May 9, 2017

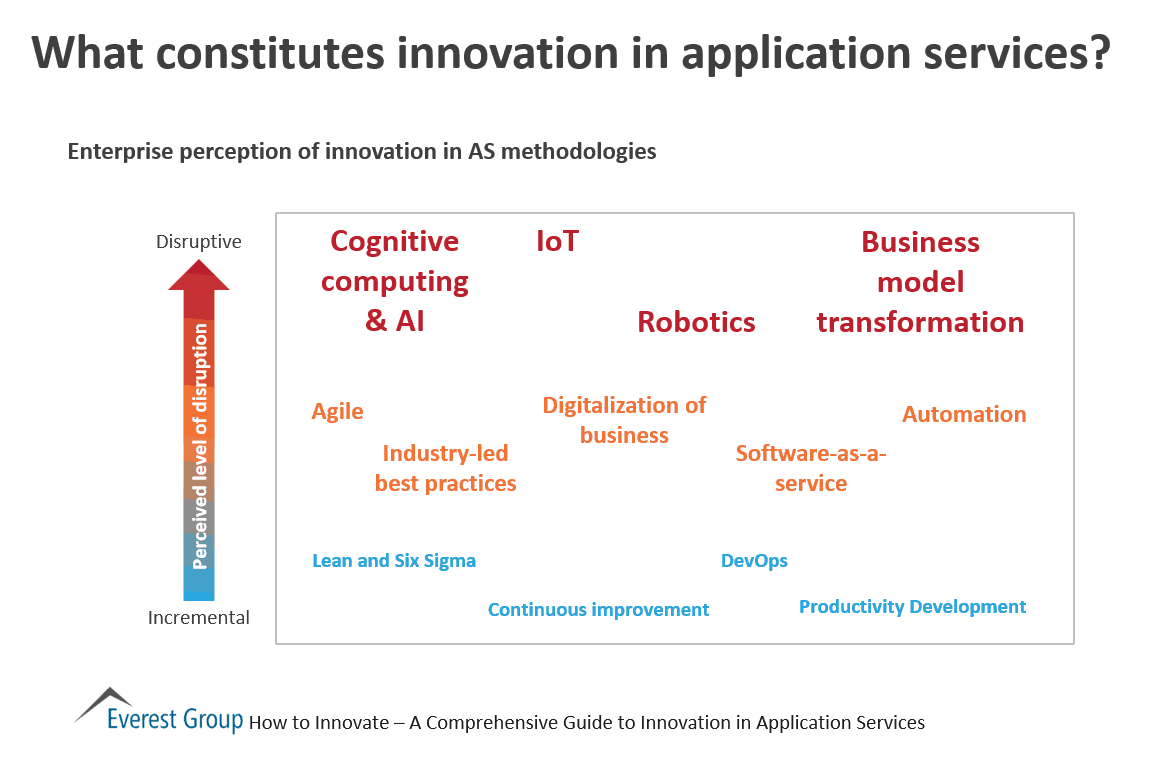

Outlook for 2017-2018: Automation, artificial intelligence, cognitive computing and robotics will become mainstream and pervade the enterprise portfolio.

Enterprises no longer consider automation merely a service delivery tool; in fact, automation is now “front end,” with enterprises proactively demanding strategy, vision and strong Proof-of-Concepts (POCs) for advanced automation in 33 percent of all application services contracts in 2016, according to Everest Group. Everest Group expects this trend to accelerate in 2017 and 2018.

“Automation will become a high-priority investment for buyers in the coming years, owing to automation’s direct impact on software development life cycles [SDLCs] and speed to market,” said Yugal Joshi, practice director at Everest Group. “Also, artificial intelligence, cognitive computing and robotics will no longer be fringe technologies dominated by major players; rather, these technologies will begin to pervade the enterprise portfolio and will eventually become mainstream in the application landscape.”

Compared to adoption of automation, enterprises adoption of artificial intelligence (AI) is progressing at a slower pace, with only 15 percent of application services contracts of 2016 including AI in the scope. Although enterprises are currently taking small steps to adopt AI in their IT services environments, AI and its allied techniques soon will profoundly impact application services in the way applications are developed, tested, and maintained.

“AI is no longer a fringe, fantasy-riddled technology,” added Joshi. “AI techniques present significant opportunities in the application services landscape, and enterprises can leverage these techniques to completely transform application services functions. The key to unleashing the transformative potential is to move beyond using AI for enhancing developer productivity to making intelligent machines that develop their own snippets of code, allowing developers to focus on more complex tasks.”

Activities in the testing and maintenance functions of the SDLC present the most opportunity to leverage AI techniques. Even creative activities such as software development can be significantly improved by leveraging AI.

These results and other findings are explored in a recently published Everest Group report: “Application Services—Annual Report 2016: AI in SDLC? There is a Long Journey Ahead”

Other key findings:

- A decline of 28 percent in application services deal sizes (to an average contract value of US$5.4million) in 2016 is a cause for serious concern for application services providers.

- Owing to the nascence of fields such as deep learning, there is a dearth of talent to develop innovative use cases for AI. Startups that have made some headway are becoming prime targets for acquisition and talent sourcing.

- Stand-alone application services deals continued to dominate the IT services landscape, with 62 percent of deal activity.

- Deal activity continued to be dominated by small buyers (i.e., revenues less than US$5 billion) that took up 47 percent of application services deals.

***Download Complimentary 11-page Preview Report Here*** (Registration required.) This preview summarizes the report methodology, contents and key findings and offers additional resources for further study.

The full report analyzes the application services market, focusing on:

- Major trends in application services adoption

- Key factors shaping the market, including buyer expectations

- The outlook for 2017-2018

***Publication-Quality Graphics***

High-resolution graphics illustrating the key takeaways from “Application Services—Annual Report 2016: AI in SDLC? There is a Long Journey Ahead” may be included in news coverage, with attribution to Everest Group. Graphics include:

- Talent for artificial intelligence: a whole new ballgame

- Enterprises are demanding automation

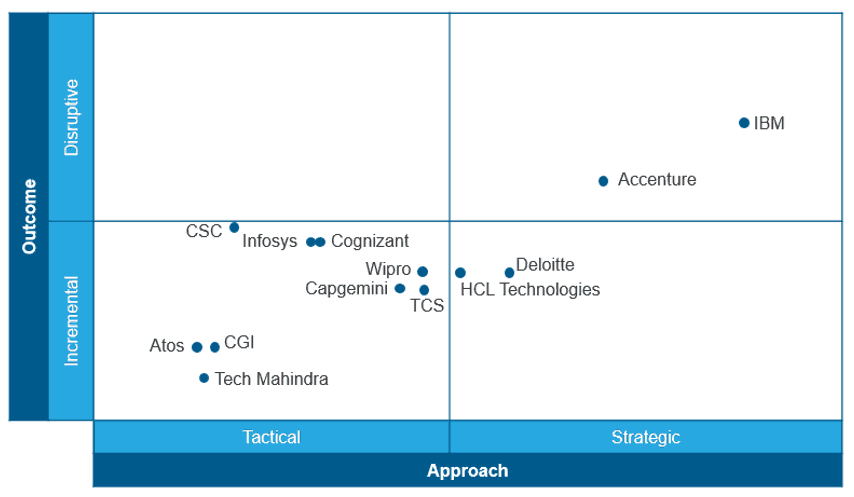

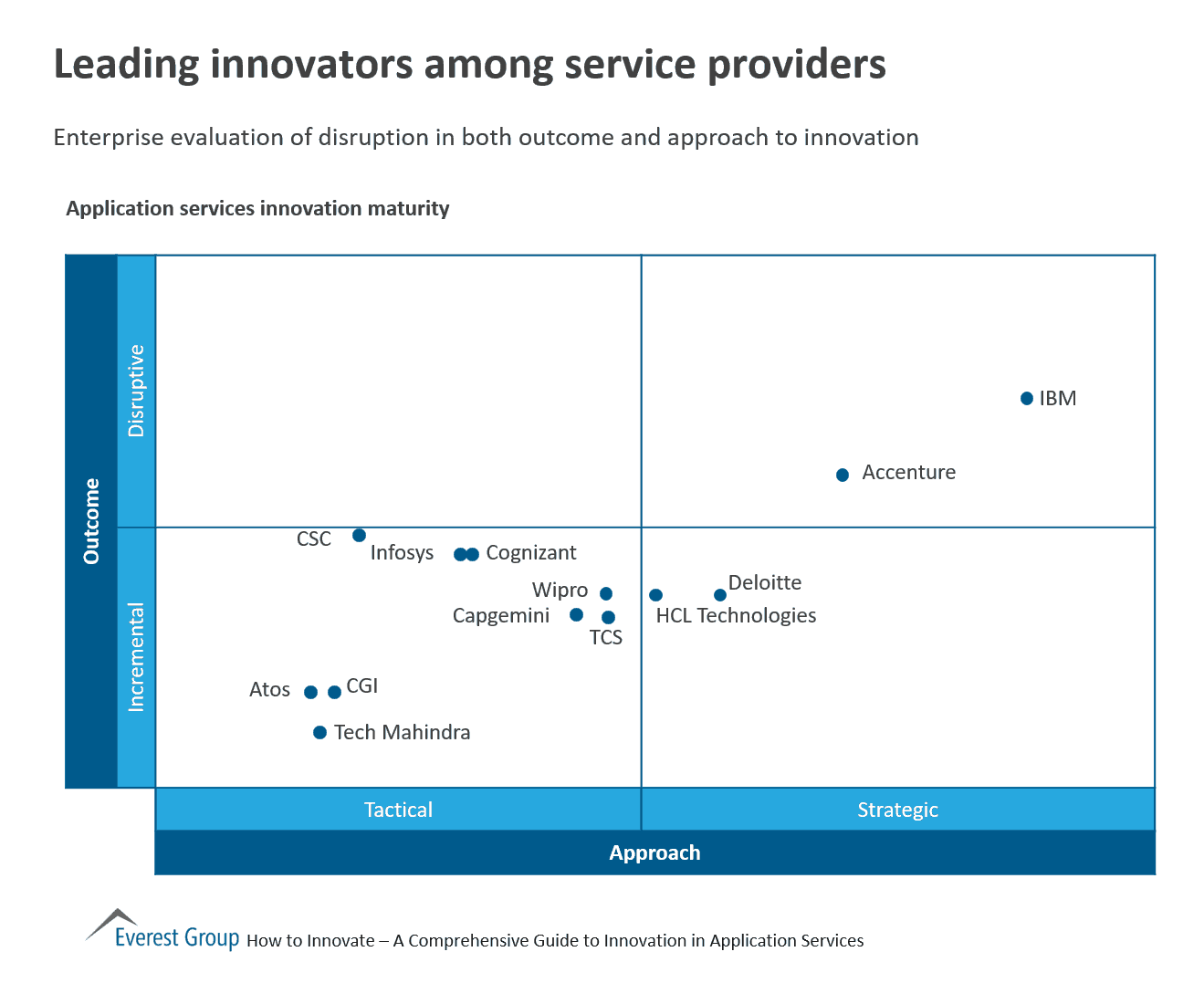

- Applications services technology providers missing disruption opportunity

- Artificial intelligence adoption

- AI techniques present significant opportunities in the application services landscape

Download graphics here.