Annuities Market Reimagined: What’s the Path to Scalable, Personalized Protection Journeys? | Blog

The North American annuities market is at a critical inflection point. After years of incremental modernization, the industry is now under pressure to pivot fast, toward scaled personalization, digital-first engagement, and ecosystem-based growth.

Annuity providers now face growing friction as they navigate legacy systems, regulatory hurdles, and shifting consumer expectations, despite the need for offerings that are simple, secure, and personalized.

Reach out to discuss this topic in depth.

What’s emerging is a new set of imperatives. For annuity carriers and their technology provider partners, success will depend on building four core capabilities:

- Modular, cloud -native platforms for product flexibility and in-plan integration

- Artificial intelligence (AI)-powered analytics to personalize income projections, improve persistency, and optimize pricing

- Workflow automation and digital experience orchestration for efficient, scalable servicing

- Ecosystem readiness, ensuring seamless integration with advisors, platforms, and compliance systems along with provision of onboarding different category complementary products

These capabilities aren’t future-forward aspirations but table stakes for competing in a market that is being reshaped by demographic urgency, regulatory changes, and rising consumer expectations.

Personalization is now the baseline

Consumers today expect financial products to reflect their preferences and life context, not just their age or account balance. In annuities, this shift is particularly urgent. Retirement is no longer a static endpoint but a dynamic journey spanning decades and multiple financial goals. As a result, annuities must evolve from rigid contracts to adaptive, client-centric solutions.

The regulatory environment is making space for this change. Provisions under the SECURE Acts have expanded the role of annuities in defined contribution plans, enabling plan sponsors to embed lifetime income options more confidently. This has opened the door for innovation in both product design and distribution pathways.

Meanwhile, macro volatility, especially interest rate swings, inflation, and uncertainty around long-term savings, has reignited interest in guaranteed income solutions. But customers are increasingly demanding more than just income guarantees. They want flexibility, fee transparency, hybridization with investment portfolios, and seamless digital experiences.

The question is no longer “Which annuity product fits my risk appetite?” but rather “How does this product supplements my life goals”.

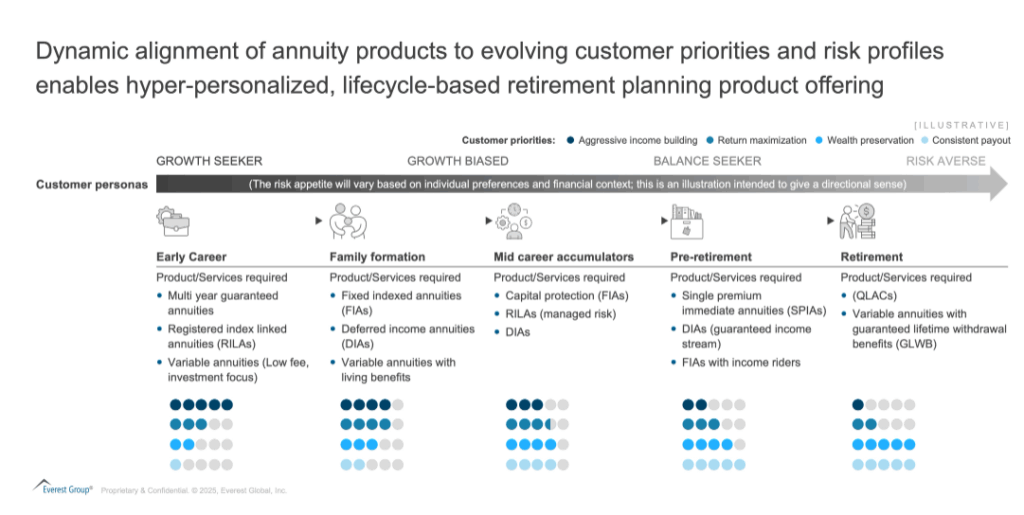

Understanding the persona spectrum

Delivering personalization at scale starts with understanding who the customer is, beyond traditional segmentation. The customer persona visual identifies distinct consumer archetypes based on life stage, financial behavior, and risk preference:

- Early career savers: Prioritize liquidity and simplicity. Best served through digital-first, low-cost annuity wrappers with optional growth exposure

- Mid-Life accumulators: Juggling multiple financial priorities. They seek hybrid products offering both growth and downside protection

- Pre-Retirees: Focused on locking in income with withdrawal flexibility. Interested in Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and managed payout options within retirement plans

- Retirees: Want simplicity, peace of mind, and estate-friendly solutions, delivered with minimal friction

This segmentation enables the design of experiences, advice models, and products tailored to each persona-based archetype. For example, one user persona might benefit from AI-driven comparison tools that simulate income across scenarios, while the other might prefer pre-packaged options integrated into 401(k) rollovers.

The shift to personas also changes how annuities are marketed and distributed. Content strategies, onboarding flows, and advisor tools all need to reflect the preferences of the persona, not only the product.

Tech as the enabler of personalization at scale

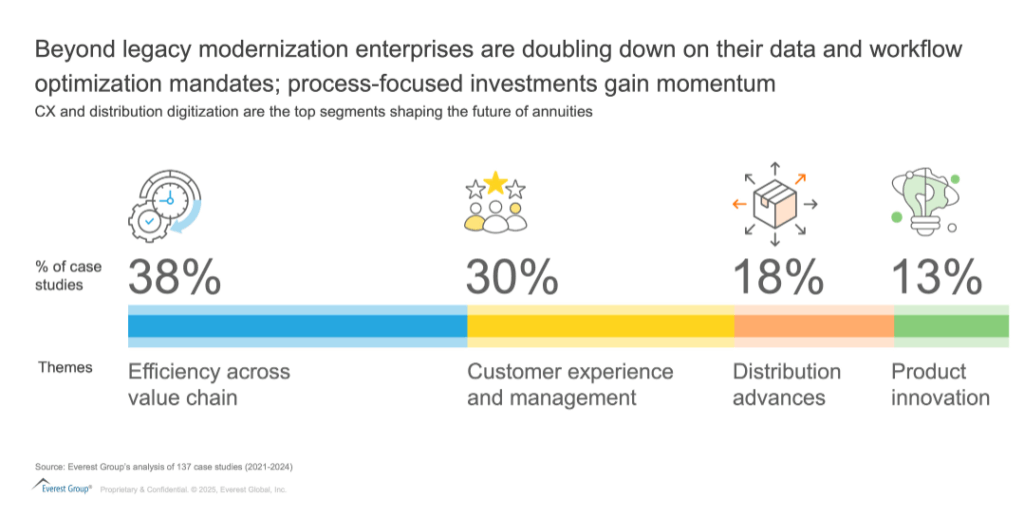

To support this shift, annuity providers are radically transforming their technology stacks. The goal: not just digital distribution, but end-to-end personalization infrastructure.

According to Everest Group’s analysis, leading carriers are investing in:

- Modular product engines that enable rapid configuration of hybrid annuities

- Income modeling tools that simulate projections across multiple time horizons and market assumptions

- Integrated onboarding platforms with automated Know Your Customer (KYC), digital signature capture, and educational content

- Data fabrics and AI orchestration layers to drive personalized nudges, churn prediction, and advisor recommendations

As shown in the visual (prevalent investment themes), the top areas of enterprise focus include enhancing customer experience, streamlining workflows, digitizing distribution, and enabling product innovation. These efforts are often supported by partnerships with system integrators and technology vendors that bring composable architecture, low-code configuration, and scalable deployment capabilities.

For example, Direct-to-Customer (D2C) onboarding journeys now include tiered user paths, enabling basic users to explore products while advanced users simulate retirement income projections using embedded calculators and behavioral analytics.

The strategic shift: From siloed tools to embedded ecosystems

The market is also moving towards wealth management and annuity products being offered in complement, which is driving the need for embedded solutions rather than stand-alone products. Carriers are no longer operating in isolation, they must collaborate with digital advisors, plan sponsors, and Registered Investment Advisors (RIAs) to distribute annuities in the flow of retirement planning.

Consider two illustrative shifts:

- DPL Financial Partners is helping RIAs access commission-free annuities, expanding fiduciary adoption

- BlackRock’s LifePath Paycheck embeds guaranteed income within a target-date fund, turning a growth product into a retirement income solution

These models succeed because they integrate seamlessly into existing workflows. They depend on open Application Programming Interfaces (APIs), explainable AI, and regulatory-grade data governance. More importantly, they represent a new operating model: one in which annuities are no longer sold, they’re selected and configured as part of a broader financial journey.

To support this shift, carriers must view themselves not just as product manufacturers, but as services orchestrators.

What this means for stakeholders

Carriers

- Build product agility through modular, rules-based architecture

- Shift from feature-led design to persona-centric planning

- Partner with technology providers to embed personalization and automation into core operations

Technology & SI partners

- Move beyond legacy platform modernization to enable hyper-personalized customer experiences

- Co-create advisory tools, onboarding journeys, and AI engines that drive real-time income personalization

- Embrace joint Go-to-Market (GTM) models with product providers and advisory platforms

Retirement platforms

- Offer in-plan annuity rails with configurable options based on customer personas

- Enable embedded tools for advisors to simulate income, compare product classes, and personalize drawdowns

- Provide flexible, white-labeled portals for small/mid-sized employers to scale personalized benefits

Everest Group forecasts a sustained annuities market rebound with 9–10% Compound Annual Growth Rate (CAGR) through 2027, driven by demographic waves and in-plan integration. The question is not whether the market will grow, but who will grow with it.

Our latest report “Life and Annuity (L&A) State of the Market 2025: Crystal ball gazing into the future of the annuity industry” explores in depth how the annuities sector is transforming, why persona-driven strategies matter, and what stakeholders must do to prepare for the next phase of growth.

Report link – Life and Annuity (L&A) State of the Market 2025 – Everest Group Research Portal

Reach out to Vigitesh Tewary ([email protected]), Chinmay Pathak ([email protected]), Sohit Kumra ([email protected]) to discuss in depth about our insights and offerings. To explore our full portfolio of insights, visit our Insurance IT Services hub.