Forecasting the Future: Key Trends Reshaping CXM Outsourcing in 2024 | Blog

After a turbulent past year, 2024 holds great promise for CXM outsourcing, with generative AI and other technologies poised to transform contact center operations. Discover five key trends that will impact the CXM industry going forward by reading on, or get in touch.

Amid the tumultuous landscape of 2022-23, the Customer Experience Management (CXM) outsourcing industry faced a barrage of challenges. Economic uncertainties, unfavorable exchange rates, and mounting financial pressures compelled many enterprises to tighten their belts, leading to reduced spending on CXM services. In the face of these adversities, the industry weathered a turbulent period, seeking resilience in the storm.

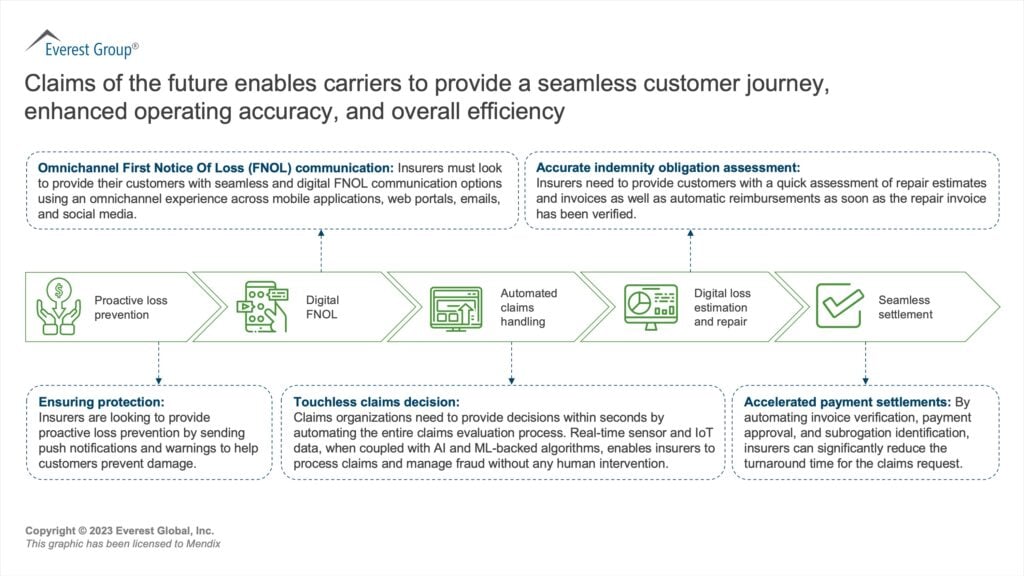

2024 has ushered in an exciting new chapter of transformation. Several technological advancements are poised to catalyze growth and reshape contact center operations. Generative AI (gen AI) holds the potential to redefine customer service offerings, automate more interactions, enhance agent performance, and provide superior customer experiences.

Advancements in accent neutralization and AI translators are expected to enhance service quality, boost workforce efficiency, and alleviate language barriers. The current surge in investments targeting various delivery geographies aims to unlock untapped talent pools. This trend is accompanied by a pressing need for agent reskilling to match the pace of evolving technologies.

Enterprises are reevaluating vendor management strategies, prioritizing providers with robust capabilities and talent, and focusing on embracing sustainability. This transformative shift is reshaping the CXM landscape and heralding a future defined by resilience and adaptability.

In this rapidly evolving environment, innovation isn’t just an option, but a prerequisite for enterprises and providers to prosper, making 2024 a pivotal year for the CXM industry.

Let’s deep dive into five key trends expected to reshape the CXM industry in the near future:

- Gen AI pilots to move to production: 2024 marks a pivotal moment in implementing gen AI pilots, heralding a transformative era in CX delivery. Gen AI is not merely a technological upgrade. It is a catalyst poised to elevate efficiency, redefine agent assistance capabilities, revolutionize voice bots, introduce cutting-edge self-service tools, and fundamentally reshape the overall service delivery landscape. Enterprises are proactively gearing up for the widespread deployment of gen AI across established use cases, strategically positioning themselves to harness its potential within the next two years.

- Accent neutralization and AI translation to redefine CX: Beyond the scope of gen AI, innovative technologies like accent-neutralization and AI translation are poised to revolutionize customer interactions. Accent-neutralization facilitates more transparent communication and promotes inclusivity, while AI translation bridges linguistic divides, enabling global interaction. Together, these advancements promise to enrich customer engagement, surpassing conventional limitations. They equip businesses to navigate language challenges, streamline processes, and cut costs significantly. These technologies simplify the complexities of multilingual support, boosting customer satisfaction and loyalty. Ultimately, they empower businesses to provide seamless, effective, and inclusive service worldwide.

- Evolving shoring dynamics: We anticipate a significant increase in offshoring and nearshoring activities continuing this year. This surge is propelled by factors such as escalating onshore talent costs, rapid technological advancements, and an increasing need for geographical diversification in response to the growing complexities of the business landscape. Emerging delivery locations in Africa (Ghana, Rwanda, Kenya, Senegal, Burkina Faso, and Morocco), Latin America (Suriname, Argentina, Nicaragua, Uruguay, and Caribbean countries), and Asia Pacific (Malaysia, Taiwan, Sri Lanka, and Indonesia) present compelling options for enterprises aiming to diversify their delivery capabilities and fortify their Business Continuity Planning (BCP) strategies.

- Strategic portfolio management: Enterprises will continue refining service provider portfolios through consolidation, rebalancing, or integrating new suppliers. This strategic portfolio management approach will be characterized by its sophistication, considering cost, risk, capabilities, and productivity factors. The overarching objective will be to achieve an optimal balance that enhances operational efficiency and positions enterprises to swiftly adapt to evolving market dynamics and shifting customer expectations. By strategically managing their portfolios, enterprises aim to gain a competitive edge by aligning their service provider relationships with their broader business objectives. This proactive approach will enable them to optimize resource allocation, mitigate risks, and capitalize on emerging opportunities.

- Embracing sustainability Initiatives: Sustainability initiatives are poised to play a pivotal role for enterprises and service providers. Enterprises will prioritize partnering with providers actively involved in such initiatives, aligning seamlessly with their organizational goals. By collaborating with these providers, businesses will demonstrate a commitment to ethical and socially responsible practices, contributing to the broader objectives of responsible and sustainable outsourcing.

Impact on the CXM Outsourcing Landscape

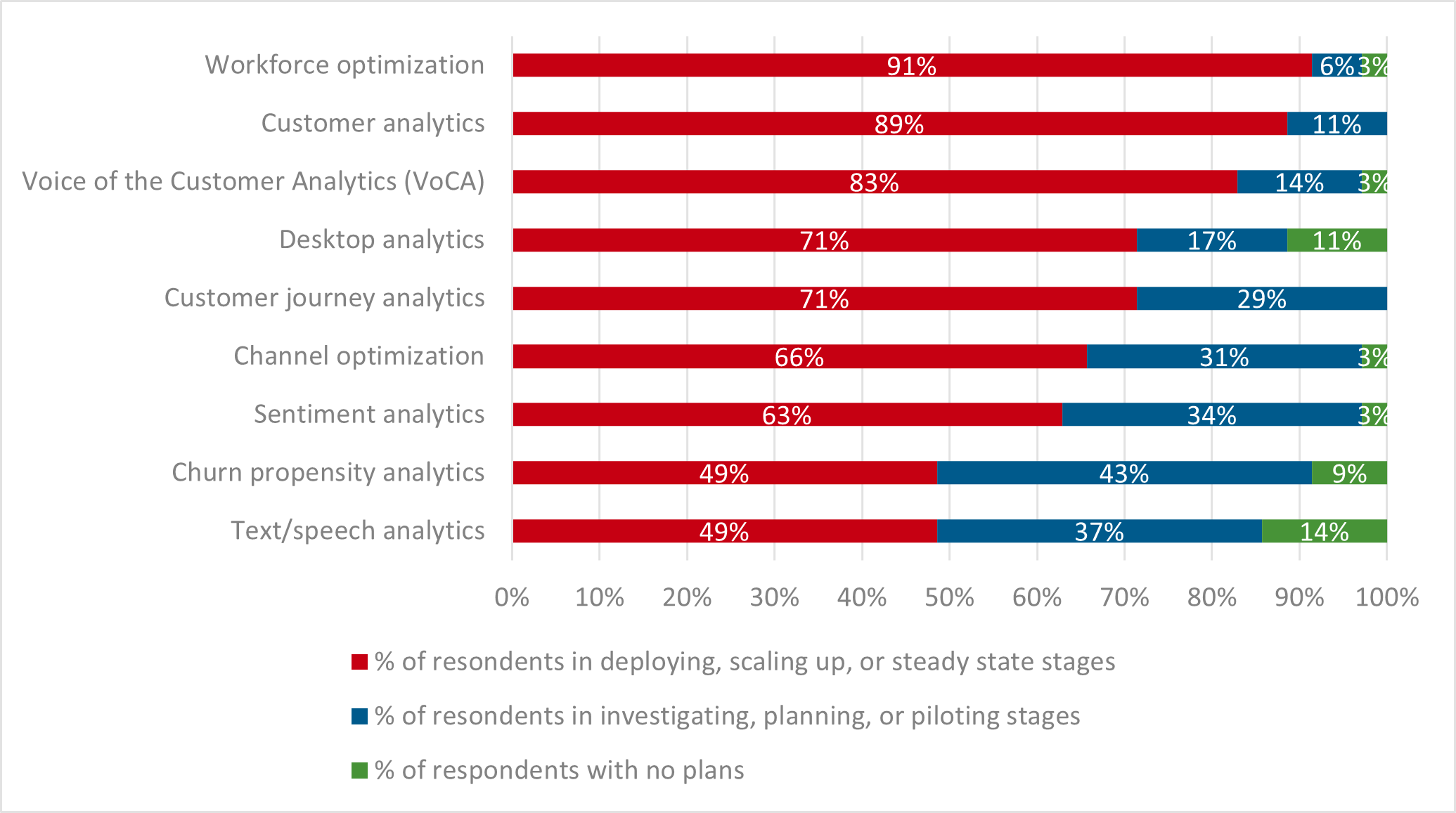

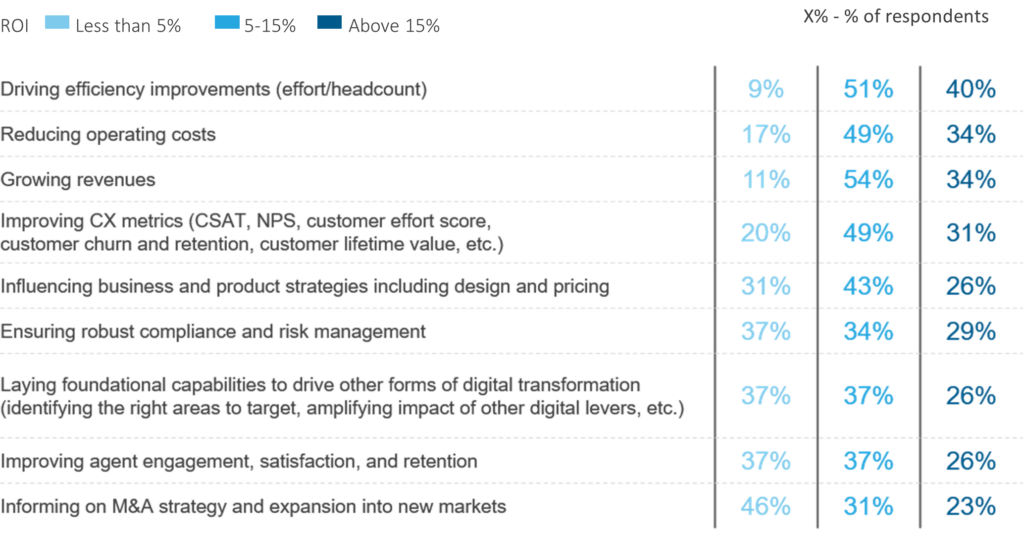

The CXM outsourcing landscape stands on the cusp of a transformative era, poised for a revolution fueled by the advent of technology and various strategies. These innovations promise remarkable productivity gains by automating more tasks and elevating customer and agent experience.

These trends signal a gradual departure from human-centric interventions to digitally-led customer experiences. As the industry moves towards a future shaped by AI and sustainability, customer service is expected to increase as a true differentiator between enterprises. The ability to personalize interactions, resolve issues quickly, and demonstrate empathy is expected to be key to success.

To gain more insights into the dynamic CXM outsourcing landscape, evolving customer requirements, and the significant impact of emerging technologies, explore our in-depth report, Strategic Keys: Unlocking the Potential of Customer Experience Management. For questions about the CXM outsourcing industry, contact [email protected] and [email protected]. You can also catch up on the latest insights with our webinar on demand, The Generative AI Advantage in Enterprise CXM Operations.