Everest Group Talent Demand Growth Index | India IT Services | Blog

Welcome to our monthly India IT services talent demand index. We are excited to bring you this comprehensive analysis, powered by Talent Genius™, our AI-powered insights platform purpose-built to guide IT and Business Process Services location and workforce decisions. To gain a deeper understanding of the capabilities of Talent Genius and learn how to book a demo, watch this quick 2-minute video, Introducing Talent Genius™.

Monthly India IT services talent demand tracker

Here is our in-depth analyses of the India IT services industry demand:

December 2023

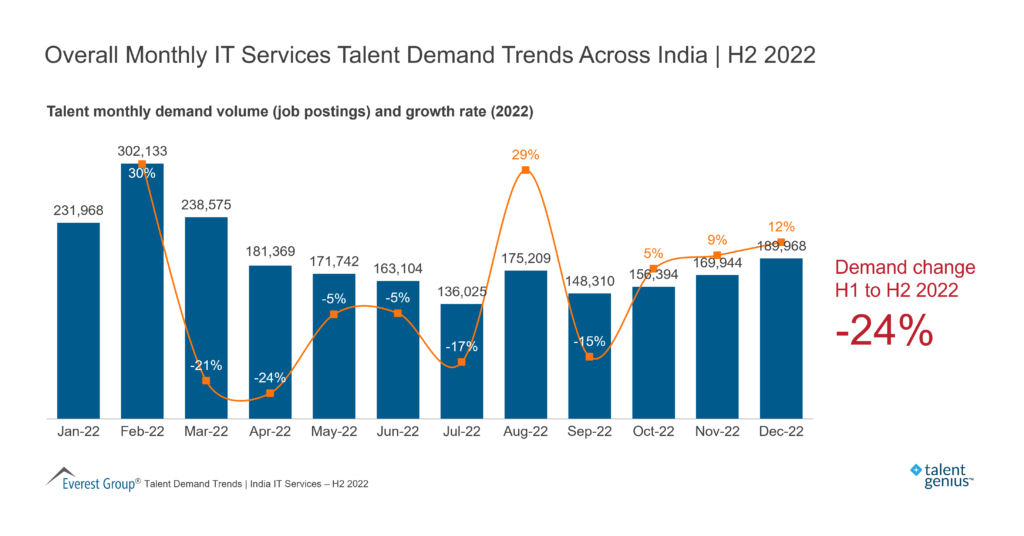

Demand for IT services in India hit a 17-month low due to declining spending and clients postponing projects. As a result, most Indian IT service providers are reexamining revenue and hiring forecasts. The overall demand across service providers decreased by 28% from last month and 11% from the previous year.

Many service providers slowed hiring, realizing they posted jobs too early and hired ahead of the demand. Service providers are now focusing on improving employee utilization rates and do not anticipate the job requirements returning to the original levels anytime soon. Demand for IT services also declined by a notable 20 percent across enterprises from November.

Overall, the second half was slower than the first half, with demand falling by 7% for service providers and 4% for enterprises. Service providers were impacted more as enterprises cut discretionary spending and insourced some work.

At the city level, demand for employees declined consistently across tier 1, 2, and 3 cities. After peaking in November, the workforce requirements in Hyderabad and Chennai fell significantly by 32% this month.

Demand hit its lowest point of the year across all segments. Despite relatively stable employment over the last few months, retail and healthcare had the biggest drop at 35%. While it is uncertain if this is the bottom, a full recovery is not expected in the near future.

November 2023 update

IT services demand in India increased by 9% month-on-month and 5% year-on-year. Demand for IT application data management (ADM) grew 9.5%, and IT infrastructure increased 5 percent compared to the prior month. However, the surge is expected to be temporary because macroeconomic conditions pushed IT project timelines ahead for most companies.

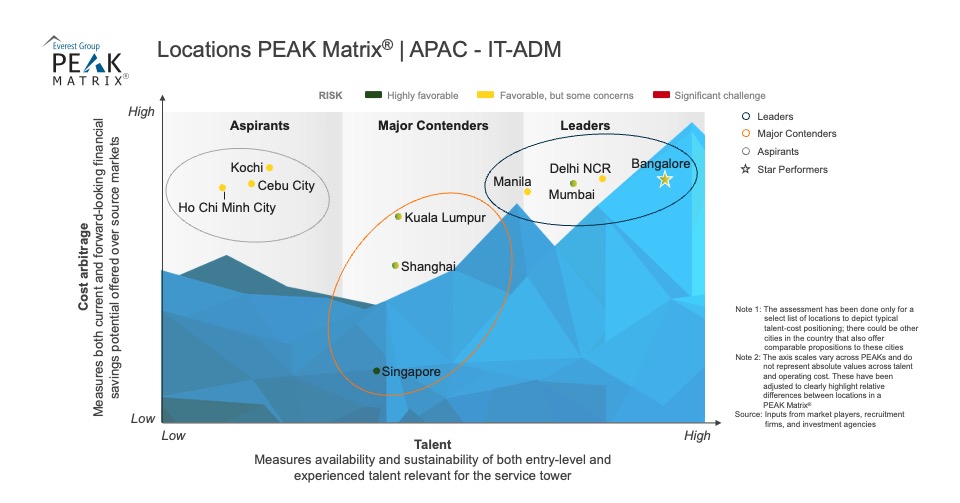

Talent demand increased more in tier 2/3 cities than tier 1 cities, indicating that enterprises are increasingly confident in hiring outside tier 1 cities to gain a labor cost arbitrage advantage.

The number of available positions increased in all tier 1 cities, except Kolkata, where the job postings fell for the second consecutive month. Since the prior month, job openings increased 18% in Hyderabad and 14% in Chennai, representing the highest month-on-month increase.

Among tier 2/3 cities, Jaipur recorded one of the highest month-on-month increases in open positions at 34%. All the other cities experienced increased monthly postings – except for Chandigarh and Thiruvananthapuram.

IT services demand increased across all industry segments, with service providers and manufacturing demonstrating the most strength, up 5% from October.

Demand fluctuates more for service providers than other enterprises. As clients cut back on outsourcing spending, the talent need from service providers is expected to decrease in the coming months.

October 2023 update

The demand for IT services in India declined by 9% from last month but increased by 5% year-on-year, with significant variation over the past few months. Despite the shifts, demand remains near the same level as May 2023, when IT services demand increased after being at its 12-month lowest the prior month.

Tier 2/3 cities continued to be more attractive for companies seeking employees. Hyderabad and Kolkata had the biggest monthly drop in talent demand among tier 1 cities at 15% and 12%, respectively. Employee talent needs remained the most stable in Pune, with only a 5% drop compared to the previous month.

Although demand for most roles declined, help desk engineer, data analyst, and business analyst roles continued to increase by about 5% monthly. Only the retail segment maintained net positive month-on-month growth rates at about 7%. Cyclical commodities and service providers declined the most by 12% and 7% month-on-month.

Over the past few months, India IT talent demand has been volatile across roles, cities, and industries. Talent demand is expected to continue to fluctuate as major Indian IT service providers lose contracts and enterprises explore more insourcing opportunities.

September 2023 update

The demand for IT services in India jumped by 19% on a month-on-month basis after declining for two consecutive months. The year-on-year increase of 22% pointed to a significant uptick in hiring activities this month, rebounding from the slowness over the previous few months.

On a month-to-month basis, demand again surged in tier 2/3 cities compared to tier 1 cities. The increased reliance on tier 2/3 cities suggests a growing client preference for cost-effective IT service delivery locations.

Among tier 1 locations, Hyderabad and Kolkata bounced back the strongest with 36% and 35% growth in demand on a month-on-month basis. All locations in the three top tiers showed increased IT services demand – except for Pune, which dropped slightly.

Every major industry segment, except for banking, financial services, and insurance (BFSI), returned with increased demand. Service providers led the chart with a 22% increase in job demand compared to last month. However, BFSI declined 23% from the prior month.

August 2023 update

The demand for IT services declined for two consecutive months after recording a 14-month high in June 2023. Demand fell by 16% month-on-month and 32% on a year-on-year basis. At a segment level, IT ADM and IT infrastructure declined from July.

This trend could be a result of a quick fix by employers to adjust for the hiring surge in the second quarter of 2023. If the pattern continues, employee attrition will rise. However, the demand will likely pick up in the next few months as the end of the year nears.

Tier 1 cities continue to experience a higher decline in demand than tier 2/3 cities on a month-on-month basis, indicating the preference by enterprises to leverage low-cost talent from tier 2/3 cities.

At a city level, Kolkata witnessed the sharpest decline in demand at 47% and had an all-time low in the last 20 months. Among leading tier 2/3 cities, Kochi and Thiruvananthapuram showed the least decline in month-on-month demand.

The surge in demand by industry sectors halted, with consumer packaged goods registering the greatest decline since July. Business and professional services also reversed the growth trend.

A slightly higher decline in month-on-month demand across service providers that has continued for several months now clearly indicates increased insourcing by enterprises.

July 2023 update

While the month-on-month view showed a 9% drop in the IT services talent demand trend in India, demand grew 17% over the prior three months and by 32% year-on-year.

Tier 1 cities witnessed a relatively higher decline than tier 2/3 cities month-on-month, showcasing the increased leverage of tier 2/3 Indian cities. This trend is consistent across most tier 1 and tier 2/3 cities. Jaipur and Coimbatore are the only exceptions across tier 2/3 cities, showing 10% and 3% growth, respectively. Among tier 1 cities, Mumbai and Kolkata witnessed the highest decline, while Pune recorded the lowest decline of approximately 2%.

Service providers witnessed the highest decline of all industry verticals for IT services demand over the past year. Business and professional services and consumer packaged goods saw a slight uptick in demand.

June 2023 update

The demand for IT services in India showed further recovery and grew by 15% compared to May 2023. For the first time in the last six months, demand also showed growth on a year-on-year basis (21% growth compared to June 2023). At a segment level, both IT ADM and IT infrastructure segments witnessed 14-month high demand levels in June 2023, with IT infra talent demand growing 40% on a year-on-year basis.

The growth trend, which started in May, is solidifying and was consistent across all cities, though the extent of recovery varied. Chennai saw a modest recovery, whereas Mumbai saw a significant spike in demand. We believe the demand surge in Mumbai may not be entirely due to net new demand but could be due to talent management/attrition challenges arising from the hybrid/in-office model and the need to back-fill resources.

The demand from service providers continues to grow, and we believe there is more focus on hiring laterals this year compared to the previous year, which saw a significant uptick in campus hiring. This increase could also be due to multiple large deals that are at play in the market and providers hiring in anticipation of winning large business in the medium term.

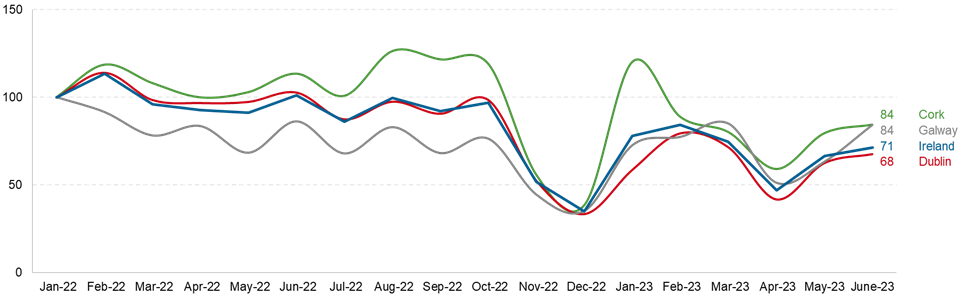

May 2023 update

The demand for IT services in India showed a recovery in the month of May, growing by 34% compared to the previous month and staying flat compared to 2022. This spike compared to March and April could be attributed to buyers placing demand ahead of the summer in key onshore geographies, which tend to be slower from a business perspective. The increase in demand was consistent across both tier-1 and tier-2/3 cities; however, the recovery was much steeper for tier-1 cities (growing 14% YoY) compared to tier-2/3 cities (shrinking by 20% on a YoY basis). Among the tier-1 cities, all showed an uptick in demand; however, Pune set a demand record of a 17-month high. The service provider segment, while it showed recovery compared to the previous month, on a YoY basis, registered a 7% decline in demand. On similar lines, BFSI and technology & communications verticals continue to show a declining demand trend on a YoY basis.

April 2023 update

The demand for IT services in India further shrunk by 17% in April, reaching a 16-month low, and declined by 29% on a year-on-year basis. The impact of the anticipated global economic slowdown is clearly visible in the latest demand trends.

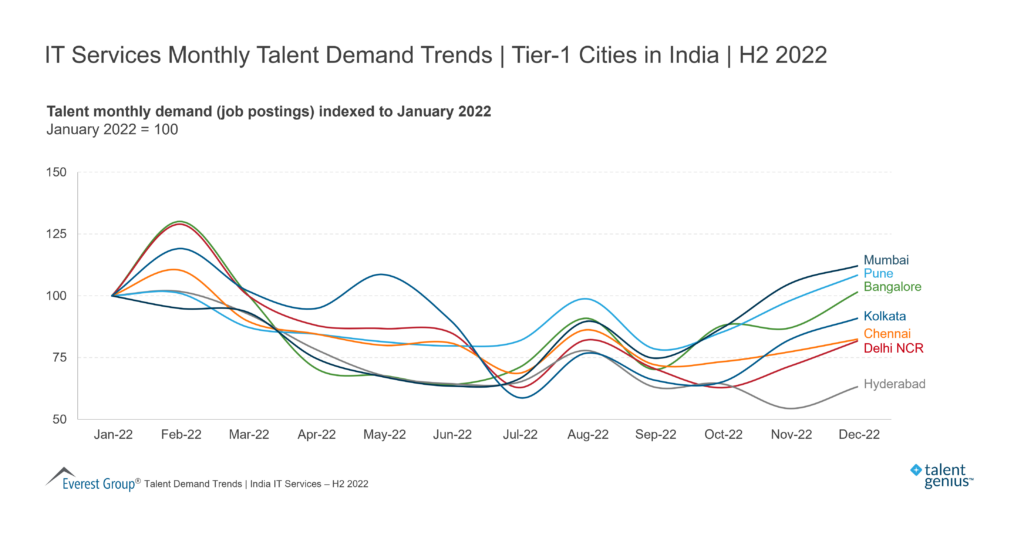

The declining trend is consistent across both tier-1 and tier-2/3 cities. Among tier-1 cities, Chennai, followed by Delhi-NCR, witnessed the highest decline. Tier-2 cities saw an even higher decline on a year-on-year basis at 32%. At this point, the demand for IT services talent in India is almost 50% of the demand in January 2022. However, this trend needs to be observed over a slightly longer period. If this trend continues for a few more months, the already reduced attrition numbers are likely to come down further.

Being the first month of the new fiscal year for many leading India-heritage service providers, this indicates a not so good start to the year 2023-24, and declining talent demand is deeply correlated to reduced business growth.

March 2023 update

After five consecutive months of demand growth/stability, the demand for IT services in India dropped significantly (21%) in March and by 36% on a year-on-year basis. The declining trend in March was consistent across all tier-1 cities, though Mumbai witnessed the lowest decline among all tier-1 cities.

The demand in tier-2/3 cities also reduced by 26% on a year-on-year basis. This overall declining trend is expected as Q1 2022 witnessed a significantly higher demand due to attrition and talent wars faced by the industry, and with the current economic environment, most companies are not in an expansion mode.

Stay tuned for regular monthly updates as we monitor the landscape of the India IT services industry demand market. We’ll continue to provide the latest insights and trends, so you stay well-informed on locations and workforce developments.