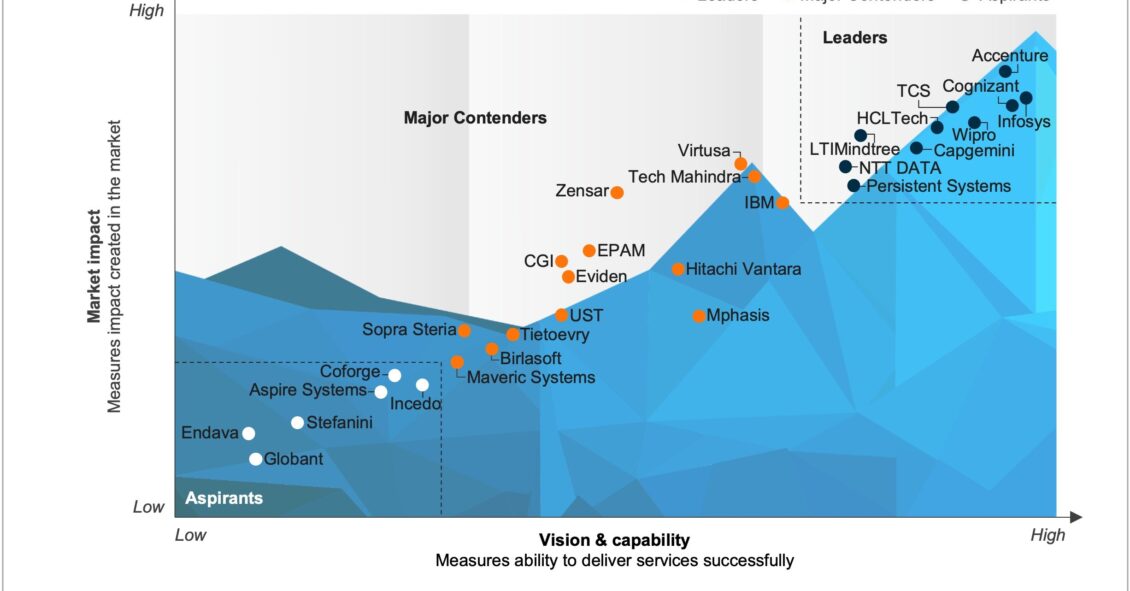

In this report, we examine the vision and capability and market impact of 30 payments IT service providers and position them on Everest Group’s proprietary PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants.

Content:

In this report, we:

- Examine key trends in the payments IT services industry

- Classify 30 payments IT service providers as Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Discuss the IT service providers’ competitive landscape for payments IT services in BFS

- Assess providers’ key strengths and limitations

Scope:

- Industry: Banking and Financial Services (BFS)

- Geography: global

- The assessment is based on Everest Group’s annual RFI process for the calendar year 2023, interactions with leading technology and IT services providers, client reference checks, and an ongoing analysis of the payments IT services market

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.