Impact of Digital on Outsourcing Contract T&Cs | Sherpas in Blue Shirts

Many enterprises today are restructuring their existing outsourcing contracts with changes to scope, pricing mechanisms, and SLAs to help ensure they reap the benefits of the emerging digital technologies being used in their engagements.

For example, because the focus has shifted from quality of service delivery to service innovation and business outcomes, we are observing more incentive and benefit sharing mechanisms being added to digital services contracts. And because enterprises are mindful of the uncertainties that exist in the digital transformation journey, they are willing to include some contractual flexibility around scope changes, SLA revisions, etc.

However, one important area that has been somewhat neglected in this digital-driven contract realignment is terms and conditions (T&Cs.) In these contract T&Cs, enterprises must do all they can to safeguard themselves from potential risks, even those that are unforeseen. Consider the case of a global consumer goods company, whose outsourced RPA solution was working incorrectly due to issues with the automation technology platform. It took six months for the base product to be updated and fixed, but the enterprise could not recoup lost opportunity costs from its service provider because such a scenario was not adequately incorporated into the contract T&Cs.

Key outsourcing contract term considerations

Following are just some of the areas that enterprises should consider including in their digital automation outsourcing contract T&Cs.

- Who owns the IP rights to the automation bots? Does this change when the solution has cognitive features that generate business insights?

- Can the service provider reuse the automation solution with other enterprise clients? Can it do so with the buyer’s competitors?

- What happens to the automation solution on contract termination? What part of the automation solution can be retained by the buyer? If the solution is non-transferable, what assistance is the automation provider contractually obligated to provide?

- If the automation solution fails to work as originally designed, who is responsible for the damages that arise?

- Does the outsourcing contract provide flexibility to incorporate additional scope or automation projects, or will separate negotiations and contracts be required?

- What happens if the provider under- or over-performs on the productivity improvement or cost savings targets? Will the parties share the benefits or opportunity losses?

- What happens if there is a change in the process or underlying IT system? Who will be responsible for the subsequent changes in automation solution?

Of course, there’s a double-edged sword here: in general, the more stringent the T&Cs, the higher the price charged by the service provider. So, you need to carefully weigh the risks versus the rewards.

Have you experienced an issue relating to non-inclusion of any clause in your digital services contract? Or did you successfully safeguard your company through a specific term or condition? Please feel free to directly share with me at [email protected].

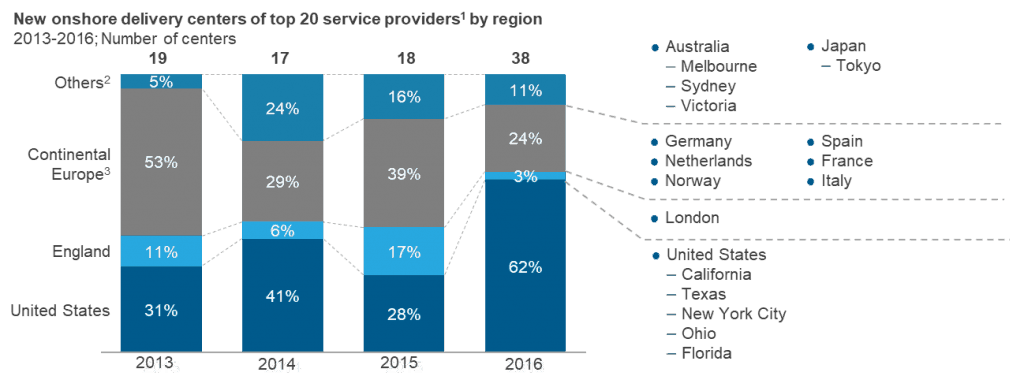

1 20 leading service providers across IT and BPS that

1 20 leading service providers across IT and BPS that