Blog

Actuarial 2.0: Modernizing the Actuarial Function to Drive Enterprise Value

In an industry defined by precision and prudence, few areas have remained as resistant to change as the actuarial function. Traditionally rooted in deterministic models, quarterly cycles, and spreadsheet-driven workflows, the actuarial function has long been central to insurers’ risk management. However, the world around it has changed.

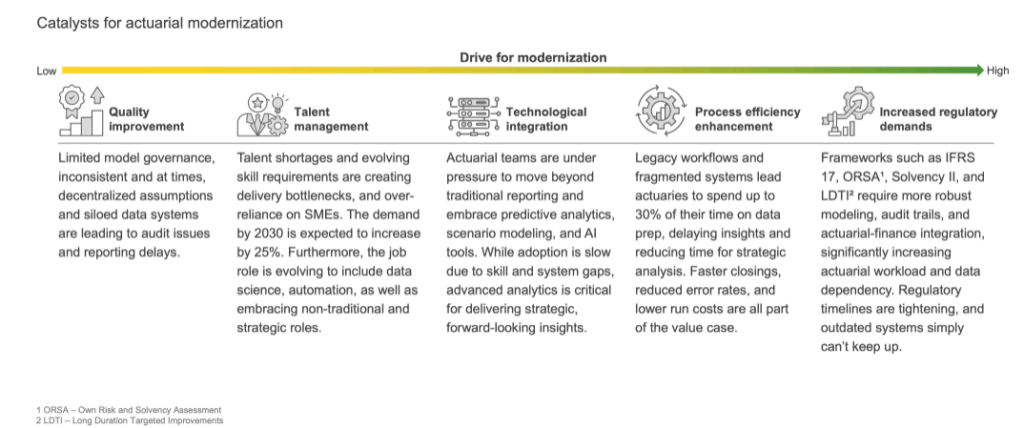

Today, insurers face increasing pressure from real-time decision-making demands, complex regulatory environments (such as IFRS 17, LDTI), talent shortages, and rising customer expectations for personalized, digital-first products to an urgent need for data-driven agility. In this new reality, the actuarial function can no longer afford to play defense.

Reach out to discuss this topic in depth.

A look at current workflows explains the pressure to change. Actuaries today still spend a disproportionate amount of time wrangling data and managing legacy processes. 50% of Property & Casualty (P&C) insurers report that actuaries spend more than half of their time on data preparation. This inefficiency is untenable when margin pressures demand faster insights and when management needs actuarial input on strategic decisions (pricing, capital, and risk) in near real-time.

As insurers adapt, the actuarial function is being reimagined. It’s no longer a back-office compliance engine. Instead, it’s evolving into a strategic nerve center, one that would blend predictive analytics, cloud platforms, and artificial intelligence (AI) to support enterprise-wide decisions.

Actuaries can no longer rely on siloed spreadsheets and quarterly routines; they must operate as agile, data-driven partners to the business.

“New technologies are allowing us to significantly reduce the time we spend producing results and more time on value-added activities like product Research & Development (R&D) and developing insights.”

— Candace Woods, Chief Actuary, Prudential (What does the Chief Actuary do, and how does one come a Chief Actuary?)

However, too many modernization journeys with the newest systems stall when legacy workflows, hand-offs and controls remain unchanged. A process-first mindset flips that script

The urgency to transform: What’s driving modernization?

Modernizing the actuarial function is not just a technological upgrade; it isn’t about swapping spreadsheets for cloud dashboards. It’s a systemic shift, one that cuts across talent, tools, governance, and workflows.

Modernization isn’t a nice-to-have anymore, it’s becoming mission-critical to stay ahead of regulatory pressure, margin compression, and capital risk.

Forward-thinking insurance carriers have recognized the writing on the wall. They are breaking out of the old mold and overhauling actuarial operations to be faster, smarter, and more integrated. Notably, these are not just tech upgrades, they are strategic, enterprise investments in risk management and growth. For example:

-

- AXA’s Asia division undertook a regional actuarial transformation to standardize its capital modeling and Application Lifecycle Management (ALM) across multiple countries in response to Solvency II and rapid growth

- Generali Hellas implemented FIS Prophet not just to meet regulatory demands, but to assert stronger financial control and decision governance

“By joining forces with a highly specialized partner, we will be able to further enhance our actuarial procedures and access high-level technology necessary for IFRS 17” — Antonis Dimitriou, Head of Actuarial at Generali Hellas (Generali Has Joined Forces with FIS on its IFRS 17 Journey » Prophet Web)

-

- Insular Life (Philippines) migrated its actuarial modeling and risk management systems to a cloud-based service to lower costs and boost performance

Mid-size P&C insurer Gore Mutual (Canada) modernized its pricing and underwriting function by implementing an AI-driven pricing platform, dramatically speeding up rate changes

“The current market demands speed…We picked a solution that eliminated disparate systems and provided advanced analytics – it’s been a game-changer for us,” — Deb Upton, VP of Pricing and Actuarial at Gore Mutual (Faster, Smarter Insurance: Gore Mutual Partners with Earnix to Improve Pricing and Rating Processes)

These aren’t simply Information Technology (IT) projects, they’re strategic investments. The common thread? A recognition that actuarial modernization is foundational to managing capital, risk, and growth in a volatile world.

Why is progress still so painfully slow? It’s a process (not a tech) problem: Lead with operating model and not tools

Despite strong drivers and all the urgency, most actuarial transformations are still stuck in first gear. The primary culprit is not solely a lack of technology; it’s outdated processes and operating models. Too often, insurers have tried to “modernize” by layering new software over broken processes. True modernization demands a process-first approach: redesigning data flows, models, and team structures before implementing technology. In other words, technology must follow an operating model redesign, not lead it. The following reveals why modernization has been slow.

-

- Fragmented tooling: Heavy reliance on Excel/Visual Basic for Applications (VBA) or legacy tools such as MoSes/ALFA being alarmingly common. These siloed tools impede consistency and scale

- Disjointed data landscapes: Actuarial, finance, claims, and other teams don’t share a common data backbone, leading to endless reconciliation and version control issues

- Opaque models, making validation and governance difficult

- Cultural inertia: Actuarial culture has rewarded precision and prudence; experimentation and change are often resisted. There is comfort in the familiar quarterly routines, and change can threaten established roles and hierarchies

- Regulatory concerns over AI-driven models: Both internal risk teams and regulators have valid concerns about AI-driven or automated models. Without proper governance, new tech can be seen as a “black box,” raising model risk and compliance questions

Bottom line? This isn’t a tech problem, it’s an operating model problem. And until that’s addressed, transformation will remain cosmetic. The hard but essential work is to redesign the actuarial operating model: establish a unified data infrastructure, clean up and document models, define clear governance, and realign roles and incentives. Only then can modern technology be truly effective.

In practice, a process-first modernization might include steps such as: mapping end-to-end actuarial processes (from data ingestion to reporting), eliminating manual handoffs, centralizing assumptions and model code, and instituting agile workflows (e.g. monthly sprints for model updates instead of annual cycles). By doing this groundwork, technology can then be applied in the right places to automate and enhance, rather than put paper over cracks. Modernization “done right” often involves cross-functional effort, actuarial, IT, finance , and risk teams working in tandem, to rebuild a more integrated actuarial function.

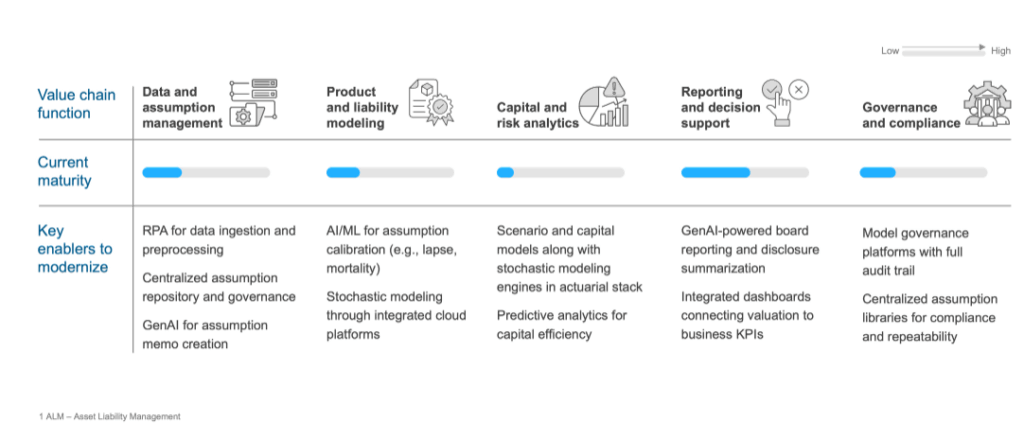

Where it’s really happening: A value chain in motion

No part of the actuarial value chain is immune from modernization, and leading carriers are pursuing improvements across pricing, valuation, governance, capital management, and more. While progress varies by business line and company, the direction is clear: towards more automation, integration, and strategic insight delivery. Here’s a look at how modernization is playing out in key actuarial domains.

However, before any major transformative initiative, five macro-processes should be chalked out to identify areas of friction

-

- Data acquisition and quality – ingestion of policy, claim, external and emerging risk data

- Assumption setting and governance – transparent, traceable, multi-scenario controls

- Modelling and projection – deterministic, stochastic, and now generative models

- Reserve / capital calculation – IFRS 17, LDTI, Solvency II, RBC

- Insight delivery and decision support – storytelling to finance, product, risk, investor relations

For each segment, CAOs (Chief Actuary Officers) should rate manual effort, latency, error exposure, and business impact. The greatest gaps become transformation sprints, not monolithic programs.

What’s clear is that no part of the value chain is immune to transformation and no carrier can afford to be either. While progress varies by line of business and geography, the direction is consistent: toward platforms, automation, and integration. Carriers that modernize selectively, only where it’s easiest, risk entrenching inefficiencies elsewhere.

Agentic AI in actuarial workflows – A new era of “co-pilot” intelligence

No discussion of modernization in 2025 can ignore the rapid rise of AI, particularly Generative AI (gen AI) and “Agentic AI”, AI systems capable of autonomous actions. For actuarial leaders, the question is not whether AI will reshape their function, but how. Importantly, the most impactful use of AI in actuarial work is as an augmentation and acceleration tool within a well-designed process, rather than a black-box replacement for actuarial judgment.

Concrete examples of agentic AI in actuarial workflows are already emerging:

-

- Automating data intake and cleanup: Actuaries often spend inordinate time collecting and cleaning data from multiple sources. AI models excel at recognizing patterns and anomalies in data. For instance, an AI could automatically detect missing or inconsistent entries in policy data and either fix them or flag them for review. The National Association of Insurance Commissioners (NAIC) surveys show most insurers are already exploring AI for data tasks, especially in lines like auto and healthcare where data volume is high. By letting AI handle data prep, actuaries ensure they’re starting analysis on a solid foundation and reclaim hundreds of hours that can be redirected to analysis.

- AI-Augmented analysis and modeling: AI “actuarial co-pilot” can pull in loss data as soon as the quarter’s books close, clean it, apply several reserving methods across segments, and produce an initial reserve indication report complete with charts and commentary. By the time the human actuaries sit down, they have a comprehensive first draft of analysis in front of them, allowing them to apply expert judgment on top, rather than spending days on manual computations.

The advent of agentic AI does not diminish the importance of actuarial judgment; rather it elevates it. Routine tasks and even moderately complex analyses can be handled by AI co-workers, freeing actuaries to focus on high-level judgment calls, scenario planning, and communicating implications to stakeholders.

Regulators and leadership will expect actuaries to validate AI outputs, mitigate any biases in models, and maintain transparency. Agentic AI brings tremendous speed and flexibility but also requires robust oversight and governance.

So what? Implications you can’t ignore

For Insurers, modernization is no longer optional. It’s being mandated by regulators, demanded by the C-suite, and expected by customers. However, success depends on a few key enablers:

-

- A clear transformation roadmap and not just point solutions: While point solutions can be valuable, they often fail to deliver lasting impact in isolation. Successful insurers instead articulate a clear multi-year roadmap that aligns actuarial modernization with enterprise goals such as faster close cycles, better reinsurance strategy, or integrated financial forecasting

- Integrated governance across actuarial, IT, and finance: Modern actuarial platforms don’t exist in isolation. They pull from enterprise data lakes, feed into finance ledgers, and require strong controls for model risk, access, and compliance. Siloed ownership leads to friction and delay, particularly when IT and actuarial functions speak different languages

- A blended talent model, including in-house, outsourced, and AI-augmented roles: While core actuarial judgment remains indispensable, today’s function requires a blended talent model, combining traditional actuaries with embedded data scientists, engineers, and select outsourcing partners. This is increasingly essential to meet demand and skill gaps

- Process automation to shift actuarial roles upstream: As automation and cloud platforms reduce manual data prep and model runs, the actuarial function will shift from production-heavy to insight-driven. Actuaries will be expected to take on more strategic and consultative roles influencing pricing, reinsurance, and capital allocation

For providers, the opportunity is to move up the value chain, from staff augmentation to becoming embedded partners in transformation. As actuarial operations shift from siloed tools to execution platforms, providers that can combine domain depth, automation capability, and delivery scalability will shape the future. To remain relevant and indispensable, providers must bring more than people to the table:

-

- A platform-led approach, not just staffing and task execution

- Deep domain fluency that spans actuarial, regulatory, and data science contexts

- Scalable delivery models that blend global footprint with local responsiveness

- Innovation accelerators, especially in gen AI, automation, and model governance that shorten time to value

Actuarial transformation is no longer optional. It’s being driven by regulatory mandates, C-suite expectations, and a growing need for real-time insight and enterprise integration. What was once a technical back-office function is now being recast as a strategic nerve center, powering everything from capital allocation to product agility.

This shift demands more than new tools. It requires bold change: in governance, in talent models, and in how value is measured. The most successful insurers won’t be those with the latest software, but those that can orchestrate people, platforms, and partners around a shared vision of what the actuarial function can become.

As the actuarial function modernizes, those who embrace change and partner smartly will find themselves at the heart of insurance innovation. The future of the actuarial function isn’t just faster or cheaper, it’s smarter, connected, and built to lead.

To this topic in depth, please reach out to Dinesh Udawat ([email protected]), and Anubhav Dutta ([email protected]).

To explore how insurers are rethinking outsourcing across the insurance value chain, including in areas such as underwriting, new business development, and claims, read our report, Navigating the Next Wave: Emerging Opportunities in Insurance BPS