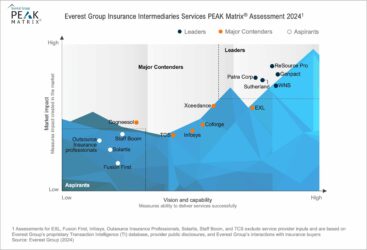

Insurance Intermediaries Services PEAK Matrix® Assessment 2024

Insurance Intermediaries Services

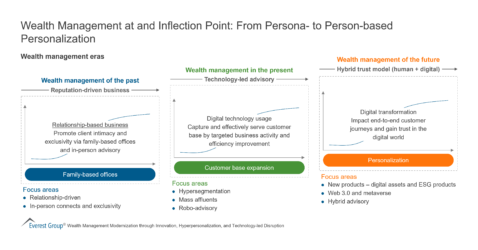

Amid evolving market dynamics, the insurance intermediary sector is transforming significantly. There is a noticeable shift toward prioritizing digitization and adopting advanced technologies to drive change, especially amid the challenging economic landscape and ongoing market consolidation. Additionally, with the emergence of risks associated with climate change and cyber threats, intermediaries are expanding their role beyond traditional risk placement to become strategic advisors. They leverage data-driven insights to offer proactive risk management solutions to clients.

As the insurance intermediary segment adapts to this evolving landscape, there is a growing trend of forging partnerships with providers to optimize costs, access technical capabilities, and tap into talent expertise. Concurrently, providers are actively investing in digital capabilities, partnering with InsurTech companies, and enhancing collaboration with intermediaries through a consultative approach.

Insurance Intermediaries Services PEAK Matrix® Assessment 2024

What is in this PEAK Matrix® Report

Contents:

This report features 15 insurance intermediary service provider profiles and includes:

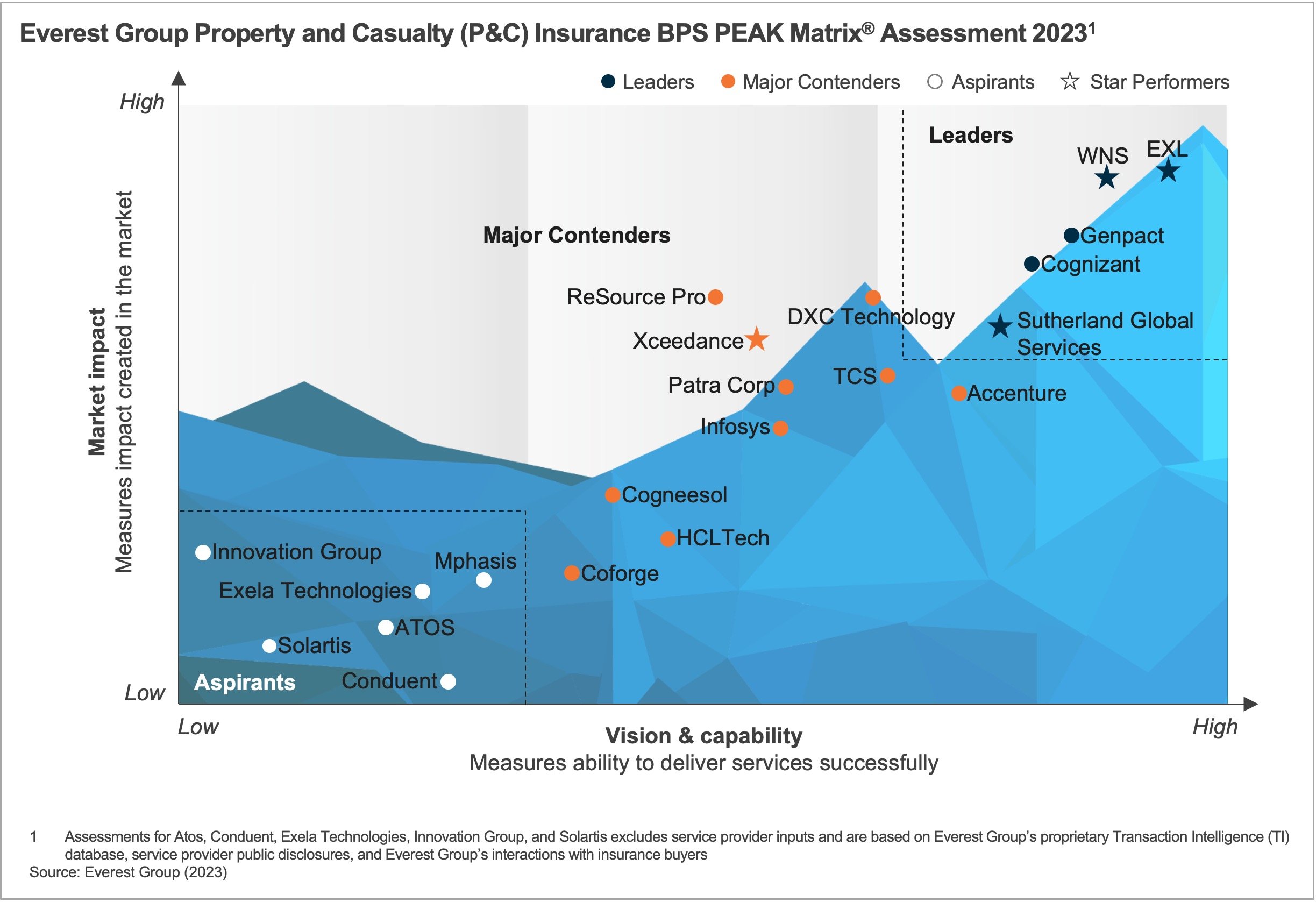

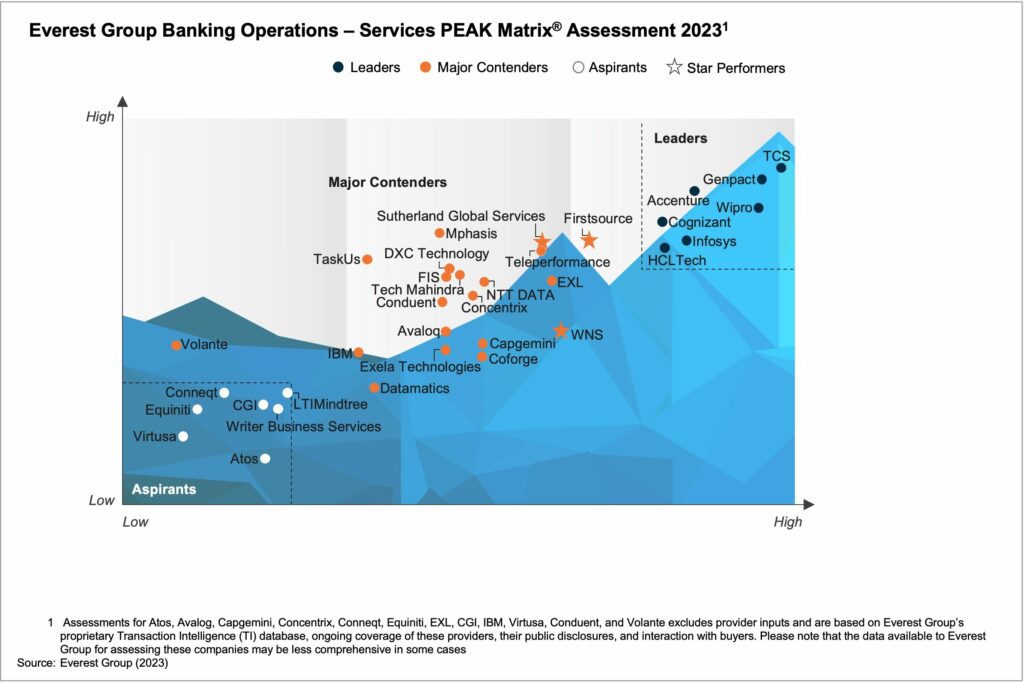

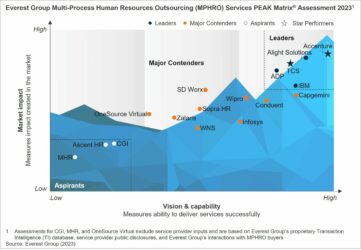

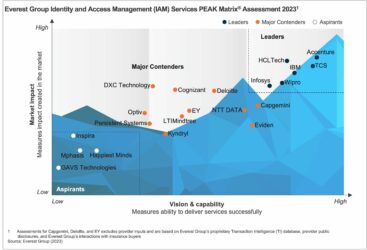

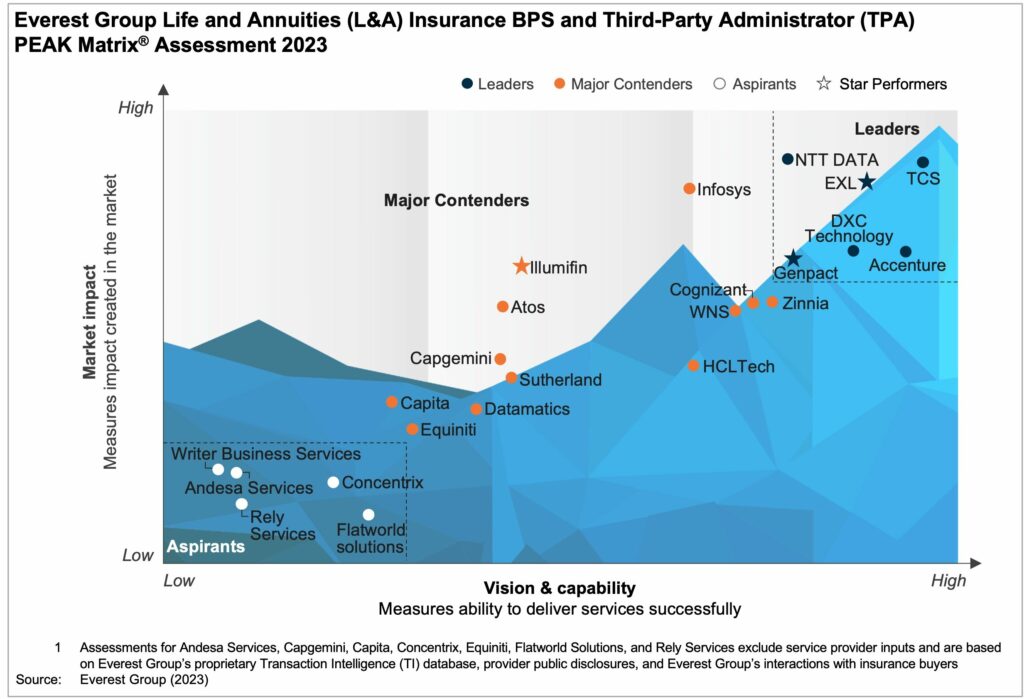

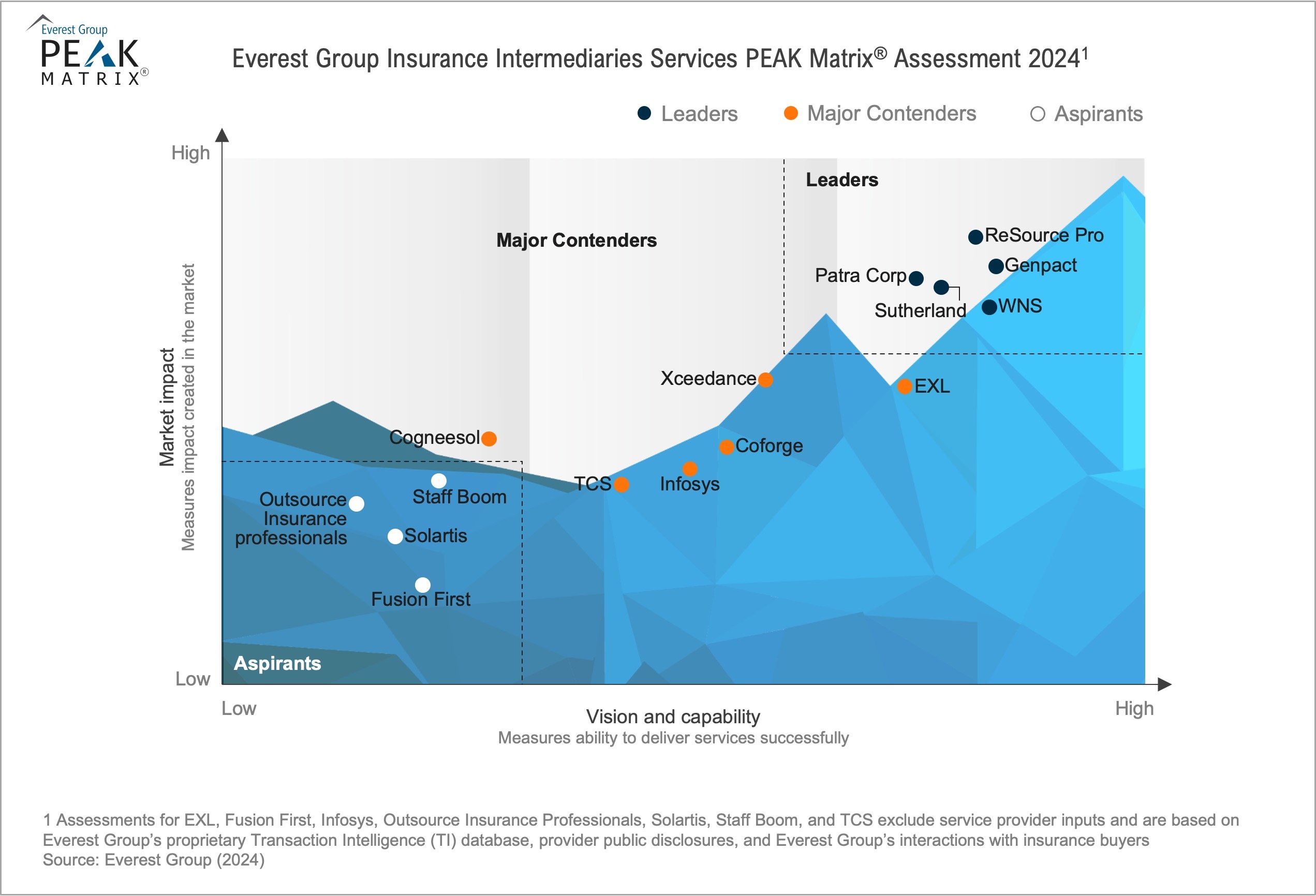

- Providers’ relative positioning on Everest Group’s PEAK Matrix® for insurance intermediary services

- Providers’ market impact

- An evaluation of providers’ vision and capabilities across key dimensions

Scope:

- Industry: insurance intermediary services

- Geography: global

- In this report, we only cover vertical-specific insurance intermediary operations and have omitted horizontal business processes, such as Finance and Accounting (F&A), HR, procurement, and contact centers

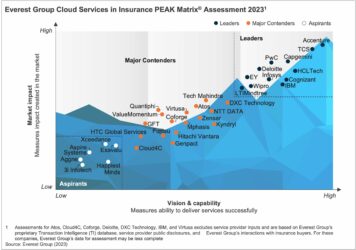

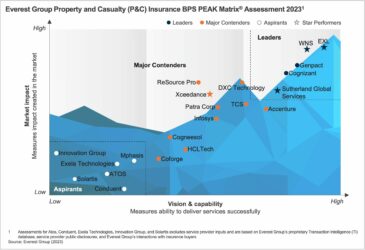

Related PEAK Matrix® Assessments

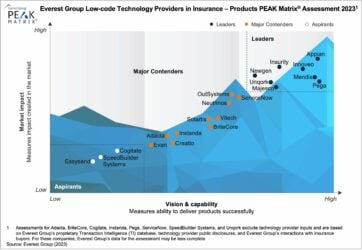

Low-code Technology Providers in Insurance – Products PEAK Matrix® Assessment 2023

Our Latest Thinking

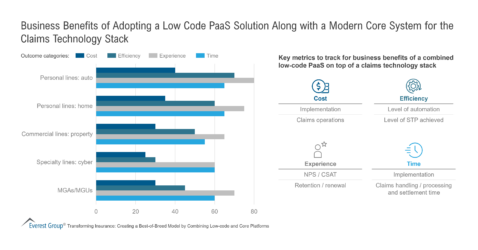

Transforming Insurance: Creating a Best-of-Breed Model by Combining Low-code and Core Platforms

Insurers are Prioritizing Low-code Solutions for Speed-to-market and Cost Benefits

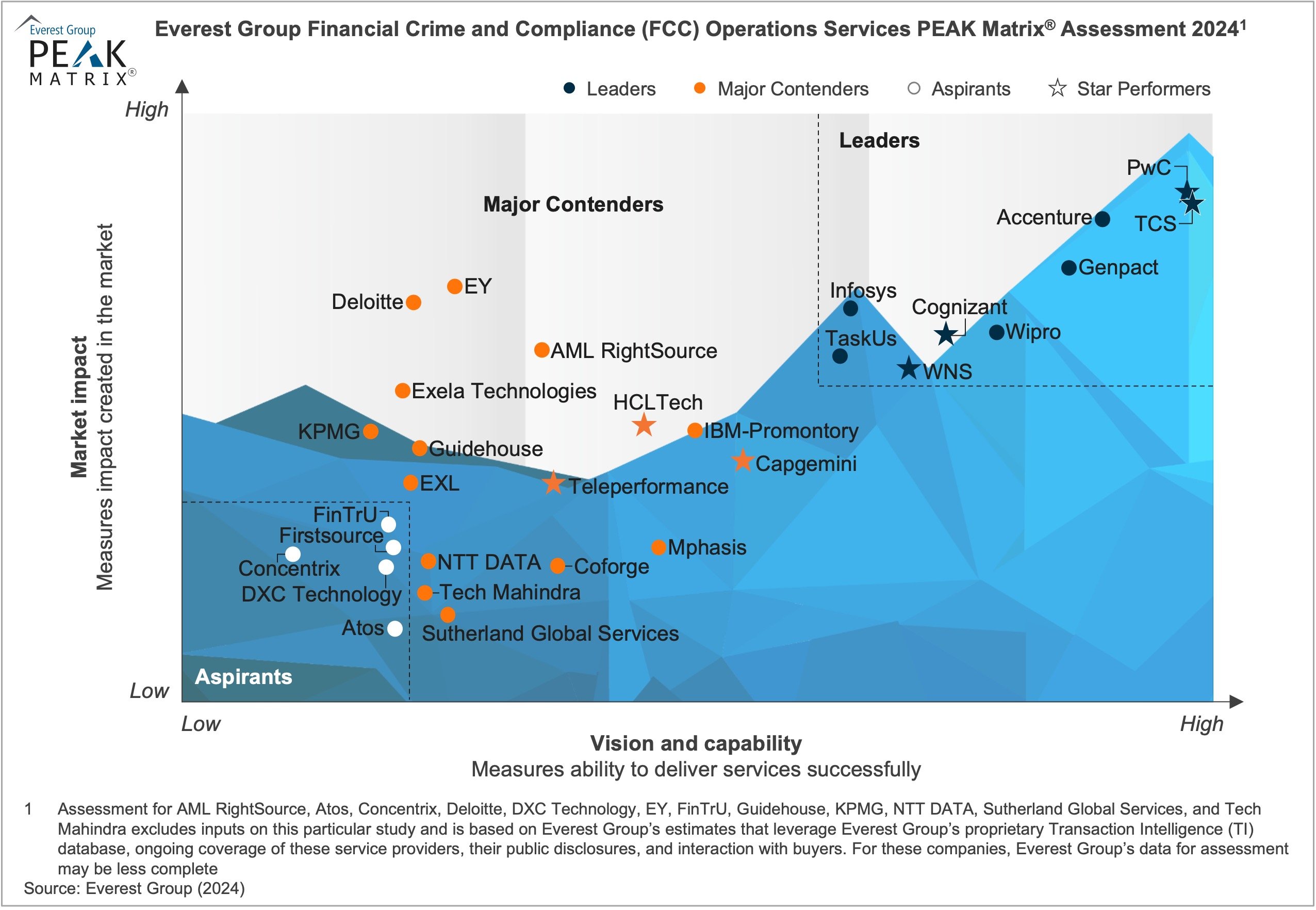

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.