Stablecoins Go Mainstream: How Enterprises, Tech Firms, and Regulators Should Respond

The cryptocurrency space is undergoing a quiet transformation. In mid-2025, several developments converged to push stablecoins from speculative tools to serious infrastructure for global payments. The passage of the GENIUS Act in the United States, the expansion of support from networks like Visa and Mastercard, and the launch of new regulated stablecoins by players such as Fiserv and PayPal are all pointing to a similar trend: stablecoins are entering the financial mainstream.

This shift opens up new opportunities and responsibilities for enterprises, technology providers, service firms, and regulators. The stablecoin ecosystem is no longer experimental. It is becoming foundational.

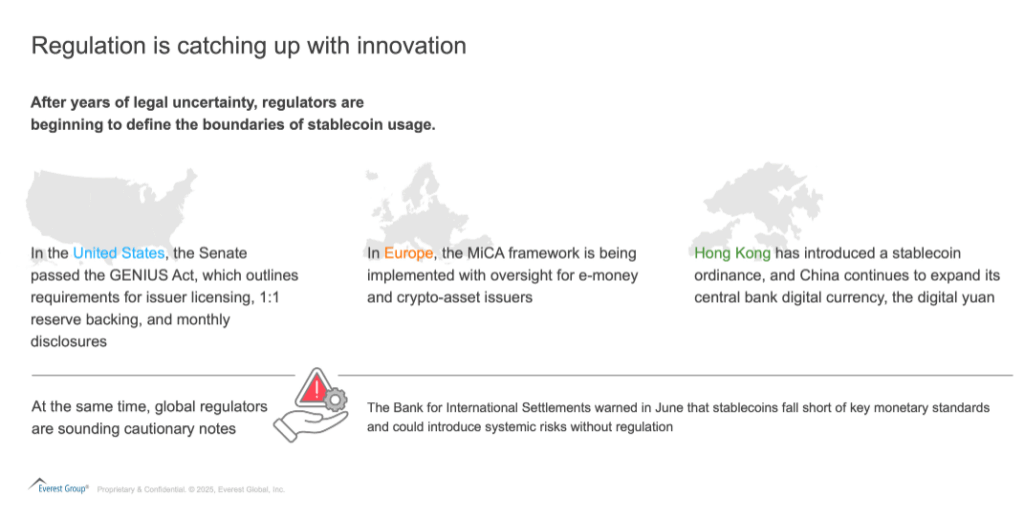

Regulation is catching up with innovation

Governments are no longer reacting from the sidelines. They are building frameworks that could unlock scaled adoption while controlling risk.

Enterprises are moving beyond experimentation

Stablecoins are becoming embedded into mainstream business infrastructure. A growing number of enterprises are adopting them as tools for faster payments, lower fees, and digital treasury efficiency.

Recent examples include:

-

- Visa has processed over US$225 million in stablecoin settlements and is expanding to new regions

-

- Mastercard is supporting stablecoins like USDG and offering cross-border settlement tools

-

- Fiserv, in partnership with Circle and PayPal, launched FIUSD, a dollar-backed stablecoin integrated with banking networks

These moves give enterprises a path to:

-

- Enable near-instant supplier and partner payments

-

- Reduce foreign exchange exposure and transaction costs

-

- Optimize liquidity with 24/7 settlement options

Enterprises, however, need to make informed choices. Not all stablecoins offer the same transparency or safeguards. Key factors to evaluate include:

-

- The quality and liquidity of backing reserves

-

- The issuer’s regulatory compliance

-

- Integration capabilities with ERP, treasury, and finance systems

Technology providers are the infrastructure enablers

The rise of stablecoins is creating real demand for enterprise-grade technology solutions. As businesses adopt tokenized money, they need tools that are secure, scalable, and compliant.

Opportunity areas include:

-

- Stablecoin wallet APIs and on-chain payment gateways

-

- Smart contract support for automation and settlement

-

- Compliance modules for KYC, AML, and real-time monitoring

-

- Blockchain interoperability layers that bridge multiple networks

-

- Platforms that enable banks to issue and manage their own stablecoins

For instance:

-

- Fiserv is not building everything from scratch. It is relying on Circle and Paxos for stablecoin infrastructure

-

- KuCoin has achieved AAA ratings for cybersecurity, signaling its intent to serve institutional clients

-

- Visa and Mastercard are connecting stablecoin rails to multiple public chains like Ethereum and Solana

Technology firms that deliver these capabilities are no longer just crypto vendors. They are becoming core financial infrastructure partners.

Service providers and consulting firms must evolve their role

Crypto-native firms also need to adjust. Institutions now expect enterprise-grade performance, regulatory alignment, and auditability. Exchanges, wallets, and issuers that meet these expectations will be in a strong position to capture market share as adoption scales.

Regulators must balance innovation and oversight

Stablecoins offer efficiency gains but also introduce new risks. Regulators are beginning to treat them as integral to the future of payments, not just speculative crypto assets.

Regulatory priorities now include:

-

- Ensuring reserve transparency and preventing liquidity mismatches

-

- Coordinating across jurisdictions to avoid loopholes

-

- Studying the impact of stablecoins on monetary policy, especially in emerging markets

-

- Educating consumers about risks, limitations, and safe usage

Stablecoins are also emerging as geopolitical tools. For example, dollar-backed coins could extend the reach of the US dollar globally, while countries like China may double down on central bank alternatives to retain monetary control.

A practical framework for enterprise adoption

Final thoughts: the next phase starts now

Stablecoins are no longer hypothetical. They are becoming part of the foundation of global financial systems. With market forecasts projecting growth into the trillions of dollars over the next five years, the time to act is now.

-

- Enterprises should begin integrating stablecoins where they create operational or strategic value.

-

- Technology firms should invest in infrastructure that supports scale, security, and compliance.

-

- Service providers should deliver stablecoin readiness as part of digital transformation.

-

- Regulators should continue clarifying the rules while enabling innovation that improves the financial system.

The stablecoin shift is already underway. Those who move early will be in the best position to shape, lead, and benefit from what comes next.

In our next blog, we’ll uncover why banks, traditionally conservative, are suddenly leaning into stablecoins, what’s driving enterprise activity, and how this shift could reshape revenue, compliance, and competitive strategy across the financial ecosystem.

If you enjoyed this blog, why not check out Shaping The Future Of Crypto: FCA Opens Dialogue On Regulation | Blog – Everest Group, which delves deeper into another topic relating to crypto.

If you are interested in hearing more on this topic, please contact [email protected], [email protected] and [email protected]