On 31 January 2017, Australia-based Ascender and NGA Human Resources announced that Ascender had acquired NGA’s Australia and New Zealand business. Part of the agreement is a partnership between the two companies to deliver payroll and HR services solutions for the ANZ region, ensuring a seamless solution for NGA HR’s global payroll and HR clients. The deal makes Ascender one of the largest HR and Payroll providers in the ANZ and APAC region.

What are the implications of the deal?

For NGA:

For Ascender:

Of course, as with any deal of this type, there are numerous things those in the region should watch out for.

First, NGA and Ascender will be looking to forge a partnership in a way that is beneficial to both parties beyond the immediate operational need. The scope and extent of this new partnership will evolve and take shape as the dust settles. It remains to be seen what form it will take, especially in light of Ascender’s recent entry into the Europe-based Payroll Services Alliance, wherein eight major payroll service companies have bundled their services into a unified offering that consists of strong local expertise and services, supplemented by coordination and integration at an international level.

As far as technology is concerned, with NGA’s PS Enterprise and Preceda HCM platforms coming into Ascender’s fold as part of the acquisition, Ascender will likely seek to integrate the different system capabilities under one brand over time. As with a lot of private equity-backed acquisitions, since the focus will be on improving margins, we are likely to see more investment in consolidating and improving technology, driving automation, and increasing self-service functionality.

Although the APAC market continues to experience relatively high growth rates – 7-9% in single country payroll outsourcing and 23-25% in MCPO – the region is fairly complex, and each country requires a distinct strategy to ensure sustainable growth. For instance, while India requires a heavily price-sensitive services sales approach, a technology-driven approach works better in Australia.

With the APAC region requiring a great deal of management attention and local presence to drive continued success, global providers’ APAC arms tend to be private equity acquisition targets. Indeed, while Western economy-based global players don’t necessarily have the focus to negotiate the uniqueness of the APAC region’s HR services and payroll requirements, private equity can certainly help bring that focus to the table. For example, Ascender is backed by a private equity-led consortium, and just two years ago, private equity firm Everstone Capital bought out Aon Hewitt’s APAC business, (renamed Excelity Global).

While not all will be private equity-driven, we do anticipate more acquisitions and consolidation in this space in the APAC region as the market matures, particularly in geographic markets that are fragmented, with no clear leader in sight.

Enterprises, service providers see themselves as digital innovators, but most have only scratched the surface; Everest Group’s Digital Services research practice to identify, inform digital disruptors

Many of the world’s leading enterprises and service providers see themselves as digital innovators whose applications of digital concepts and technologies are cutting edge, when, in fact, these organizations have merely scratched the surface of digital’s disruptive potential, according to Everest Group, a consulting and research firm focused on digital services, strategic IT, business services and sourcing.

To guide organizations in the transformative adoption of the digital ecosystem, Everest Group today announced the formation of a dedicated team and a comprehensive research agenda devoted entirely to digital services. The new Digital Services research practice will address growing enterprise needs for data-based insights into Internet of Things (IoT), artificial intelligence (AI), digital design and innovation, and successful business strategies based on digital concepts.

“Since Everest Group began covering digital services in 2013, the rate of enterprise adoption of digital technology has multiplied,” said Yugal Joshi, practice director at Everest Group. “However, the digital journey is about more than the technologies alone; it is also about the people, processes, design, and innovation philosophy of an organization.

“Unfortunately, many enterprises are pointing to their piecemeal application of digital technology—using a mobile app to engage with employees, for example—and equating that with digital leadership when, in fact, digital leadership is less about these application instances and more about leveraging the interplay of digital concepts and technologies to fundamentally change the structure of their business and even the industry,” continued Joshi. “Our goal is to elucidate this distinction and provide the fact-based analyses and insights that guide enterprises and service providers to move beyond ‘look at our cool technology’ to ‘look at our cool use cases.’”

Everest Group has planned a robust 2017 research agenda focused on digital services, including deep-dives into topics such as IoT, digital marketing, mobility, next-generation and conversational analytics, platforms and disruptive start-ups. Also, Everest Group’s Digital Innovation Index and PEAK Matrix™ assessments will provide insights into the comparative market position of enterprises and service providers in terms of digital innovation.

Furthermore, through fact-based research that imparts reality, the new Digital Services research practice will explore how enterprises and service providers are tapping the interplay of technologies to drive innovation and disrupt their industries.

“Our dedicated Digital Services research program will better serve clients not only by examining a broader scope of digital services but also by zooming in on how these are being used to support business objectives,” said Gunjan Gupta, practice director at Everest Group. “Take, for example, the application of artificial intelligence. Our research will be instrumental in more clearly defining hazy terminology, such as what it truly means to have an AI solution. It will also separate the wheat from the chaff—revealing what works and what doesn’t. And, most importantly, our analysis of market leadership in digital services will clearly distinguish between organizations using AI to simply crunch data versus those using AI to truly support a business objective or drive Transformation with a capital T.”

***Click here for more information about Everest Group’s Digital Services research practice.***

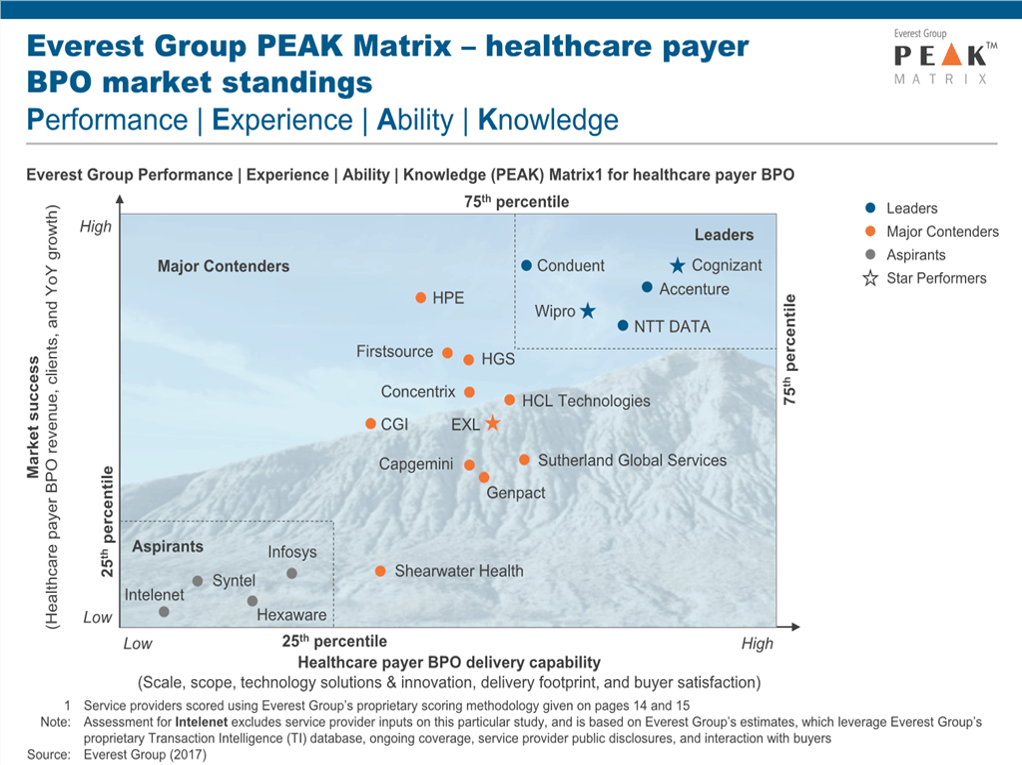

Everest Group PEAK Matrix – Healthcare Payer BPO

The Trump administration’s move to table H1-B visa bill in the house has led to a bloodbath for IT services stocks. While there appears to be near unanimity on the “absurdness” of the move, there is a silver lining most experts seem to have missed. I’ll explain this through two acts that have played out.

Act #1: Old Wine in New Bottle

In a November 2015 blog (“My Digital is Bigger Than Yours” and The Technology Pulp Fiction), I explained the rationale behind my cynicism for buzzwords that were driving the discourse on IT services. The story being told was that IT services was undergoing a paradigm shift in innovation. However, instead of witnessing a real shift in strategy, talent model, and offerings, what we have seen is a largely marketing driven illusion of change. Digital, cloud, automation, and cognitive are terms that are being thrown around without caution, giving an impression of disruption in services delivery. In reality, it’s just the natural course of progression in IT services getting embellished by these buzzwords. Analysts know it, service providers know it and – no prizes for guessing – buyers know it too.

As our January 2017 enterprise pulse report on buyer (Dis)satisfaction highlighted:

Point 3 above is the reason why, as much as I would like to take service providers to task on this pretense of transformation, I believe that enterprise IT must take its fair share of the blame. They have been running mediocre, unimaginative, and long past use-by-date procurement practices. There are two primary reasons behind this inertia:

Net-net, labor arbitrage, offshoring, and time & materials still continue to drive the lion’s share of IT services. In the current scenario, despite all the “digital” and “cognitive” washing, there is no way this reality can be swept under the rug. Does this mean that services transformation is a lost cause?

Act #2: And then Trump happened….

All this is getting Trumped now. Visa regulations mean less access to the same cheap labor. Now, instead of paying lip service to service delivery automation, enterprise IT and providers will actually have to think about hyper-automation to keep the lights on and manage margin improvement expectations. Things will have to move faster towards autonomics and/or cognitive for service providers to stay afloat and enterprise IT to stay relevant for CFOs.

My message to the ecosystem to which I belong? – It’s time to put your money where your mouth is!

The Philippines has been in the news a lot lately, for a range of negative reasons. But is its risk profile becoming such that U.S. enterprises should stop evaluating it as a global sourcing destination, or that those already there should consider pulling out?

That depends on your perspective, especially when you look at both its risk and benefits profiles. I believe one can argue that the current dynamics in the Philippines are potentially a hidden positive for the global sourcing industry. Yes, this bad thing could actually be a good thing.

Before you tell me I’m off my rocker and should be put in a padded room, hear me out.

Among other things, Philippine President Rodrigo Duterte made statements regarding “separation from the U.S.” This understandably caused concerns among multiple global companies with one or another type of exposure to the Philippines. But the Philippine government subsequently tried to clarify that the statements were reflective of intent in foreign and military policy, not business ties. Although a general tilt in military and foreign policy away from the U.S. may eventually hamper business relations, there will probably be little impact in the near term.

That said, while the uncertainty and noise surrounding the Philippines will cause some companies to slow or moderate their exposure to the country’s labor market, a slowing of its offshoring industry growth could be incredibly helpful.

For example, with somewhat less demand for talent, attrition rates should decrease. With somewhat lower attrition rates, employees are likely to develop in their roles to a greater level of proficiency. Additionally, salary increases are also likely to moderate and, with likely less investment into the Philippines, the Filipino peso may weaken and lead to a more attractive cost base.

In other words, assuming that the actual work environment is not disrupted by the new posture, the labor pool should become more attractive – lower cost and more stable – for those organizations continuing to operate in the Philippines.

From an economic standpoint, despite President Duterte’s saber rattling and the unnerving optics, the ties between the two countries won’t be threatened any time soon. The IT and Business Process Association of the Philippines (IBPAP) reported that the IT-BPS industry represented revenue of US$22 billion to the Philippines, and employed ~ 1.2 million FTEs in the country in 2015. With those kinds of numbers, an economic split can’t happen.

Socially, there are very deep ties between the U.S. and the Philippines, much of which is rooted in the fact that English is one of the two official languages in the country. One of the strongest predictors of social ties is language, as the more easily you can communicate with each other, the easier it is to talk about family, share jokes, discuss vacations…topics that help forge bonds.

It’s true that the Philippines’ risk profile appears to be shifting, but largely in ways that seem unlikely to materially impact business ties. For enterprises willing to manage and continue to operate within that environment, it would appear that the benefits of more skilled, language- and culturally-aligned talent at lower prices could easily outweigh the perceived risks.

Of course, there are numerous things you and your location-scoping team should monitor when considering the Philippines as a sourcing destination. The top five are:

Is your enterprise already offshoring to the Philippines, or in the process of evaluating it against other destinations? We’d love to hear your thoughts, perceptions, concerns, and experiences!

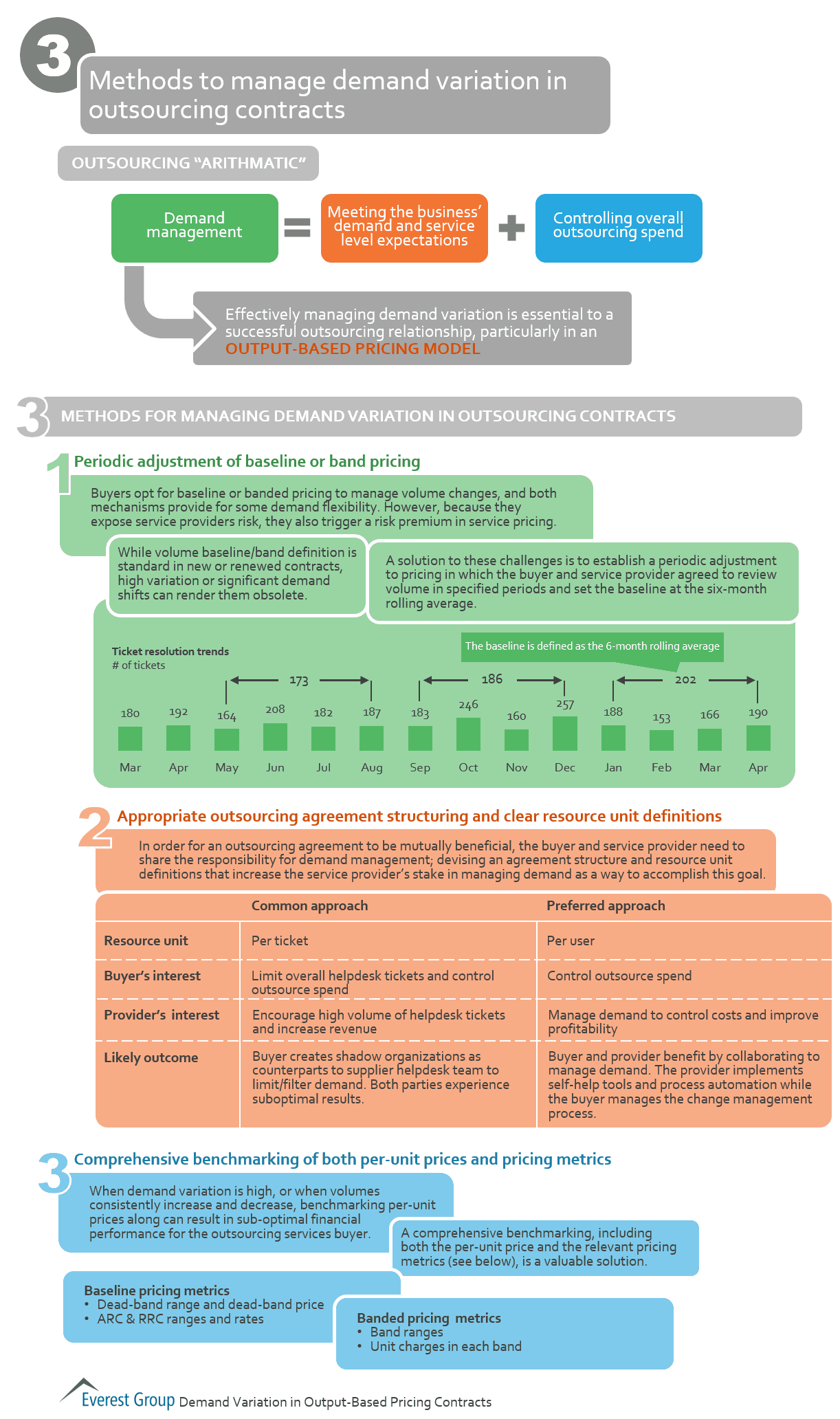

Methods to manage demand variation in outsourcing contracts

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields