Capgemini Announces the Acquisition of WNS: a Sign of Renewed BPS Positioning in an AI-first World

What happened

After months of speculation, Capgemini announced that it has entered into an agreement to acquire WNS for US$3.3 billion. Under the definitive transaction agreement, Capgemini will pay US$76.50 per share, representing a 17% premium over WNS’ closing share price on Friday, July 4, 2025. In terms of valuation, the acquisition – valuing WNS at 16.3x of EBITDA and 2.5x of revenue – comes at a premium over a median of 11.6x (EV/EBITDA) and 1.5x (EV/Sales) for some of its pure-play BPS peers.

What works

This acquisition presents two key advantages.

-

- Strong complementarity between Capgemini and WNS, as highlighted in Exhibit 1.

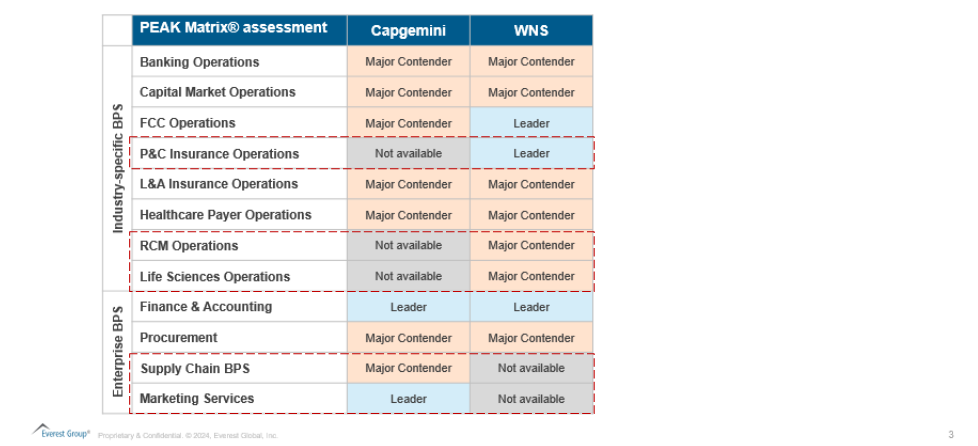

Exhibit 1: Complementary strengths from Capgemini’s acquisition of WNS

We take a closer look below at the synergies.

Offerings: The complementarity in offerings will be at two levels. At the group level, WNS’ acquisition will diversify Capgemini’s consulting-, engineering-, and IT services-heavy portfolio by significantly increasing its BPS footprint. At the BPS level, the acquisition will position the combined entity as a broad-based BPS player in its true sense. WNS brings deep industry-specific BPS expertise – particularly in P&C insurance, travel and leisure, and healthcare and life sciences – addressing critical white spaces in Capgemini’s existing portfolio. Building on Capgemini’s strong heritage in enterprise BPS, the acquisition can create a well-rounded value proposition that significantly enhances cross-selling potential (see Exhibit 2)

Industry: Integrating WNS will bring depth in Capgemini’s underpenetrated verticals, such as insurance, travel, and healthcare and life sciences, enabling Capgemini to rebalance its industry mix beyond its core focus on manufacturing and financial services

Geography: The acquisition provides Capgemini with immediate scale and stronger market access in North America and the UK, advancing its strategic growth agenda in these priority geographies

Exhibit 2: The acquisition’s complementary business process capabilities, as highlighted in Everest Group’s PEAK Matrix assessments

-

- Critical mass for BPS

In our latest BPS Top 50™ 2025 report, Capgemini and WNS ranked 33rd and 34th, respectively. Based on this assessment, the combined entity would rise to rank 19.

While the combined BPS business size of Capgemini and WNS remains below the competition, it significantly narrows the gap with the peer average – a notable step up from Capgemini’s stand-alone position.

Exhibit 3 depicts BPS revenue as a percentage of the overall top line of leading IT-BPS providers.

Exhibit 3: BPS revenue as a percentage of the overall top line of leading IT-BPS providers

Key risks and watchouts

This acquisition poses its own unique challenges beyond those associated with integrating a sizable business, including:

-

- Timing: The volatile macro situation, marked by tariffs, AI pervasiveness, and economic slowdown, requires providers to be nimble and agile. In this backdrop, the timing of the acquisition and WNS’ integration can create distraction if not managed well.

-

- Cultural and organizational alignment: Headquartered in France, Capgemini Global Business Services’ strategic leadership is based in Europe, while its primary delivery centers are located in India and Eastern Europe. Integrating this European-led model with WNS’ India-led operations could pose cultural challenges, particularly at the mid-to-senior management level. Notably, Capgemini faced similar challenges when it announced the acquisition of iGate in 2015, followed by the exit of iGate’s CEO shortly after and apparent concerns from iGate’s clients. Capgemini should revisit that acquisition to manage the dynamics related to the WNS leadership, as well as client sentiments, especially given its recent challenges on both fronts.

-

- Value premium justification: The premium paid for the acquisition comes with expectations from investors. Capgemini will need to start showing results both on the top line and margins to justify its decision.

Implications

-

- For enterprises

-

- Potential access to end-to-end services: For existing WNS clients, the acquisition addresses the uncertainty in recent times about the company’s future. It also offers the opportunity for more robust consulting and tech services offerings. Existing Capgemini clients will have access to more industry-specific BPS services. Put another way, Capgemini’s existing clients on both sides can expect the combined entity to position its end-to-end services

-

- Watch for execution gaps in integration: There is often a disconnect between synergies outlined on paper and those realized in practice. Even when aligned, integrations take time to materialize. Enterprises should remain mindful of the challenges outlined in the previous section

-

- For enterprises

-

- For the industry

-

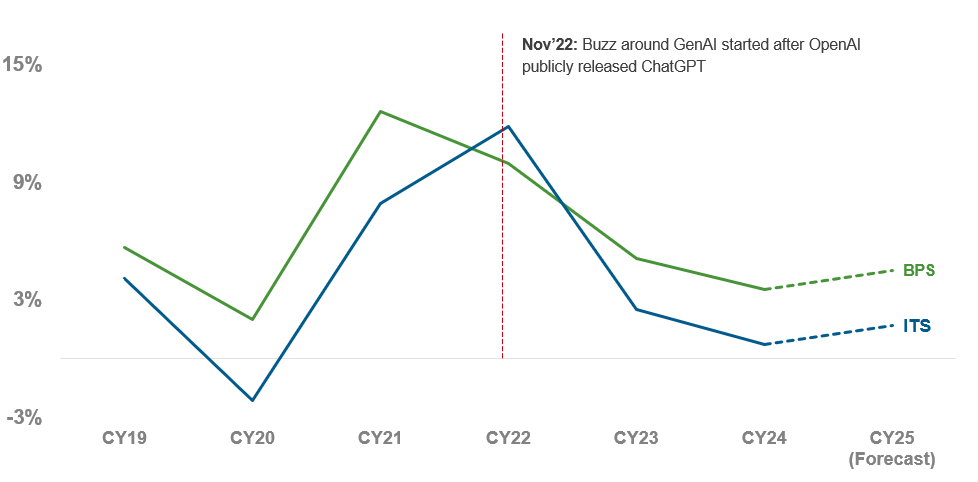

- Signal of a rising process-first mindset in the AI era: While some are quick to write the obituaries of BPS in the age of AI, the data tells a different story. BPS has outpaced IT services in growth since the emergence of generative AI, and this trend is expected to continue into 2025 (see Exhibit 4). More importantly, unlocking business value from AI requires organizations to overcome their Process-Skills-Tech-Data (PSTD) debt. A major barrier for service providers is the lack of domain and process expertise needed to address this gap effectively. Capgemini’s decision to pay a premium in this acquisition reflects its intent to bridge that process expertise gap. The question now is: will others in the industry take similar steps?

-

- Expect more acquisitions, but don’t discount non-IT heritage BPS providers

The technology services industry is poised for significant transformation over the next 3-5 years, and with it might come a wave of M&As. However, this evolution should not be mistaken for the decline of non-IT heritage BPS providers. In fact, our analysis shows that these players are currently driving much of the growth within the BPS market

- Expect more acquisitions, but don’t discount non-IT heritage BPS providers

-

- For the industry

The BPS growth leaders are non-tech-heritage BPS players

Exhibit 4:

The growth of BPS versus ITS

2019-25F

Conclusion

Like any major acquisition, the Capgemini-WNS deal will remain under close scrutiny across several dimensions, including strategic fit, integration effectiveness, and valuation justification. While questions persist around its timing, cultural alignment, and premium expectations, we see this acquisition as a pivotal move for Capgemini. It plugs critical portfolio gaps, enhances Capgemini’s capabilities, and strengthens its positioning in the market with more comprehensive, end-to-end offerings.

More importantly, it answers a question that is fast gaining urgency: What is the role of BPS in an AI-led world? The answer lies in harnessing deep process intelligence and domain expertise – core strengths of BPS – and combining them with skill, data, and technology to fully unlock AI’s potential. This calls for a process-first, not tech-first, approach – one that organizations cannot afford to overlook.