August 7, 2018

How hot has Summer 2018 been around the globe? Red hot…but not as hot as the RPA marketplace. The speed of evolution in this industry segment is almost without precedent. Firms that had revenues worth tens of millions of U.S. dollars just a couple of years ago are talking about reaching a billion in revenue in just a couple of more years.

So why all the excitement? Some chalk it up to Robotic Process Automation being a clever product idea and others to the even cleverer marketing of sexy robots.

But the reality is that it’s the perfect storm – or heat wave – of innovation and capital intersecting at just the right time.

Of course, it doesn’t hurt that enterprises have already captured most of the potential value from offshore labor arbitrage. But when you combine the need for a new source of cost savings with the acute shortage of labor in the U.S. and Europe, you have a market condition in which enterprises are screaming for automation that allows continued productivity improvements for less money, with less human labor-based effort.

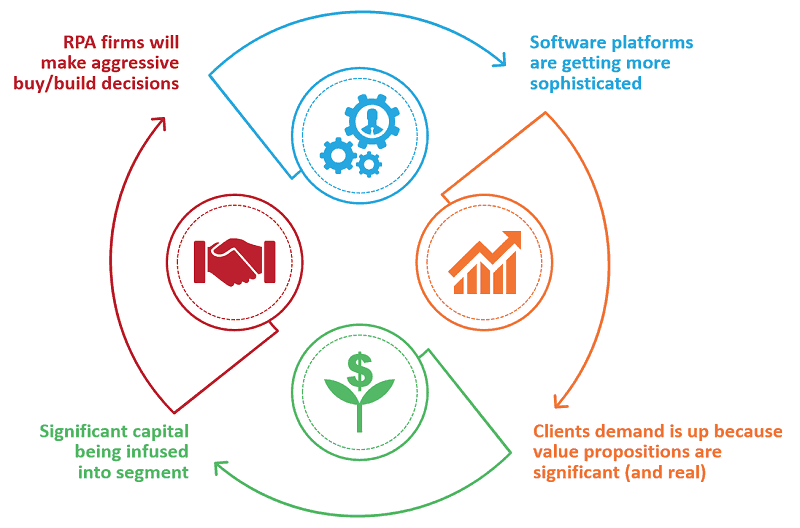

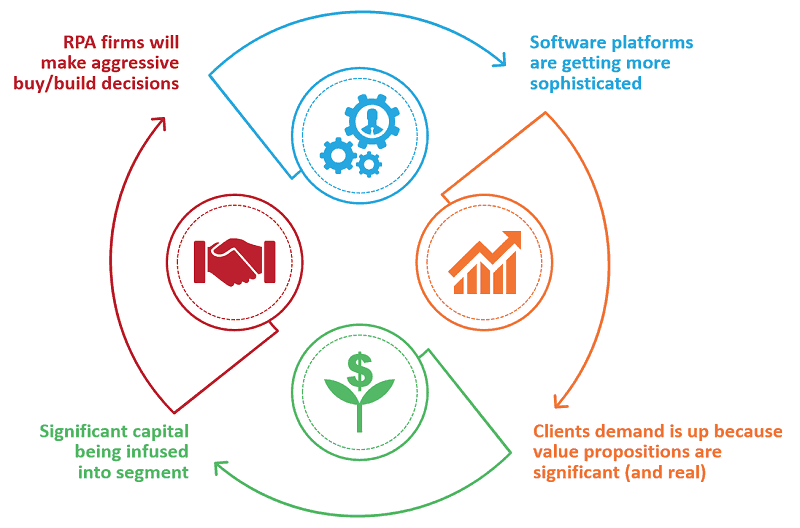

The RPA Virtuous Circle Story

These four keys make up the RPA virtuous circle: More sophisticated software platforms, real value propositions, significant capital infusion, and aggressive buy/build decisions. Let’s unpack each one to get the full story.

More sophisticated software platforms – the software platforms underlying RPA are not new; some of them have been around for many years. But as interest and revenues in the segment grow, the vendors are investing in better software and getting invaluable real-life implementation experience. And great use cases and robust feedback loops will drive enhanced software innovation.

Real value propositions – while a great idea is always fun to talk about, the story quickly fades if the economics are insufficient. In RPA’s case, enterprises are finding real savings and, probably most important, operational improvement. What makes this such an exciting story is that RPA doesn’t apply to just one aspect of the enterprise – it applies anywhere human resources are being deployed for labor-intensive services. So not just G&A functions, but also core business operations.

Significant capital being infused – where there is monetary value creation, Wall Street and Silicon Valley will certainly be found nearby. In the RPA segment, multiple investments in excess of US$100 million have been made. In total, we have seen more than a half billion dollars in investments in just the past six months. These are huge flows of capital, especially considering that in many cases they far exceed current revenues.

Aggressive buy/build decisions – of course, when that much capital is deployed, there’s tremendous pressure to take action to generate real, quantifiable results. The most obvious is to deploy larger sales/account teams to support the growth. But, there will be also significant development needs as use cases expand. We also anticipate that RPA firms will go on a buying spree of niche competitors or companies that increase automation functionality for items like OCR, machine learning, artificial intelligence, and natural language processing.

Right now, the velocity of the Virtuous Circle is increasing…better software, increased enterprise value propositions, and another round of investments.

To learn more about Everest Group’s take on RPA, view the replay of our popular August 8 webinar on the latest developments and implications for enterprises. By registering, you will also receive a a copy of the presentation and deck for download after the webinar.