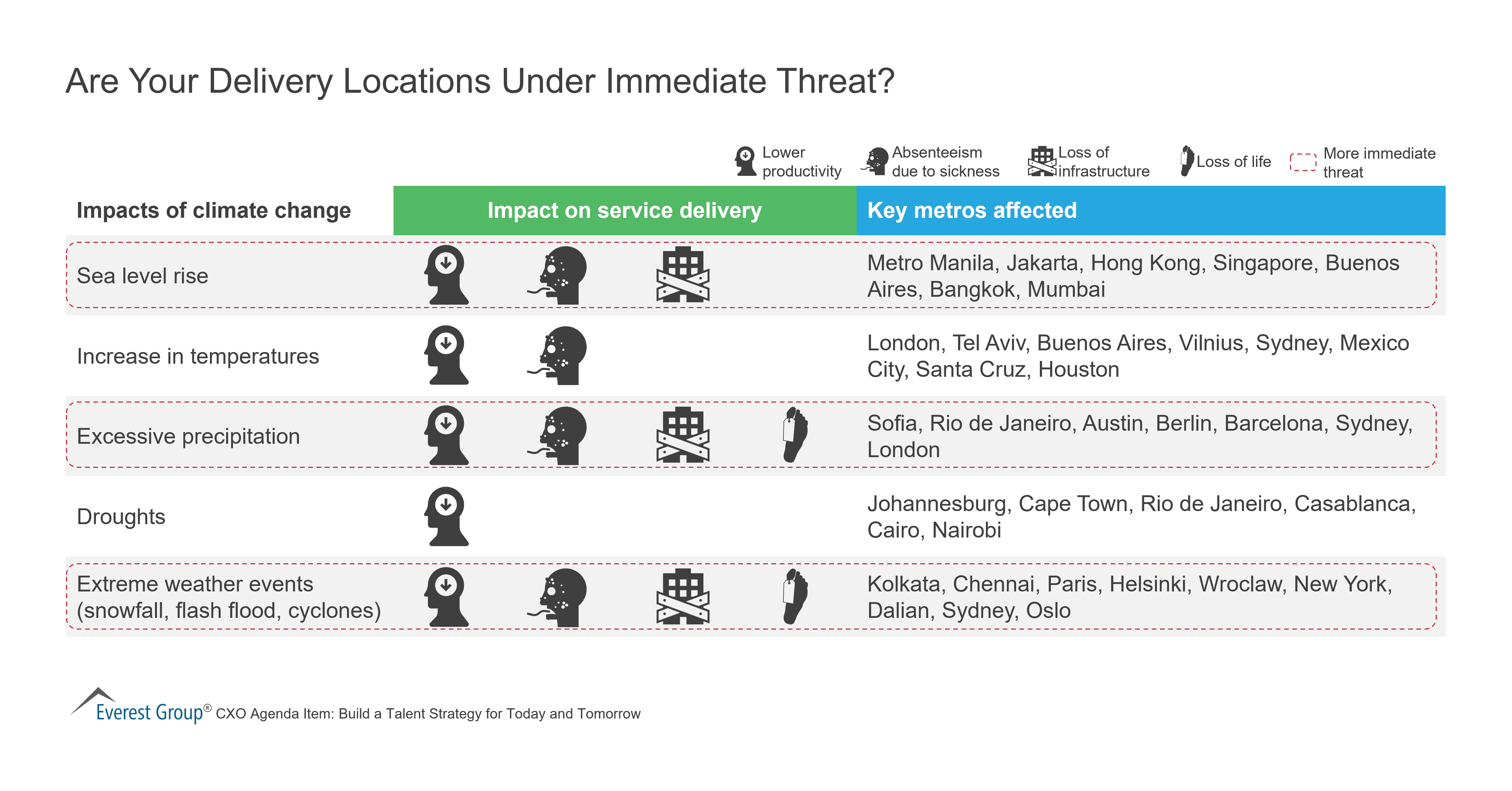

Delivery locations

ACCESS THE WEBINAR ON-DEMAND

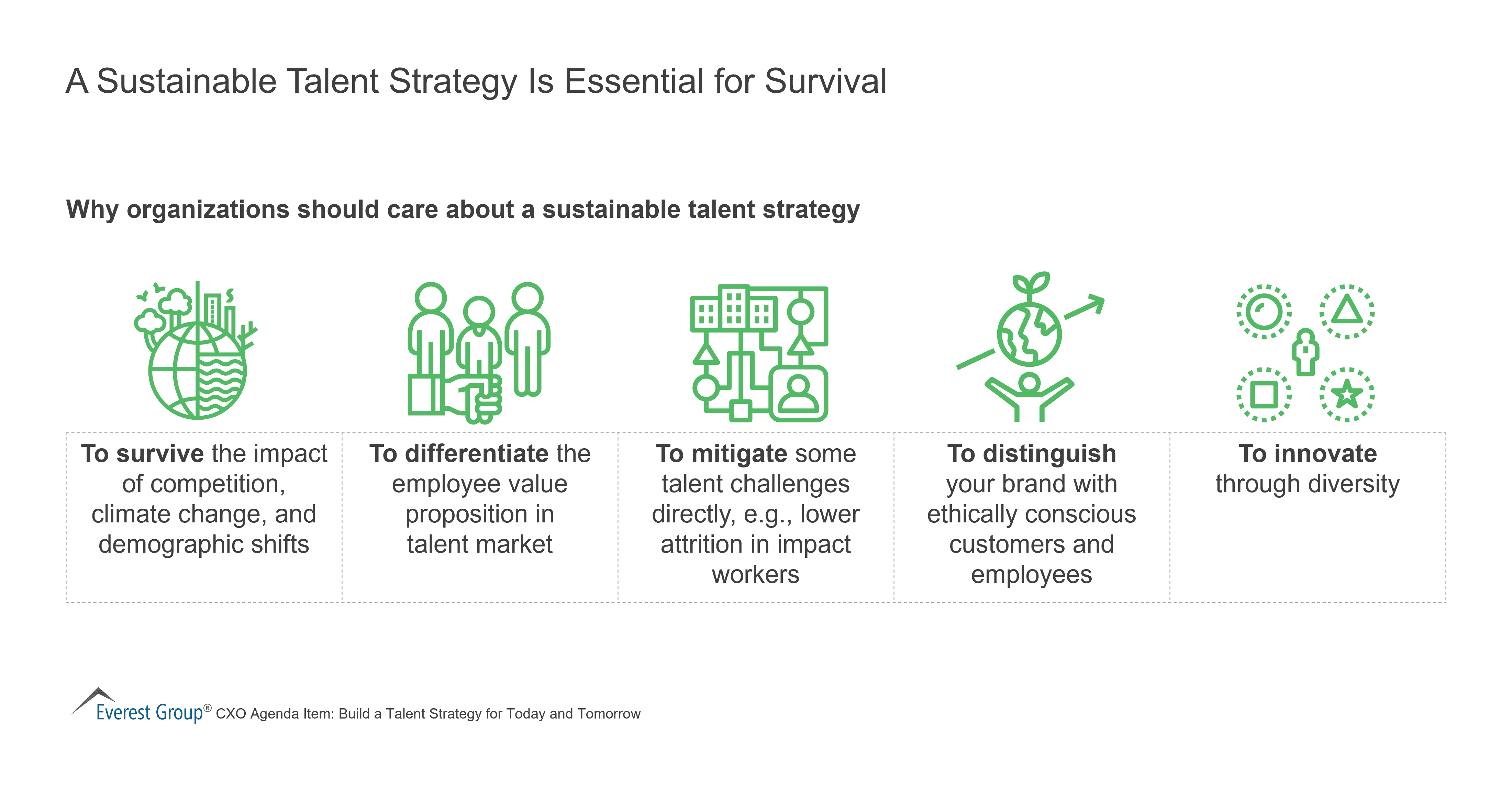

sustainable talent strategy

ACCESS THE WEBINAR ON-DEMAND

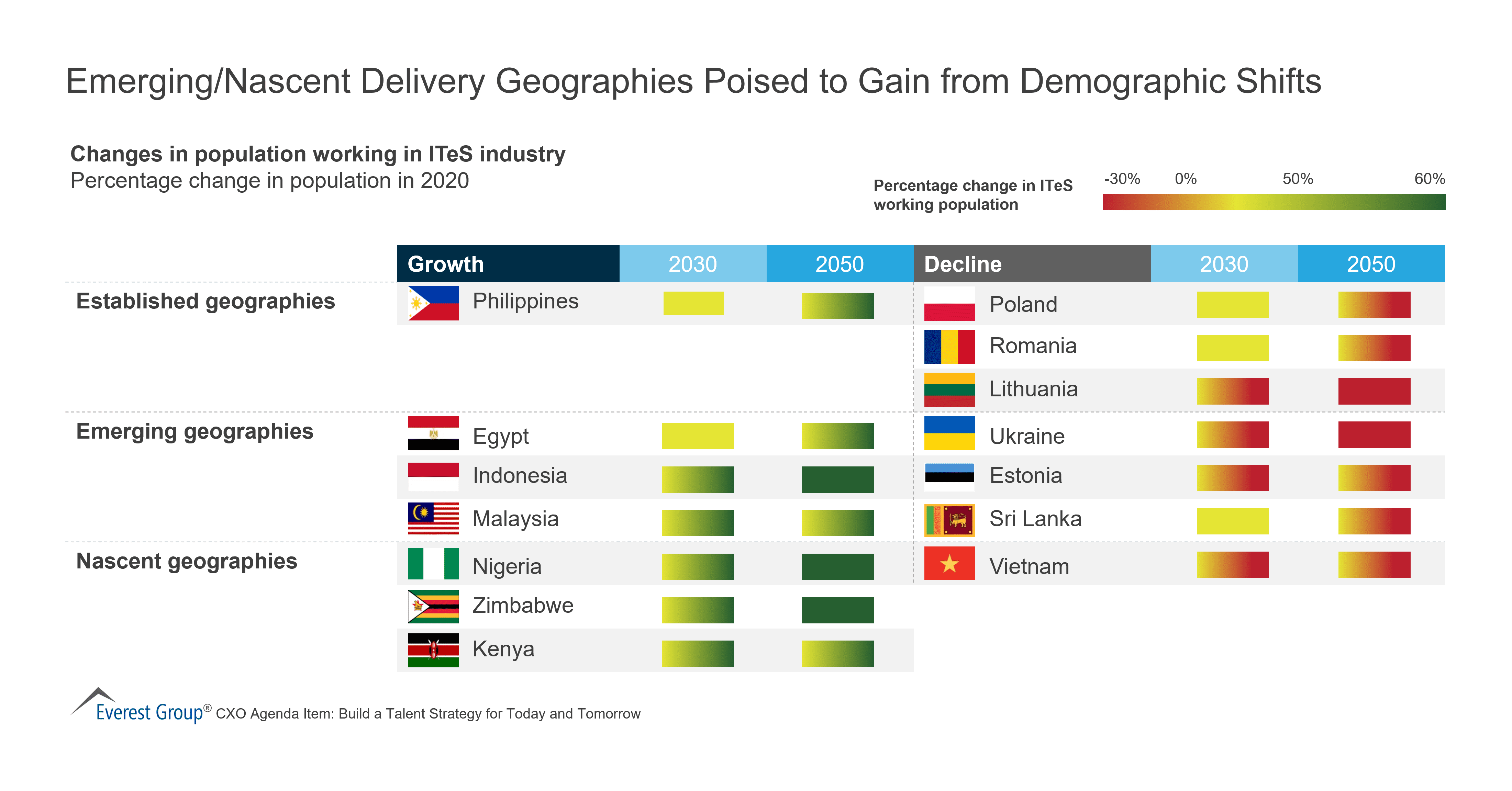

Delivery Geographies

ACCESS THE WEBINAR ON-DEMAND

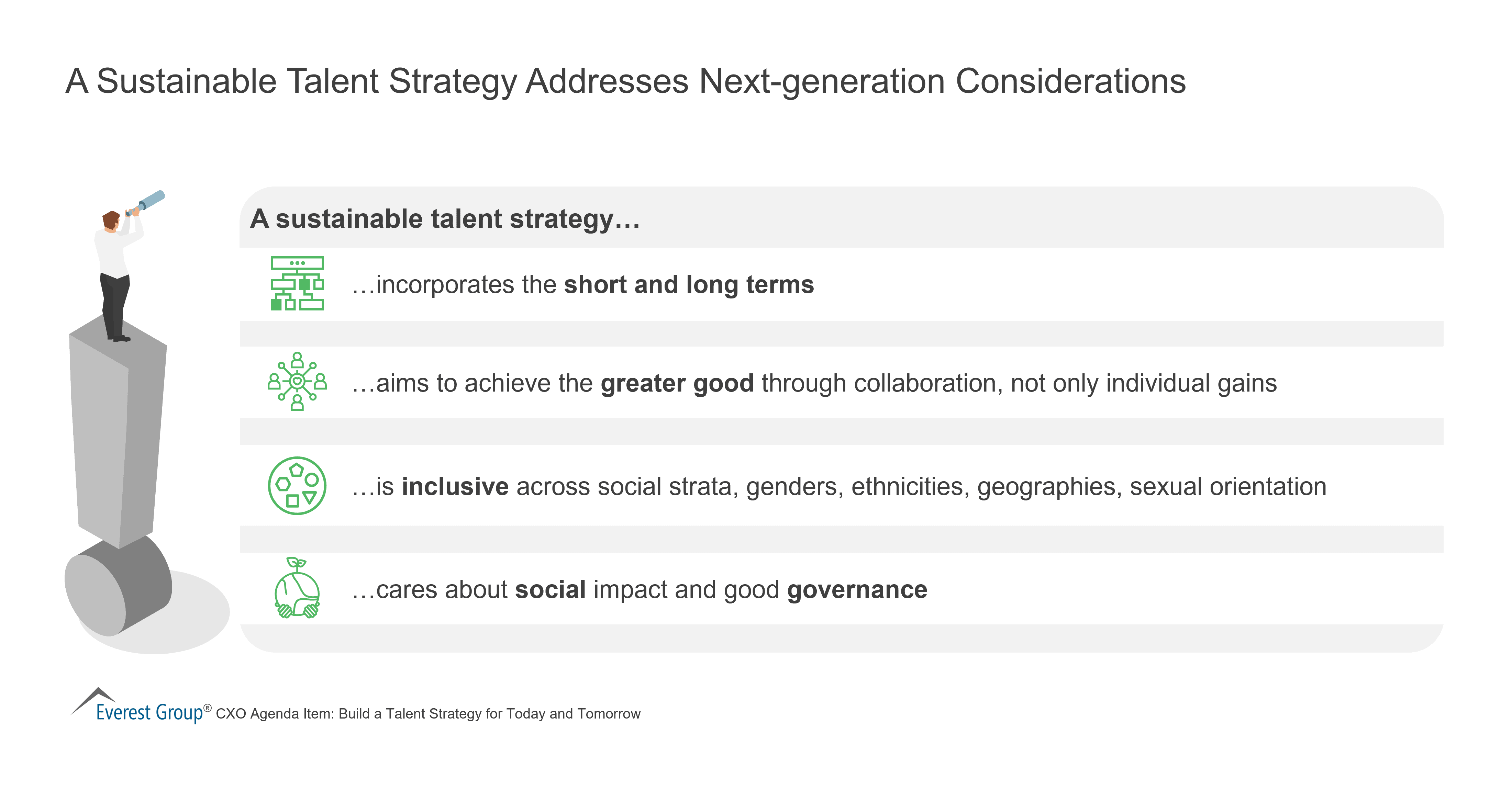

talent strategy

ACCESS THE WEBINAR ON-DEMAND

Pending legislation intended to protect the privacy of India’s citizens could set the stage for a sovereign cloud initiative and new opportunities in the Indian cloud ecosystem. Is India following the same trajectory as Europe toward data sovereignty? And what benefits could it bring to the country and its people? To learn more about the ripple effects passing the Personal Data Protection Bill (PDP) could have on the industry, read on.

The passage of the PDP Bill would change the data privacy dynamics within India by regulating the use of an individual’s data by the government and private companies. While not expected to come before the Indian Parliament for at least another three months when the winter session starts in November, the long-delayed and highly-debated legislation has larger potential implications.

First brought to the Parliament in 2019, the bill is now with the Joint Parliamentary Committee (JPC) for examination, where five extensions to submit its report on the bill have already been granted.

The most current draft has been criticized by many, including former Justice B.N. Srikrishna, who worked extensively in defining and writing the first draft of the PDP Bill. Justice Srikrishna has highlighted certain provisions in the amended PDP Bill 2019 that he says make it “dangerous” and can turn India into an “Orwellian State.”

The JPC, led by chairperson P.P. Chaudhary, has been tasked with identifying the problems and potential solutions and has held talks so far with Facebook, Twitter, Amazon, Google, Airtel, Jio, Ola, Uber, and Paytm among other major tech giants.

Among the points of concern are the definitions of the types of data and where each can be stored and processed. PDP Bill 2019 has segregated personal data into the following sub-categories:

Unlike the original intent that mandated the storage of all personal data within India’s boundaries, the amended bill states that a copy of Sensitive Personal Data needs to be stored locally and can be sent abroad for data processing, under certain regulations.

The revised bill would require Critical Personal Data to be processed as well as stored within India and only sent outside India under certain conditions (outlined in Chapter VII, Section 34, Sub-Section 2 of the draft).

These data localization amendments have given the tech giants a much-needed respite, especially considering the Competition Commission of India (CCI) has tightened its rope on them over the past two years, with the latest episode being the debate over WhatsApp’s new privacy policy.

India’s current path draws a parallel with the European Union (EU), where data privacy across all the European member states is regulated under the General Data Protection Regulation (GDPR). If we follow the analogy closely, the next logical step for India would be to launch its sovereign cloud, in line with the new European sovereign cloud initiative named GAIA-X.

If India goes ahead with a sovereign cloud, it would unlock a new dimension, at least for the public sector, to explore and build on. With the strong government push under the ‘Make in India’ and ‘Digital India’ initiatives as well as a strong IT workforce, a sovereign cloud platform would not be a too distant dream.

Some of the benefits to India from a sovereign cloud initiative include:

The only big challenge that India might face is not having a successful sovereign cloud initiative of this scale to benchmark against. Europe’s GAIA-X will be the closest counterpart for India’s sovereign cloud initiative and that also is in a nascent stage.

With some degree of data localization seemingly inevitable, companies have identified a good business opportunity and are racing to get the ‘first-mover’ advantage. Various firms have started the ball rolling – from construction giants like Adani and Hiranandani jumping into the data center business to cloud solution providers like Genesys launching new capabilities with localized data storage and data sovereignty as key factors for its contact center solution.

With the enactment of PDP as law, we expect the proliferation of data centers and an increased cloud hyperscaler presence in India. A new hyperscaler-backed sovereign cloud initiative also could be possible, along with an increased focus by cloud service providers on the legal framework to keep critical data within India’s geographic boundaries.

In the long run, we can see certain service offerings emerging to manage client data, which would be very similar to how the software and services market for GDPR has evolved over the years.

What do you think the next logical steps for the government will be after passing the Personal Data Protection Bill, and how will the law impact the industry? Please share your thoughts with us at [email protected] and [email protected].

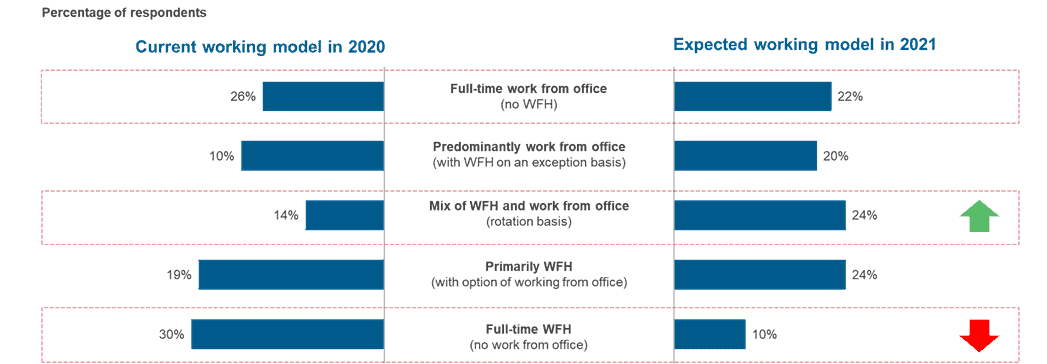

COVID-19 has fundamentally altered the Work From Home (WFH) proposition for global organizations, prompting a shift from opportunistic leverage in 2020 to rapid integration of WFH within the future delivery model strategy. Now that the dust is settling a bit from the global health crisis, WFH strategy design and implementation will be critical to ensuring global business services (GBS) organizations’ future success. And WFH will look far different than it did in 2020.

Most organizations successfully transitioned to scaled remote delivery models with minimal service delivery disruptions in response to COVID-19. This experience has served as a critical proof of concept, and exposed key learnings and opportunity areas associated with scaled WFH delivery.

Let us take a closer look at several key things we learned while conducting the research for our recently published report, Future of Work-From-Home in GBS – Separating Hype from Reality:

Our interactions with leading GBS organizations over the last 12 months revealed multiple key themes that will determine the success of a hybrid WFH model going forward:

While many GBS organizations are addressing key WFH-related challenges in an agile manner, they must proactively design their WFH strategy and align it with their parent organization’s needs and objectives.

As GBS organizations build their future WFH strategy, they need to solve for six key elements.

COVID-19 has presented organizations with a unique opportunity to re-strategize their priorities, optimize their operating models, and develop a robust future-proof WFH strategy. We believe GBS organizations that proactively seize this opportunity will emerge resilient and stronger.

Read our report, Future of Work-From-Home in GBS – Separating Hype from Reality, to gain insights on global organizations’ outlook on the WFH model, the extent of adoption, key design elements and approaches, emerging trends and best practices, and key challenges and success factors to enable a scaled WFH model.

We’d love to hear about your WFH experience and approach to designing a WFH strategy for your GBS organization. Please share with us at: [email protected] or [email protected].

India is going through a new COVID-19 wave that is truly horrific. On May 19, India set the world record for the most COVID-19 deaths in a single day (4,529 deaths and 267,334 new cases in the prior 24 hours). In the past month, its COVID-19 fatalities increased by sixfold. A huge percentage of the nation’s workforce is affected (either sick or caring for family who are sick). Businesses in the US and Europe have questions about whether India is still viable as the primary destination for third-party services. Read this blog for my answer.

India is experiencing a COVID-19 spike that started in April and is worse than the original outbreak months ago. Not only are more people infected, but more are also hospitalized this time. It is particularly difficult because the variant that seems to drive this spike is more infectious and affects young people as well as elderly people. It clearly affects offshore services work performed for US companies.

Today, most companies have staff working from home due to the pandemic. Although customer experience management (CXM) agents aren’t essential workers in the truest sense, consumers sheltering in the safety of their homes for months on end have relied on them so heavily for wide-ranging reasons that they might as well have considered them so. What those consumers probably don’t know is that the call center agents assisting them are most likely working from home. In fact, our recent research report, Customer Experience Management (CXM) State of the Market Report 2021, found that the percentage of CXM FTEs working at home grew from less than 10 percent in 2019 to as much as 80 percent during the health crisis. While we expect that there will be some movement back towards the brick and mortar model in the coming months and years, many service providers and in-house contact centers will continue to utilize Work at Home Agents (WAHA) as a key component of their service delivery strategy.

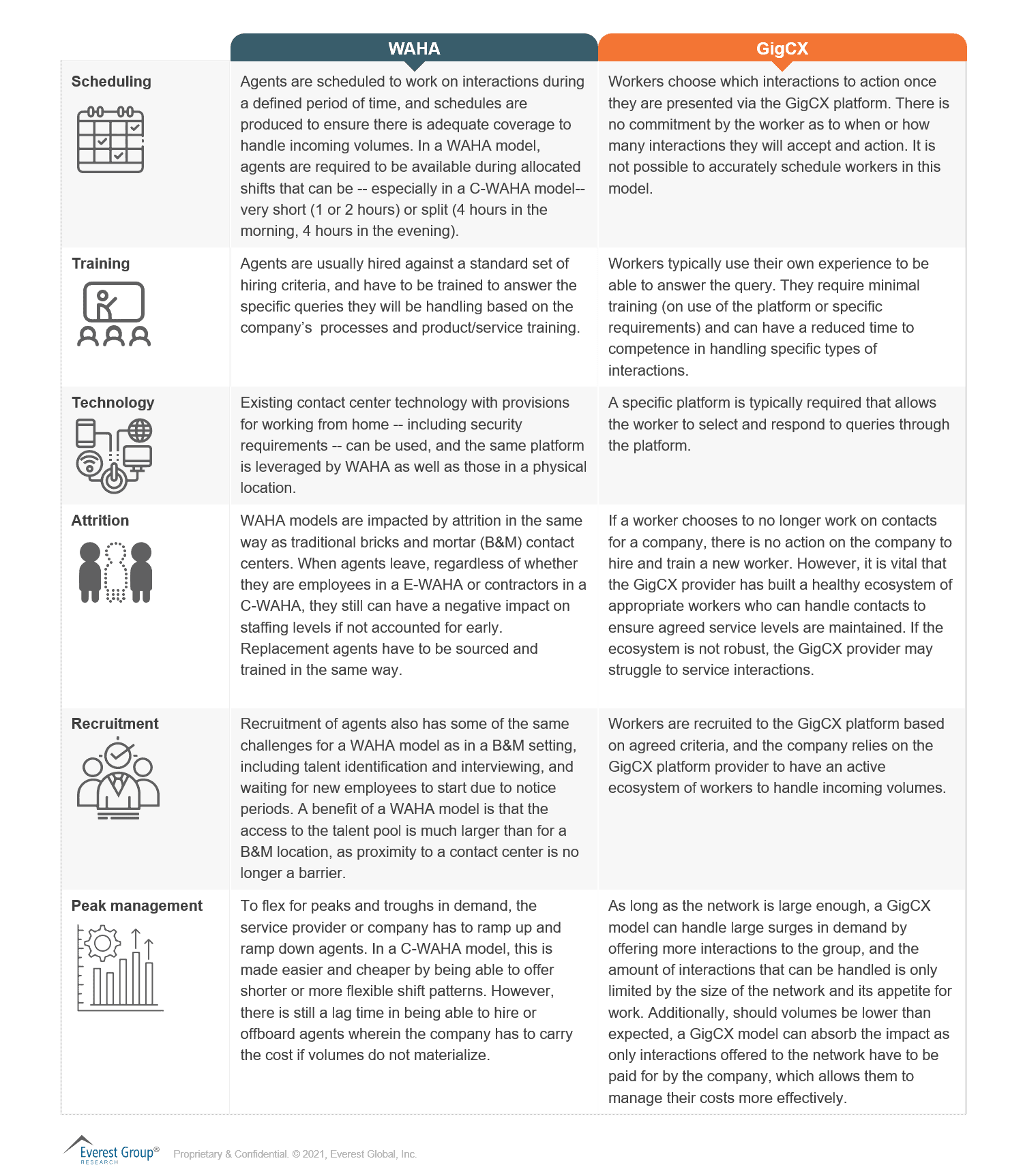

Two WAHA models are currently in use. One is employee-based (E-WAHA), wherein the agents are on the service provider’s or company’s payroll. The other is contract-based (C-WAHA), wherein contractors are leveraged and only paid for the time they work for the organization.

In recent years, GigCX has emerged as an alternate approach to CXM staffing and is being utilized by the likes of organizations such as eBay and Microsoft. GigCX includes the use of freelance or self-employed workers to handle specific interaction types, leveraging an AI-powered technology platform. They are recruited for their existing knowledge and passion for the product and service.

Initially, GigCX was utilized for very simple work; however, those interactions are increasingly being eliminated or automated. Now, growing use of this model is for more complex query types that require a level of brand affinity and awareness, which can be a differentiator many GigCX providers are publicizing.

GigCX, which is often seen as another strain of the WAHA model, should not be confused with WAHA, as there are some fundamental differences in how the models operate.

When considering which approach is best to meet a set of business requirements, organizations should understand the following differences in the two models:

While we have seen both WAHA and GigCX being effective models for handling customer interactions, there are some stark differences in their operation. Any company considering using either model should assess the positives and negatives of the approaches and factor them into their operating model design. Both models are highly effective when utilized appropriately to handle the right interaction types, especially if all the limitations and dependencies are considered early in the design process.

For more information, please feel free to contact me at [email protected].

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields