On December 6, 2018, HCL announced it had acquired seven IBM products across security, commerce, and marketing for a record US$1.8 billion. To provide a financial context to this acquisition: HCL, India’s third largest IT services provider, invested about 22 percent of its annual revenue to bolster its products and platforms portfolio – what it refers to as its Mode 3 portfolio – which barely contributes to 10 percent of its annual revenue.

Demystifying the Why

What strategic outcomes could HCL potentially derive from this deal?

- Cross-sell opportunities: Access to the more than 5,000 enterprises currently using the acquired IBM products

- Superior value proposition around as-a-service offerings: Integration of these products with HCL’s ADM, infrastructure, and digital services

- Top-line growth due to recurring revenue streams and expanded EBIDTA margins

- Fewer dependencies on external vendors: Improved capabilities to bundle internal IP with services can enable HCL to have greater control over outcomes, thereby enhancing its ability to deliver value at speed

Sounds good…Right?

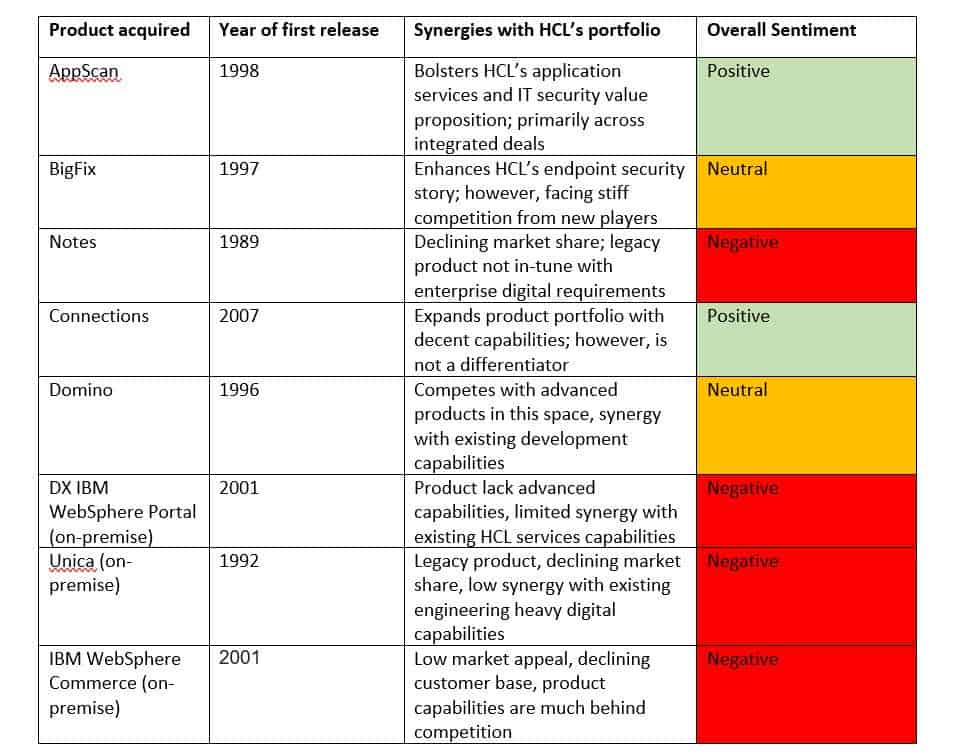

At first glance, the acquisition may seem to be a strategic fit for HCL. But when we dug deeper, we observed that while some of the IP plugs gaps in HCL’s portfolio, others don’t necessarily enhance the company’s overall capabilities.

This analysis raises meaningful questions that indicate there are potential potholes that challenge its success:

- Confusion around strategic choices: The product investments point to a strong proclivity towards IT modernization, rather than digital transformation. This acquisition of on-premise products comes at a time when inorganic investments by peers’ (recent examples include Infosys’ acquisition of Fluido and Cognizant’s acquisition of SaaSFocus) and enterprises’ preference are geared towards cloud-based products

- Capability to drive innovation at speed on the tool stack: To address the digital needs of new and existing clients, as well as to deliver on the promise of as-a-service offerings, HCL needs to repurpose the products and make significant investments in modernizing legacy IP

- Financial momentum sustenance: With an increasing number of clients moving away from on-premise environments to cloud, it remains to be seen if HCL can sustain the US$650 million annual revenue projection from these products

- Customer apprehensions: Customers that have bundled these products as part of large outsourcing contracts built on the foundation of their relationships with IBM will likely be apprehensive about the products’ strategic direction, ongoing management, and integration challenges as their IT environments evolve

- The illusion of cross-sell: It remains to be seen if HCL can succeed in cross-selling digital services for these legacy products, especially in the beginning of its relationship with the 5,000+ clients currently using the in-scope IBM products.

The Way Forward

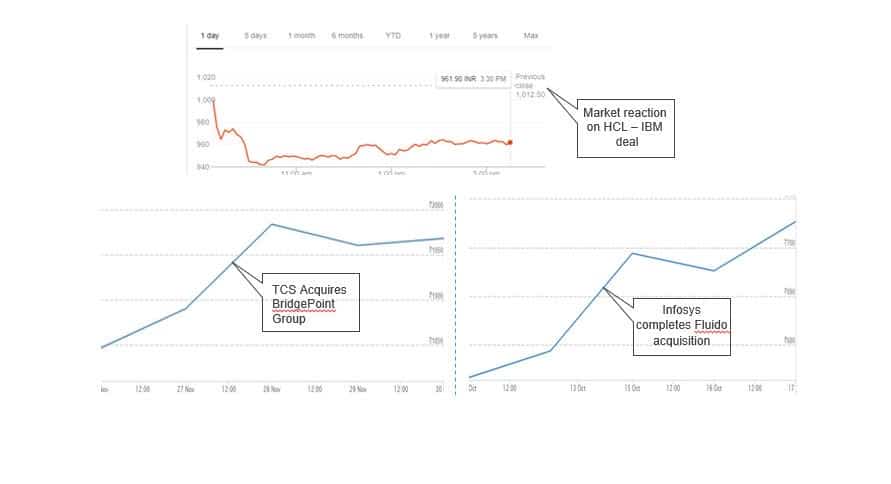

The acquisition definitely is a bold move by HCL, which may seem meaningful from an overall financial investment and ROI perspective. However, the subdued investor confidence reflects poor market sentiment, at least at the start. Although this could be considered a short-term consequence, HCL’s investments in these legacy products is in stark contrast to the way the rest of industry is moving forward.

On the day of the acquisition, HCL’s stock price fell 7.8 percent, signaling negative market sentiments and thumbs down from analysts. In contrast, the market behaved differently in response to acquisitions by HCL’s peers in the recent past.

On the day of the acquisition, HCL’s stock price fell 7.8 percent, signaling negative market sentiments and thumbs down from analysts. In contrast, the market behaved differently in response to acquisitions by HCL’s peers in the recent past.

To prove the market wrong, HCL needs to focus its efforts on developing and innovating on top of these products; developing synergies with its ADM, infrastructure, and digital services; alleviating client apprehensions; and providing a well-defined roadmap on how it plans to sustain momentum leveraging these products over the long term.

What is your take on HCL’s acquisition of these IBM products? We would love to hear from you at [email protected] and [email protected].