Capgemini Announces the Acquisition of WNS: Unlocking End-to-End F&A Excellence for the Modern Enterprise | Blog

Capgemini has announced that it has entered into an agreement to acquire WNS for US$3.3 billion. From a finance & accounting (F&A) perspective, the acquisition aims to create a global powerhouse blending Capgemini’s technology and consulting heritage with WNS’s deep finance domain and vertical-specific capabilities.

Reach out to discuss this topic in depth.

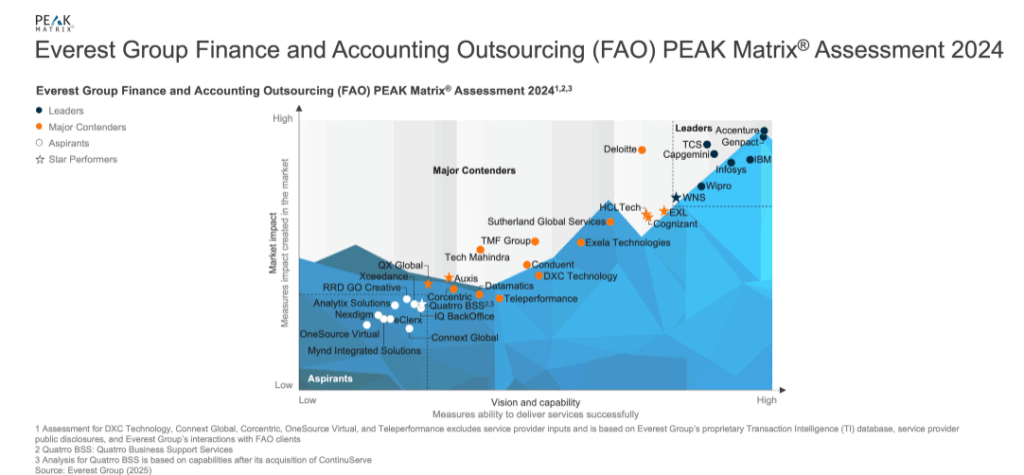

Strategic rationale: an F&A-centric view

Although both Capgemini and WNS are Leaders in the most recent Everest Group Finance and Accounting Outsourcing (FAO) PEAK Matrix® Assessment 2024, as shown in exhibit 1, they have distinct plays in the FAO market. While Capgemini leverages its consulting and technology capabilities to deliver integrated Information Technology (IT) + Finance and Accounting (F&A) services, WNS leverages its deep domain expertise to deliver end-to-end F&A services across both upstream and downstream F&A processes.

EXHIBIT 1

Everest Group Finance and Accounting Outsourcing (FAO) PEAK Matrix® Assessment 2024

Source: Everest Group (2025)

Fundamentally, the deal addresses Capgemini’s need to accelerate growth and capabilities in F&A managed services by adding WNS’s high-growth, domain-centric operations. At the same time, joining Capgemini offers WNS access to global consulting and IT capabilities and thereby strengthening its FAO offerings.

The merged entity can support enterprise finance transformations end-to-end: from high-level consulting on operating models, through technology implementation (Enterprise Resource Planning (ERP), Robotic Process Automation (RPA), artificial intelligence (AI)) to running optimized F&A processes. This aligns with the market’s direction where integrated IT-Business Process Outsourcing (BPO) deals are on the rise as companies seek both cost efficiency and digital transformation in F&A.

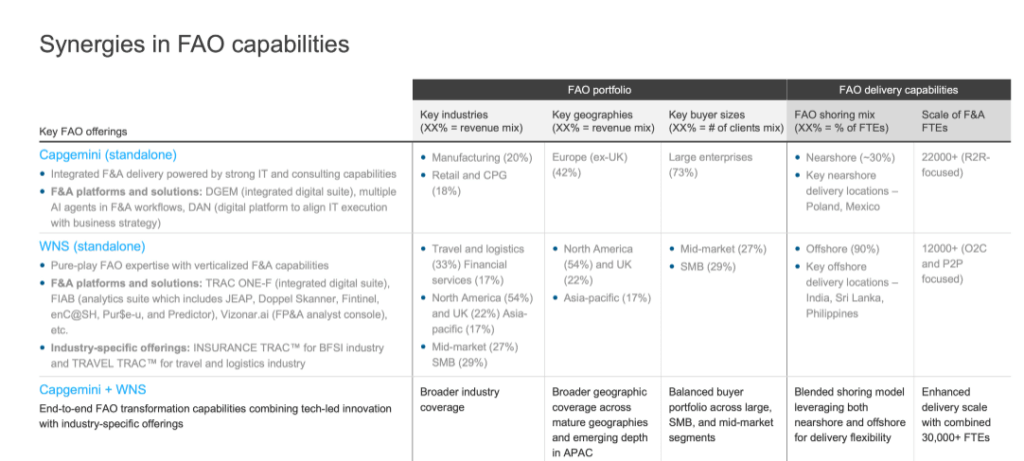

We explore the complementarity between Capgemini and WNS across three dimensions as shown in exhibit 2.

EXHIBIT 2

Synergies in FAO capabilities

Source: Everest Group (2025)

FAO offerings

The acquisition brings a comprehensive and innovation-led FAO offering that blends Capgemini’s deep technology, consulting, and AI agentic ecosystem with WNS’ domain-rich, modular digital platforms and advanced analytics capabilities. A combined focus on transformation-led delivery, through Center of Excellences (CoEs), strategic tech partnerships, and process intelligence, positions them strongly for clients seeking both scale and specialization in F&A modernization. Buyers benefit from end-to-end coverage across the F&A value chain, enabled by mature digital suites, strong vertical-specific solutions, and embedded generative AI tools tailored for Chief Financial Officer (CFO) use cases.

FAO portfolio

-

- Industries: The acquisition expands industry coverage beyond Capgemini’s manufacturing/retail and WNS’s travel / financial services , resulting in a diversified and balanced FAO industry mix that aligns well with the varied demands of the global FAO buyer base

-

- Geographies: One of the most strategic gains from the deal comes from the fact that Capgemini’s heavy European footprint now finds balance with WNS’s dominance in mature markets such as North America and UK and prominence in high growth markets such as Asia Pacific (APAC). This reshapes Capgemini’s FAO market exposure, especially important given the outsourcing maturity and deal velocity in the US market, while unlocking emerging APAC opportunities

-

- Buyer sizes: WNS brings a significant mid-market and SMB client base, often first-generation outsourcers with high growth potential. This complements Capgemini’s large enterprise focus, creating a well-rounded buyer portfolio for the merged entity across the F&A buyer spectrum

FAO delivery capabilities

-

- Shoring mix: The integration of WNS offers Capgemini a more balanced hybrid operating model as it can combine its nearshore strength with delivery centers in Poland and Mexico with WNS’s deep offshore backbone in APAC across India, Philippines and Sri Lanka. It sets the stage for scalable global delivery at lower cost, a lever Capgemini has underutilized historically

-

- Scale of operations (FTEs): Adding WNS’ 12,000+ FAO FTEs significantly boosts Capgemini’s delivery capacity, credibility, and competitive positioning to compete for large, multi-tower FAO deals that require critical mass and geographic depth

Implications

For provider landscape

-

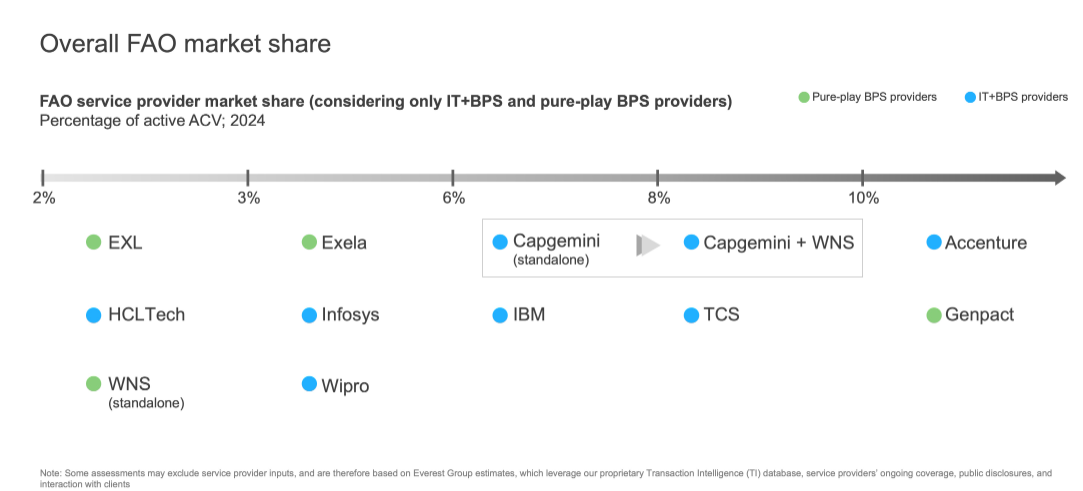

- Rising competitive pressure among large FAO providers: As we evolve into an era where the lines between IT and process outsourcing are blurring, the provider that can offer a truly integrated solution (tech + operations + industry expertise) stands to win. Capgemini’s move raises the bar – it is now closer to peers like Accenture and Genpact in having both sizeable consulting/IT practices and a strong FAO operation, as shown in exhibit 3

EXHIBIT 3

Overall FAO market share

Source: Everest Group (2025)

-

- Consolidation of F&A capabilities: Consolidation of capabilities is emerging as a key investment theme in the FAO market, with providers actively striving to integrate technology, domain expertise, and delivery strength across the value chain. This trend is playing out through both organic initiatives, such as the development of proprietary agentic AI suite by Genpact and inorganic moves as in this acquisition by Capgemini. Going forward, other providers may also pursue such bold moves, whether through in-house innovation, or through acquisitions or forging alliances with both service and technology providers to bridge capability gaps across process, skills, technology, and data

For enterprises

-

- Potential availability of end-to-end F&A excellence: Enterprises now have a newly strengthened option that can deliver end-to-end finance operations. For existing WNS clients, this acquisition alleviates any uncertainty about WNS’s long-term future and opens the door to broader services. Those clients can potentially tap into Capgemini’s consulting, IT integration, and large-scale transformation expertise, beyond the scope of their current WNS contracts. Conversely, Capgemini’s existing clients will gain access to WNS’s industry-specific solutions and deep F&A talent pool

-

- Acceleration of AI-first F&A operations: Both Capgemini and WNS have been champions of injecting AI and analytics into F&A operations, and together they are likely to double down on this approach. For enterprise buyers, this means the combined provider will bring even more innovation to the table, from agentic AI solutions to autonomous finance operations. CFOs should look for new offerings from Capgemini-WNS such as AI-powered virtual finance assistants, predictive cash flow analytics, intelligent document processing at scale, and perhaps usage-based outcome pricing models tied to AI efficiencies. While these capabilities are promising, buyers should stay vigilant on execution

Key risks and watchouts

-

- Retention of focus amid other initiatives: It’s worth noting that WNS itself has been on an acquisition spree in recent years, for example, it acquired Kipi.ai in 2025 to strengthen its data engineering and advanced analytics offerings, The Smart Cube and OptiBuy in 2023 to enhance analytics and procurement capabilities and earlier acquired an automation firm (Vuram) in 2022. This means WNS’s organization was already digesting those integrations. There’s a risk that the ongoing integration of those acquired capabilities might slow down or get overshadowed by the bigger merger

-

- Overlap and rationalization risks: Although Capgemini and WNS are largely complementary, there could be some overlaps in service offerings and supporting tools. Both have their own proprietary frameworks for F&A (e.g., Capgemini’s D-GEM and WNS’s CFO TRAC-F). The new entity will need to rationalize this over time, deciding which platforms to use or how to integrate them

-

- Geographic white spaces (e.g., Latin America): A notable strategic watch-out following the merger is the combined entity’s limited delivery presence in Latin America – a region that is not only experiencing strong FAO demand but is also becoming critical as a preferred near-shore hub for North America-based enterprises. Historically, both Capgemini and WNS have had only modest delivery footprints in the region – WNS in Costa Rica and Capgemini in Guatemala and Mexico, and this geographic gap remains unaddressed by the acquisition. Given Latin America’s (LATAM’s) rising significance, both as a near-shore delivery hub as well as a buyer hub, this coverage gap could limit the combined entity’s ability to fully capture nearshoring-driven opportunities in the region

And finally…

The deal is arguably going to be one of the most consequential ones in the FAO space. That said, the journey ahead will be closely scrutinized across several dimensions. Will the whole truly be greater than the sum of parts? Early signs are positive in terms of complementary strengths and market rationale. However, success will depend on how well Capgemini can merge WNS’s operations without losing momentum or customer trust.

For CFOs and Chief Information Officers (CIOs), the takeaway is that the F&A provider landscape is evolving to serve you better. The Capgemini–WNS combo is likely to spur innovation and perhaps more consolidation, all with the aim of delivering “AI-augmented finance operations” that are faster, smarter, and more efficient. As you consider your own finance outsourcing or transformation journey, keep an eye on how this new entity performs, it could very well become a trendsetter for intelligent finance operations.

If you found this blog interesting, check out our Capgemini Announces The Acquisition Of WNS: A Sign Of Renewed BPS Positioning In An AI-first World | Blog – Everest Group which delves deeper into another topic regarding Capgemini.

If you have any questions or want to discuss the evolution of Capgemini in more depth, please contact Vignesh K ([email protected]), Anurag Saha ([email protected]), and Smarajeet Das ([email protected]).