August 9, 2018

There are two primary commercial options – or export-oriented schemes – available to GICs looking to export IT/ITES services from India. One is setting up a 100 percent Export Oriented Unit (EOU) under the Software Technology Parks of India (STPI) scheme. This allows operations to be carried out from any location in the country. The other is setting up a delivery center in a specified, demarcated, duty-free enclave called a Special Economic Zone (SEZ). These offer additional economic benefits (e.g., tax holiday) in lieu of positive net foreign exchange earnings from the export of IT/BP services.

Which option is best for your company? Read on to learn the differences, the trade-offs, and the variables you should factor into your decision.

The Major Differences

- Income tax holiday: SEZ units enjoy a graded income tax holiday period that translates to significant tax savings for a large-scale setup in India. The tax holiday incentive for STPI units expired in March 2011

- Indirect tax benefits: both SEZ and STPI schemes provide custom duty exemption on imports of capital goods. However, SEZ units are also eligible for a “zero-rated” Goods and Services Tax (GST) that effectively decreases the cost input for domestically procured goods and services

- Location: STPI units can set up operations in any location in the country. SEZ units are restricted to a designated area.

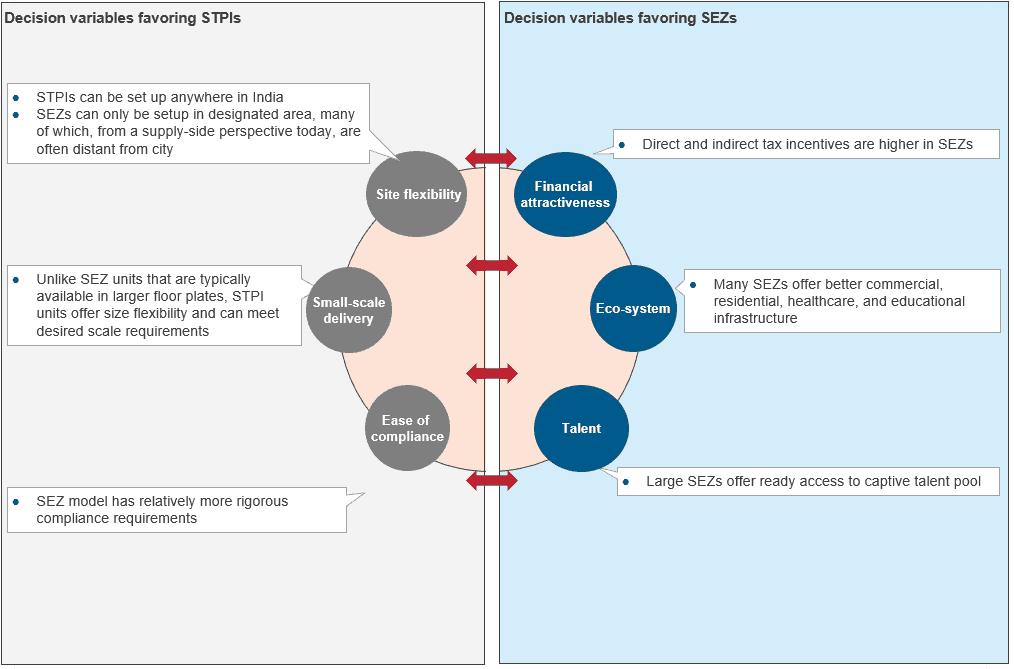

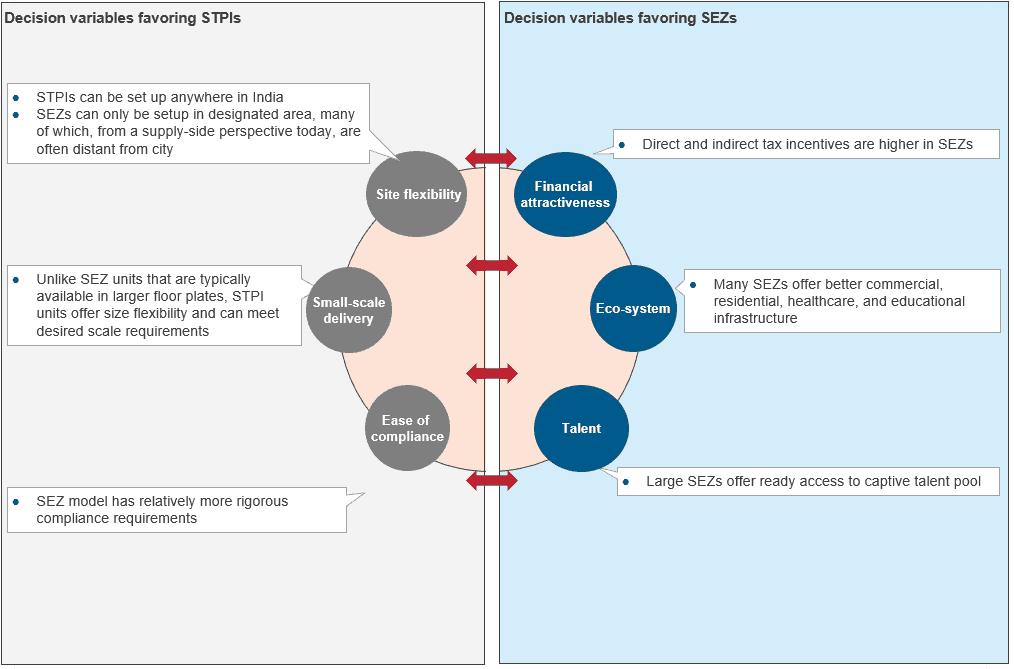

Key Decision Variables in Selecting SEZ or STPI

- Financial attractiveness: SEZs outweigh STPIs in both direct and indirect tax incentives. Where cost savings are significant (e.g., a large-scale setup) and need to be prioritized, SEZ is a clear choice for many enterprises

- Access to a broader ecosystem: Many SEZs offer a complete ecosystem, with easy access to commercial, residential, healthcare, and educational options. Further, SEZs offer quality infrastructure and business continuity planning advantages including:

- Large reputed SEZs offer a more reliable supply of utilities including electricity, water, telecommunications, and overall security

- The office space standards and building compliances (e.g., natural disaster preparedness) are typically more stringent in SEZs

- Access to large talent pool: Given their size, SEZs offer ready access to a large, skilled talent pool with relevant technical, functional, and managerial skills. And the ecosystem often developed in and around SEZs is a significant attraction for the talent pool to work in them

- Site and scale flexibility: STPI units provide far more location (e.g., financial district or central business district) and scale options than do SEZs. Many small-sized GICs tend to prefer this flexibility

- Ease of compliance: Compliance and statutory reporting requirements in STPIs are relatively more lenient than in SEZs. For instance, introduction of GST has increased the compliance and record maintenance burden on SEZ units. Exiting SEZs may involve more scrutiny given the higher economic benefits involved.

How a Financial Services Firm Made the Decision

Everest Group recently supported a U.S.-headquartered financial services company looking to set up a small-scaled GIC in India to deliver high-end niche IT services. Our setup advisory team used a three-step process to ultimately recommend the right facility and commercial model to meet all the client’s requirements: outlining the space, handover timeline, and proximity to the central and/or secondary business districts; assessing potential savings in operating from an SEZ; and evaluating and scoring the additional pros and cons of shortlisted sites to make our final recommendation.

When we evaluated and scored the client’s “must-haves” — scope for expansion or relocation, access to social infrastructure, lower commute time, and proximity to talent hubs – against the limited SEZ options available, it became clear that an SEZ was not the right answer for the client.

Thus, we recommended that the client go ahead with an STPI option in a large IT business park, and register the unit with the STPI to benefit from indirect tax benefits. This option allows the client to take advantage of all the business park’s large talent pool, marquee tenant profile, social infrastructure, and other amenities, and gives it flexibility for any future expansion or potential relocation within or outside the business park.

More than 30 new GICs are set up in India annually, and half of these are first-time center setups. In order to ensure their success, the enterprises establishing these centers must take the time upfront to clearly understand their objectives and requirements against the trade-offs of SEZs and STPIs.