Blog

Shaping the Future of Crypto: FCA Opens Dialogue on Regulation

The UK’s Financial Conduct Authority (FCA) has taken a bold and necessary step toward establishing a world-leading regulatory framework for crypto assets. In May 2025, it released Discussion Paper DP25/1, inviting public and industry feedback on the future of crypto regulation.

This consultation spans all major activities in the crypto space from trading platforms and intermediaries to lending, staking, and decentralized finance (DeFi). Coupled with the FCA’s detailed Crypto Roadmap, this initiative lays the foundation for a safer, fairer, and more competitive UK digital asset market.

This blog provides a comprehensive breakdown of the discussion, roadmap, and implications for market participants.

Reach out to discuss this topic in depth.

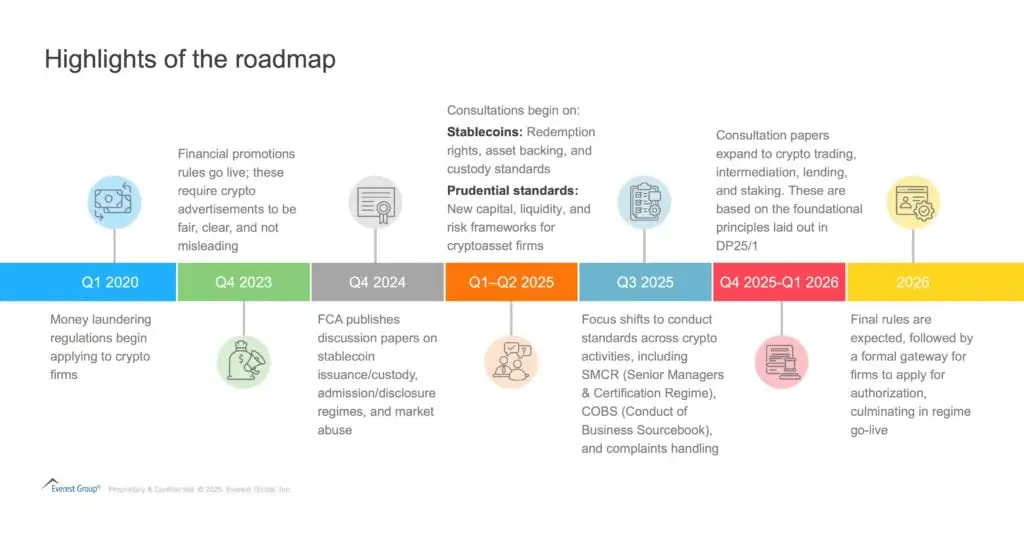

The FCA’s Crypto Roadmap: Regulating in phases

The FCA’s vision is not a one-off reform, it’s a sequenced rollout of interconnected policy instruments designed to bring clarity, oversight, and structure to a rapidly evolving market.

Highlights of the roadmap

The roadmap reflects a “same risk, same regulatory outcome” philosophy, meaning crypto services that mirror traditional finance in function will face comparable obligations, regardless of the underlying technology.

Topics under discussion: Deep dive into DP25/1

DP25/1 proposes new rules under the upcoming Regulated Activities Order (RAO), designed to cover six key areas of the crypto market. Each comes with its own risk profile and regulatory implications.

- Crypto asset Trading Platforms (CATPs): The FCA proposes that all CATPs serving UK clients must be authorized, prohibit proprietary trading against users, and follow non-discretionary order execution rules to ensure fairness and transparency. Platforms must also publish pre- and post-trade data, maintain strict access controls (especially for retail and algorithmic participants), and enforce legal separation between trading and custody functions while managing conflicts from affiliated entities

- Intermediaries: To address risks like opaque business models, inconsistent execution, and conflicts of interest, intermediaries will be required to follow best execution practices, ban Payment for Order Flow (PFOF), categorize clients correctly, and disclose fees and execution venues. They must also retain transaction records for five years and support market abuse surveillance

- Lending and borrowing: Deemed high-risk for retail investors, crypto lending and borrowing may be restricted unless enhanced safeguards are introduced. These include credit and affordability checks, explicit consent for collateral changes, restrictions on platform token use, and limiting exposure to qualifying stablecoins to reduce volatility

- Staking: Given concerns around ownership clarity, slashing risks, and third-party validators, the FCA proposes rules requiring firms to disclose risks upfront, obtain user consent for each staking agreement, take liability for operational failures, and segregate staked assets with regular reconciliations and robust operational controls

- Decentralized Finance (DeFi): DeFi services with identifiable control (e.g., protocol governance or smart contract updates) will fall under regulation similar to centralized platforms. The FCA will issue guidance on determining control and assess factors such as governance authority, upgradability of protocols, and custody over user funds

The FCA outlines several key objectives below:

-

- Consumer protection: Reduce harm by ensuring informed decision-making, transparency, and fair treatment

- Market integrity: Address insider trading, wash trading, and price manipulation, especially on vertically integrated exchanges

- Effective competition: Level the playing field for firms by applying uniform standards

- Growth and international alignment: Facilitate UK competitiveness while harmonizing with global standards (e.g., IOSCO, FATF, FSB)

- Sustainable system: Ensure long-term market development through predictable regulation and operational resilience

Is Crypto’s entering a phase of operational formalization?

The FCA’s proposed framework, if implemented, effectively normalizes crypto through the lens of traditional finance. From a process and operational standpoint, the message is clear: crypto markets are expected to mirror capital markets in how they manage trading, custody, transparency, risk, and investor protections.

This has three strategic implications:

-

- Crypto is becoming infrastructure not just an asset class, but a capability embedded in the financial system

- Regulation will drive operational convergence between crypto-native and traditional finance firms

- Demand will surge for business process transformation, compliance modernization, and cross-functional technology orchestration

Implications for enterprises1. Operating Model Rewiring

Traditional financial institutions exploring crypto (e.g., custody banks, exchanges, wealth platforms) will need to:

-

- Stand up segregated trading and custody stacks

- Establish full trade lifecycle transparency

- Develop real-time KYC/AML and surveillance layers for on-chain/off-chain activity

Many will find that their crypto initiatives are underpinned by fragmented capabilities not fit for regulated market standards. This will trigger strategic rearchitecture both internally and via ecosystem partnerships.

2. Commercial Recalibration of Crypto Offerings

Lending, staking, and DeFi products can no longer be positioned as high-yield, high-risk “alternatives” with loose controls. Under FCA expectations:

-

- Suitability frameworks must extend to crypto

- Credit risk assessments, stress testing, and reserve modeling will be essential

- Crypto must be integrated into holistic risk-adjusted portfolios, not managed as exceptions

3. Authorization is a Strategic Decision

The proposed removal of the Overseas Person Exclusion (OPE) is pivotal. Foreign firms will need a UK legal presence to serve local clients shifting crypto from a borderless experiment to a jurisdiction-bound business. Institutions will need to evaluate:

-

- Whether to commit to a UK branch/subsidiary model

- How to align global platforms with local compliance expectations

- Which partnerships (e.g., with BPS providers or regtechs) can accelerate readiness

Implications for service providers

The future of crypto regulation is not just a compliance challenge it’s a demand driver. We see five major impact areas for service providers:

1. Regulatory Infrastructure-as-a-Service

-

- Stand up capabilities for crypto trade surveillance, transaction reporting, and asset segregation

- Build and maintain modular RAO-aligned platforms for trading, lending, staking, and custody

2. KYC/AML Redesign for Crypto-Specific Risks

-

- Expand identity, source of funds, and behavioral risk detection across decentralized channels

- Automate ongoing risk scoring in real time especially for high-velocity wallets and synthetic assets

3. Client Categorization and Suitability Engines

-

- Enable investor profiling, product suitability scoring, and consent management workflows across retail/institutional segments

- Support version-controlled disclosures and informed-decision audit trails

4. Governance Framework Design for DeFi and Staking

-

- Help enterprises assess decentralization levels and assign liability boundaries

- Operationalize controls for validator governance, asset slashing events, and smart contract risks

5. Gateway Enablement and Onboarding Services

-

- Support FCA authorization application readiness: documentation, testing, sandbox participation, and systems integration

- Provide change management and internal training for crypto business lines in regulated contexts

What does this mean for the industry’s future

The future of crypto will not be shaped by breakthrough tokens or platforms, but by the quality of integration with the traditional financial system. Firms that view regulation as a barrier will struggle. Those that view it as an enabler — of trust, market access, and scale — will lead.

Over the next 18–24 months, we expect to see:

-

- An acceleration in crypto operating model transformation programs

- New vendor partnerships focused on regulatory readiness and crypto risk controls

- A shift in board-level narratives: from “crypto strategy” to “crypto operating strategy”

- A maturation of service provider offerings into crypto compliance-as-a-service portfolios

The FCA’s consultation ends in June 2025. But the long game is already underway.

If you found this blog interesting, check out our Deconstructing The Digital Assets Revolution – What Financial Institutions Can Learn From The Meteoric Rise Of Coinbase | Blog – Everest Group , which delves deeper into another topic regarding crypto.

If you have any questions or want to discuss the evolutions of crypto in more depth, please contact Saumil Misra ([email protected]) and Srawesh Subba ([email protected]).