Demand for Next-Gen Services Defining Location Strategies | Blog

Regulatory uncertainty, technological disruption, talent challenges, and a host of other issues have all played significant roles in enterprises’ and service providers’ location strategies for global services delivery over the past couple of years.

The deep-dive analysis we conducted on enormous volumes of 2018 data to develop our Global Locations Annual Report 2019 made it clear that five key trends came into play in 2019, and will continue into 2020:

- Increased focus on digital and R&D/engineering services

- Increase in nearshoring

- Slowdown in headcount growth

- Increase in onshoring by service providers

- Growth in emerging locations.

Here’s a quick look at each of these trends.

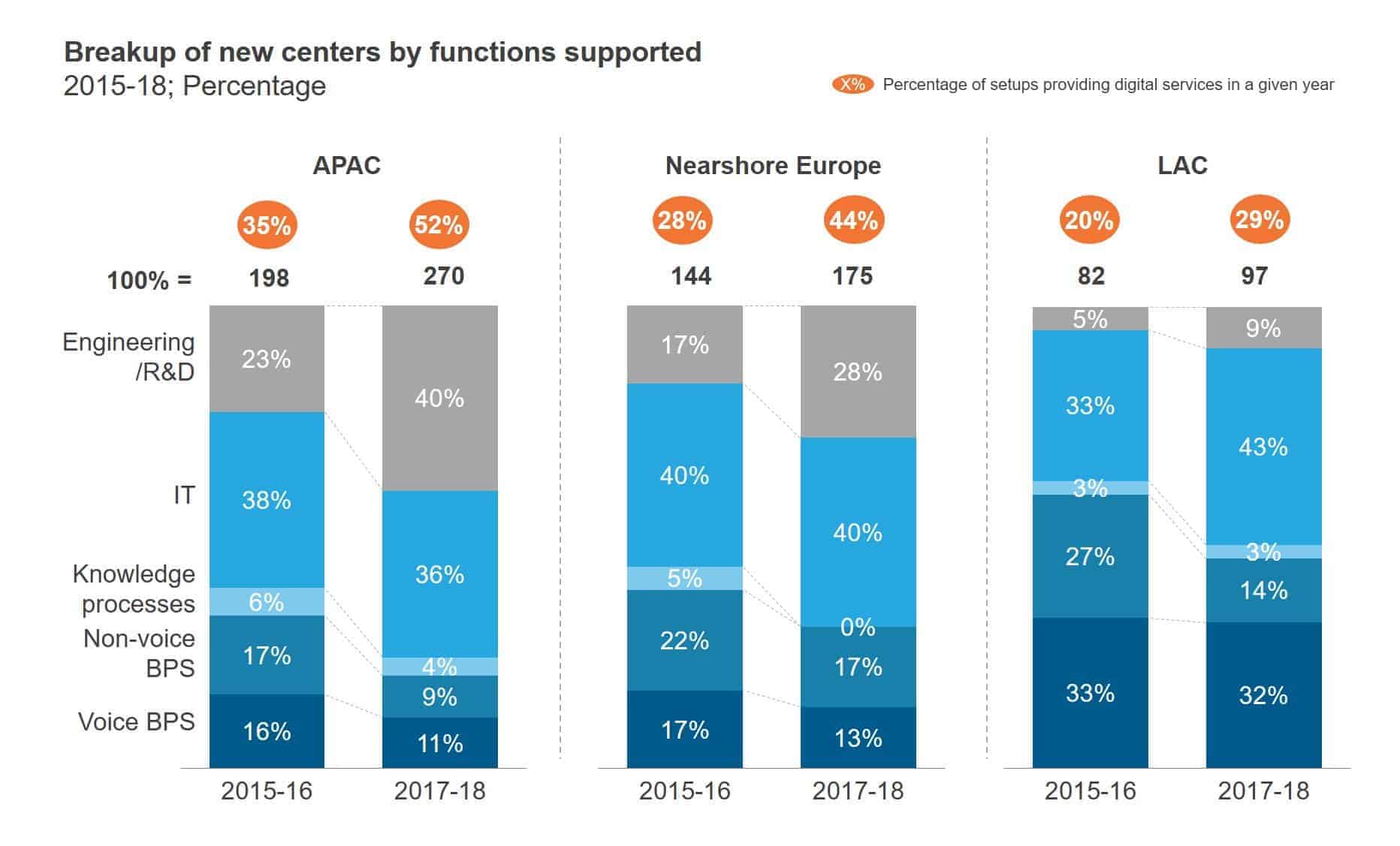

Digital and R&D/engineering services continue to dominate

Enterprise demand for digital services and the associated R&D/engineering services compelled most global service providers to set up innovation centers and COEs to keep up with the changes in the digital landscape. And there was a significant rise in the number of R&D/engineering and digital service delivery centers – especially in APAC and nearshore Europe – as providers vie to develop data-driven, intelligent, and robust systems using automation, cloud, and AI-based capabilities.

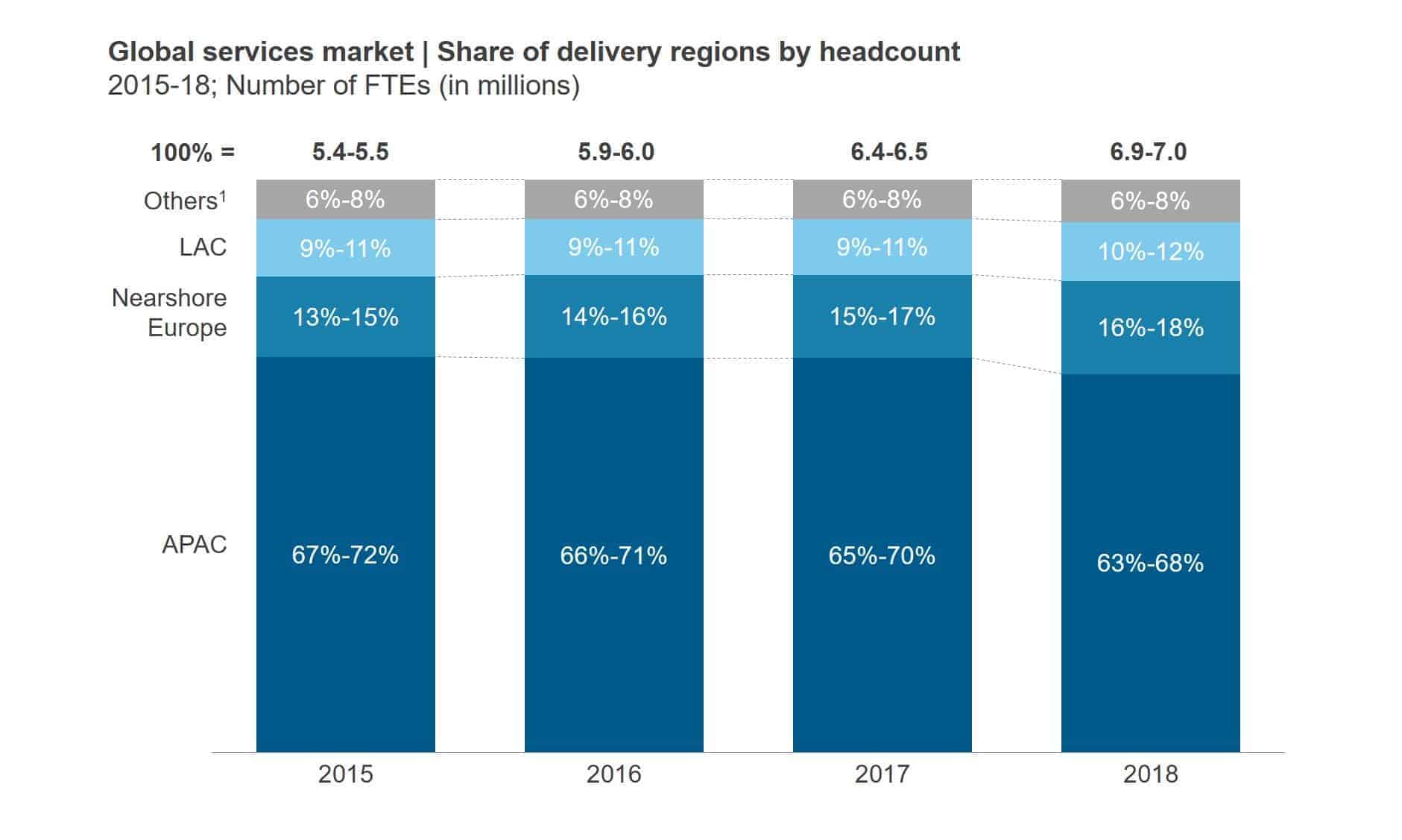

Global services delivery is increasingly being characterized by nearshoring

In a move to rebalance and optimize their existing locations portfolio and comply with data protection mandates, both enterprises and service providers are marginally shifting from offshore to nearshore locations. Nearshore Europe experienced the greatest increase in headcount and new center setups in 2018 due to the availability of complex skills, proximity to customers in Western Europe, increased regulatory oversight, and demand for multi-lingual support.

Poland, Ireland, and Scotland will continue to dominate the global services landscape in nearshore Europe, followed by Ukraine, the Czech Republic, and Romania.

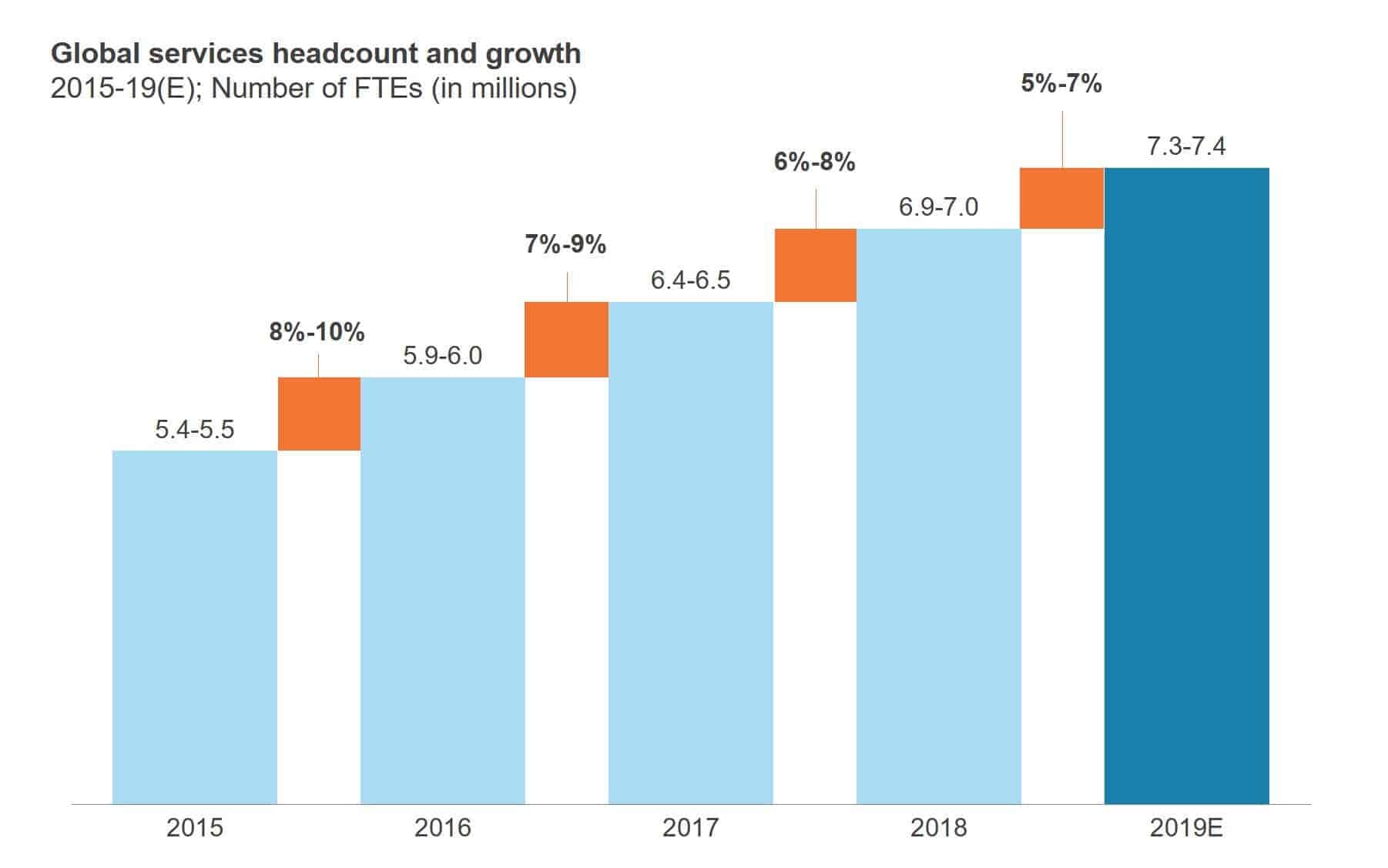

Global services headcount continues to grow, but modestly

Increasing use of automation for low complexity, high volume services is having a considerable impact on the talent landscape. While growth in digital services will lead to newer job and skill profiles, the headcount required for newer digital jobs will be significantly lower than that required for low complexity jobs, and the growth will be slower due to technological advances and the shortage of talent for new-age technologies.

Service providers continue to grow in onshore geographies

Leading service providers have been continuously growing their presence in onshore geographies. This is in large part due to increasingly stringent data protection laws and mounting pressure from clients to have local delivery centers. The United States and continental Europe continue to remain the destination of choice for setup activity across onshore locations. The lion’s share of the work delivered from these onshore centers is in IT services.

We expect the United States to continue to grow in the wake of uncertainty around visa regulations and increased pressure from clients to have local delivery centers for ease of coordination, better alignment/training, and promoting customer intimacy. And, we also expect growth in digital services to push providers to continue to expand in other onshore locations – such as Belgium and Switzerland – due to availability of skilled talent and the ability for extensive collaboration with Europe-based clients.

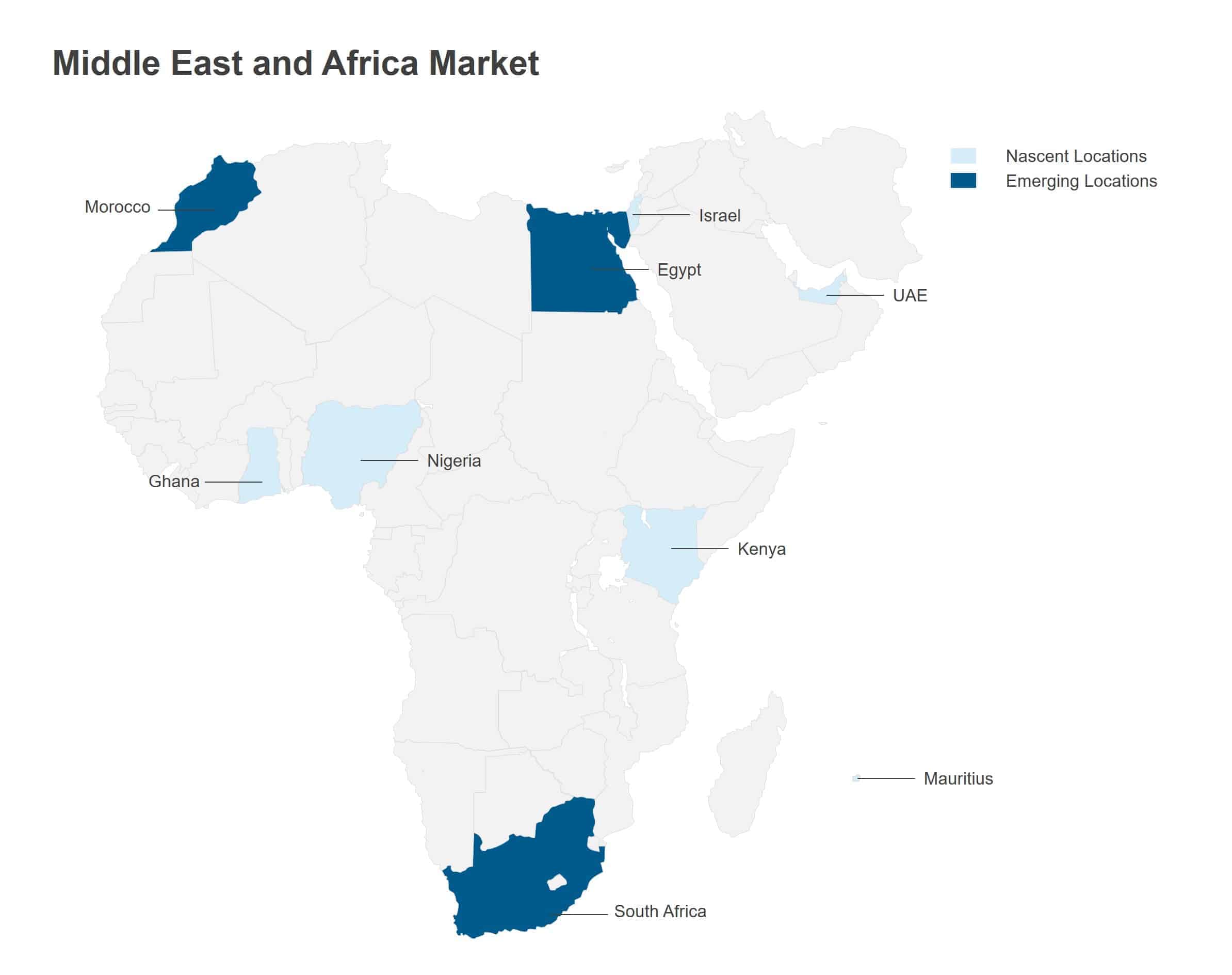

Growth in emerging locations for global services delivery

While use of the traditional delivery locations continues to grow, other locations are picking up steam, including:

- Jamaica continues to grow in setups for voice services

- Ghana and Kenya are being leveraged to support the East and West Africa regions

- Israel is growing significantly for delivery of R&D/engineering and high-end IT services

- Lithuania is also growing as a destination for delivery of IT (largely digital) and R&D/engineering services.

To learn more about the dynamics shaping the global services locations landscape, please read our recently published report, “Global Locations Annual Report 2019: Demand for Next-Gen Services Defining Locations Strategies.” We developed the report based on deep-dive discussions with the regional investment promotion bodies, leading shared services centers, service providers, recruitment agencies, and other market participants.