May 2, 2018

At the Procurecon Indirect conference in Copenhagen a couple of weeks ago, three senior procurement people from different corporations approached me with their woes about the lack of control and the high levels of procurement indiscipline their marketing departments exhibit. They wanted to know how and if Everest Group could solve the problem of rogue spend with external agencies for marketing services. It’s an interesting and very valid question.

Marketing services is one area in which many enterprises’ Chief Procurement Officers (CPOs) have had neither the evidence nor the mandate to challenge established thinking. Furthermore, unlike IT and non-core business process outsourcing alternatives that have been around for 20 years, outsourcing options for marketing didn’t exist until recently. Now that they do, CPOs are sensing the opportunity, in partnership with Chief Marketing Officers, to transform the way marketing services are delivered.

Benchmarking Can Help, but…

Benchmarking can certainly provide rate-card analysis, SLA review, a breakdown of the cost-stack, and any number of other elements from the contract, to give a view of pricing and equitable contracting. But there are problems:

- Marketing services engagements are often part of the long-tail of spend, ad hoc in nature, sometimes not subject to a formal contract, and often worth not much individually. Benchmarking these could cost a CPO several-fold more than would likely be saved

- If a contract did exist, benchmarking would drive the discussion between a procurement team wanting to understand whether marketing services suppliers are delivering value and a marketing department wanting to defend the status quo. Typically, however, benchmarking informs the commercial negotiation between client and supplier

- The nature of marketing services engagements are sometimes niche and specialist, based on knowledge of a vertical or channel acquired over time. Providing meaningful points of comparison is likely to be difficult

- Buyers will doubtless maintain that it is impossible to benchmark creativity.

But, as one of my Procurecon conversations suggested, the issues for CPOs aren’t high levels of spend or a desire to be in control of every spending decision. Rather, they’re concerned about fragmented spend and lack of overall visibility.

5 Steps CPOs Can Take

They can begin by promoting the procurement function as an exemplar of best practice by pointing to examples in other spend categories of how procurement has driven cost savings, improved quality, or stimulated innovation. Doing so establishes CPOs’ leadership credentials.

Next, they can introduce some level of technology that will deliver at least visibility into spend. Several speakers at the conference cited the need for the procurement process to generate data to increase efficiency. Many CPOs without a mandate for category management seem reluctant to push for integrated procure-to-pay or source-to-contract systems. But less invasive approaches, such as customized applications in Salesforce, could still generate useful information about spend categories, transaction volumes, and whether suppliers are being contracted by separate groups within an enterprise.

Third, they can consider portfolio rationalisation, against these rationales:

- unravelling large numbers of small, often informal arrangements is hard, but the disconnected procurement of “specialized” or creative skills by separate parts of the business can produce a rate-card premium of up to 25 percent

- buyers may have contracted long-term rates for specialized skills; in this age of rapid obsolescence, the skills may have become commonplace, but the long-term contracts continue to charge contracted premiums

- a specific resource requirement may indeed be specialised for a provider with low capability in a particular area, but may fall into another provider’s delivery sweet spot; in our experience, transitioning such skills to a best-fit provider can save between 1 percent and 3 percent of contracting costs.

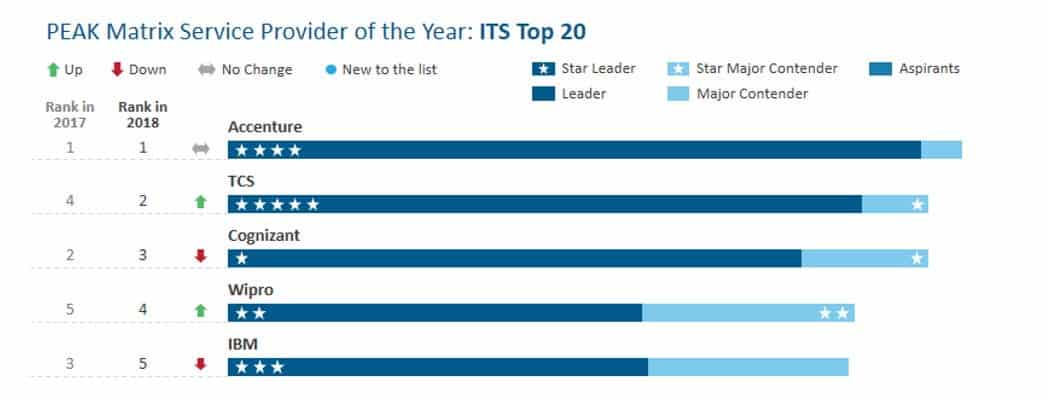

Next, they can investigate alternatives. Arguably, marketing services and creative agency spend are still immature enough to offer the opportunity to arbitrage. And providers with capability are rapidly emerging. Accenture has acquired over 20 agencies since 2010. Onsite digital design agencies such as NuFu, Oliver, and Spark44 have a growing impact. Every major service provider – Atos, Cognizant, Sutherland Global, Wipro, etc. – is investing in or acquiring digital agencies, and these investments will allow enterprises to consider accessing marketing services alongside a suite of outsourced IT or business process services.

Finally, they can benchmark the status quo with an alternative. Can a sourced solution give the enterprise not only a cost advantage but also faster delivery, access to global talent, measurable outcomes, and real transparency?

So, CPOs, there’s little reason to ask yourself “how do I do it?” Instead, the real question is, “why wait?”

You can find out how Everest Group helps enterprises optimise global procurement operations here. We also help enterprises rationalise complex portfolios of external suppliers.