March 23, 2022

2021 was a milestone year for Global Business Services (GBS) with most enterprises reporting the model exceeded expectations for global business services solutions and delivery. GBS provided the needed strength and agility to seamlessly supply value without disruption from the pandemic. GBS organizations also saw higher Net Promoter Scores (NPS), a metric showing customer satisfaction and loyalty, with an increase of 10-25% in 2020 and 2021, and established higher stakeholder engagement and service delivery expansion.

With this steady stride set in motion, GBS organizations are now looking to approach 2022 with a renewed focus on increasing the value of delivering global business service solutions. They are striving to boost proficiency, digitalization, and customer-centricity while taking steps to adapt to current challenges like inflation, a talent deficit, higher costs, and the ripples set in motion from the pandemic.

So, what should GBS organizations focus on now to establish and meet expectations for 2022 and beyond?

Challenges Abound – A Global Talent Shortage Compounded by Rising Costs

Based on our report, It’s Not a Talent War; It’s a New Reality – 2022 Key Issues in Global Sourcing, GBS headcount growth is expected to be steady, with average growth moving from 4-5% in 2020 to 8-10% in 2021. However, with the current global talent shortage and inflation rates reaching as high as about 15% for some roles in 2021, expectations for salary will increase by about 8.1% in 2022.

The talent shortage will not be a brief bump in the road and will require short- and long-term strategies. We’re seeing declining population pyramids across North America and Europe, which means fewer new working-age people in the coming years. Specifically, 2.4 million fewer new workers are coming into the market than in the past five to ten years. India will bring 1.8 million more people into the workforce in the next few years but is showing an impending decline about ten years out.

Top Priorities for GBS Leaders in 2022

GBS leaders should act swiftly in 2022 to make addressing these challenges a priority. Our Key Issues study reports that GBS organizations plan to make cost improvement their number one priority. With the current talent shortage, GBS organizations must also focus on shaping the workforce they have today, including better integrating a future hybrid working model and reskilling and upskilling their workforce to meet evolving needs, among other strategies. Finally, even though GBS organizations thrived during the pandemic, many are getting back on the innovation and growth path and picking up projects that were sidelined during 2020.

Five Actions GBS Leaders Should Take to Address 2022’s Challenges

As GBS leaders rethink cost and talent strategies in 2022, what actions should they consider today and in the coming months to continue delivering value?

Action #1 – Advance Efforts to Shift to Hybrid – If You Fail to Plan, You Should Plan to Fail

In 2022, GBS leaders will look at adjusting their leadership, governance, operating, and talent models to ensure career growth and preserve productivity.

As workers moved to a work from home (WFH) model during the pandemic, most were surprised to discover how well employees and organizations adapted. The GBS industry learned ways to manage remote teams very quickly, and many workers today prefer to continue working from home. The hybrid model is emerging as the preferred working model to reach a balance and retain the benefits of working from home and the office. Our research shows that 70% of teams are likely to operate in hybrid models moving forward. However, many have reservations about maintaining performance benchmarks and ensuring data security, among other concerns. But with the pressure to meet the needs of their employees, many are bending to incorporate the hybrid model to avoid risking losing talent to other more flexible organizations.

Action #2 – Reset Expectations on Cost Arbitrage from the GBS Model

We saw wages increase significantly in 2021, many by 10% and more. This increase is more apparent for IT and engineering skills; however, we’re seeing increases across various roles and skills, including finance, supervisory, managerial, senior executives, business operations, and others. We expect an average wage increase of 8.1% in 2022.

GBS leaders will need to rethink how best to control operating costs. This could be done by assessing the scale of real estate needed or managing talent to retain value without overspending. Leaders will also need to reset expectations in light of the current changes and challenges and focus more on business impact than historical expectations.

Action #3 – Pivot GBS to Support the CEO Agenda Through Innovation, Transformation, and Operation Resilience

GBS organizations will want to pivot this year to focus on supporting the CEO agenda. With the current challenges top of mind, CEOs are looking for innovation transformation and operational resilience. Mature GBS organizations that aim to deliver an increased services evolution beyond arbitrage can deliver twice as much total business impact, whether through enhanced end-customer experience, accelerated digital transformation, increased productivity, or other methods. To do this, we’re seeing many GBS organizations develop multiple types of Centers of Excellence (CoEs), either within or outside of the GBS, to alleviate cost pressure, an absence of existing capabilities or innovation, or an urgent need for business model or digital transformation. The CoEs might target core operations, IT, talent, automation, or sourcing and vendor management, to name a few, and focus on optimizing and innovating various aspects of people, processes, and technology.

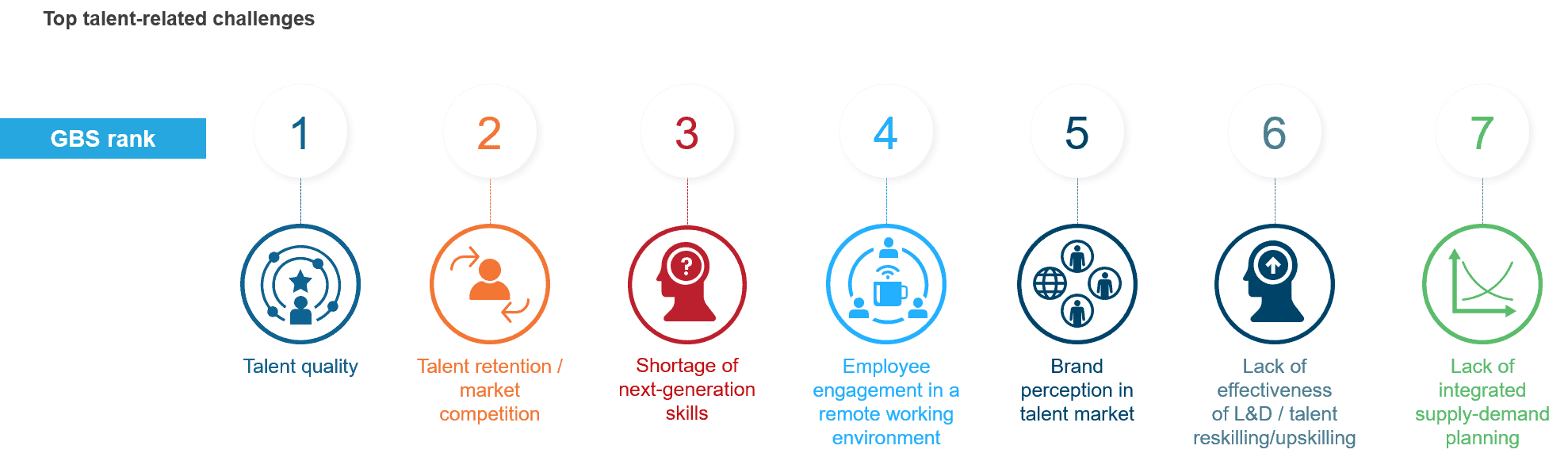

Action #4 – Execute Battle Plans to Navigate the Talent Wars – Understand the Talent Shortage Poses Serious Risks to GBS Model Success

A multi-pronged strategy with various tactics is needed to address short- and long-term talent challenges. These approaches could range from making the best of existing talent through engagement, reskilling/upskilling, and evolving the delivery model to rethink talent acquisition altogether. For example, GBS leaders could consider ways to stand out during college recruiting, find new methods to retain talent, or even look into different locations through options like impact sourcing. Finally, many are considering if now is the time to partner with universities to improve education and training programs and develop more project-ready talent.

Action #5 – Obsess Over Employee Experience

For our final action, GBS organizations should consider how to drive GBS employee experience at the enterprise level. It’s no surprise that enhanced employee experience results in improved productivity, efficiency, and innovation, better retention rates, and, ultimately, increased customer satisfaction. If GBS employees have thriving employee experiences, they will better serve the enterprise functions, business units, and internal and external stakeholders. Further, GBS organizations that focus on improving the employee experience and offer hire-to-retire services will maximize their capabilities and help deliver a better overall customer experience.

To learn more, watch the webinar, “5 Success-driving Actions GBS Organizations Need in 2022,” for expert insights from our analysts and the complete, in-depth breakdown of these five strategy actions. You will also hear from leaders from Cargill and Novartis on their employee value proposition and plans for future working models.