Everest Group regularly supports clients in developing fact-based business case models to assess all relevant costs and benefits associated with their service delivery portfolio and delivery location decisions.

Not surprisingly, we’ve seen an increase in this type of activity in the last several years due to technology disruptions, potential immigration reform laws, intensifying competition for talent, and macroeconomic and geopolitical uncertainties. We’ve also seen an increase in the number of faulty/incomplete business cases that, if unresolved, can result in unnecessarily high costs and less than expected benefits.

#1 Clarity on the primary objective of the business case:

Establishing clarity on the key objectives of the business case for service delivery location selection is of utmost importance. Companies often include benefits of other initiatives (e.g., transformation) which may impact their overall locations footprint, but fail to include costs associated with these initiatives, resulting in a faulty business case. As business case assessment is typically done for long-term strategic decisions, it is critical to ensure clarity on the locations strategy and implementation roadmap under consideration.

#2 Underestimating the costs of “what it takes to get there”:

Companies often underestimate the costs associated with exiting their current location (e.g., lease termination and severance costs); disruption in their existing locations (e.g., loss of knowledge due to higher than expected attrition); migrations (e.g., employee relocation, technology migration, parallel/shadow run); and set-up of new centers (e.g., capex, cost of hiring and ramp-up, training costs, etc.)

Example: A global Financial Services company had a 12-month long shadow/parallel run to effectively complete knowledge transfer for high complexity processes. This negated most of the arbitrage-related benefits for the initial 12-18 months. In fact, the company incurred relatively higher total cost of operations (TCO) until steady state operations was achieved.

Example: In a recent engagement, the location selection for a Latin American client’s shared services center was greatly influenced by applicable withholding taxes (i.e., the Argentinean government levies a ~31.5% withholding tax on import of global services from certain locations such as Mexico). These factors significantly impacted the relative cost attractiveness of locations under consideration.

#3 Overestimating benefits:

Companies often plan multiple transformation and optimization initiatives in parallel with changes to their services delivery portfolio. In such cases, things seldom pan out as planned, and the savings achieved are significantly lower than expected in areas including:

- Headcount reduction from process improvements

- Delivery pyramid optimization

- Implementation of automation/technology solutions

- Economies of scale (in cases of location consolidation)

- Optimization of management and administrative overheads

Example: A BFSI firm changed its planned strategy midstream, as its initial plans to fund the business case for large scale service delivery location consolidation by reducing FTE headcount by ~ 6,000 could not be realistically achieved.

#4 Stakeholder misalignment:

A service delivery location decision must involve multiple stakeholders including onshore business leaders, offshore delivery leads, functional and GIC leaders, migrations and/or transformation teams, corporate real estate, and technology teams. Any lack of coordination among these stakeholders can pose challenges in alignment on data used, key assumptions, the roadmap for service delivery portfolio changes, and the plan for other transformation/optimization initiatives. All stakeholders must be kept in the loop from the beginning of the location evaluation, and they must periodically periodic sign-off on the approach.

#5 Industry benchmarks:

While it is important to leverage industry benchmarks, companies must contextualize information to their own unique situation. The specificity of operations or the role a location plays for the company can be different from the typical value proposition of that location/geography.

Example: A recent engagement for a global Financial Services client demonstrated that, despite industry benchmarks that indicated Location A offered ~20 percent cost savings over Location B for typical BPO processes, the client’s specific processes and talent needs reversed the cost attractiveness of the two locations.

#6 Talent competition in the local market:

Companies often underestimate the true extent of competition in the local talent market, and the impact of attrition on sustainability of their operations. This impacts a company’s ability to scale initially, retain talent, and back-fill lost staff.

Example: A global manufacturing company faced significant challenges in hiring language skills for its newly setup shared services center in the APAC region, resulting in significantly lower arbitrage savings than expected.

While developing business cases models can be a significant challenge, we believe that addressing the above-mentioned points can reduce chances of error significantly. Learn more about Everest Group’s Service Delivery Locations practice.

April 18, 2017

Everest Group and other global services experts convene to discuss challenges of managing in uncertain times

Washington is a fitting if not symbolic location for Everest Group’s next On Point Summit – “New World [Dis]Order: Managing in Turbulent Markets.” Everest Group experts and other global services executives will convene at The Watergate Hotel in the U.S. capital on May 17 and 18 to discuss the rapidly evolving landscapes of globalization, automation, immigration and digital transformation.

The two-day event exclusively for enterprise sourcing executives features a slate of renowned thought leaders:

- Uri Dadush, former director of international trade for the World Bank, will deliver the keynote address, “Globalization: Curve or Cliff?”

- Peter Bendor-Samuel, CEO of Everest Group, and Rod Bourgeois, head of research for DeepDive Equity Research, will present “Immigration: The Latest and What to Expect”

- Bill Price, first worldwide vice president of customer service at Amazon, author of “The Best Service is No Service,” and partner at Antuit, will join a panel to discuss “Digital Disruption: Pain or Gain”

- Everest Group’s Jimit Arora, partner, IT services research, and Sarthak Brahma, vice president, pricing assurance, will discuss “Outsourcing Market: Pricing Collapse and Shifting Provider Landscape”

Other speakers include senior executives at leading North American financial institutions, digital retailers, natural resources companies, and more.

“Times of uncertainty can be career inflection points for senior executives who are armed with actionable data and insights and able to offer wise strategies for navigating perilous waters,” said Eric Simonson, managing partner at Everest Group. “So at this gathering of global services executives, we will put the facts on the table, exchange war stories, and engage in provocative discussions. The goal is to equip and inspire these executives to provide invaluable leadership, helping their companies not only to survive but also to emerge from the disorder as successful market leaders.”

***Enterprise executives may apply to attend the event at http://www1.everestgrp.com/OnPointSummit-May2017.html. ***

April 17, 2017

How do Amazon, Apple, and Tesla keep innovating? What do they do differently than many others do not, or cannot, do? And how many industry leaders can say their organization is truly innovative?

To get answers to these and other pressing questions, we conducted a focused research study with more than 100 application service executives – approximately 50 percent of whom were CXOs – in North America-based enterprises engaged in IT outsourcing programs. The research revealed startling insights. For example, only 30 percent of study participants felt their companies were somewhat innovative, even though all of them realized the importance of innovation and had made strategic investments in it.

And from defining it and its objectives, to funding it, to defining and institutionalizing the process to drive it, innovation has remained an elusive concept both for enterprises and service providers.

The study also busted innumerable myths associated with IT innovation. Let’s look at the top five.

IT Innovation Myth 1: Innovation is abstract and cannot be measured

But, over 75 percent of the study participants already have a highly effective mechanism to measure the impact of innovation. Linking the investment made to measurable results and desired benefits has enabled them to devise a formal approach for impact assessment.

IT Innovation Myth 2: Innovation should result in a disruptive idea

In reality, this is the last priority for executives of best in class enterprises! A siloed disruptive idea that does not impact the business model or enhance customer experience is the least appreciated outcome, and does little to serve the purpose of innovation. Instead, transformation is the primary lever deployed by enterprises to identify disruptive innovation. Moreover, the overall approach to it and the returns derived from it are considered more significant for driving innovation than the idea itself.

IT Innovation Myth 3: Episodic initiatives such as “idea of the month” and “innovation events” can deliver innovative results

Unfortunately, such sporadic investments have a probability of less than 10 percent to deliver innovative outcomes. Though used by most service providers, these are the least preferred approach to innovation from the enterprise executive’s perspective. Continuous innovation with prototyping and demonstrations/MVPs are far more likely to deliver on customers’ expectations.

IT Innovation Myth 4: Large scale investment is required from the enterprise or service provider to fund innovation

Though investment is required, 65 percent of the study participants with high satisfaction with their innovation program believe in shared responsibility and co-funding. Their belief is that shared responsibility spreads the risk involved, and reduces the investment required, thereby attracting the best-in-class capabilities from both sides.

IT Innovation Myth 5: A dedicated centralized team/CoE should be set up to drive innovation

Rather, best-in-class innovative businesses embed a culture of innovation across their enterprises to encourage the concept of continuous and crowdsourced innovation.

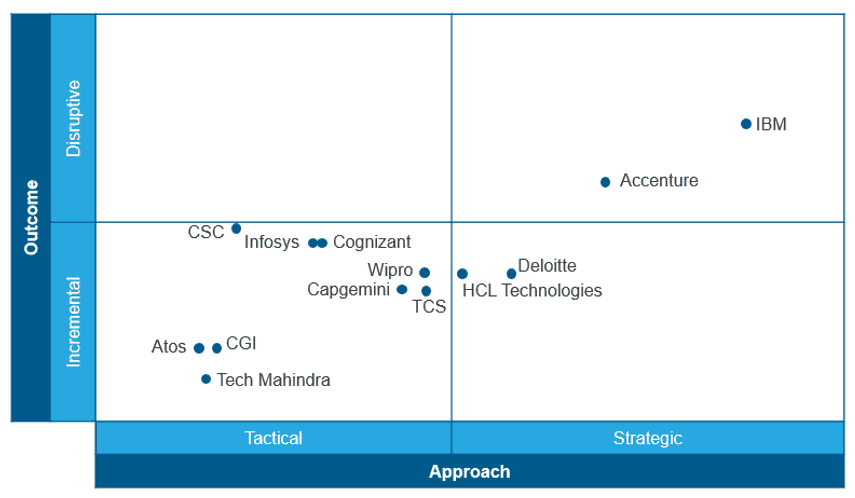

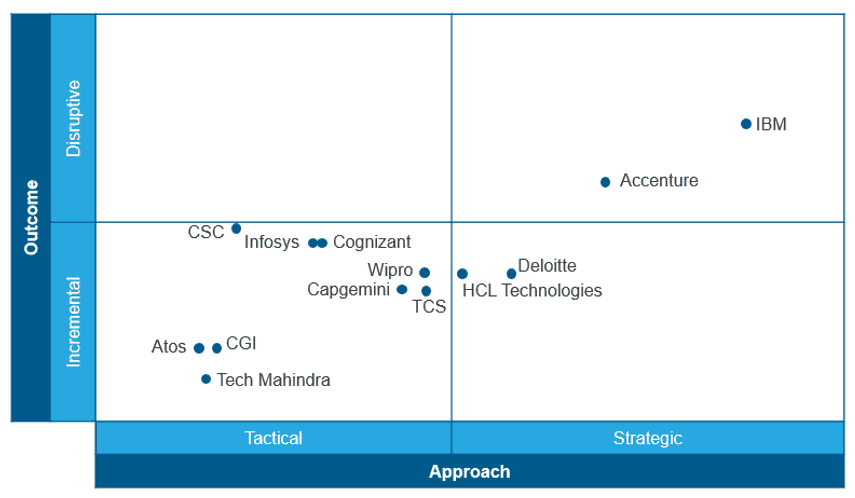

To enable enterprises to adopt a systematized innovation approach and achieve their desired outcome, Everest Group designed a unique framework on which to base their innovation strategy. We also used the framework to identify the 14 most innovative service providers in the industry.

Application Services IT Innovation Maturity

For more information and insights on this research, please refer to our reports, “How to innovate – A Comprehensive Guide to Innovation in Application Services,” and “Cracking the IT Innovation Code.”