View the event on LinkedIn, which was delivered live on Wednesday, January 24, 2024.

As macroeconomic uncertainty continues to reign, the APAC market is becoming steadily more desirable for global services. 🌏 With unique talent availability and growth potential, the APAC market could be key for both buyers and providers in 2024. 🚀

Watch this LinkedIn Live session to hear how our analysts explored the demand drivers, challenges, and requirements to succeed in the APAC market.

During this event, our speakers unveiled the key issues that determined the trajectory of the APAC global services market and shared insights gathered from senior leaders across enterprises, shared services, and third-party providers in the APAC region.

During this event, we explored:

✅ What is the business outlook for 2024 in the APAC global services market? 📈

✅ What are the likely changes in sourcing patterns, investment themes, and challenges for enterprises? 💡

✅ How will generative AI impact the IT-BP services industry in APAC?

✅ What does it take to succeed in this market?

View the event on LinkedIn, which was delivered live on Wednesday, July 12, 2023.

Generative AI (GAI)💻 is rapidly gaining traction in customer experience (CX), with organizations striving to grab hold of the possibilities, real-world use cases, and what constitutes responsible adoption 📥.

📢 📢Join this LinkedIn Live session as our experts highlight the vast potential of GAI in CX and explore 🌟🔎 how this revolutionary technology can be applied within a variety of CX use cases, from streamlining marketers’ content supply chains to optimizing UI/UX value chains, and driving efficiencies in the creative development process.

We will also examine the future implications of GAI for both enterprises and service providers.

What questions will the event answer for the participants?

• What is GAI?

• What potential does it have in the experience services space?

• What are the real-world use cases 👁 that enterprises are currently focusing on?

View the event on LinkedIn, which was delivered live on Wedneday, April 26, 2023.

Today’s retail and CPG enterprises are facing the dual challenge of adverse macroeconomic conditions and rapidly changing customer behaviors. While macroeconomic factors are putting pressure on input prices 💲 and razor-thin margins, shifts in customer behavior are translating into a demand for sustainable products and hyper-personalized omnichannel experiences.

💻📱Technology disruptions over the past few years have successfully mitigated these challenges and created new avenues of growth 📈 for both enterprises and service providers.

📢 📢 In this LinkedIn Live, our analysts will share insights into the key technology investment priorities of retail and CPG enterprises and opportunity areas for service providers.

What questions will the event address?

✅ What are the top investment priorities for retail and CPG firms?

✅ How are enterprises rethinking transformation while balancing customer experience, cost competitiveness, and sustainability?

✅ What is the role of the technology and service provider ecosystem in enabling this transformation journey?

✅ What challenges are enterprises facing in their present engagements with service providers?

The Asia Pacific (APAC) macroeconomic environment has experienced considerable ups and downs; additionally, banking and financial services (BFS) firms are up against the dual challenge of bringing in cost efficiencies while staying current with the latest technologies.

Amid these ongoing challenges, the paradigm of modernization is shifting from a point-in-time activity to continuous evolution.

In this webinar, our experts will discuss how, in an era where cost savings is critical, continuous modernization for BFS firms is key.

Our speakers will discuss:

Who should attend?

Low code is emerging as a key technology for enterprises to rapidly develop and deploy custom applications and accelerate their digital transformation journey. Multiple low code platform providers have surfaced in the past few years, offering immense potential. However, the technology remains underutilized because of enterprises’ lack of awareness, multiple myths and misconceptions, and the limited availability of talent.

In this webinar, we’ll share our views on the low-code market, its potential, and key opportunities for enterprises to drive digital transformation. We’ll also explore the low-code adoption journey leading enterprises to maximum benefits.

What questions will the webinar answer?

Who should attend?

Selecting the Right Low-code Platform: An Enterprise Guide to Investment Decision Making | Blog

What factors make this economic downturn different, and is IT services spending recession-proof? Despite recessionary fears, digital transformation and post-pandemic demand will help maintain IT services growth with more cautious tech spend moving forward. Learn the three strategies service providers should take now to plan for the slide in this blog.

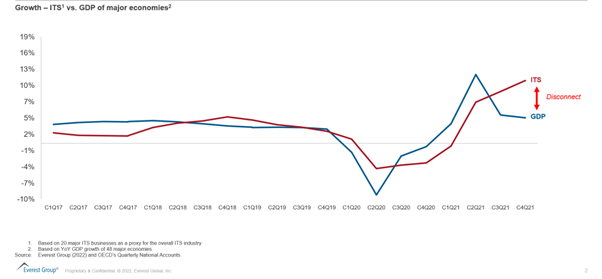

By all accounts, it seems we are entering a cyclical phase of economic downturn. Gross Domestic Product (GDP) declined for the US, Italy, and Japan in the first quarter, while the UK, France, and Canada flatlined or deaccelerated meaningfully.

This has been visible a long way off, and the equity markets have adjusted their guidance for IT services stocks accordingly. However, we at Everest Group believe this is very different than past cyclical downturns.

To truly understand the nature of the impact on the IT services industry, we need to ask the following three questions:

Chart one tells us a few things:

A combination of the second and third factors is leading to the divergence between the IT services and aggregated economic activity, as measured by the GDP.

Chart 1

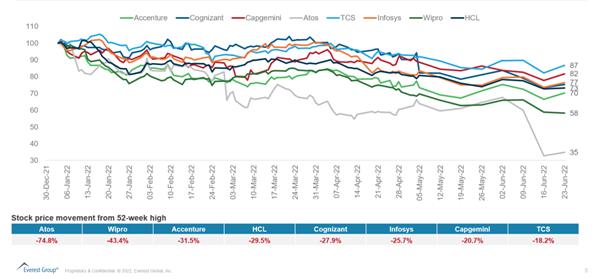

Now, look at this second chart. Suffice to say that IT services stocks have taken a beating in 2022.

While some stock price erosion can be attributed to inflationary pressures leading to margin compression, a significant part is due to negative macro expectations.

Curiously, during the same period, consensus revenue estimates have continued to expand (Accenture, Cognizant, Infosys, Wipro, TCS), and book-to-bill ratios remain healthy (expanded Year-over-Year for Capgemini and IBM, with mild deceleration for TCS and Accenture).

Quite simply, this downturn was visible a mile off. All of us could see it, as could customers, economists, governments, central banks, and equity markets. And a little bit like seeing a slow train coming, we skipped the tracks and readjusted our expectations. Consequently, it’s unlikely we will see a trainwreck, but tech Return on Investment (RoI) will be increasingly scrutinized.

Chart 2

Finally, we need to remember that the world is still coming out of COVID-19. Every enterprise made massive cost adjustments during the pandemic by automating routine tasks, moving to the cloud, and divesting non-core assets. In other words, many of the usual cost adjustment levers are already pre-adjusted, and one has to pause and ask – how much padding do we still have before we risk cutting too close to the bone?

Service providers will still need to readjust. Here are some recommended immediate steps to take:

What is your outlook for IT services spending? And how are you planning for the downturn? Please feel free to share your perspectives, email me at [email protected] or Contact Us.

To learn more about the increase and changing rates across the services industry, request a 30-minute briefing.

The recent headline, Indian IT Firms Set to Slash 3 Million Jobs by 2022 Due to Automation, grabbed attention. But our analysis shows this is nothing more than a catchy title. To learn about the other side of the picture that points to job and hiring growth, read on.

Occasionally, a news article or stray comment will suggest the Information Technology (IT) industry in India faces a stiff battle to survive against an onslaught of automation, cloud, and insourcing. The latest is the claim in news stories that 3 million jobs in India will be lost by 2022. The next day, NASSCOM shared data that suggested the opposite, and a few media outlets issued clarifications.

We had a chance to view an excerpt of the original Bank of America report that found automation is creating millions of new jobs and boosting global productivity. Our initial reaction is that the original story is a combination of faulty or incomplete analysis and lack of context, topped with a sensational headline.

Below we share a more nuanced understanding of the industry to help avoid such storms in teacups in the future.

Media coverage of the Indian IT and Business Process Services (BPS) industry often conflates the India-based talent pool with homegrown industry giants like TCS, Infosys, Wipro, HCL, and Tech Mahindra. The reality is that all firms, including globally headquartered giants like Accenture, Capgemini, DXC Technologies, and IBM (to name a few), have a massive presence in India.

The IT-BPS talent pool in India is employed across the following key segments:

Any analysis that fails to look at the swings and roundabouts between these segments risks missing the mark. For instance, insourcing – a growing trend of using an organization’s own resources instead of outsourcing – often tends to benefit Global Business Services (GBS) organizations at the expense of third-party providers. Automation and technology disruption may pull down demand for a few outsourced services, but simultaneously increase the desire for services in many other categories.

Even if we assume for a moment that the term “Indian IT” was used loosely to focus on third-party outsourcers, the facts still do not support the following conclusions:

Most of the industry leaders we speak with cite the opposite problem. They are facing a glut in demand and can’t hire fast enough. Enterprises are frantically upskilling existing employees to learn new technologies, impacting hundreds of thousands of FTEs across the talent pool in India. These skills do not exist in sufficient numbers externally so laying off current workers and hiring new ones is not an option. If the original report wanted to convey that companies are seeking to replace old tasks with new ones through reskilling, the headline failed to convey this accurately.

Myth #1: “Indian IT” survives on doing commodity jobs that no one else wants to do

Reality: The talent pool in India enables many of the world’s most innovative companies to meet their objectives

Yes, the industry might have started to provide labor arbitrage but it sure as heck could not have survived and grown that way over decades. Just to cite a few examples, talent pools in India are supporting the advancement and application of technologies critical for autonomous driving. Software that is required to roll out 5G networks is being built and supported by India-based talent pools, as are platforms that power banking operations for some of the biggest names in the world. Many GICs we speak with mention that the share of commodity tasks in their portfolio is down to 30% (from 70% 10-15 years back). The current reality is a very far cry from the days of Y2K and spammy call centers. It might be helpful for skeptics to visit some of today’s modern India-based development centers and labs. The experience is usually quite eye-opening!

Myth #2: Automation is the equivalent of the Infinity Stone

Reality: Automation takes years and years to get right, and scale. This usually means time to adjust, and more work, not less

No, the RPA God does not snap its fingers to kill jobs. At the current level of maturity, RPA typically eliminates specific tasks. However, it is still some distance away from automating a process (a series of tasks/activities). Further, the scalability of RPA remains a challenge. What works for one type of task or even a series of tasks may not work as the context changes. Yes, automation is getting intelligent through cognitive and Artificial Intelligence (AI). But as anybody who has spent some serious time in the AI world would attest, it takes time to first get the AI-engine trained and usually requires human-in-the-loop (HITL) to complete the process. To be clear, smart automation does increase the productivity of the individual meaningfully and, in turn, lead to process efficiency and other benefits. However, instead of “killing jobs,” it is creating more opportunities for service providers and GICs to serve enterprises more deeply and widely leading to higher demand for labor in India.

Myth #3: Things just die

Reality: In the world of technology, services usually evolve, and new categories get created, replacing old ones

We often hear an implicit (and occasionally explicit) assumption that technology disruption will kill old service categories. For instance, cloud will kill the need for IT infrastructure management, and that application testing is passe. And that’s it – nothing else happens.

In reality, IT infrastructure management is evolving to handle the complexities of hybrid and multi-cloud and is facing an acute talent shortage. There is a shortage of people who can test complex apps that are hosted on the cloud, control software-driven physical devices, or have elements of AI baked into them.

The history of technology shows that every disruption creates its own service model. Enterprise Resource Planning (ERP) systems were supposed to be the death knell for bespoke applications. Instead, they spawned a massive industry of consulting, implementation, customization, and maintenance. Automation to scale will require highly skilled talent to build, monitor, and maintain algorithms and datasets. As the pace of AI and Machine Learning adoption picks up, we are witnessing the expansion of Machine Learning Operations (MLOps) services, which help in the continuous delivery of algorithmic models.

Vindicating the Indian IT Industry

The world of technology is changing, arguably faster than ever before. India just happens to have the world’s largest reservoir of talent that can enable this change. The “Indian IT industry” does not need a sensational headline and it does not need defending. It deserves a deeper understanding that will help us predict and navigate these changes better.

This is one in a series of blogs that explores a range of topics related to COVID-19 and will naturally evolve as events unfold and facts reveal themselves. The blogs are in no way intended to provide scientific or health expertise, but rather focus on the implications and options for service delivery organizations.

These insights are based on our ongoing interactions with organizations operating in impacted areas, our expertise in global service delivery, and our previous experience with clients facing challenges from the SARS, MERS, and Zika viruses, as well as other unique risk situations.

At the outset, let me be clear. The COVID-19 pandemic is a human tragedy of unprecedented proportions. It has real human impact in terms of loss of life and livelihood. It is also about tremendous bravery, and countless inspirational stories from around the world. I am sure all of us are doing our bit to help those impacted as are the brave men and women fighting the battle from the trenches.

However, this post is not about that. Instead, I wanted to write about how IT services will change once we emerge into the light at the end of the tunnel. As Helen Keller said, “Nothing can be done without hope and optimism”; we must believe that this too shall pass. Frankly, we will have bigger problems than the health of our P&L if it doesn’t.

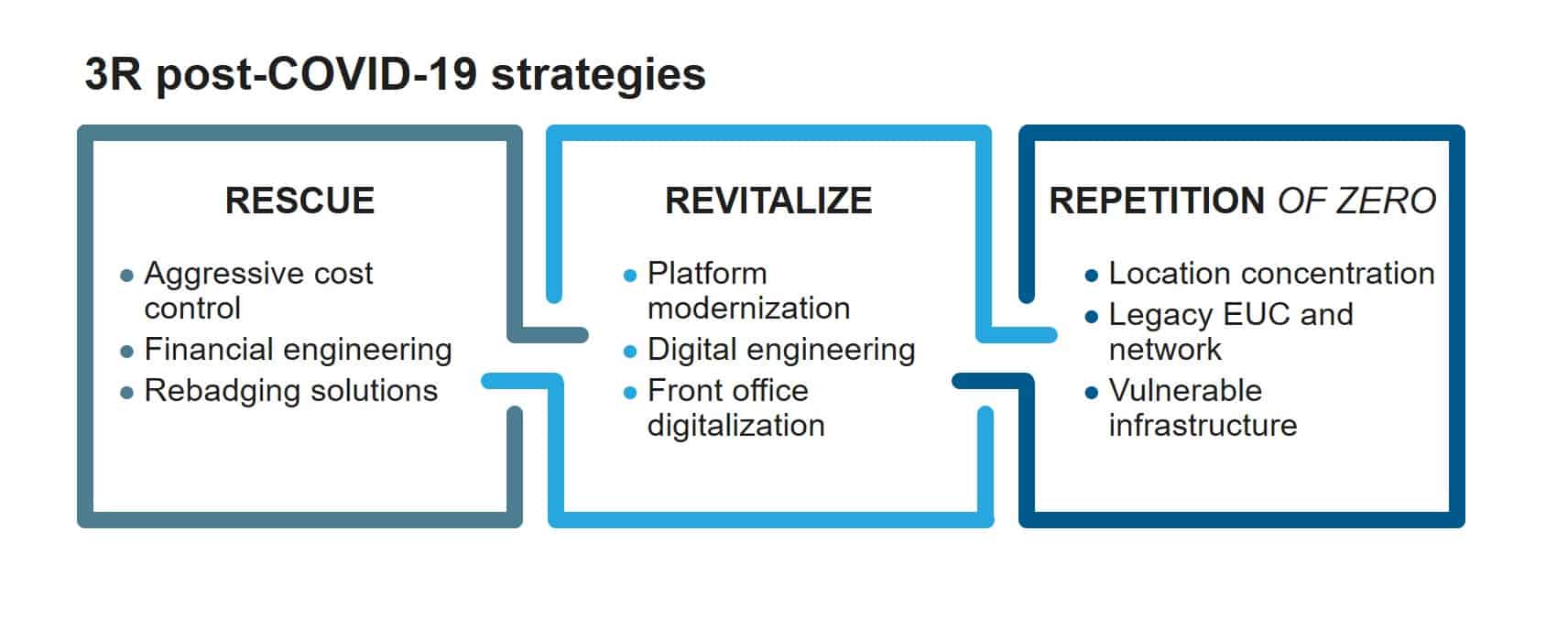

I believe that, while the world will no doubt face economic challenges, the post-COVID-19 world will also offer three sets of interesting opportunities for IT service providers.

Enterprises that have borne the frontal assault of the pandemic will need significant help to recover. They will look for an infusion of cash and engage in deep cost-cutting. Further, as governments across the world ease liquidity and lower the cost of capital, enterprises will seek financial engineering solutions from their IT and BPO providers.

Key opportunities will include asset-leveraged IT infrastructure deals, rebadging of existing workforces, and post-M&A integration support in industry consolidation scenarios. We expect these opportunities to come up in the travel, transport, and hospitality industries.

The disruptive phenomenon of COVID-19 will underscore the need to move to alternate, digital-friendly business models for many industries. Sophisticated enterprises will want to accelerate their digital transformation initiatives for a variety of reasons – to recover lost time, to lower the cost of customer service, and to derisk their traditional business models. Digital disruptors will sense weakness in their competitors and will seek to accelerate their expansion plans.

We anticipate key opportunities in the shape of IT platform modernization, digital product engineering, and digitalization of front-office functions in industries like financial services, retail, and consumer goods. These were initiatives that most enterprises were already seeking to scale. As they go after them with renewed vigor, service providers must find ways to construct self-funding, agile journeys instead of big bang transformation. There will be little appetite for the latter.

COVID-19 has fundamentally altered risk perception in the global services industry. Delivery models will need to be re-evaluated for their resilience to risks that were hitherto relegated to the “it can’t happen to us” category. Cost-conscious enterprises that stayed clear of initiatives like BYOD, VDI, and cloud-based collaboration systems now have a clear business case, albeit one they didn’t want or foresee. Key opportunities: Enterprises will need to modernize and secure their networks to enable remote working at scale, modernize and automate their datacenters, move to the cloud, and establish multiple levels of disaster recovery sites. There might even be opportunities to set up enterprise-class home offices for mission-critical workers analogous to how remote and branch office infrastructure has been managed. Global delivery frameworks will be scrutinized for location concentration risks, and secure ODCs will need new operating procedures. We expect almost every enterprise to be dealing with their own version of derisking.

How are you preparing for a post-COVID-19 world? Let me know at [email protected]

Visit our COVID-19 resource center to access all our COVD-19 related insights.

If you are a sourcing professional, you have our deepest respect, because now, more than ever, your job is a tough one. The sourcing industry is changing fast, disrupted by emerging technologies, shifting talent requirements and evolving service provider capabilities. Moreover, fluctuating geopolitical and legislative issues are causing enterprises to rethink substantial, long-held sourcing strategies and provider relationships. Sourcing professionals face formidable challenges in the global economy as the new year approaches and they look for better strategies in an industry experiencing unparalleled turbulence.

It used to be that a sourcing professional’s No. 1 responsibility was finding a way to get the work done as cheaply as possible. Not any more. Technology has changed the game. In nearly every industry, digital technologies are driving the development of innovative products and services and improved customer experiences. To keep pace in this digital world, enterprises are now pursuing a digital-first rather than arbitrage-first strategy. In fact, the global services market has seen a threefold increase in digital-focused deals.

Automation, once merely a service delivery tool, is now “front end,” with enterprises demanding strategy, vision and strong Proof-of-Concepts (POCs) for advanced automation in 33 percent of all application services contracts in 2016. Similarly, artificial intelligence, cognitive computing and robotics will soon begin to pervade the enterprise portfolio and will eventually become mainstream in sourcing landscape.

The increasing adoption of digital strategies is changing the workforce skills that enterprises seek, and, in turn, forcing sourcing professionals to revamp their location portfolios in the midst of a dynamic landscape. Location options for traditional global sourcing continue to expand, and new locations are emerging for unique talent demands, such as digital capabilities.

Sourcing professionals also must anticipate and react to numerous geopolitical disruptions that keep the sourcing landscape shifting like windblown sand. In the past year, for example, we have seen a significant decrease in demand from the United Kingdom given the uncertainty with Brexit; uncertainty about healthcare legislation in the US has dampened the healthcare sourcing market; and the uncertainty due to visa reforms has led to increased local hiring and onshoring in the U.S.

Sourcing professionals also are challenged to stay abreast of changes in the provider landscape. Mergers and acquisitions are on the rise, and leading providers are making fundamental changes to their talent and service delivery models. Between April of 2016 and March of this year, Everest Group witnessed 40 acquisitions to expand digital capabilities, 140 alliances between providers and technology providers or startups, and the setup of 35 new centers and digital pods to help clients rethink their digital strategies.

In the midst of this complexity, buyers of global services are tasked with making critical decisions. Recompeting an outsourcing contract, selecting a location for a global in-house center, or contracting for new tech services—these are the types of decisions that can significantly impact an organization’s performance and an executive’s career.

That’s why Everest Group has announced that it is doubling down on its commitment to provide fact-based comparative assessments. We’re consolidating our comparative analysis offerings – previously offered under a variety of product names – under our flagship PEAK Matrix brand, which will now evaluate services, solutions, products and locations. Additionally, we’ll be expanding the market segments addressed to include new functions, processes and industry verticals. Read more about it here.

In the midst of all the complexity and change that sourcing professionals face, one thing remains the same: Everest Group is your source for the fact-based analyses you need to make informed decisions that deliver high-impact results.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields