Blog

Banking on Autonomous Agents: Embracing Agentic AI in Financial Services

In our earlier blog Agentic Artificial Intelligence (AI): The Next Growth Frontier – Can It Drive Business Success For Banking & Financial Services (BFS) Enterprises? | Blog – Everest Group, we introduced the concept of agentic artificial intelligence (AI) and its disruptive potential across Banking And Financial Services (BFS) from autonomous decision-making to self-directed customer engagement. This blog explores how enterprises can move from concept to scaled adoption.

Banking is undergoing a profound shift from automating tasks to delegating decisions. The question is no longer “What can we automate?” but “What can agents decide, and how independently can they act?” This reflects a move away from back-end Robotic Process Automation (RPA) and task-level AI toward intelligent, autonomous systems that operate with reason in real time, and act across the enterprise.

Agentic AI is no longer a possibility but is actively reshaping the operational strategy of global banks. At JPMorgan Chase, a generative AI (gen AI) assistant is being rolled out to over 140,000 employees with the goal of unlocking more than US$1.5 billion in productivity and risk-related value. Wells Fargo’s virtual assistant, Fargo, has already completed over 200 million fully autonomous customer interactions. These are live, enterprise-scale deployments redefining how decisions are made.

Reach out to discuss this topic in depth.

What are banking agents?

Agentic AI in banking refers to autonomous digital agents that go beyond task automation. These aren’t just virtual assistants, but decision-makers embedded across front, middle, and back-office workflows. They navigate multiple systems, remember context, reason through steps, and act independently in real time.

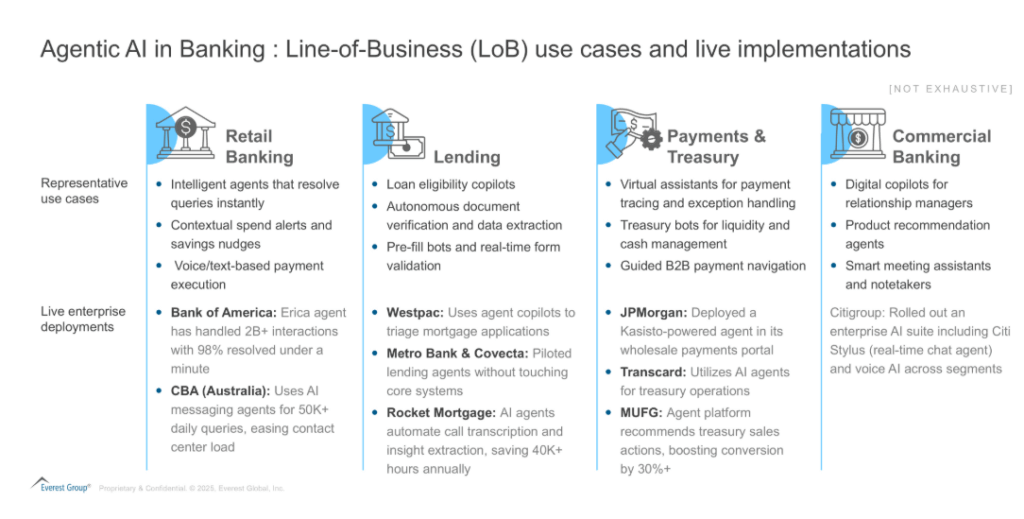

We’re already seeing these agents in action across leading banks. And they’re no longer sitting in pilot labs. They’re live, handling high-volume processes, shortening decision cycles, and helping teams engage clients more effectively across lending, servicing, compliance, and more.

Why now: The case for agentic AI in banking

Agentic AI addresses some of banking’s most immediate challenges: rising customer churn, the limits of rule-based personalization, and pressure to grow revenue with fewer resources. Traditional automation can’t meet these demands. Agentic systems offer proactive engagement, tailored advice, and autonomous decision-making across key workflows.

Efficiency is just as critical. Early deployments show promising results, onboarding that takes minutes, fewer compliance delays, and less time spent on manual checks. Agents now handle complex, multi-step tasks from start to finish, freeing employees to focus on the work that really needs human judgment. They’re also improving risk outcomes by spotting anomalies faster, adapting to regulatory changes, and reducing false positives in fraud and compliance reviews.

Together, these benefits create a compelling case for agentic AI. It gives banks a way to personalize at scale, boost productivity, and build operational resilience. As customer expectations grow and cost pressures mount, adopting this technology is becoming a strategic necessity.

Delaying the adoption of agentic AI compounds the risk. Banks face high upfront investment in orchestration and data infrastructure, but those that hold back risk falling behind peers already building scale. Without decision logic, it becomes harder to meet regulatory expectations.

Agents operating without oversight can raise privacy concerns, especially when data access spans multiple systems. Poor integration can lead to workflow breakdowns, disrupting operations instead of enhancing them and without clear change management, employees may show resistance slowing down adoption.

What’s slowing down broader adoption?

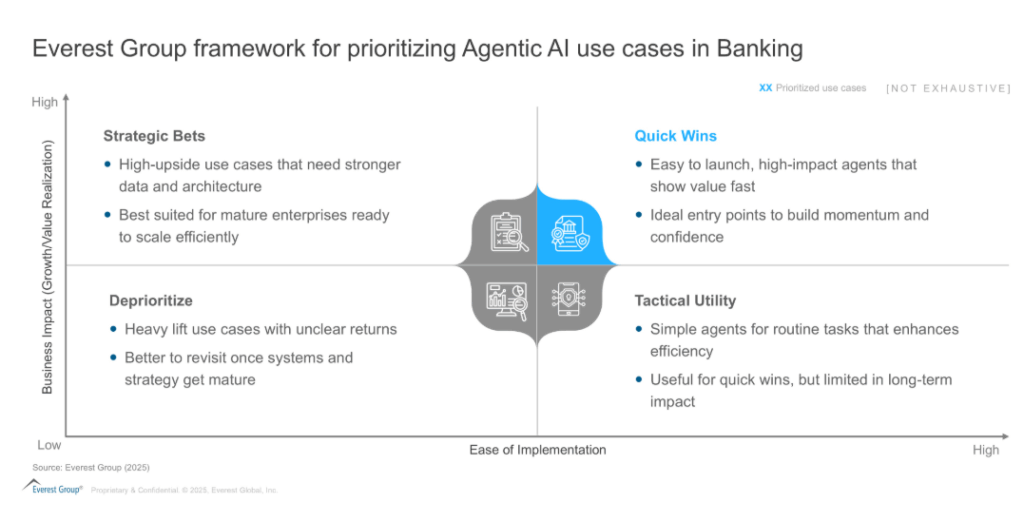

One of the biggest challenges isn’t just technical, but that teams are working with systems that weren’t built for agents. Legacy platforms slow things down, limit access, and make it hard for agents to move across workflows. Without flexible architecture and clean data, even the smartest AI can’t deliver much value. And even when the infrastructure is in place, many banks still grapple with a fundamental question: where should we invest first? With use cases spread across the enterprise, it’s easy to get stuck in pilot mode without a clear path to scale.

Then there’s the trust factor. Agents handle sensitive customer and transaction data, so banks can’t afford mistakes. That’s why the best are already building privacy-first pipelines, clear decision guardrails, and escalation paths because both regulators and employees expect transparency from day one.

But even with the right tools, people need to be ready. Agentic AI changes roles, decision-making, and day-to-day work. It’s not just about adding a new tool, it’s about helping teams know when to rely on it, when to step in, and how to work alongside it.

Strategic lock-In and flexibility agentic AI unlocks

Many banks are still tied to core tech providers whose upgrade cycles move slower than the pace of innovation. That dependency creates a kind of strategic lock-in where teams must wait for vendor timelines even as new AI capabilities emerge around them.

Agentic AI offers a way out. Instead of replacing existing systems, banks can layer agents around them building intelligence without waiting for a core overhaul. This shift gives teams more freedom to experiment, deploy quickly, and adapt as needs evolve.

The key is flexibility. By investing in modular frameworks, open Application Programming Interfaces (APIs), and orchestration models, banks can plug in best-fit agent solutions as they emerge without giving up control over data, workflows, or compliance.

Case in point: Agents moving faster than the core:

-

- Metro Bank deployed Covecta-powered lending agents without changing its loan stack

-

- JPMorgan layered AI agents atop its wholesale platforms (Coach AI, Kasisto)

-

- Westpac used AI agents to migrate Common Business Oriented Language (COBOL) code without disrupting cloud modernization timelines

This is where agentic AI shines: it offers modular innovation via overlay layers, giving banks breathing room to modernize without re-platforming.

The road ahead: From point agents to orchestrated intelligence

Today’s agents often operate in silos, efficient at specific tasks, but disconnected from the bigger picture. The real shift ahead is orchestration: agents working together, learning from every interaction, and acting before they’re asked. It’s not just about automation but intelligent teamwork that moves across onboarding, compliance, servicing, and beyond.

Imagine a mid-sized bank looking to speed up Small and Medium Sized Enterprises (SME) loan onboarding. A customer submits an application online. One agent verifies Know Your Customer (KYC), another pulls credit data, a third scans for red flags, and a fourth generates a tailored pricing offer. What used to involve days of back-and-forth now takes minutes, with agents doing the heavy lifting and employees focusing on relationships, not paperwork.

Orchestration brings its own challenges. Quick wins like onboarding or fraud checks are easy to launch and prove value fast but broader coordination across business lines demands cleaner data, stronger governance, and alignment across teams. The right approach isn’t to solve everything at once but to begin where the value is clear and scale from there.

How banks should respond

To succeed with agentic AI, banks must lead with impact. Start with use cases that solve real problems, show measurable value, and scale with existing architecture. Build for orchestration from day one agents that can’t connect become blockers, not enablers. Governance is non-negotiable, it defines how agents decide when they escalate, and how they stay accountable. System integrators can help embed agents into live workflows without breaking what already works. Winning in this shift isn’t about tech for tech’s sake, it’s about putting intelligence to work where it matters most.

Implications for core banking technology providers, system integrators and consulting providers

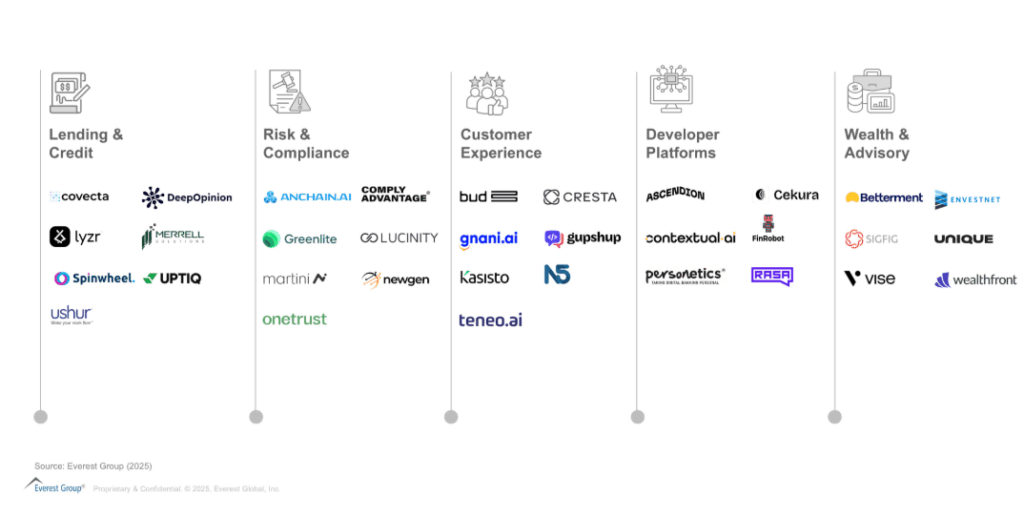

Agentic AI isn’t just reshaping banks it’s reshaping their ecosystem. Core technology providers need to evolve fast. Banks now expect platforms that support lightweight plug-and-play agent integration through APIs and event-driven architecture. Waiting for monolithic upgrades no longer works. The core doesn’t need to be replaced but it must be flexible enough to keep up with the intelligence happening around it.

The bar is rising. Providers that simply enable agents won’t be enough. Banks will look for native capability where decision making agents, copilots, and orchestration layers are built in, not bolted on.

System integrators will play a key role in bridging vision and execution. As banks shift from pilots to scaled orchestration, System Integrators (SIs) must help embed agents into real workflows without breaking what already works. Their value lies in modular design, interoperability, and deep integration expertise.

Consulting firms, meanwhile, must help shape the path forward aligning agentic AI to business priorities, mapping the trade-offs, and building governance that lasts. This isn’t about tech strategy but about rethinking how banks operate in an AI-native world.

Agentic AI is taking root across the banking value chain, one domain at a time. As capabilities mature, distinct application areas emerge, each with its own architecture, intelligence layer, and business outcomes. The web below illustrates how agentic intelligence is beginning to organize across core functions in Banking And Financial Services.

Agentic AI is banking’s next transformation layer

Agentic AI will not replace the core, but it will reshape how the core is experienced. Banks that succeed in this transition will embed agents not just into digital channels, but into the decisioning fabric of the enterprise.

The technology is ready. The ecosystem is maturing. BFS enterprises must now act by piloting high value use cases, investing in orchestration layers, and modernizing their enterprise architecture for autonomous collaboration. As the shift from “Can we automate this?” to “Can an agent decide this?” accelerates, the leaders will be those who combine ambition with discipline.

Banking’s agentic future has arrived.

If you found this blog interesting, check out our Redefining Connected Banking: AI-Powered Physical Devices And The Impact On Financial Ecosystems – Everest Group blog, which delves deeper into another topic regarding the banking and financial sector.

If you have any questions, would like to gain expertise in agentic AI and artificial intelligence, or would like to reach out to discuss these topics in more depth, contact Ronak Doshi ([email protected]), Kriti Gupta ([email protected]), Laqshay Gupta ([email protected]), Ketan Kumar ([email protected]) and Rakshit Gupta ([email protected]).