Programmable Money Has Arrived: Why Banks Can’t Afford to Sit Out the Next Wave of Digital Finance

In our previous blog, Stablecoins Go Mainstream: How Enterprises, Tech Firms, And Regulators Should Respond | Blog – Everest Group, we explored how regulatory clarity, enterprise adoption, and technology maturity are pushing stablecoins into the financial mainstream.

That marked the beginning of a shift, one where money tokenized moves from being a crypto-native innovation to becoming a foundational layer of enterprise payments and liquidity infrastructure.

This blog dives deeper into the following wave of this transformation: programmable money, and how regulated institutions, especially banks, are redefining their role in the digital asset ecosystem. Powered by blockchain but governed by traditional financial safeguards, programmable deposit tokens enable money to flow like software: 24/7, conditional, transparent, and integrated with business logic.

For enterprises and financial institutions, this shift is not just technological, it’s strategic. It alters how liquidity is managed, how products are designed, and how value moves across global networks.

Reach out to discuss this topic in depth.

From stablecoins to bank deposit tokens: An institutional shift

A key signal of this shift is JPMorgan’s launch of JPMD, a tokenized bank deposit issued on Coinbase’s public Base blockchain. Unlike earlier experiments such as JPM Coin, JPMD operates on a public network while retaining regulatory safeguards. Each token represents one U.S. dollar on deposit, combining the programmability of blockchain with the trust of a commercial bank. Notably, JPMD may eventually offer features like deposit insurance and interest benefits not typically associated with crypto-native stablecoins.

This transition isn’t limited to JPMorgan. Globally, FinTechs such as Circle and Paxos in the U.S., Monerium in Europe, and Partior in Asia are helping enterprises scale programmable money. These players are not just filling infrastructure gaps, they’re enabling banks and corporates to operationalize tokenized liquidity across treasury, settlement, and payments.

While stable coins such as USDT and USDC solved critical issues around real-time cross-border payments, their architecture falls short for enterprise use. Institutions evaluating tokenized money identified four key limitations: legal enforceability, compliance alignment, counterparty clarity, and integration with enterprise systems.

This created space for regulated banks to lead a second wave one that brings blockchain-based speed and programmability under the guardrails of traditional finance. Banks issuing deposit tokens combine regulatory assurance (e.g., deposit insurance, clear claims) with tokenized flexibility. Ongoing pilots from Citi, HSBC, UBS, and Deutsche Bank reflect this strategic shift. Even large enterprises like Amazon and Walmart are considering stablecoins for payments, underscoring how programmable digital money is fast becoming a mainstream enterprise priority.

Transforming B2B payments and treasury workflows

One of the clearest enterprise use cases for programmable money is in Business to Business (B2B) payments and liquidity management. Traditional corporate payment flows, especially cross-border, are slow, fragmented, and restricted by cutoffs and intermediaries. Tokenized deposits, such as JPMD, enable businesses to move funds instantly, conditionally, and 24/7, eliminating friction tied to correspondent banks or multi-day clearing. For global enterprises, this means real-time treasury movements, improved reconciliation, and reduced need for pre-funded accounts.

Beyond speed, programmable money introduces workflow-aware financial logic. Payments can be auto triggered by smart contracts such as releasing funds on delivery confirmation or splitting settlements across multiple parties. As enterprises seek more agility in finance, programmable money is poised to become the backbone for next-gen B2B transactions.

Why now and what’s at stake

Banks are accelerating programmable money efforts in response to a convergence of enterprise demand, economic necessity, regulatory clarity, and competitive pressure. Corporate clients are demanding liquidity that moves with the business instantly, globally, and under programmable logic. These aren’t experimental desires; they directly impact working capital efficiency, cash flow visibility, and balance sheet optimization. At the same time, frameworks such as the GENIUS Act (U.S.) and MiCA (EU) provide regulatory confidence for banks to issue tokens under compliant models.

System integrators (SIs) play a pivotal role in enabling this shift by embedding tokenized money into legacy systems, ensuring enterprise-grade governance, compliance, and scale. They help banks and corporates embed programmable money into legacy Enterprise Resource Planning (ERP), treasury, and compliance systems, ensuring that tokenized liquidity is not just a tech pilot but a scalable enterprise tool. Banks that move now can monetize programmable cash services, automate FX and escrow functions, and reduce operational drag.

Banks that delay risk disintermediation, as corporates turn to FinTech-issued stablecoins for faster, cheaper, programmable payments. As digital financial networks mature, the rules may be set by non-banks, leaving traditional institutions to plug into standards they didn’t define. Meanwhile, regulators may favor newer players offering better transparency or resiliency, especially if incumbent banks lag behind. The message is clear: now is the time to modernize money

Emerging ecosystem: Technology providers and partners

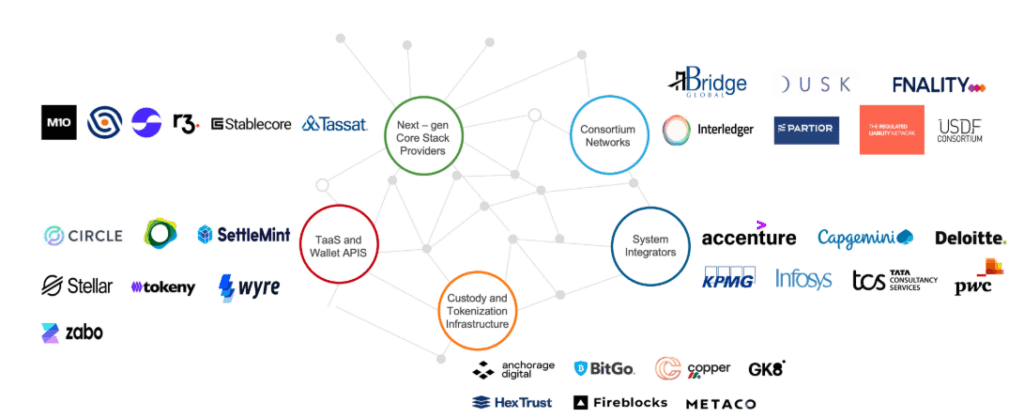

As the industry moves towards this programmable future, an entire ecosystem of technology providers and FinTech partners has emerged to support banks and enterprises in the transition. Some key players and categories include:

-

- Next-gen core stack providers: A new class of fintech infrastructure firms offers modular platforms that sit alongside a bank’s core systems to handle tokenized assets. For example, Stablecore enables banks to offer stablecoin and digital asset products. Such platforms act as an out-of-the-box solution for banks to launch digital currency products without rebuilding their core banking from scratch

-

- Custody and tokenization infrastructure: Companies like Fireblocks and Anchorage Digital are key enablers of secure blockchain operations. Fireblocks offers enterprise-grade custody and transfer services, allowing banks to store digital assets, move tokens, and access Decentralized Finance (DeFi) with built-in compliance controls. Anchorage, the first federally chartered digital asset bank in the U.S., provides regulated custody and infrastructure for handling stablecoins and deposit tokens. These platforms give banks the confidence to operate securely while meeting governance and regulatory expectations

-

- Tokenization-as-a-Service and Wallet APIs: FinTechs such as Circle and Paxos are offering white-label infrastructure that allows banks to issue tokens without building from scratch. Circle’s programmable wallet Application Programming Interfaces (APIs) enable banks to integrate digital dollar capabilities into their apps, while Paxos powers branded stablecoins like PayPal USD. This Tokenization-as-a-service model gives banks and FinTechs fast access to programmable liquidity while retaining control over branding and compliance

-

- Consortium networks and interoperability efforts: In Singapore, Partior (backed by DBS Bank, J.P. Morgan, Standard Chartered, and Temasek) is a network for cross-bank, cross-border digital payments, effectively creating interoperability between deposit tokens of different banks. In Europe, multiple banks have experimented with a “Commercial Bank Money Token” (CBMT) initiative for interbank settlement. These efforts aim to prevent a fragmented landscape of siloed bank coins by establishing common standards or networks

-

- System Integrators (SIs): Large Information Technology (IT) consulting and integration firms play a pivotal role in making all the above work for enterprises. SIs are the ones who stitch together legacy ERP, core banking, and blockchain systems into a coherent whole. By acting as the architects of scale, SIs ensure that pilot projects can turn into production systems. They also help navigate organizational challenges effectively smoothing the path for adoption. Banks often rely on these partners to bridge gaps in internal expertise and to accelerate time-to-market for new digital offerings

Lastly, consumer and end-user sentiment is an often-overlooked driver in this ecosystem. Today’s users expect financial services to be as instant and convenient as sending a text message. As digitally native generations move into decision-making roles, they are less tolerant of slow, opaque banking processes. This shifts enterprise priorities: features like real-time treasury dashboards, on-chain auditability of funds, or programmatic escrow are becoming not just “nice to have” but soon standard expectations.

The programmable money ecosystem is evolving through a layered set of enablers from modular banking platforms and wallet APIs to tokenization infrastructure and service integrators. Highlighted below are some key players across each category shaping the institutional adoption of digital assets.

What lies ahead?

The road ahead for programmable money in Banking Financial Services (BFS) enterprises is not about replacing the old financial system but rather layering new capabilities on top of it. We will likely see a hybrid landscape for years: traditional payment networks and core banking systems will continue to operate, but their centrality will undergo a change as programmable, blockchain-based rails handle an increasing share of liquidity, settlement, and transaction logic.

For banks, this future demands a reimagining of their role. No longer will they be only custodians of money, they must become providers of programmable infrastructure, offering clients the tools to move and utilize value in sophisticated new ways.

Banks that succeed will likely be those that combine their strengths (trust, compliance, customer base) with fintech-style innovation, whether through partnerships or in-house development. For FinTechs and tech providers, the opportunity is vast: serving as the connective tissue and service layer for this new financial stack, be it through platforms, APIs, or integration services.

In conclusion, programmable money is rewriting the financial stack, not by obliterating the old, but by augmenting it with a smarter, faster layer. The message for incumbents is clear: now is the time to experiment, partner, and invest in these new digital money capabilities. The financial institutions that act today will help define the future of money in a world where code and currency become one and the same.

If you enjoyed this blog, check out The Next Frontier Of Banking And AWM Experiences: The Power Of Customer Experience Orchestration | Blog – Everest Group, which delves deeper into another topic regarding Banking Financial Services.

To discuss this topic in depth and learn more about core banking, contact Ronak Doshi, [email protected], Kriti Gupta, [email protected], Laqshay Gupta ,[email protected], and Rakshit Gupta, [email protected].