Beyond Borders: How Executive Order (EO) 14178 And European Banking Authority’s (EBA) 2025 Opinion Are Resetting AML Strategy Amid Rapid Crypto Integration and Regulatory Alignment

In July 2025, two landmark policy releases redefined the financial crime compliance landscape. The European Banking Authority (EBA) issued its fifth opinion on money laundering and terrorist financing (ML/TF) risks, while the US government released its Digital Assets Report under Executive Order 14178.

EO 14178 marked a clear departure from years of fragmented oversight, establishing a unified federal framework for stablecoin governance, DeFi risk accountability, and innovation safeguards, while formally ruling out a US central bank digital currency (CBDC).

This shift comes at a time when digital assets are rapidly integrating into mainstream payment rails, cross-border transfers, and institutional finance, intensifying exposure to fraud, illicit finance, and regulatory blind spots. As global regulators accelerate alignment, financial institutions, technology providers, and service partners must respond with systems that are explainable, defensible, and resilient across fiat and token ecosystems.

This blog explores the transatlantic signals and what they mean for the future of financial crime compliance (FCC).

Reach out to discuss this topic in depth.

A shared shift toward explainable, accountable compliance

Although regionally distinct, both policy frameworks converge on several foundational principles:

-

- Regulators are no longer focused on whether banks adopt Regulatory Technology (RegTech) or Artificial Intelligence (AI); they now demand explainability. Alerts must include logic, model outputs must be auditable, and override decisions must be tracked

-

- Crypto oversight is expanding. Stablecoins, decentralized finance (DeFi) protocols, and wallet activity now fall within supervisory scope. Institutions are expected to apply anti-money laundering (AML) and sanctions controls across fiat and token rails

-

- Outsourcing does not remove accountability. Banks must govern vendors, fintech partners, and embedded providers with the same scrutiny as internal operations

-

- As real-time payments and social engineering scams rise, financial institutions must integrate fraud and AML systems. Criminals do not separate channels, neither should compliance teams

Taken together, these shifts raise a strategic question: What capabilities are needed to support this new compliance mandate, one that spans AI oversight, token risk, and cross-border controls?

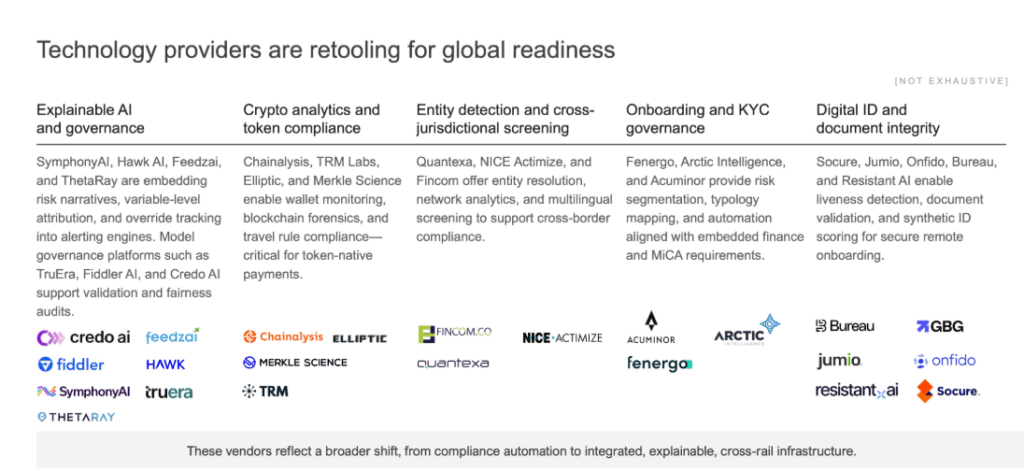

These vendors reflect a broader shift, from compliance automation to integrated, explainable, cross-rail infrastructure.

Consulting and system integrators drive defensible transformation

As compliance expectations rise, advisory and integration partners are becoming critical enablers:

-

- Consulting firms are helping institutions interpret evolving regulations, assess internal control maturity, and design integrated governance frameworks that unify fraud, AML, and sanctions detection. Many are now focused on building governance blueprints for token onboarding, stablecoin issuance, and DeFi engagement aligned with EO 14178, MiCA, and Financial Action Task Force (FATF) guidance.

-

- System integrators are implementing these designs by embedding explainability modules into existing detection platforms, integrating blockchain analytics into case management systems, and upgrading transaction monitoring environments to support token-native financial flows.

In our view, the biggest challenge system integrators face today is embedding explainability within legacy case management workflows. While new tools support override logging and variable attribution, older platforms often lack the User Interface (UI) and data models required to deliver clear, auditable risk narratives to compliance investigators.

To overcome this, system integrators are increasingly partnering with compliance vendors to build joint delivery ecosystems. For example, firms like TCS, Capgemini, and IBM are integrating explainability platforms such as Fiddler AI and TruEra into established FCC suites. Others are embedding crypto risk engines from TRM Labs or Chainalysis directly into transaction surveillance workflows for banks piloting stablecoin services or expanding Decentralized Finance (DeFi) risk coverage.

These partnerships are enabling faster deployments, better regulator alignment, and smoother upgrades to detection infrastructure. Going forward, the most effective compliance ecosystems will not be standalone tools or services, they will be coordinated architectures combining advisory rigor, delivery consistency, and embedded explainability.

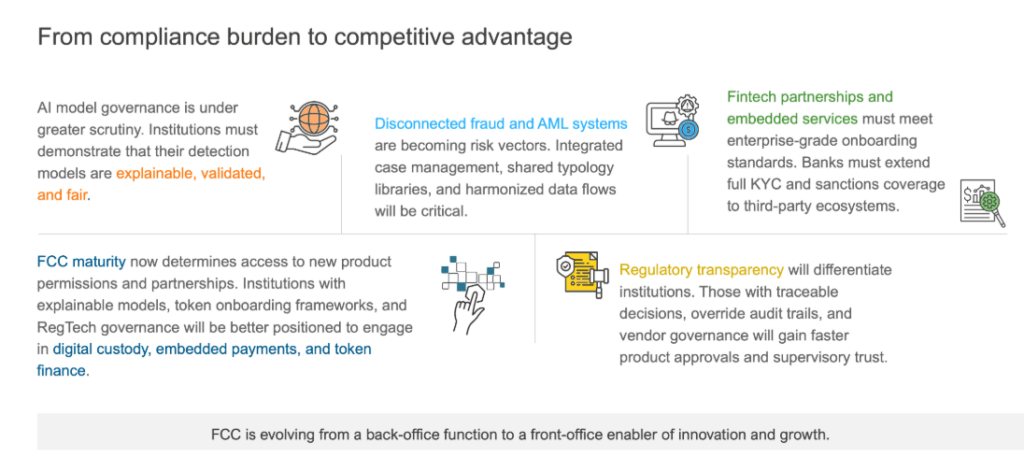

FCC is evolving from a back-office function to a front-office enabler of innovation and growth.

Global ripple effects and regulatory convergence

These developments are part of a broader global alignment:

-

- The UK’s Financial Conduct Authority is advancing AI explainability expectations via its Consumer Duty framework.

-

- Singapore’s Monetary Authority of Singapore is expanding its FEAT and Veritas initiatives for ethical AI in finance.

-

- Australia’s AUSTRAC and Canada’s Office of the Superintendent of Financial Institutions are preparing for AI governance and crypto supervision.

The convergence of AML standards across jurisdictions demands systems that are modular, explainable, and globally adaptable.

What comes next: foundational shifts in FCC

In the near term, financial institutions are accelerating investments in explainable AI, crypto risk coverage, and integrated fraud-AML operations. Compliance teams are being retrained to interpret AI-driven alerts and wallet-based risks, while vendors fast-track audit-ready features like override logs and alert narratives.

Regulators, through sandboxes and early guidance, are already influencing how institutions structure token onboarding and model governance. These shifts are laying the groundwork for deeper structural change.

Over time, several foundational transitions will take place, as several long-term changes will emerge:

-

- Model assurance becomes essential: Alerting systems will require built-in narratives, override logs, and defensible logic.

-

- Cross-rail integration becomes default: Surveillance must span fiat, stablecoins, tokenized assets, and APIs, anchored by unified detection and case management.

-

- Compliance becomes a strategic gateway: FCC quality will determine access to high-value ecosystems such as tokenized payments and embedded platforms.

-

- Regulators become co-creators: Through supervisory sandboxes, guidance, and data-sharing mandates, regulators are shaping infrastructure, not just auditing outcomes.

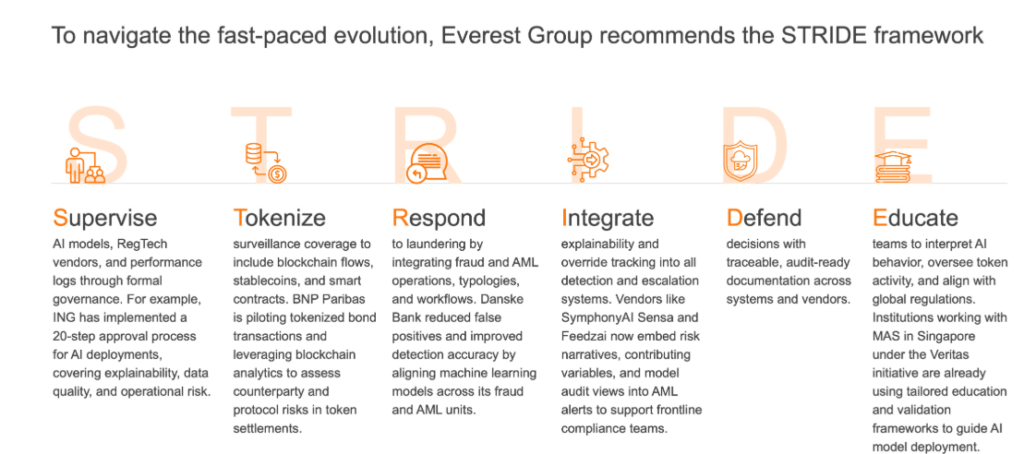

Everest Group’s STRIDE framework for FCC transformation

Final thoughts

The EBA’s opinion and EO 14178 signal more than policy updates. They reflect a unified global direction for FCC, one that prioritizes explainability, token readiness, and architectural integrity.

Institutions, vendors, and service providers that adapt early will shape the next generation of trusted, scalable financial services.

Everest Group continues to cover the FCC transformations globally, to help institutions become scalable and regulation ready.

If you found this blog interesting, check out our The Next Frontier Of Banking And AWM Experiences: The Power Of Customer Experience Orchestration | Blog – Everest Group, which delves deeper into the global services industry regarding Banking.

If you have any questions or want to discuss the evolution of the European Banking space in more depth, please contact Rahul Mittal ([email protected]), Kriti Gupta ([email protected]), Dheeraj Maken ([email protected]) and Ronak Doshi ([email protected]).