Everest Group regularly supports clients in developing fact-based business case models to assess all relevant costs and benefits associated with their service delivery portfolio and delivery location decisions.

Not surprisingly, we’ve seen an increase in this type of activity in the last several years due to technology disruptions, potential immigration reform laws, intensifying competition for talent, and macroeconomic and geopolitical uncertainties. We’ve also seen an increase in the number of faulty/incomplete business cases that, if unresolved, can result in unnecessarily high costs and less than expected benefits.

#1 Clarity on the primary objective of the business case:

Establishing clarity on the key objectives of the business case for service delivery location selection is of utmost importance. Companies often include benefits of other initiatives (e.g., transformation) which may impact their overall locations footprint, but fail to include costs associated with these initiatives, resulting in a faulty business case. As business case assessment is typically done for long-term strategic decisions, it is critical to ensure clarity on the locations strategy and implementation roadmap under consideration.

#2 Underestimating the costs of “what it takes to get there”:

Companies often underestimate the costs associated with exiting their current location (e.g., lease termination and severance costs); disruption in their existing locations (e.g., loss of knowledge due to higher than expected attrition); migrations (e.g., employee relocation, technology migration, parallel/shadow run); and set-up of new centers (e.g., capex, cost of hiring and ramp-up, training costs, etc.)

Example: A global Financial Services company had a 12-month long shadow/parallel run to effectively complete knowledge transfer for high complexity processes. This negated most of the arbitrage-related benefits for the initial 12-18 months. In fact, the company incurred relatively higher total cost of operations (TCO) until steady state operations was achieved.

Example: In a recent engagement, the location selection for a Latin American client’s shared services center was greatly influenced by applicable withholding taxes (i.e., the Argentinean government levies a ~31.5% withholding tax on import of global services from certain locations such as Mexico). These factors significantly impacted the relative cost attractiveness of locations under consideration.

#3 Overestimating benefits:

Companies often plan multiple transformation and optimization initiatives in parallel with changes to their services delivery portfolio. In such cases, things seldom pan out as planned, and the savings achieved are significantly lower than expected in areas including:

- Headcount reduction from process improvements

- Delivery pyramid optimization

- Implementation of automation/technology solutions

- Economies of scale (in cases of location consolidation)

- Optimization of management and administrative overheads

Example: A BFSI firm changed its planned strategy midstream, as its initial plans to fund the business case for large scale service delivery location consolidation by reducing FTE headcount by ~ 6,000 could not be realistically achieved.

#4 Stakeholder misalignment:

A service delivery location decision must involve multiple stakeholders including onshore business leaders, offshore delivery leads, functional and GIC leaders, migrations and/or transformation teams, corporate real estate, and technology teams. Any lack of coordination among these stakeholders can pose challenges in alignment on data used, key assumptions, the roadmap for service delivery portfolio changes, and the plan for other transformation/optimization initiatives. All stakeholders must be kept in the loop from the beginning of the location evaluation, and they must periodically periodic sign-off on the approach.

#5 Industry benchmarks:

While it is important to leverage industry benchmarks, companies must contextualize information to their own unique situation. The specificity of operations or the role a location plays for the company can be different from the typical value proposition of that location/geography.

Example: A recent engagement for a global Financial Services client demonstrated that, despite industry benchmarks that indicated Location A offered ~20 percent cost savings over Location B for typical BPO processes, the client’s specific processes and talent needs reversed the cost attractiveness of the two locations.

#6 Talent competition in the local market:

Companies often underestimate the true extent of competition in the local talent market, and the impact of attrition on sustainability of their operations. This impacts a company’s ability to scale initially, retain talent, and back-fill lost staff.

Example: A global manufacturing company faced significant challenges in hiring language skills for its newly setup shared services center in the APAC region, resulting in significantly lower arbitrage savings than expected.

While developing business cases models can be a significant challenge, we believe that addressing the above-mentioned points can reduce chances of error significantly. Learn more about Everest Group’s Service Delivery Locations practice.

April 4, 2017

On June 23, 2016, the United Kingdom (U.K.) voted to leave the European Union (EU) through a referendum, also known as “Brexit.” Indications over the last few months are that it will be a “hard Brexit,” wherein the U.K. makes a clean break from the EU’s common market. If that happens, we can anticipate the following major changes to the global services operating environment:

- Passporting for companies will become tougher: Banks and financial institutions in the U.K. will find it more challenging to operate/set up new centers across countries in the region, as the U.K. will no longer be a part of the EU free trade market

- Talent movement across U.K. borders will be a challenge: People will require separate work visas to work in the U.K. and continental Europe. Although this is expected to apply to new work visas, changes to visas for people currently working in these countries are still uncertain.

As many global companies leverage the U.K. and countries in continental Europe to deliver services to all of Europe, passporting and talent movement restrictions could have a significant impact on their business strategy, regardless of their operating location in the region.

Potential Brexit impacts on companies operating in the U.K. and EU

In the wake of the uncertainty, global companies that are planning to service their European customer base would prefer setting up their GICs/back-office centers in continental Europe instead of the U.K. This might cause a surge in back-office activity in continental European locations, and talent demand for multiple IT and business process functions in those countries might go up.

Additionally, companies that are currently operating in the U.K. and the rest of Europe will need to prepare for possible legal/policy changes, and will need to expedite visa, HR, and administrative processes for their employees. We expect this to lead to increased demand for back-office activity in the U.K. and continental Europe.

Moreover, with talent movement restrictions becoming a possibility, companies currently operating only in the U.K. might need to rethink their talent hiring strategy in the region, especially for language-specific needs that were previously easy to fulfill.

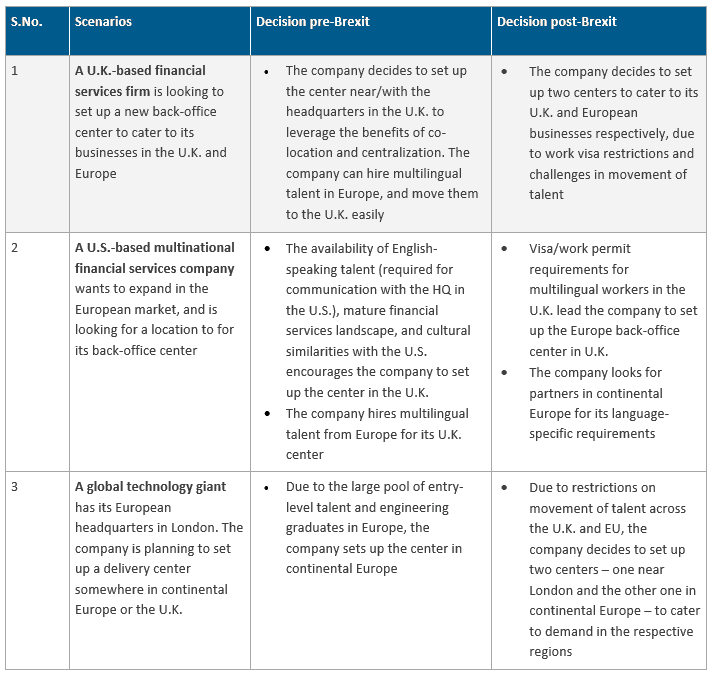

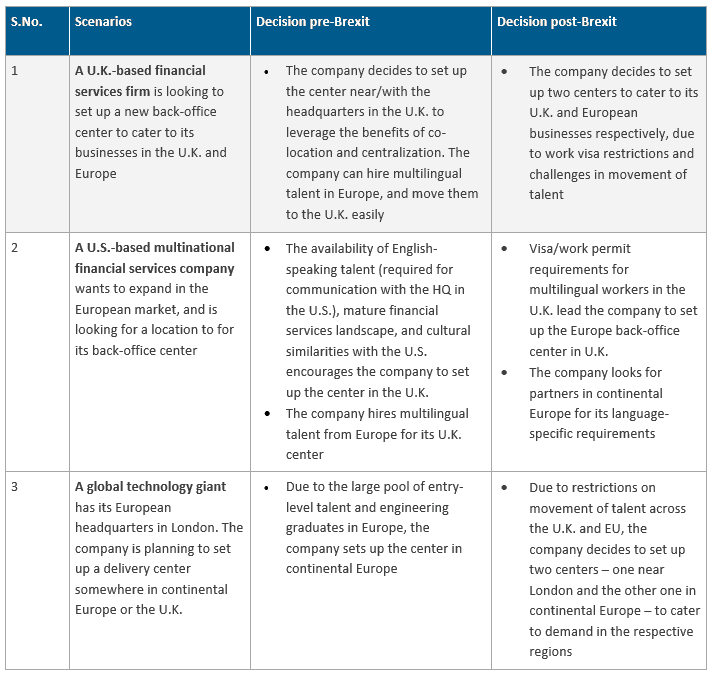

To paint a picture of the potential Brexit impacts, following are several sample scenarios about companies operating in the U.K. and EU, and their possible decisions pre- and post-Brexit.

What lies ahead for those impacted by Brexit decisions

Until the exact Brexit-related policy changes become clearer, global companies might delay or shelve their investment decisions for the U.K. and rest of Europe. They might also possibly move toward greater levels of automation in their business operations to mitigate potential risks.

While it will be a wait and watch game over the next 10-12 months for companies operating in the U.K. and EU, they’ll need to keep their eyes carefully trained on developments in order to create effective strategies for dealing with the possible changes in the near- and long-term.

For a more detailed discussion on the topic, please refer to the recently released Everest Group viewpoint, “The Road Ahead: A Global Services Perspective on the Impact of Brexit. ”

March 27, 2017

It is no hidden fact that the outsourcing industry is on the cusp of change. While the labor arbitrage model and legacy ERP applications ruled the 1990s and 2000s, digital has become the heartthrob of the current decade, and you can see enterprises entering new forays to keep themselves relevant in this fast-changing business landscape.

In this context, even the demand for technical skills has changed tremendously over the past few years. Some skills that used to have the largest pull have become obsolete, and others are struggling to keep their hold in the IT services industry.

Specialist skills losing leverage against generic skills

Consider the case of SAP on-premise business solutions. Until recently, SAP as a skillset had been very attractive among fresh graduates and lateral hires alike. High market demand coupled with supply playing catch up meant higher wages and easy to switch options in the ever-competitive outsourcing market. But over the past few years, on-premise ERP and factory-led offshoring have matured to the extent that once premium technical skills such as ABAP or Basis no longer command the same leverage over generic skills such as Java, .NET, and COBOL. Even functional skills such as finance controller (FICO) or sales and distribution have seen their premium declining over the last few years.

Specialist skills such as Cognos, Informatica, and IBM Websphere are also facing the heat in large outsourcing deals, where high competition and enterprise awareness have forced service providers to utilize a common, generic rate card irrespective of the complexity or diversity of skills involved. Also, organizations such as NetSuite, Salesforce, SuccessFactors, and Workday provide a viable option with consumption-led pricing models, which make them highly attractive. The level of competition and clear buying trends are forcing even behemoths to come to the table with cloud-based, integrated business solutions. Think SAP with S/4 HANA, which is pushed aggressively by the company’s account sales teams.

With the change in the business landscape, there’s increasingly a clear preference for new age phenomena such as big data analytics, hyper-automation, and the Internet of Things (IoT).

The impact of IoT, digital technologies, and automation on skill demand

IoT is one area in which organizations are investing large sums for either cost optimization or revenue generation, depending on their business models. And it is one area in which hardware, firmware, mobility, cloud, and analytics specialists are in extremely high demand to address its hot growth. While the likes of Angular JS and Swift are being used to develop mobile applications, Hadoop and Spark are seeing a huge demand in data analytics. Even firmware and hardware engineers are being required to work in an agile fashion using DevOps methodology, a phenomenon never seen before in industrial manufacturing.

Another big area in which significant investment is being made is Service Delivery Automation (SDA). It is being looked at as a viable alternative to labor arbitrage. Enterprises are looking to automation to reduce costs and streamline business processes. Service providers and enterprises alike are scouting for Robotic Process Automation (RPA) developers and DevOps engineers for onshore/GIC/service provider operations to significantly downsize the low-level tasks performed offshore.

Overall, the current market is in a state of flux as digital takes precedence and legacy becomes less prominent. But the demand for digital services across enterprises is clear, regardless of existing market shares.

March 20, 2017

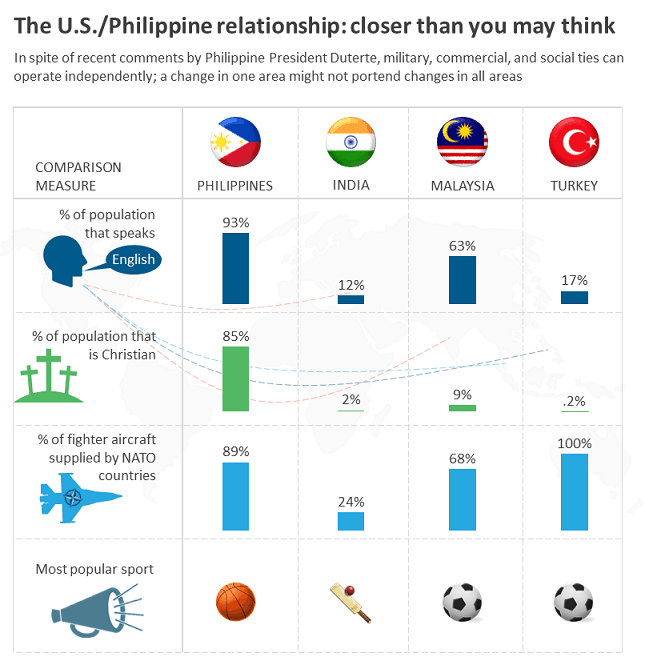

With the uncertain political situation in the Philippines and the comments President Duterte has made about distancing from the United States militarily to align closer to China and Russia, many are concerned about what this means for the relationship between the Philippines and the U.S. And rightfully so – this would be a major shift, and over time could be a cause for concern.

At the same time, the Philippines has been quick to point out that the commercial and social relationships between it and the United States are very strong, and that it wants and expects those to continue.

And therein lies an important point… a rebalancing of military relationships does not automatically lead to poor commercial and social relationships between countries.

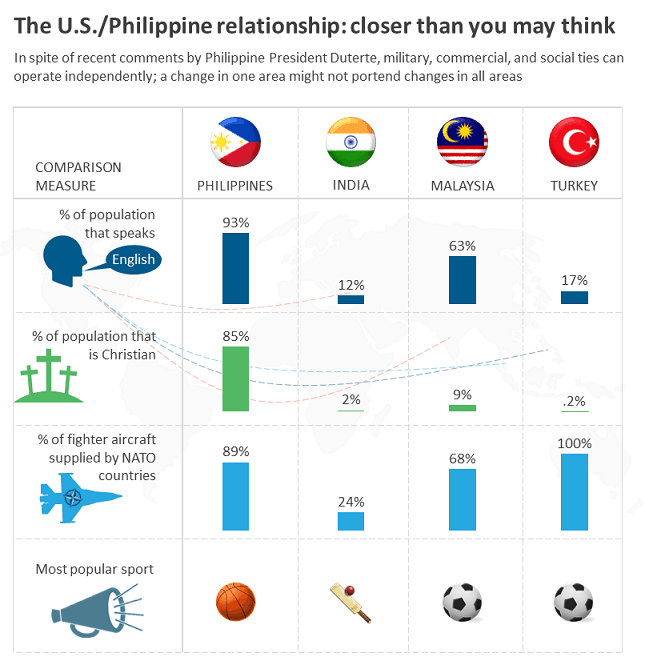

In a quick exercise to demonstrate how countries can have a variety of types of relationships with the United States, I did a super simple comparison of several military and social dimensions in the graphic below. In addition to the Philippines, I chose India, Malaysia, and Turkey to represent a cross-section of countries near Russia and China that have some level of meaningful connection to the United States. Turkey is a member of NATO, India is a major trading partner for services and goods, and Malaysia is an interesting mix of relations with China and the U.S. (not to mention the Malay flag looks very similar to the United States flag).

I looked at language, religion, sports, and use of NATO-sourced fighter craft (both trainers and actively deployed.) Those without NATO-sourced fighter craft tend to attain theirs from Russia or China. Most countries not in NATO and near Russia have some mix of fighter aircraft.

Based on this very simple comparison, many in the global services industry might be surprised to see that India appears to be the least well-aligned to the U.S. on most dimensions. In particular, India depends primarily upon Russia for various types of military equipment, beyond just aircraft, and India is an important export market for Russia.

By contrast, the Philippines is very closely aligned to the U.S. on all dimensions, which explains why the average Filipino has a hard time with the concept of weakened commercial and social ties to the U.S.

Time will tell what actually happens. But we should all remember that military, commercial, and social ties can operate somewhat independently. Relationships between most countries are complex and multi-faceted, so a change in one area may be slow to impact the overall relationship.

March 15, 2017

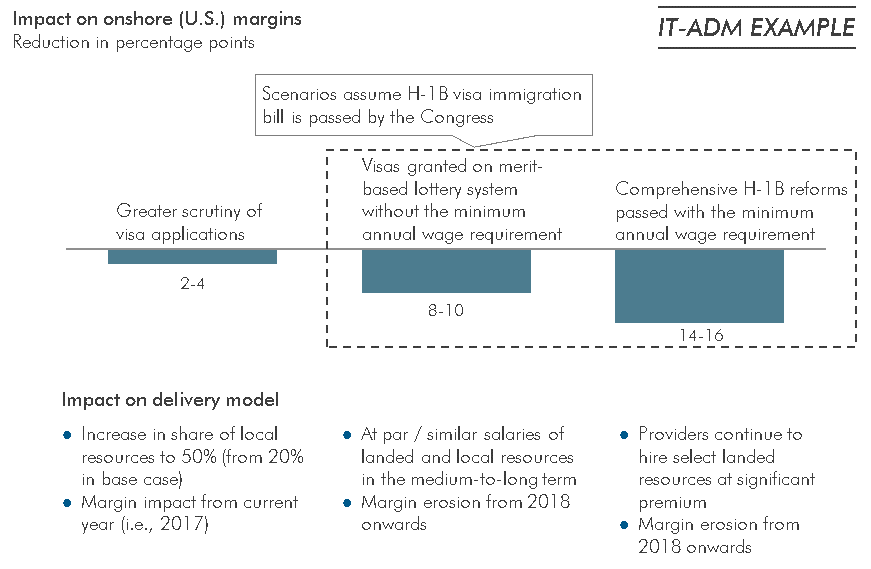

In a recent blog entitled, “Is rising costs the only impact immigration reform bills will have on the services industry?” our colleagues wrote about a variety of potential effects Representative Zoe Lofgren’s (D-CA) “High-Skilled Integrity and Fairness Act of 2017” H1-B visa proposal would have on numerous parties.

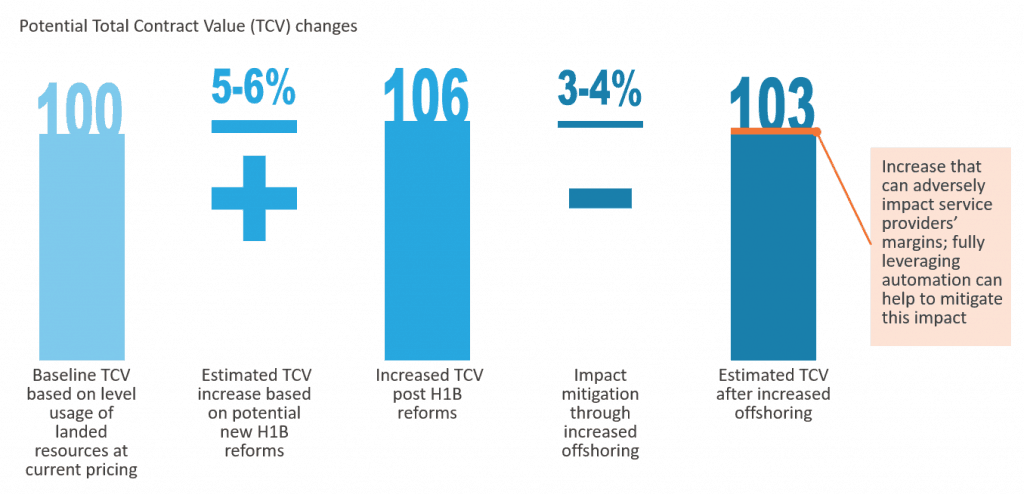

Let’s look squarely at the potential impact of these changes on total contract value (TCV). Some of the key IT service providers, especially Cognizant, HCL, Infosys, TCS, and Wipro – all of which rely heavily on “landed” resources to provide IT services in the U.S. – would have some major decisions to make, ranging from tactical, such as recruitment strategy, to business strategy, such as margin cuts.

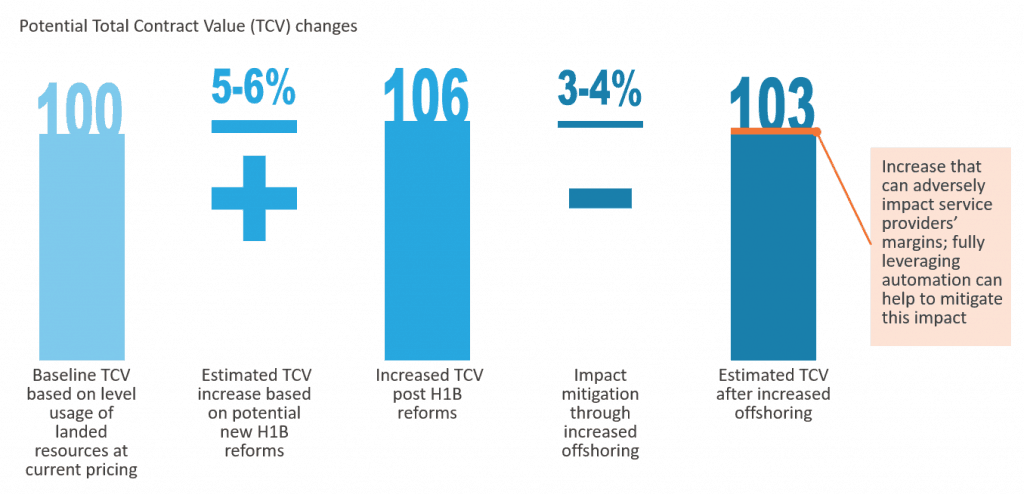

If passed, the bill would most likely take away the landed resources cost advantage. Having assessed numerous IT ADM contracts in the last 12 months, Everest Group conducted a simulation to represent a typical three-year IT AM deal, using industry standard offshoring, staffing pyramids, and local-to-landed resource ratios. Our simulation showed that the removal of the difference in pricing of local and landed resources alone would result in a 5-6 percent increase in TCV, not taking into account any auxiliary impact on service providers’ cost (recruitment, organizational restructuring, etc.)

Already pressed for margins, IT service providers would try to pass the TCV impact on to their enterprise clients. As it is very unlikely clients would be willing to bear the cost increase, it would remain with the providers. As a margin decline of 500-700 basis points would significantly disrupt any company’s financial standing, the providers would need to deploy countermeasures to mitigate this impact.

Already pressed for margins, IT service providers would try to pass the TCV impact on to their enterprise clients. As it is very unlikely clients would be willing to bear the cost increase, it would remain with the providers. As a margin decline of 500-700 basis points would significantly disrupt any company’s financial standing, the providers would need to deploy countermeasures to mitigate this impact.

To reduce the impact on margins, service providers could use levers such as degree of offshoring and staffing pyramids. Our simulation showed that increasing offshoring by about 2-3 percent resulted in a 50 percent decline in the impact of TCV (essentially lowering the increase from 5-7 percent to 2-3 percent) for a typical three-year ADM deal. While the impact on more complex deals might not be easy to mitigate, our simulation demonstrates there is hope for service providers who play smartly and are proactive in adopting strategies to counter the potential impact of any negative reforms.

Another way service providers can drive down their costs is through automation. For example, key aspects of onshore resources’ work include coordination with offshore resources for alignment of work and managing timelines and quality objectives. If automated, these aspects could significantly nullify the impact of onshore cost increases. And with 300-400 basis points at stake, providers might finally have the motivation to adopt automation at the enterprise level, rather than as a deal- or client-specific objective.

It will be very interesting to see if service providers are able to convince the enterprises to share some of the increased cost burden. What’s your guess?

Already pressed for margins, IT service providers would try to pass the TCV impact on to their enterprise clients. As it is very unlikely clients would be willing to bear the cost increase, it would remain with the providers. As a margin decline of 500-700 basis points would significantly disrupt any company’s financial standing, the providers would need to deploy countermeasures to mitigate this impact.

Already pressed for margins, IT service providers would try to pass the TCV impact on to their enterprise clients. As it is very unlikely clients would be willing to bear the cost increase, it would remain with the providers. As a margin decline of 500-700 basis points would significantly disrupt any company’s financial standing, the providers would need to deploy countermeasures to mitigate this impact.