The Next Frontier of Banking and AWM Experiences: The Power of Customer Experience Orchestration

In today’s financial services landscape, the customer journey is no longer linear, predictable, or isolated. While Retail Banking customers toggle between mobile and in-branch interactions, high-net-worth investors demand seamless transitions from digital dashboards to live advisor support. What binds these evolving touchpoints together is a new class of experience infrastructure: Customer Experience Orchestration Products (CXOP).

CXOP platforms represent the convergence of portals, journey intelligence, and communications in a modular stack designed to orchestrate experiences across digital and human channels. As banks and Asset and Wealth Management (AWM) firms modernize their front-office systems, CXOP platforms are becoming the glue that enables real-time personalization, data-driven engagement, and scalable hybrid servicing.

Reach out to discuss this topic in depth.

Customer Experience Orchestration Reimagined: Portals, journeys, and messaging

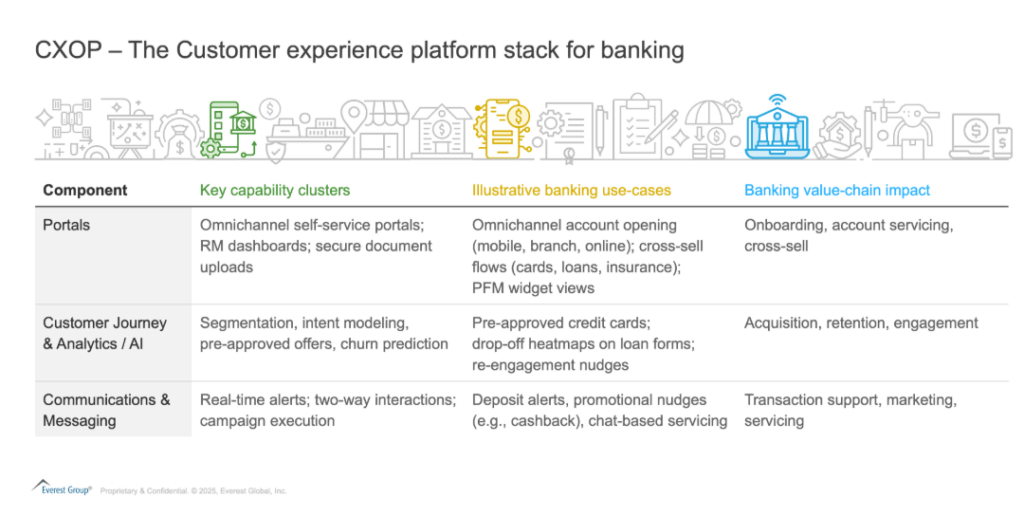

CXOP platforms enable financial institutions to design and deliver personalized experiences using three core layers.

At the heart of every modern bank and AWM firm’s experience layer lies a trio of capabilities:

-

- Portals serve as the user interface layer for self-service, advice, and transactions

-

- Journey orchestration uses Artificial Intelligence (AI) and behavioral signals to personalize navigation and decisioning

-

- Communications ensure the right message reaches the right stakeholder, at the right time

Together, this orchestration stack replaces static workflows with adaptive engagement platforms.

What Customer Experience Orchestration means for banking?

Retail and commercial banks are under pressure to enhance digital onboarding, reduce servicing friction, and improve cross-channel consistency. CXOP addresses this by offering:

These capabilities operate across touchpoints including mobile, desktop, websites, chatbots, and contact centers-ensuring consistent and proactive experience delivery.

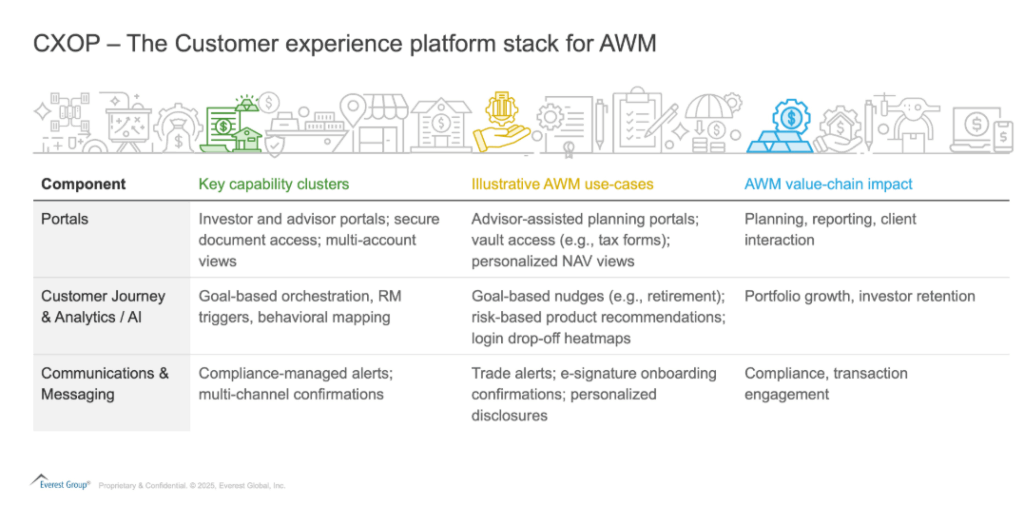

What Customer Experience Orchestration means for Asset and Wealth Management (AWM)?

AWM firms are rethinking client journeys in the context of goal-based planning, fiduciary obligations, and digital-plus-human engagement. CXOP platforms support:

CXOP tools enable multi-channel personalization across investor portals, Requirements Management (RM) tools, and advisor desktops, while ensuring regulatory audit trails and secure communications.

Technology enablers powering CXOP transformation

The orchestration stack in banking and AWM is underpinned by horizontal technology enablers:

-

- Developer experience: Open Application Programming Interfaces (APIs), Software Development Kits (SDKs), and low-code components speed up journey innovation

-

- AI and agentic orchestration: Predictive models and autonomous agents drive journey progression and suggest advisor actions

-

- Collaboration tools: Embedded workflows connect marketing, compliance, advisors, and Information Technology (IT) teams for faster approvals

-

- Data management: Zero-copy architectures and unified data fabrics enable secure, real-time customer understanding

-

- Security and compliance: CXOP stacks embed Identity Access Management (IAM), encryption, and regulatory controls out-of-the-box

Strategic imperatives for banking and AWM leaders

-

- Target friction-heavy journeys

Prioritize orchestration efforts around high-friction areas such as onboarding, self-service, and product servicing. These are often the entry points where drop-offs occur or customer satisfaction lags. CXOP platforms can modularly address these pain points by introducing dynamic forms, biometric verification, intent-based routing, and straight-through integrations, reducing effort while increasing engagement

- Target friction-heavy journeys

-

- Embed AI-driven journey engines

Move from static, rule-based workflows to intelligent engines that process real-time behavioral and transactional data. These engines should generate predictive insights (e.g., churn likelihood, upsell propensity), trigger next-best-actions, and continuously optimize flows. This shift not only improves conversion and retention but also aligns better with customer context

- Embed AI-driven journey engines

-

- Enable hybrid advisory engagement

Equip RMs and financial advisors with digital tools that surface relevant client insights, nudges, and documentation within their workspace. In AWM, this is especially vital to support hybrid models of digital plus human-led engagement. CXOP platforms should embed advisor prompts tied to customer goals, portfolio milestones, or service gaps

- Enable hybrid advisory engagement

-

- Treat communications as orchestrated experiences

Instead of fragmented alerts and transactional messages, adopt a holistic approach to communication orchestration. Ensure messages, whether service updates, product nudges, or compliance notices, are coordinated across preferred customer channels (email, Short Message Service (SMS), portal, chatbot) and timed appropriately within the journey to maximize response and reduce friction.

- Treat communications as orchestrated experiences

-

- Engage ecosystem-ready CXOP providers

Choose technology vendors that offer pre-built BFSI connectors (e.g., Know Your Client (KYC), Customer Relationship Management (CRM), payments), open APIs, and configuration-ready workflows tailored to banking and wealth. These providers enable rapid deployment and seamless integration with the broader tech stack, making it easier to scale orchestration across products and geographies

- Engage ecosystem-ready CXOP providers

What this means for CXOP technology providers in banking and AWM

-

- Design for open composability

Providers must enable seamless integration by offering well-documented APIs, SDKs, and accelerators that plug into core banking systems, portfolio platforms, and advisor desktops. Composability is now a baseline expectation, allowing financial institutions to embed Customer Experience (CX) capabilities into their existing ecosystem without heavy customization or disruption to legacy infrastructure

- Design for open composability

-

- Enable autonomous decisioning

AI should be natively embedded into the CXOP layer to automate key decision points across onboarding, product recommendations, and servicing workflows. The ability to detect intent, score eligibility, and trigger contextual actions without human intervention can significantly improve speed-to-resolution and enhance personalization across journeys

- Enable autonomous decisioning

-

- Provide Banking Financial Services (BFS)-specific content and templates

Technology vendors must go beyond generic workflow engines by offering out-of-the-box, BFSI-aligned content and journey templates. This includes onboarding forms, risk profiling modules, financial planning flows, and regulatory-compliant messaging packs tailored for banking and wealth use cases, accelerating both time-to-value and implementation assurance

- Provide Banking Financial Services (BFS)-specific content and templates

-

- Embed journey analytics in-context

Journey intelligence should not be limited to standalone dashboards. Providers should embed analytics directly within journey orchestration interfaces to support A/B testing, conversion analysis, and real-time optimization. This empowers experience teams to experiment and iterate without long development cycles or external Business Intelligence (BI) dependencies

- Embed journey analytics in-context

-

- Unify customer and product data natively

A strong CXOP product must support real-time ingestion of customer, transaction, and behavioral data from both internal and external sources. Native support for zero-copy data fabrics and metadata tagging, combined with granular consent frameworks, ensures compliance while powering hyper-personalized experiences

- Unify customer and product data natively

-

- Preconfigure for high-impact use cases

Platforms should come with prebuilt micro-journeys for common banking and wealth scenarios,—such as omnichannel account opening, trade confirmations, relationship onboarding, and KYC refresh. These accelerators not only reduce setup time but also demonstrate a provider’s understanding of BFSI-specific needs

- Preconfigure for high-impact use cases

Bridging CX and MarTech

As financial institutions advance their CX Orchestration maturity, many are exploring how to enrich these journeys using adjacent capabilities from the marketing technology (MarTech) stack. While CXOP platforms orchestrate real-time, intent-driven journeys across sales and servicing, MarTech tools contribute depth through audience segmentation, content personalization, and activation intelligence.

For example, Customer Data Platforms (CDPs) can supply identity resolution and behavior signals to CXOP engines; content management tools can streamline compliance for advisor communications; and audience orchestration modules can sync product nudges across email, app, and portal channels.

Firms are increasingly building modular bridges between CXOP and MarTech layers, enabling unified yet decoupled stacks that serve both real-time interactions and campaign-driven engagement. Those that achieve this balance are likely to see measurable impact across onboarding conversion, customer retention, and wallet share growth.

The road ahead

As digital maturity deepens, banks and AWM firms are evolving from managing disconnected channels to orchestrating unified, real-time journeys, stitching together interactions across personas, products, and platforms. This shift is redefining what leading experience infrastructure looks like: composable, insight-led, and outcome-driven.

Technology providers that enable this transition will be pivotal to the next wave of transformation. This shift also prompts renewed interest in understanding which technology providers are best positioned to enable modular, data-driven, and intelligent customer journeys across banking and asset and wealth management.

In 2025, Everest Group will publish its upcoming PEAK Matrix® assessments covering:

-

- Banking Customer Experience Orchestration Products (CXOP)

-

- Asset and Wealth Management (AWM) Customer Experience Orchestration Products (CXOP)

-

- Insurance Customer Experience Orchestration Products (CXOP)

-

- BFSI Marketing Technology (MarTech) Products

These assessments will evaluate providers across dimensions such as functional depth, AI-led innovation, vision and strategy, ecosystem readiness, and market impact.

To express interest in participating in the assessment, please submit your details via the official participation page:

Participate in the 2025 BFSI Products PEAK Matrix® Assessments

or reach out to [email protected], [email protected], [email protected], [email protected] for more information.