Why Benchmarking Fails: 5 Common Factors | Market Insights™

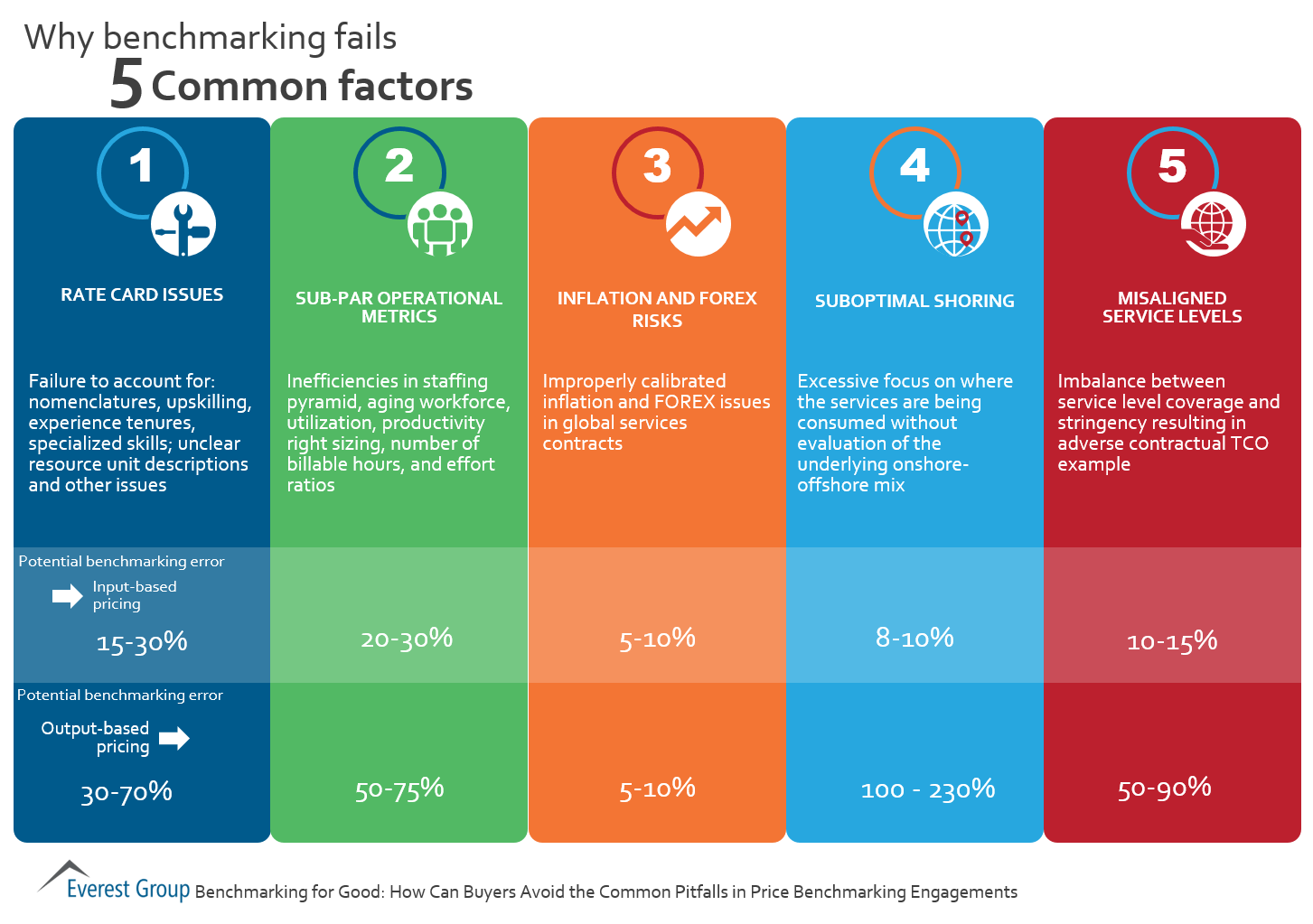

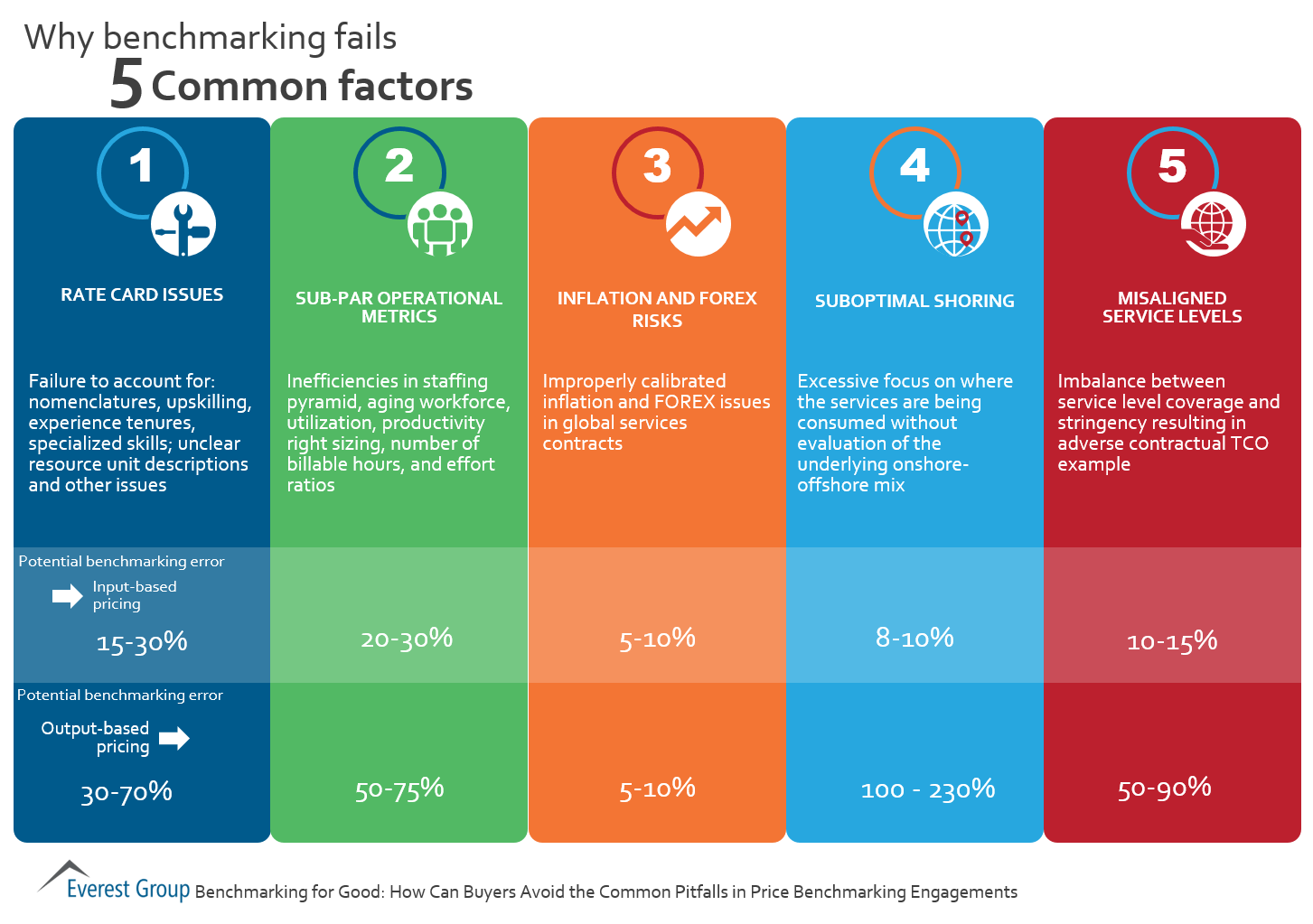

Common issues relate to: rate cards, sub-par operational metrics, inflation and FOREX, suboptimal shoring, and misaligned service levels

Common issues relate to: rate cards, sub-par operational metrics, inflation and FOREX, suboptimal shoring, and misaligned service levels

Is Infosys moving in the right direction? At the end of 2014, I blogged that Vishal Sikka, who had been on board as CEO and MD only a few months, had made an effective start in reshaping the company’s strategy. In Q1 2015, I blogged about how Infosys was aligning with the digital direction of the market and rethinking how to optimize its existing services. And a year ago, I blogged about Sikka shifting the company away from the maturing labor arbitrage market with slowing growth and margin compression and into more fertile growing markets. Recently there has been a lot of noise in the media again and a lot of rumors about disagreement among the company’s founders, board members, and activist investors/shareholders. I want to shed some light on their debate, as the Infosys dilemma is really an industry-wide dilemma.

Infosys has been in the press a lot recently, across a number of issues. However, at the heart of many of these stories is a deeper debate that Infosys is having with its shareholders to determine the go-forward vision for the company. At this time, it appears that the two visions Infosys must choose between are “arbitrage first” or “digital first.” Let’s look at these visions from each side’s perspective.

“Arbitrage First” Vision

The vision: Infosys will consolidate its role as the leading labor arbitrage player. It will grow through industry-leading talent based in India and build on its reputation for premium services.

Proponents: Infosys’ founders and activist shareholders advocate this vision, pointing to the fact that this strategy yielded robust margins for many years and gave Infosys its market-leading position. The company they built was aligned against values of personal sacrifice, frugality and expectation of high margins; and they believe the services industry will continue to be dominated by companies that maintain tight cost controls and pricing discipline.

Under this scenario:

“Digital First” Vision

The vision: Infosys will transform into a digital company to create a new source of value for its customers. The new digital business models will involve a new talent base be less dependent on labor arbitrage.

Proponents: The Infosys board of directors and CEO Sikka. When Sikka was appointed, he was given a mandate to implement a digital-first strategy. He clearly understands the challenges and has been moving the firm in this direction.

Market realities:

Under this scenario:

Hybrid Vision

In theory, both visions could exist simultaneously in a “hybrid” version. However, I believe that a hybrid vision inevitably will lead to an arbitrage-first company. I argue that the difficulty of executing the digital-first component will be overwhelmed by the near-term benefits of the arbitrage-first vision. By forcing a clear choice, Infosys will achieve better results in either strategy and avoid the pitfalls of conflicting goals and poor execution.

Implications of the Vision Choice

Both the arbitrage-first and digital-first visions are legitimate. But each will lead the firm to a different place. These choices have far-reaching consequence across all of Infosys’ constituents – affecting board make-up, firm governance, employee talent models and compensation. Investment decisions, whether to return cash to shareholders and the brand and promise that the firm communicates to customers also will flow from the choice in vision.

For now, it appears that the digital-first vision is in ascendancy. However, it remains to be seen whether the shareholders will have the patience to see this through given the activist shareholder agitation.

Practice Director of Location Optimization Sakshi Garg will be a featured speaker at the Philippine Health Information Management Business Process Offshoring Forum. She will host a session titled “Assessment of the Philippines as a Leading HIM Services Delivery Location.”

The purpose of the forum is to provide learnings about new developments in the Philippine offshoring industry and to exchange ideas with US and Philippine healthcare industry stakeholders.

When

February 16, 2017

9:00 a.m. – 2:00 p.m. ET

Where

Kalayaan Hall, Floor 2

Philippine Center

556 Fifth Avenue, New York, NY 10036

Speaker

Sakshi Garg

Practice Director, Location Optimization

Everest Group

Peter Bendor-Samuel, CEO of Everest Group, said, “I wonder if the industry deceleration we have been forecasting is catching them by surprise and they are getting feedback from the market that their original forecast is badly off. They may also be looking for a way to tell a better story given these challenging times. Another contributing factor to the uncertainty could be the pause in globalisation that is occurring as signalled by the new administration in the US and Brexit and they need more time to watch how this plays out.”

Thursday, February 16th, 2017 | 9 a.m. CST, 10 a.m. EST, 3 p.m. BST, 8:30 p.m. IST

Geopolitical dynamics have significant impact on the global services industry, and 2016 sure was a year of change in nearly every corner of the world! If you’re trying to make sense of how this volatility will impact your global services strategy, you will want to attend our Market Vista webinar.

In this one-hour webinar we’ll cover

Presenters:

Eric Simonson, Managing Partner – Research

H. Karthik, Partner – Global Sourcing

Anurag Srivastava, Vice President – Global Sourcing

Who should attend?

A sea change is starting because of digital technologies. The impact as companies apply these technologies to their business will be massive – much bigger than the Industrial Revolution with the invention of the loom for manufacturing clothing and Ford inventing the production for manufacturing automobiles. Everyone has been talking for some time about how big an impact these technologies will have on the services industry. But there is a new factor now that makes the potential impact even more significant: the protectionist activities driving companies to step back or pause in globalization and offshoring. I think the services industry would be foolish to ignore the potential of this greater impact. Let’s look at where businesses are headed.

There can be no denying that the stakes have been raised and barriers are being put in place to make globalization and offshoring less acceptable and expensive. In Europe, it is evident with the Brexit bill and the UK opting to leave the EU. In the US, protectionist barriers are starting to be executed through proposed changes to immigration law and H-1B visas, tax reform and potential border tax implications, and reputational risks arising to companies from government entities or disgruntled employees and vocal press entities. The result: companies are paying more attention to how to do work onshore without suffering negative cost impacts.

By investing in digital technologies such as Robotic Process Automation (RPA), cognitive computing, automation and cloud, companies can drive cost improvement by dramatically improving the productivity of their workforce. In many cases, they can achieve cost improvement even greater through improved productivity than through labor arbitrage and thus offset impact of not sending their work offshore.

Of course, service providers also can use these technologies to improve their own workforce productivity to offset the potential of rising costs from immigration and H-1B visa reform in the US.

Our market data shows leading providers in the services industry have been looking at digital technologies and associated digital models well before this step back in globalization. Our tracking of service providers clearly shows the traditional services (labor arbitrage, offshore factory model, remote infrastructure management and asset-intensive infrastructure) grew by only .1 percent last year. Almost all the growth in the IT and business process services market came from new digital offerings – which are currently growing at over 18 percent a year.

Although the trend in digital services has already been growing, we believe the current climate discouraging globalization and offshoring will further accelerate the adoption of digital models. This will force the current shared-services structure. It also will force the provider community to fundamentally change their business models and the way they currently structure their business to deliver services.

But in performance rankings, TCS, Cognizant, HCL, Accenture and L&T Infotech are honored for creating best ‘overall experience’ for clients

Despite large-scale investments by service providers, 48 percent of enterprises surveyed by Everest Group are not satisfied with their service provider’s performance. In particular, service providers are performing poorly as “strategic partners” for enterprises and score an average rating of five on a scale of one to ten.

There are also significant gaps in enterprises’ expectations and service providers’ performance with respect to innovation, creative engagement models and day-to-day project management.

“Most service providers are perceived to be technically competent, but technical expertise and domain expertise are considered ‘table stakes’ by enterprises across industries,” said Chirajeet Sengupta, partner at Everest Group. “Enterprises now expect their service providers to move beyond day-to-day delivery and focus on larger strategic business issues. Unfortunately, service providers still have a long way to go to meaningfully engage clients and become strategic partners, and that is a significant concern for the industry. This research signals the wake-up call and offers service providers guidance on how to strategize their engagement approach and prioritize investments to meet mounting customer expectations.”

In general, enterprises believe that mid- and small-sized service providers bring considerably more innovation and engagement flexibility than their larger counterparts. In fact, enterprises believe some large service providers have become lethargic and complacent and are indifferent to client requirements.

In contrast to these sentiments, five predominantly large service providers received the honor of creating the best “overall experience” for clients, based on client commentary and weighted aggregate ratings given by interviewed enterprises on key assessment dimensions.

These results and other findings are explored in a recently published Everest Group report: “Customer (Dis)Satisfaction: Why Are Enterprises Unhappy with Their Service Providers?” The research summarizes over 130 interviews conducted with enterprises across the globe regarding the capabilities of their service providers with respect to applications, digital, cloud and infrastructure services. The report also details the technology investment priorities of enterprises and opportunity areas for service providers.

***Download Complimentary High-Resolution Graphics***

Key takeaways from the research findings are summarized in a set of high-resolution graphics available for complimentary download here. The graphics may be included in news coverage, with attribution to Everest Group.

The graphics include:

Join Everest Group leaders and analysts at the 2017 NASSCOM India Leadership Forum, February 15 -17. On February 16, Everest Group CEO and Founder Peter Bendor-Samuel will lead a presentation titled, Demystifying Innovation: What, Why, Who, and How – An Enterprise Perspective. The discussion will highlight findings from Everest Group’s recent study with 100+ CIOs on innovation in global services and will answer key questions like, what is innovation and why does it matter to enterprises? Where does innovation create the most impact? How do enterprises measure the impact of innovation? Who is best suited to deliver innovation (a supply-model comparison)?

When:

February 15-17, 2017

Where:

Mumbai, Maharashtra, India

Upper Lobby

Everest Group speakers:

Peter Bendor-Samuel

CEO and Founder, Everest Group

Presentation will is on February 16 in Board Room I

Time: 6:00 – 7:00 pm IST

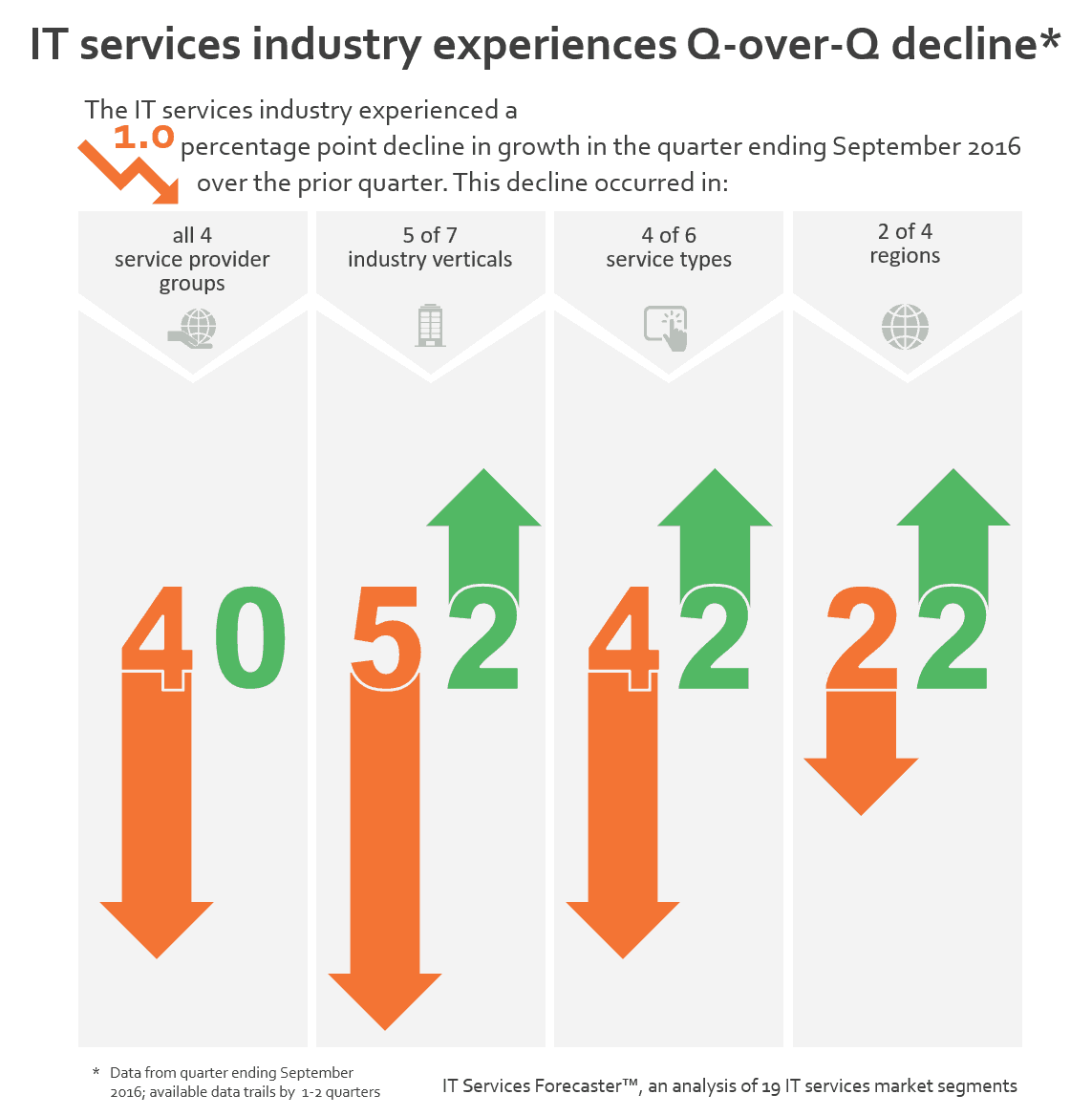

The IT services industry experienced a 1.0 percentage point decline in growth in the quarter ending September 2016

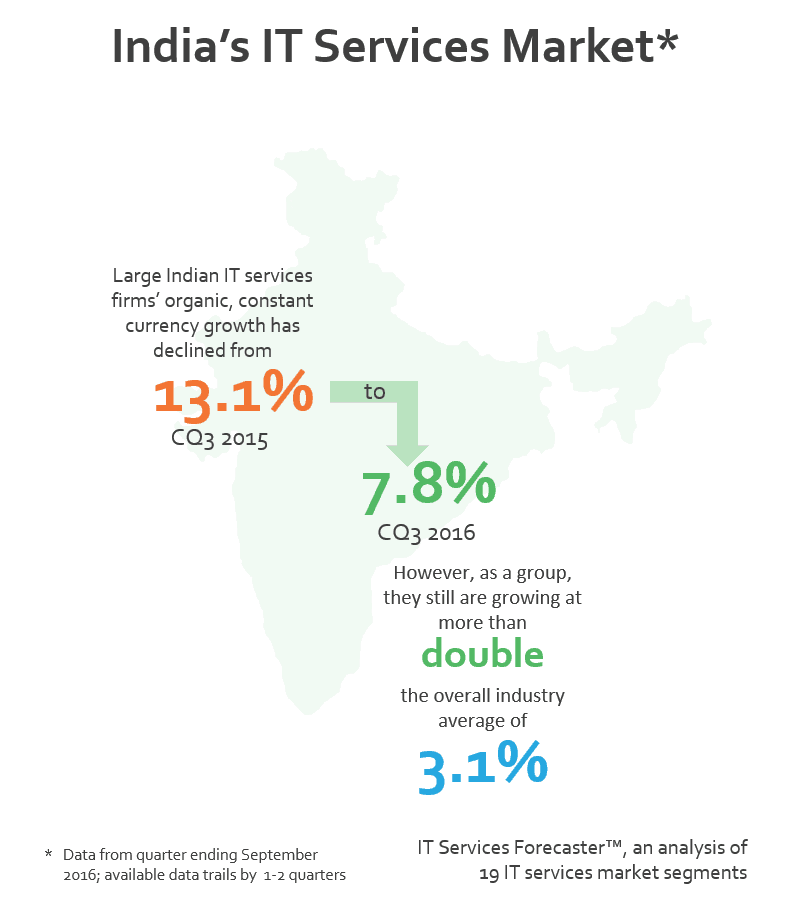

Large Indian IT services firms’ organic, constant currency growth has declined from 13.1% to 7.8%

in the last quarter

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields