The Prior Authorization Shakeup: What US Payers Must Do to Prepare for 2026

In June 2025, more than 50 major U.S. healthcare insurers, including UnitedHealthcare, Aetna, Cigna, Humana, Kaiser Permanente, and multiple Blue Cross Blue Shield plans, formally committed to streamlining the country’s Prior Authorization (PA) processes.

Collectively, these insurers cover nearly 80% of Americans, representing over 250 million members. Announced by HHS Secretary Robert F. Kennedy Jr. and CMS Administrator Dr. Mehmet Oz, the initiative marks a significant shift away from manual, fragmented workflows toward real-time, technology -enabled decision-making.

The implications for healthcare payers are both strategic and time sensitive. Beginning in 2026, insurers will be expected to implement five significant reforms aimed at reducing the administrative burden, increasing transparency, and accelerating care delivery. These changes will require coordinated investment across technology, operations, compliance, and clinical review functions, posing both challenges and opportunities for enterprise transformation.

Reach out to discuss this topic in depth.

What’s changing: The five commitments

Under the agreement, participating insurers have committed to five key reforms aimed at improving prior authorization efficiency, transparency, and patient access:

-

- Standardized electronic submissions: Transition all prior authorization requests to a Fast Healthcare Interoperability Resources (FHIR)-based electronic process by January 1, 2027

-

- Reduction in prior authorization volume: Decrease the number of services requiring prior authorization by January 1, 2026, with a focus on eliminating low-value administrative requirements

-

- Continuity of care: Ensure patients can retain approved authorizations for at least 90 days when changing insurance plans

-

- Transparency and communication: Provide clear, clinically relevant explanations for denials and publish prior authorization performance metrics through public dashboards

-

- Real time decisions: Deliver immediate approvals for at least 80% of electronically submitted prior authorization requests by 2027

PA Volume vs Denials – Medicare Advantage 2023 (PA requests in millions)]

To understand the drivers behind this reform, it is important to examine the current system’s inefficiencies. In 2023, Medicare Advantage plans processed nearly 50 million prior authorization requests (KFF, Jan 2025), with 93.6% ultimately approved (CMS 2023 MA Utilization Report).

Of the remaining 6.4% that were denied, over 81% were overturned on appeal (KFF, Jan 2025), indicating that a vast majority of initially denied services were ultimately deemed appropriate. These figures underscore a critical inefficiency: a large volume of administrative activity devoted to reviewing care that, in most cases, proceeds regardless.

The result is an unnecessary burden on providers, delayed access for patients, and avoidable costs for health plans.

Strategic implications for payers and their global operations

The shift to real-time, transparent, and technology-enabled prior authorization has far-reaching implications for payer operating models. While enterprise teams must drive policy and clinical governance, global capability centers and outsourcing service providers, particularly in India and the Philippines, will also have a pivotal role to play in enabling scalability, compliance, and cost-effectiveness. Below are five key operational priorities emerging from the reform agenda:

1. Expand clinician capacity through global talent pools

With CMS rules now requiring that all prior authorization denials be reviewed by licensed medical professionals, payers will face mounting pressure to ensure timely access to qualified reviewers. US-based clinical resources are increasingly constrained, particularly in specialized areas such as behavioral health, oncology, and radiology. Offshore delivery models, especially in India and the Philippines, can help fill this gap by tapping into a growing pool of internationally licensed or credentialed clinicians. This is particularly valuable for supporting after-hours and weekend coverage to meet real-time review expectations.

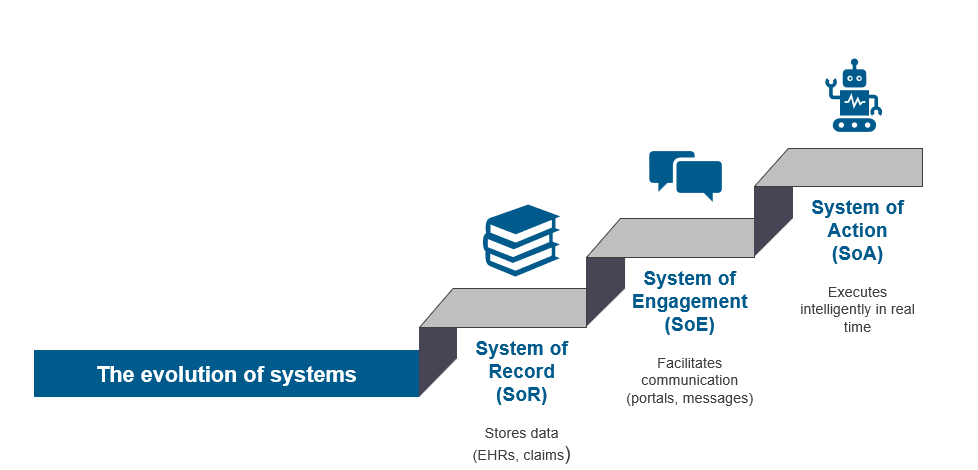

2. Transition from manual processing to AI-enabled operations

With 80% of PA decisions expected to occur in real time by 2027, the need for manual intake and case management will drop significantly. Global operations teams and service partners must shift from transactional processing to supporting intelligent automation—configuring and governing rules engines, applying Natural Language Processing (NLP) to clinical documentation, and managing AI-driven exception handling.

3. Build follow-the-sun, always-on operations

Real-time PA means real-time operations. Global teams can provide continuous coverage for prior auth workflows across time zones, reducing turnaround times and ensuring compliance with accelerated decision Service Level Agreements (SLAs), especially during US off-hours or during clinical backlogs.

4. Elevate digital and interoperability skills

As FHIR-based APIs replace faxes and proprietary portals, operational teams must improve interoperability, data exchange, and integration testing. Delivery centers and outsourcing partners should position themselves as centers of excellence for digital prior auth configuration, data mapping, and provider system connectivity.

5. Deliver transparency, reporting, and compliance support

Public dashboards, member-facing communications, and CMS audit trails will require clean, consistent data operations. Global analytics and compliance teams can support enterprise needs by tracking turnaround times, denial reasons, appeal metrics, and process exceptions, key to demonstrating regulatory adherence.

The role of outsourcing partners and Global Capability Centers

As payers implement reforms around prior authorization, the role of outsourcing service providers and global capability centers (GCCs) becomes increasingly central. These partners are no longer just extensions of payer operations, they can now act as innovative engines that shape how payers deliver timely, compliant, and provider-friendly authorization experiences.

Key areas where these organizations can create differentiated values include:

-

- Clinical review expansion and optimization: Outsourcing providers can help build offshore clinical centers of excellence with licensed physicians, nurses, and pharmacists. These centers can manage peak volumes, support complex cases, and provide time zone coverage, ensuring compliance with CMS rules requiring clinical oversight for denials

-

- Automation-led transformation: Many service providers offer proprietary or partner platforms with built-in decision support, configurable rules engines, and AI/NLP capabilities. These can accelerate real-time decisions and reduce manual processing by 60% or more. Partners can also lead implementation and tuning of payer-specific automation workflows

-

- FHIR and data interoperability: Meeting the 2027 FHIR mandate requires more than technical compliance, it demands deep integration with Electronic Health Records (EHRs), clinical documentation, and provider workflows. Outsourcing firms with HL7/FHIR implementation experience can own the build, validation, and testing processes while enabling data-rich, standards-based communication with providers

-

- Digital experience management: As providers demand better transparency and speed, GCCs and partners can support digital touchpoints for PA submission, status tracking, document management, and notifications, building API-enabled interfaces or integrating with existing provider platforms

-

- Analytics, reporting, and continuous improvement: From public dashboards to internal audits and appeals oversight, outsourcing providers can help payers build dynamic analytics environments. These capabilities not only support compliance but also enable payers to identify bottlenecks, optimize workflows, and report on member/provider impact

-

- Talent strategy and cross-training: GCCs are uniquely positioned to integrate clinical, technical, and operational capabilities under one roof. Providers can cross-train prior auth teams in FHIR APIs, medical coding, compliance, and AI model review, creating agile, multi-skilled teams that align with modern PA needs

For both traditional Business Process Outsourcing (BPOs) and next-gen digital service providers, this is an opportunity to evolve from tactical support to strategic co-creation. Those that move quickly to build industry-specific solutions, invest in tech-enabled delivery models, and embed themselves into payer transformation agendas will be well-positioned to lead in the new era of utilization management.

Final words from our analysts

The commitments made by leading US payers to overhaul prior authorization represent one of the most significant operational shifts in recent years. These reforms will drive not only regulatory compliance but also improvements in provider satisfaction, patient access, and administrative efficiency.

To succeed, payers must look beyond incremental changes and take a bold, enterprise-wide approach, anchored in automation, interoperability, and outcome-driven partnerships. Outsourcing service providers and global capability centers have a timely opportunity to step up as transformation enablers, offering the scale, skillsets, and technology expertise required to meet this moment.

As deadlines approach, the question is not whether to transform, but how quickly and effectively it can be done.

If you found this blog interesting, check out our Prevention Over Recovery: The New Era Of Payment Integrity In Healthcare | Blog – Everest Group, which delves deeper into another topic regarding US healthcare insurers.

If you have any questions or want to discuss the prior authorization shakeup in more depth, please contact Ankur Verma ([email protected]).