TrumpCare 2.0? Unpacking the ‘Big Beautiful’ Shake-Up of U.S. Health Coverage | Blog

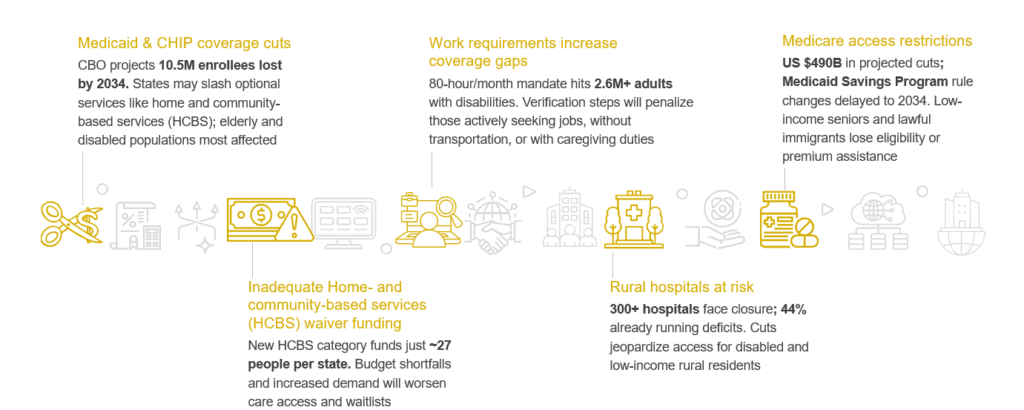

The One Big Beautiful Bill Act (OBBBA) delivers sweeping fiscal reforms aimed at reducing federal healthcare spending, most notably through a US $1 trillion cut to Medicaid over the next decade, as estimated by the CBO.

The bill introduces work requirements for adults without dependents, lowers federal support for coverage of undocumented immigrants, and restricts provider tax funding, triggering widespread coverage losses and financial strain on states. On the ACA front, it dismantles key affordability measures by letting enhanced premium tax credits expire, adding complex enrollment verifications, and eliminating repayment caps, moves which are projected to push over 5 million Americans off their Marketplace plans. Collectively, these provisions shift the burden of coverage and care back onto individuals and states.

Reach out to discuss this topic in depth.

Exhibit 1: Critical pressure points under the OBBBA

Uneven fallout: How states and health plans will bear the brunt of the OBBBA

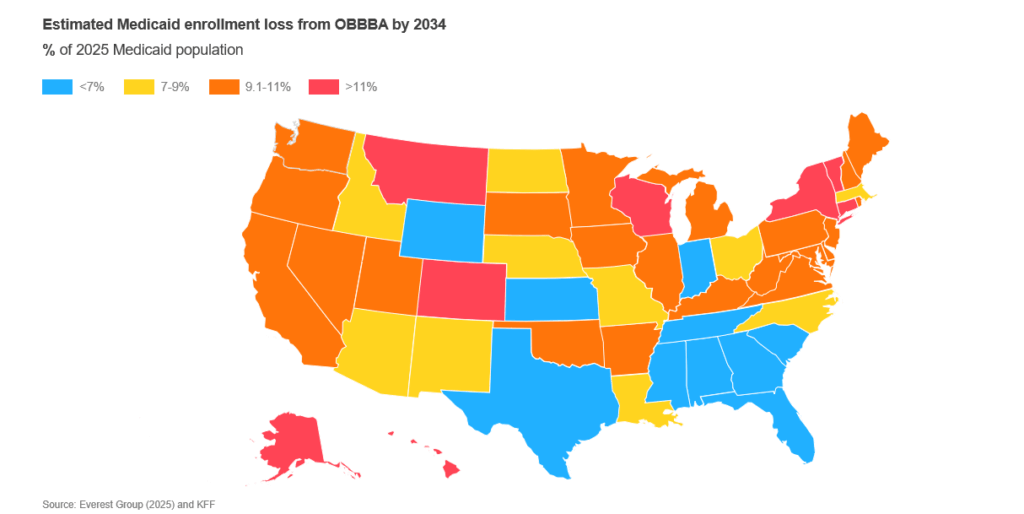

Exhibit 2: Estimated Medicaid enrollment loss from OBBBA by 2034

Note: % of 2025 Medicaid population

Not all states will feel the effects of the OBBBA equally. Here’s why some are more exposed than others:

-

- Expansion states with large able-bodied adult populations such as California, New York, and Pennsylvania may see major coverage losses due to new work and eligibility requirements

-

- States funding coverage for undocumented immigrants, most notably California, Illinois, and New York, could lose federal support, straining budgets and programs

-

- Non-expansion states like Texas, Florida, and Wisconsin lose Average Revenue Per Account (ARPA) incentives, making future Medicaid expansion financially less viable

In response to Medicaid coverage loss and potential funding slashes, several states have planned counter measurements:

-

- California may freeze enrollment and adjust premiums to address budget gaps

-

- Connecticut is weighing rainy-day fund use and boosting support for health centers and non-profits

-

- Colorado lawmakers are considering a special legislative session to address the budget shortfall

-

- Wisconsin passed a US $111B budget to raise hospital assessment rates and maximize federal match

-

- Michigan advocates are mobilizing to cushion the blow from looming cuts

Health plans

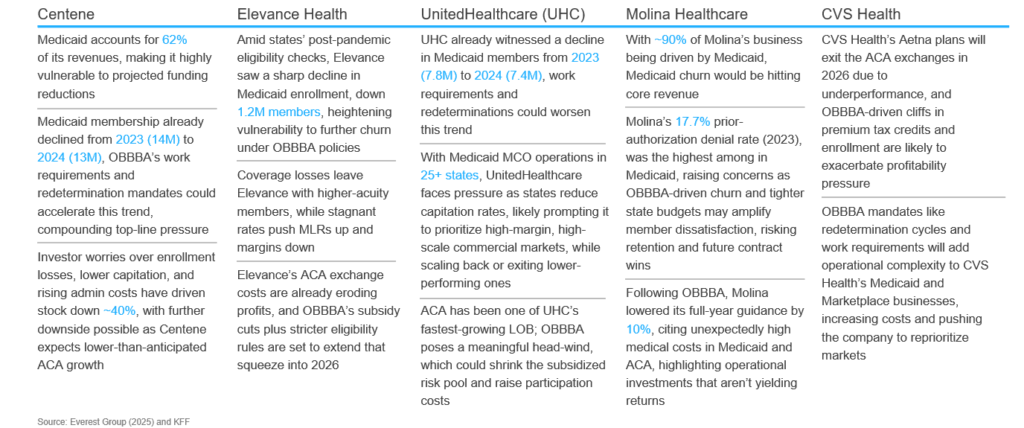

Medicaid-centric insurers face a double bind under the OBBBA: shrinking capitation revenue as enrollment falls, and higher operating costs to meet new work-requirement and redetermination mandates. Plans with the deepest Medicaid mix must quickly strengthen member-retention outreach, recalibrate state contracts, and trim low-margin markets. Conversely, more diversified players can buffer losses by leaning on commercial and Medicare lines, yet still need automation to contain compliance spend. The exhibit below details how these dynamics play out for five major health plans and highlights their specific pressure points in the Medicaid and ACA books.

Exhibit 3: Dual-line pressure: OBBBA’s effect on Medicaid and ACA business of health insurance carriers

What does OBBBA mean for service providers?

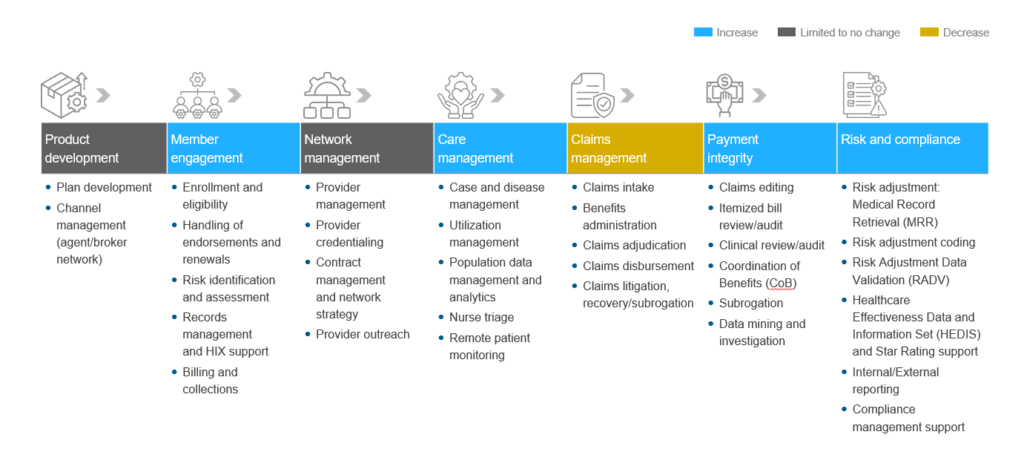

Exhibit 4: How the OBBBA would shape outsourcing across payer segments

Note: “Increase,” “Limited to no change,” and “Decrease” refer to expected changes in growth rate rather than absolute volume

As Medicaid plans race to retain members, curb revenue loss, and care for higher-acuity populations, demand will pivot to a few high-value sub-processes, prime ground for service providers to scale their offerings.

-

- Eligibility & redetermination operations: Work-requirement checks every six months create a surge of income verification, document capture, and appeals management. States and Managed Care Organizations (MCOs) will turn to vendors for high-volume automation and AI-driven eligibility engines that cut cycle-times and prevent erroneous terminations

-

- Omni-channel member engagement: Millions of members will churn between Medicaid, ACA, and uninsured status. Multilingual contact centers, outbound Short Message Service (SMS)/email bots, and self-service portals become critical for re-enrollment guidance, coverage counseling, and grievance handling, demanding scalable Customer Experience (CX) talent and analytics

-

- Tech-enabled care management & Social Determinants of Health (SDOH) coordination: With higher-acuity, SDoH-heavy populations, payers will turn to vendors for integrated solutions, combining SDoH data capture, virtual care delivery, and community referrals, to reduce avoidable utilization and meet equity-linked performance goals

-

- Payment integrity & coordination of benefits (COB): Shrinking federal dollars push states to recover every improper payment. Fraud-waste-abuse algorithms, real-time COB checks, and post-pay audit services see upticks as plans seek leakage reduction to offset lower capitation

-

- Risk adjustment and accurate coding services: Tighter capitation means every Risk Assessment Framework (RAF) point matters. Vendors offering artificial intelligence (AI)-assisted chart review, Hierarchical Condition Category (HCC) coding, and physician documentation training will help payers preserve revenue and avoid compliance penalties amid rising member acuity

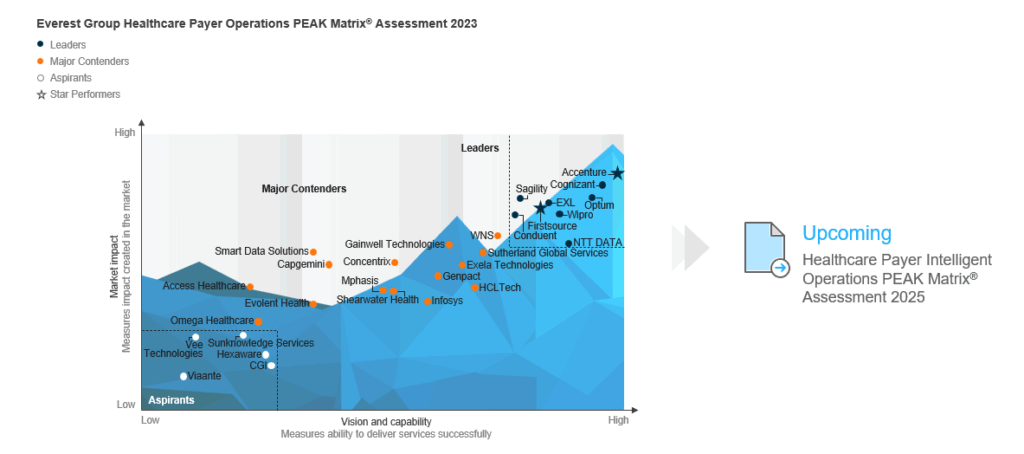

Exhibit 5: Everest Group’s upcoming assessment focus

OBBBA’s funding squeeze and fresh compliance hurdles are already rattling payer-operations vendors, and 2025 will show just how dramatically these reforms reshape the supplier landscape.

Where do payers go from here?

The OBBBA rewrites the economics of U.S. health coverage, shrinking Medicaid funding, tightening ACA subsidies, and raising compliance hurdles all at once. For payers, the mandate is clear, shore up Medicaid core with aggressive redetermination outreach and smarter SDoH-driven care, re-negotiate capitation contracts before state budgets bite, and retool ACA strategies for a leaner, less-subsidized market.

Parallel moves, automation of eligibility and payment‐integrity workflows, and precision risk-adjustment will be essential to keep margins intact. Those that act now by leveraging the right ecosystem, capabilities, and partnerships will be able to sustain market headwinds.

If you found this blog interesting, check out The Prior Authorization Shakeup: What US Payers Must Do To Prepare For 2026 | Blog – Everest Group, which delves deeper into another topic regarding US health coverage.

If you are interested in discussing how Everest Group can help you further or to speak about these parameters in more depth, please reach out to us at Sabyasachi Bhattacharjee ([email protected]) and Vivek Kumar ([email protected]).