Konecta-Comdata Merger Creates a Business Process Outsourcing (BPO) Giant – What Does it Mean for the CXM Market?

The planned merger announced last month between Konecta, the leading provider of Spanish-speaking Customer Experience solutions, with Italy-based customer management provider Comdata will create the sixth-largest player by revenue in the customer experience Management (CXM) BPO sector. This consolidation will intensify competition in the attractive CXM market, with the combined entity commanding close to €2 billion in revenues and €300 million in EBITDA. Read on to find out what this big deal will mean.

Creation of a global champion

Comdata

Global CXM provider Comdata offers end-to-end management solutions (acquisition, retention, customer service, technical support, and credit collection) in 30 languages across four continents and 21 countries with its network of 50,000-plus agents. Headquartered in Milan, it served more than 670 clients in 2021, generating revenue of approximately €980 million.

Konecta

Konecta, acquired by Pacheco together with the company’s management team in 2019, is a leading tech-enabled end-to-end CX BPO player in the Spanish-speaking markets. It has successfully integrated different companies such as the Brazilian Uranet and the Spanish Rockethall group, reinforcing the company’s leadership in Artificial Intelligence, digital marketing, and big data solutions. In 2021, it generated revenue and EBITDA of approximately €918 million and €148 million, respectively.

Combined entity

Subject to approval by authorities, the merger is expected in the third quarter of 2022, creating a global CXM leader capable of providing the “best shoring solution” to local, regional, and global clients in 30-plus languages across industries such as finance and insurance, technology, telco, retail and e-commerce, utilities, and healthcare.

The combined entity will be headquartered in Madrid (Spain), jointly chaired by the CEOs of Konecta and Comdata. It will serve more than 500 large corporations across Europe and America, leveraging the expertise of 130,000-plus employees. According to a statement by the companies, “the new group has a solid financial structure and will take advantage of its position in Spain, Latin America, Italy, and France to deploy all its commercial and operational capacity in its strategic markets. In addition, it will have additional capabilities to fuel its growth in the North American market and throughout Europe.”

Key drivers of the merger

The advantages of this deal are:

- Expansion in Latin American and Spanish markets: The combined entity will become the market leader in Spain and Italy with a strong presence in Latin American domestic markets such as Mexico, Colombia, Brazil, Peru, Guatemala, Argentina, and Chile. It will have over 500 large corporate clients in Europe and Latin America. The new company will enjoy the advantage of Konecta’s strong dominance in the Spanish market, where Konecta has been aggressively expanding in the past few years, especially by acquiring four different Spanish companies that were part of the Rockethall Group in 2020. In these markets, the joint company will have a significant role in telecom, BFSI, utilities and energy, the consumer goods sector, and several big tech and new economy global brands

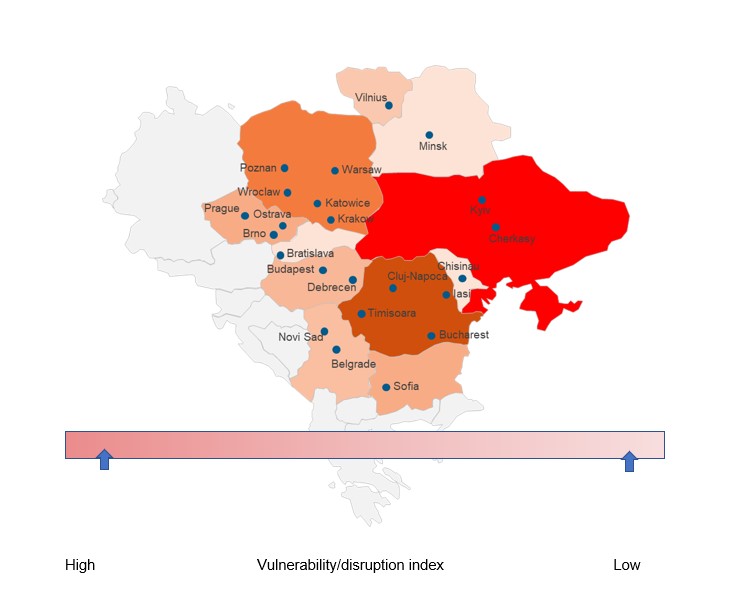

- Enhanced delivery capabilities in Latin America: Labor-cost pressures, the talent shortage in onshore North America, and the desire to relocate some offshore operations closer after the pandemic have increased Latin America’s attractiveness for nearshore delivery capabilities. Some of the latest examples include Transcom’s re-entry in Colombia; new sites opening in Trinidad and Tobago by Teleperformance, iQor, and Valenta BPO; and itel’s acquisition of Emerge BPO with employees in Guyana and Honduras. The combined entity will have strong nearshore delivery capabilities to support US clients, including 20 sites in Colombia and seven in Mexico, offering a multi-country delivery model across the entire LATAM region

- Differentiated customers: Both Konecta and Comdata are leaders in their respective local markets. The majority of Konecta’s revenue comes from Spain, Portugal, and Latin American regions, with Comdata having a strong presence in Italy, France, and some Latin American countries. Overall, the client overlap between both service providers is very limited, reducing the revenue loss due to cannibalization

- Operational synergies: Buyers’ preferences when outsourcing CXM have evolved from the traditional levers of cost and scale to now prioritizing digital CX capabilities, end-to-end integration, and value-added services in their portfolio. This merger will allow the sharing and cross-selling of certain specific CX transformation capabilities such as Comdata’s C-suite tools, expertise in Voice of the Customer (VOC), and consulting and operational redesign services with Konecta’s content and performance marketing and conversational commerce offerings. Through its Uranet subsidiary in Brazil, Konecta also owns platforms for customer journey orchestration, knowledge management, and contact center infrastructure

Competition among other global providers

With US$2 billion in revenue and 130,000 agents, the combined entity gives tough competition to other global CXM providers such as Teleperformance, Sitel, and Concentrix. Below is a look at the capabilities of these global providers in comparison to the combined entity.

| Teleperformance | Sitel | Concentrix | Konecta+Comdata | |

| Revenue | US $8.4 billion | US $4.3 billion | US $6 billion | Approx. US $2 billion |

| FTEs | 420,000+ | 160,000+ | 290,000+ | 130,000+ |

| Languages | 265+ | 50+ | 70+ | 30+ |

| Countries served | 170 | 40 | 40+ | 24 |

Considerations for buyers

Although organizations have the best intentions to use mergers and acquisitions to supplement their organic efforts, they generally underestimate the risks such as failure to achieve synergies, lack of due diligence, and security and integration challenges. Business leaders have often recognized people, culture, change management, and communication as the top reasons for integration failure. Lack of adequate change management policies can affect the organization’s governance and accountability structure, cause stress and uncertainty for employees, and decrease productivity for businesses, ultimately impacting service quality and timely delivery.

Future outlook for the CXM market

With Sitel’s acquisition of Sykes and Webhelp’s acquisition of OneLink BPO and Dynamicall in 2021, the trend of consolidation among CXM market players is gaining traction. Consolidation enables service providers to work with large clients across multiple delivery countries and end markets, a capability that is rising in importance for CX clients. It also enhances service offering portfolios and technology capabilities by serving as a one-stop-shop for buyers for all CXM needs.

This deal also represents an opportunity for buyers to reexamine their vendor portfolio since certain service providers might now be better positioned to support their clients across multiple locations and processes, representing an opportunity to optimize their portfolio with fewer providers to achieve operational and cost efficiencies.

To discuss the CXM market landscape, please reach out to David Rickard, Vice President, BPS, [email protected], Divya Baweja, Senior Analyst, BPS, [email protected], or contact us.

You can also learn how expanding and developing businesses are attracting technology-focused workers to help execute existing and evolving digital transformation, adopt new processes, and innovate. Join our webinar, How to Effectively Attract and Drive Productivity within the Tech Workforce.