Enterprises have been increasingly turning to P&C insurance BPS providers during the recession to address elevated operating costs resulting from heightened inflation, which has led to increased claims expenses and rate adjustments for various P&C products. Cost reduction has once again become the foremost reason for outsourcing, along with the pursuit of operational efficiency to achieve improved business results. Additionally, there have also been delays in decision making from key enterprise leaders for handing out transformational projects.

Nevertheless, P&C insurance BPS providers are actively seeking opportunities for expansion by enhancing their capabilities in less frequently outsourced areas such as underwriting, actuarial analysis, and claims processing, all of which represent substantial cost centers for enterprises. Additionally, they are presenting transformational initiatives to initial adopters of outsourcing who have yet to fully realize the advantages of partnering with BPS providers to boost efficiency and cut costs, enabling them to sustain and improve growth in a challenging environment.

-

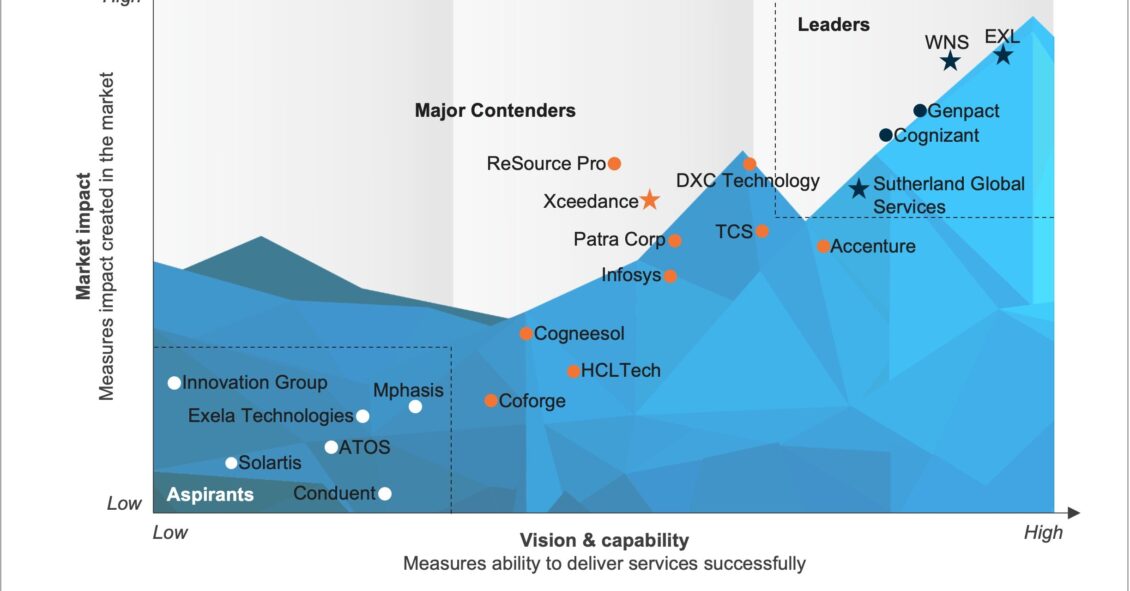

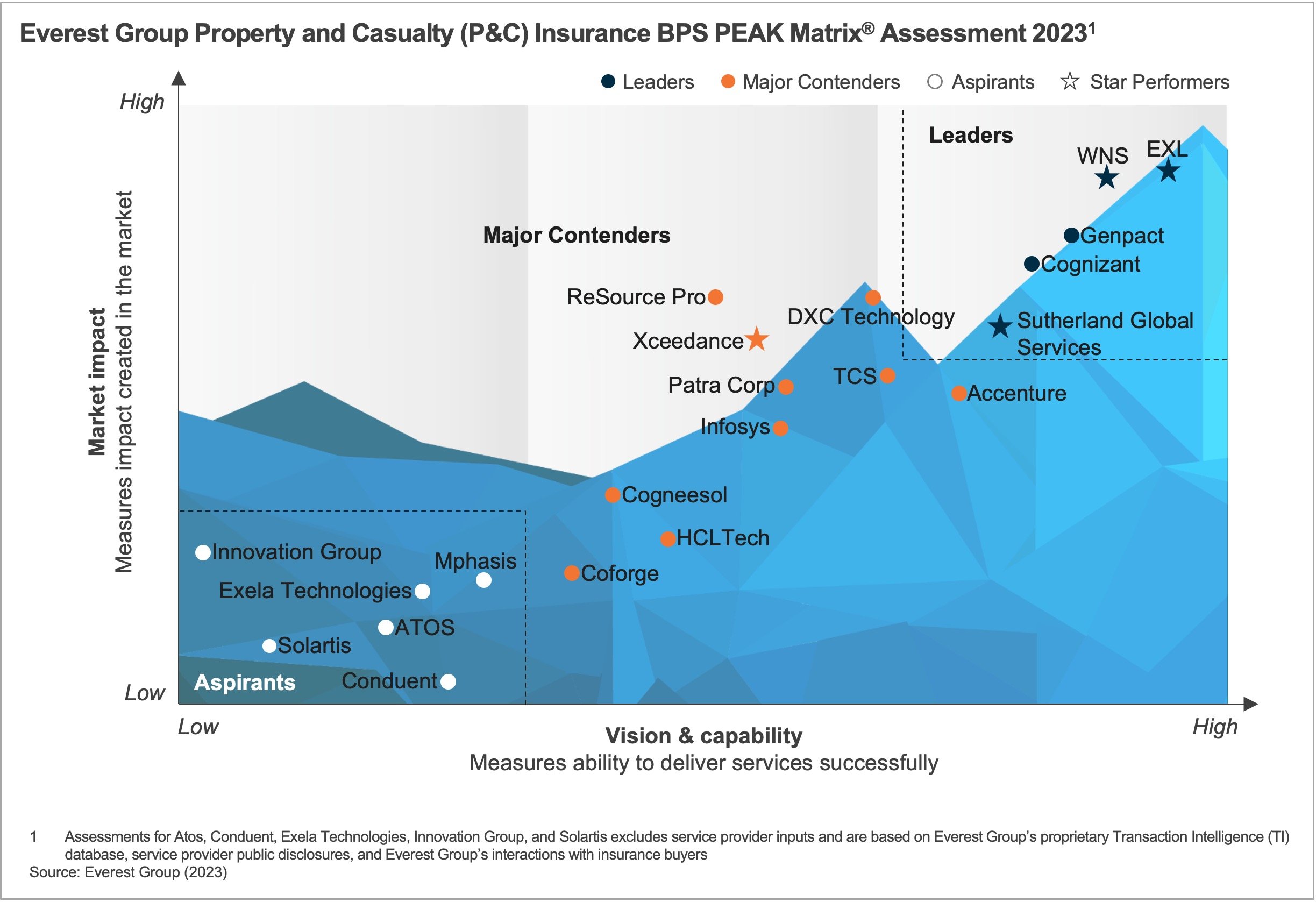

Property and Casualty (P&C) Insurance BPS PEAK Matrix® Assessment 2023

What is in this PEAK Matrix® Report

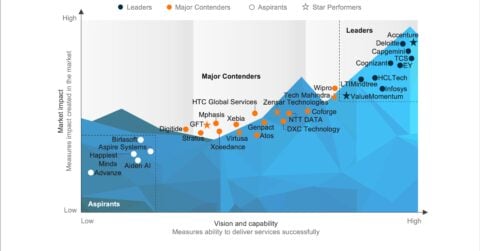

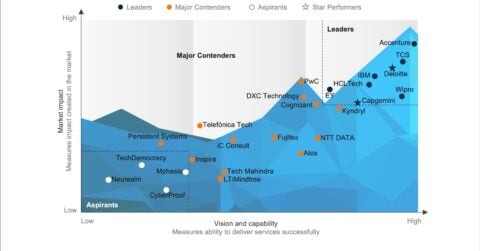

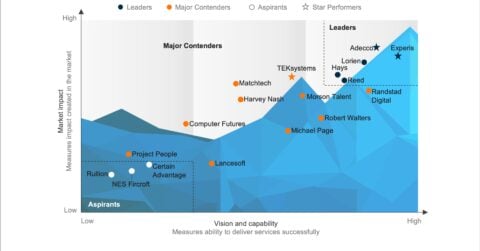

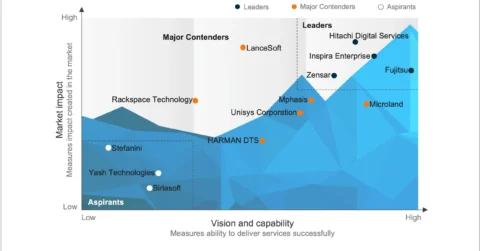

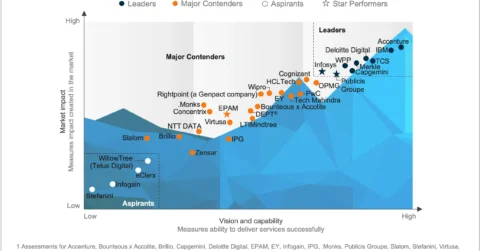

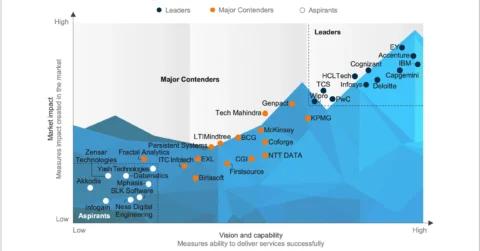

In this report, we assess 21 P&C insurance Business Process Services (BPS) providers and position them on Everest Group’s PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants. Each provider profile provides a comprehensive picture of its vision, delivery capabilities, market success, and key strengths and limitations. The report also examines the global P&C insurance BPS market and its provider landscape. The study will assist key stakeholders, such as insurance enterprises, service providers, and technology providers, to understand the current state of the P&C insurance BPS market.

Content:- Providers’ relative positioning on Everest Group’s PEAK Matrix® for P&C insurance BPS

- Providers’ market impact

- The evaluation of providers’ vision and capabilities across key dimensions

Scope:

- Industry: P&C insurance BPS

- Geography: global

- In this report, we only cover vertical-specific P&C operations and have omitted horizontal business processes, such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.