View the event on LinkedIn, which was delivered live on Wednesday, November 8, 2023.

Watch this LinkedIn Live event to hear from 🎙️ Jack Madrid, IBPAP President & CEO, and Jimit Arora, Everest Group Partner, for an enriching conversation exploring the true value proposition of the Philippines as a global services delivery destination.

Attendees gained insights into the location’s 💪 strengths, heard areas for improvement, and left with practical on-the-ground learnings and valuable recommendations for establishing a delivery center in the Philippines.

This LinkedIn Live, explored:

✅ The true value proposition – talent availability, financial attractiveness, operating environment, and more – of delivering global services from the Philippines 💰

✅ The government developments and incentives that impact the Philippines’ potential

✅ The challenges – skills availability, talent size, and more – that an organization will need to navigate if it is considering setting up a delivery center in the Philippines 🧠

Talent dynamics are an ever-changing phenomenon with varying demand-supply, the emergence of new technologies, and changing work cultures. However, enterprises can stay competitive in the talent market by harnessing value from the tech-powered revolution, including generative AI, the maturity of hybrid work models, the reshaping of employability through skills, and the prioritization of sustainability.

Watch this webinar as our expert analysts discuss trends likely to shape the talent market in 2024. The speakers will answer critical questions about the current state of the talent crisis and provide valuable insights and strategies to help organizations thrive in an environment where talent remains a pivotal factor for success.

What questions did the webinar answer for the participants?

Who should attend?

Offshoring/nearshoring has seen an uptick across functions as enterprises have embarked on a road to recovery post the pandemic. In 2023 as well, rising cost pressures and talent-related challenges in onshore geography will continue to move the pendulum in favor of offshore/nearshore geographies.

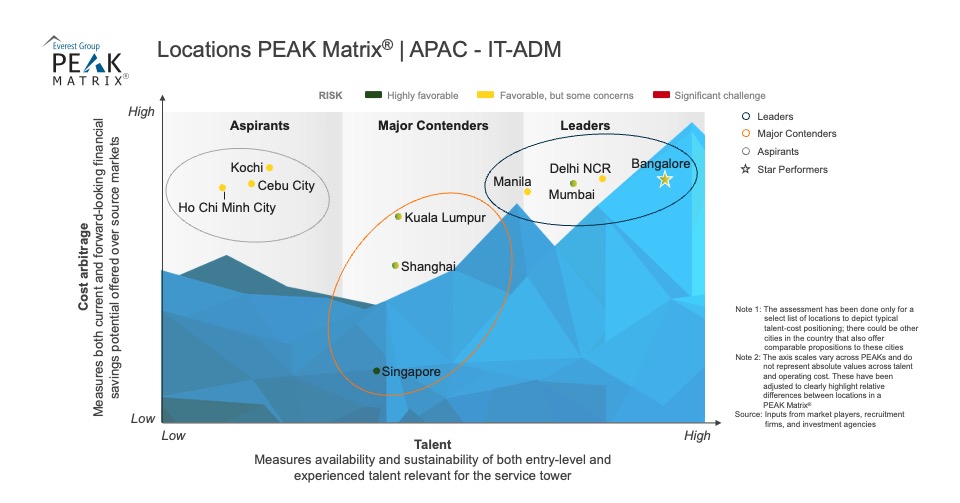

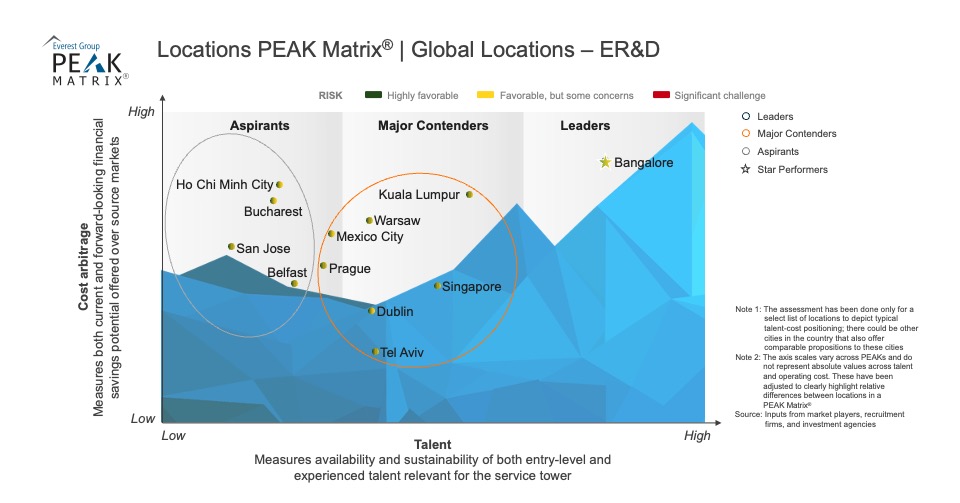

Asia Pacific continues to dominate the global services landscape as major tier-1 Indian cities maintain their Leader positions across functions. The Philippines continues to remain a Leader for contact center and transactional business process services work. In EMEA, Poland and Ireland continue to be the locations of choice for IT-BP delivery. Locations in LATAM continue to witness growth in terms of new capabilities to serve the North American (especially the US) market. Mexico, Argentina, and Colombia continue to maintain their position as Major Contenders (in the global landscape) for most functions.

Scope:

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.

View the event on LinkedIn, which was delivered live on Thursday, September 7, 2023.

Watch this LinkedIn Live session for in-depth coverage on offshoring services to Georgia and its potential as a global services delivery destination, including the region’s operating environment, the impact of its government policies, workforce capabilities, and financial viability to uncover the real value proposition for businesses seeking Georgia as a potential location. 🌍

📣 📣In this LinkedIn Live session, our analysts joined on-the-ground experts in Georgia from Girteka and Enterprise Georgia to discuss their experiences with delivery in the location. They’ll share what’s working well, what can be better, and learnings and recommendations for those already operating in the area or considering adding Georgia to their locations portfolio. 🤝📊

What questions does the event answer for participants?

Ireland’s allure as a top destination for tech talent is fading. This mature delivery hub for nearshore IT services still has much to offer but will have to overcome key obstacles to regain its appeal among international technology professionals. Gain market insights and forecasts for Ireland’s tech talent in this blog. To discuss this topic further, contact us.

In recent years, Ireland has been a magnet for job seekers worldwide, luring talent from diverse nations such as England, India, Brazil, the United Arab Emirates, Turkey, Sri Lanka, and Bangladesh. The country’s appeal as a destination has been fueled by abundant job opportunities, excellent quality of life, simplified work permit processes, and enticing government initiatives such as the Critical Skills Employment Permit and the Start-up Entrepreneur Programme (STEP). However, against the backdrop of a tech sector slump and a demand-supply disparity, Ireland is gradually losing its allure for foreign technology professionals.

Ireland has been a popular location for global companies looking to offer IT service delivery to nearshore Europe. Ireland’s diverse offerings encompass application development, infrastructure management, and other digital services. The nation’s strong talent proposition is underscored by 52,000 tertiary graduates and a thriving information technology and business processes (IT-BP) workforce, totaling 157,000 employees. The cities of Dublin, Cork, and Galway serve as prominent IT-BP hubs, contributing about 80% of the nation’s center setups, with global business services (GBS) making up the majority share at 75% of the total center setups.

While Ireland has been a preferred choice for job seekers, its appeal is waning among overseas technology talent due to various reasons. A surge in remote work options, prompted by the post-COVID era, has opened up alternate global work setups. Concurrently, factors like high living costs, housing constraints, a technology workforce demand-supply gap, and muted global tech sector growth contribute to this trend’s acceleration. Additionally, metro areas like Dublin confront issues with a dearth of international schools and high-income tax rates. Government efforts to alleviate these concerns are geared towards improving living standards through sustainable pay increases.

While programs such as Ireland’s Critical Skills Employment Permit and STEP are designed to attract and retain foreign talent. However, the acceptance and success of remote work have reshaped the scenario, making local talent shortages a thing of the past. Technology companies are tapping into the global talent pool through remote hiring, sidestepping relocation challenges.

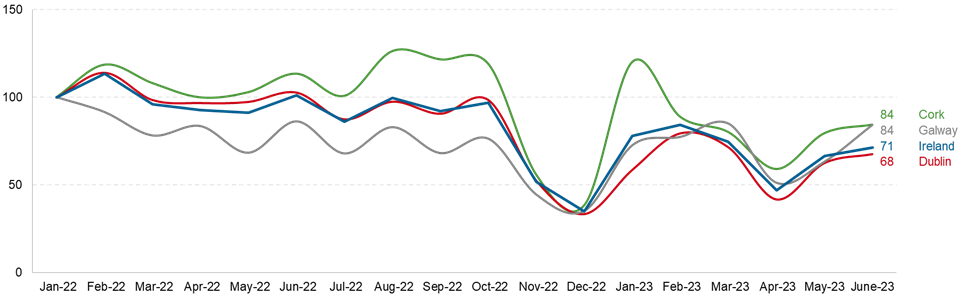

These growth-related challenges are reflected in our ongoing tracking of IT job demand in Ireland through Talent Genius™, an interactive platform for insights into IT and business process services decisions. The talent demand for IT services has seen a relative reduction since January 2022, as illustrated below. This decline was most pronounced in the last quarter of 2022, driven by tech sector contraction, economic uncertainty, and job cuts. Although some signs of recovery appeared mid-year, the market dynamics have shifted from employee-led to employer-driven, reflecting cautious hiring practices.

Monthly tech talent demand (job postings) for IT services (indexed to January 2022)

January 2022 = 100

Ireland boasts an operating cost advantage of 20-25% over London for IT application development and maintenance (IT-ADM) services. Nonetheless, tech salaries have remained steady in the first quarter of 2023 compared to the fourth quarter of 2022, reflecting a competitive yet inflexible market due to talent oversupply. Layoffs and conservative hiring practices have suppressed salary competitiveness. But as the market stabilizes, salary stickiness is expected to improve.

As global dynamics shift, Ireland’s position as a tech talent magnet has encountered new hurdles, and the inflow of international tech talent to Ireland is likely to decline in the short term. Nevertheless, with an upward trend in job numbers and signs of a tech sector revival, the second half of 2023 will hold pivotal insights into the future of Ireland’s technology workforce. Addressing challenges related to remote work, housing, taxation, and competitiveness is crucial to regain its appeal as a tech employment destination.

Be on the lookout for more talent information on other nations by clicking on our interactive platform, Talent Genius™. Connect with Sakshi Garg or Aarushi Raj to discuss the latest trends in tech talent.

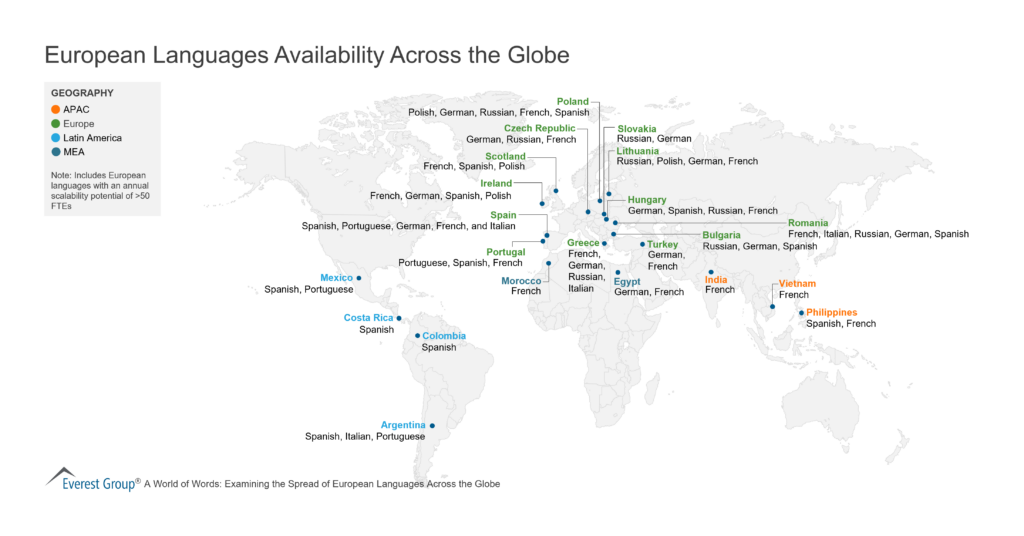

European Languages

Access the on-demand webinar, delivered live on August 17, 2023.

Is your location portfolio and workforce strategy primed to manage black swan events, persisting economic uncertainties, cost and price pressures, and the geopolitical changes of today’s business landscape?

Watch this webinar as Everest Group experts deliver approaches to secure maximum value from delivery location portfolios and offer exclusive insights into the best practices for managing location portfolios and workforce strategies.

Whether you hold the reins as a sourcing leader, a delivery head, or a workforce strategy executive, this engaging webinar will provide you with valuable insights and actionable advice to optimize your locations portfolio and maximize returns.

What questions will the on-demand webinar answer for the participants?

Who should attend?

View the event on LinkedIn, which was delivered live on Thursday, August 10, 2023.

Watch this LinkedIn Live session as our team of locations experts explore Egypt as a potential global services delivery destination

What questions does the event answer for participants?

With its high-quality talent, state-of-the-art infrastructure for delivering advanced technological services, and strong government support, Hyderabad has ascended as a top global services destination. These factors have helped the city gain a competitive edge and establish itself as a hub for innovation and excellence. But does Hyderabad have what it takes to surpass Bangalore as the foremost global services destination in the future? Let’s delve into this question in this blog.

During a client meeting in Hyderabad earlier this month, our analyst team arrived a little earlier than expected and was immediately struck by the futuristic ambiance of the impressive facility. It felt like we had stepped into a scene from a sci-fi movie. Face-scanning machines warmly greeted employees at the entrance, lush greenery adorned office walls, breathing life into the space, and solar panels powered the entire establishment. The energy was palpable as confident associates eagerly looked forward to the start of the work week.

In contrast to the thriving atmosphere we saw in Hyderabad, the environment in Bangalore is comparatively subdued as India’s capital city seems to be grappling with the impacts of the economic downturn. The two cities present a stark juxtaposition in terms of their future growth trajectories.

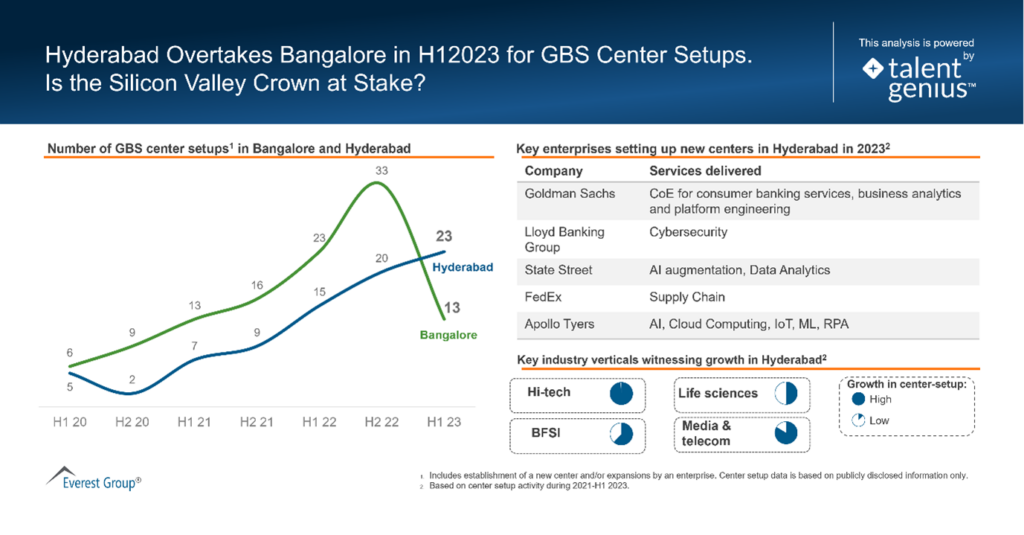

This positive outlook for Hyderabad has become a common sight across multiple Global Capability Centers (GCC). The city has shown admirable growth and resiliency during the past two years, recording one of the country’s highest growth rates for global service delivery. Remarkably, Hyderabad surpassed Bangalore for GCC delivery setups during H1 2023, highlighting its exceptional performance in this sector. Let’s explore the implications of this further.

Learn more about Everest Group’s AI-powered insights platform, Talent Genius™.

Since the early 1990s, when India started its services journey, Bangalore has been the top city, attracting maximum interest for global services delivery. Other tier-1 Indian cities, such as Delhi NCR, Hyderabad, Mumbai, and Pune, also have recorded impressive growth.

However, it was not until H1 2023 that the “City of Pearls,” Hyderabad, surpassed Bangalore, the “Silicon Valley” in GCC setup activity. During this period, more than 40 global companies established or expanded their Acceleration Centers, Centers of Excellence (CoEs), Centers of Innovation, and R&D centers in Hyderabad.

This trend is also reflected in the growth of technology jobs in the city. Hyderabad’s share of tech jobs, as a percentage of overall technology jobs in India, has surged from 33% to 44% during 2021-22. Simultaneously, the demand for non-tech services continues to grow, reflecting strong investor sentiment.

Hyderabad has traditionally been a stronghold for pharmaceutical enterprises. However, the city’s appeal has now expanded beyond this industry. Over the years, the city has also attracted multiple Fortune 500 giants from aerospace, manufacturing, retail services, pharmaceuticals, and professional services industry verticals.

The diversity extends beyond industries alone and also encompasses the types of services being delivered to clients from these centers across the globe. For example, Goldman Sachs is expanding its delivery footprint for engineering services and business innovation by employing over 2000 full-time equivalent employees (FTEs), FedEx is establishing a center of innovation for supply chain optimization, and Lloyds Banking Group is utilizing the location for delivering cybersecurity services. Other organizations such as Apollo Tyres, DAZN, Ocugen, Pi Square, and Warner Bros. Discovery also are leveraging the location for a wide variety of services.

Alongside this diversity, the city is displaying future readiness. These enterprises have delivered an increased concentration of technology, encompassing a wide range of advanced services such as animation, Artificial Intelligence (AI), cloud computing, Internet of Things (IoT), Machine Learning (ML), Natural Language Processing (NLP), Robotic Process Automation (RPA), visual effects (VFX), Augmented Reality (AR), and Virtual Reality (VR).

Hyderabad’s proposition has been anchored on two critical factors – high-quality talent and world-class infrastructure. The city has witnessed growth in both the quality and quantity of talent, fueled by its reputation as an educational hub that houses globally-recognized institutions such as ISB, IIIT, and BITS Pilani.

This skilled talent pool has contributed to the growth of various industries, including IT, biotechnology, pharmaceuticals, and finance. Efforts by both private players and the government to enhance skill development and increase the talent pipeline are underway, such as the collaborative postgraduate diploma (PGDM) program by IMT Hyderabad and HCL Technologies.

Hyderabad’s state-of-the-art infrastructure and seamless connectivity, including a well-developed road network and an expanding metro rail system, have improved commuting and accessibility. In contrast to Bangalore’s high cost of living and infamous traffic congestion, Hyderabad offers a more affordable lifestyle without compromising quality.

The unwavering government support has amplified the impact of both Hyderabad’s talent and infrastructure. The state government has implemented multiple initiatives to improve the conduciveness of the city’s business environment and foster growth.

One notable example is setting up “Hyderabad Pharma City,” the proposed world’s largest integrated pharmaceutical industry cluster that already has received interest from 500 companies. Additionally, the government’s “Hyderabad Vision 2023” plan prioritizes infrastructural development, skill enhancement programs, and improving the ease of doing business.

The commitment to fostering a conducive business environment is evident by the regular engagement between state ministers, especially K.T. Rama Rao, Minister of IT of Telangana, and top corporate executives. Several announcements of new center setups and expansions, including those from Mondee Holdings, Storable, Rite Software, Tekgence, Zapcom, and Charles Schwab Corporation, resulted from the minister’s trip to the United States this May.

A trifecta of unique factors – high-quality talent in a diverse ecosystem and state-of-the-art infrastructure to deliver advanced technological services backed by unyielding government support – has propelled Hyderabad’s ascent and contributed to its competitive edge.

This leads us to address the elephant in the room, “Will Hyderabad dethrone Bangalore as the top global services destination for enterprises in the coming years?”

In our view, Bangalore is and will continue to operate as the largest and most mature global services destination in India for the short term, riding on its solid talent proposition, especially the ability to support niche and emerging technology skills.

However, when gazing into the crystal ball and contemplating the next 7-10 years, we see Hyderabad in a captivating race, with Bangalore positioning itself as a formidable competitor for the crown of the “Top Global Services Destination in India.”

Everest Group’s dedicated team of analysts tracks 30-plus cities in India and more than 300 cities globally from a global services perspective. If you have questions or would like to discuss global services destination topics, please feel free to reach out to [email protected], or [email protected]

Contact us to learn more about popular global services locations.

Don’t miss our webinar, Masterclass in Managing Your Locations Portfolio and Workforce Strategies, for valuable insights and actionable advice to optimize your locations portfolio and maximize returns.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields