Multi-Process HRO ACV: Up and Down | Market Insights™

Multi-process HRO ACV grew by 4%, but … while new deals and scope expansions, both mid-tenure and renewal, contributed to ACV growth, terminations, de-scopes, and non-renewals hampered growth

Multi-process HRO ACV grew by 4%, but … while new deals and scope expansions, both mid-tenure and renewal, contributed to ACV growth, terminations, de-scopes, and non-renewals hampered growth

How to gain momentum for HR analytics

Most organizations experience a honeymoon period at the start of their digital journey. “Investments are flowing, everybody believes in this brave new world they are going to create together,” according to Chirajeet Sengupta, Everest Group Research vice president member of the IT services research team. Read more.

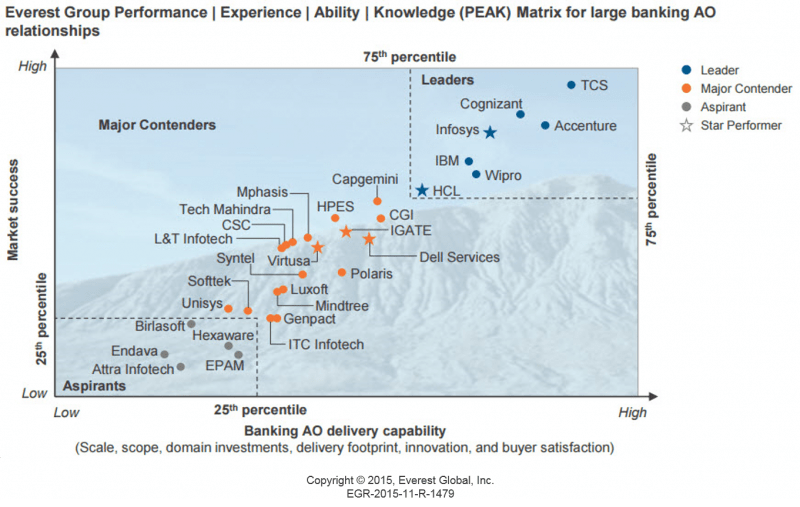

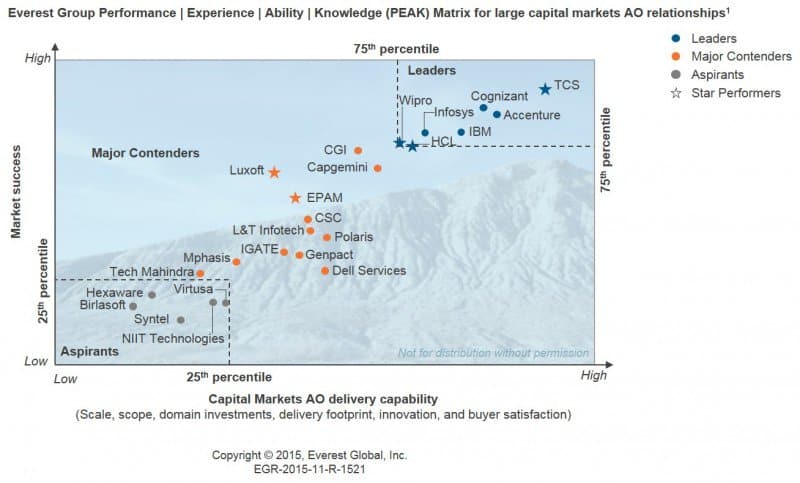

With no rest for the weary, a wave of regulatory overhaul and technological disruptions made the first half of 2015 very busy for enterprises in the banking, financial services, and insurance (BFSI) sector. Indeed, rather than being an enabler of efficiencies and operations, technology is now the fundamental differentiator for banks to grow their revenue and increase market share.

To keep up with all the activity, Everest Group in the past six months published a number of research reports examining the health of the market, the service provider landscape, and the digital effectiveness of BFSI organizations.

Following are some key insights and highlights from our research.

So what is in store for the next few months? Lots! Our upcoming reports through the end of 2015 include:

Everest Group’s goal is to help ensure enterprises and service providers achieve maximum success from their sourcing initiatives. Thus, we encourage you to reach out to us directly with your questions and comments.

Jimit Arora, VP and Global Head of IT Services Practice, [email protected]

Aaditya Jain, Senior Analyst, [email protected]

Archit Mishra, Senior Analyst, [email protected]

Ronak Doshi, Senior Analyst, [email protected]

The concept of process automation in outsourcing is getting a lot of attention these days. Everest Group has pulled together a collection of Market Insights™ to help you to make sense of your automation options … as well as to understand their benefits and challenges.

Click on any image to enlarge it

Used to be that if you delivered against the SLAs in your CCO engagements service providers could count on a pretty stable book of business. The formula was to deliver consistently solid service and continue to drive a compelling business case for clients. In fact, adherence to SLAs was often one of the top criteria against which the buyers we spoke to would evaluate the success of their CCO engagement. But times are changing. Everest Group’s research shows that delivering on SLAs is now table stakes. And despite the fact that CCO providers typically do a solid job delivering on SLAs, over the past 2-3 years the rate of contract terminations has edged up from 50% in 2012 to 60% in 2014. What’s driving this ongoing shift?

There’s more to the story than meets the eye. While terminations are up, so too is the number of net new contracts and the scope and size of existing active contracts. In fact, total spending on CCO services continues to grow at 5% CAGR. While this may seem slow compared to other services markets, you have to keep in mind that the CCO market is huge at US$75 billion in annual revenues, so the absolute spending growth is not insignificant.

A key point here is that existing contracts are now contributing the larger share of net new spending in the CCO market, with average contract sizes growing from US$32 million in 2009-2011, to US$51 million in 2014. This growth in spending tends to come from a notable expansion in process scope. Not only have we seen growth in the total number of processes clients are asking their CCO providers to assume on their behalf, a bulk of the incremental processes fall into the category of value-added services. Growing from an aggregated inclusion rate of 42% to 61%, this could involve processes such as channel management, customer retention, analytics, or performance management.

At the same time, major CCO buyers tell Everest Group they are increasingly looking for opportunities to develop deeper working relationships with fewer CCO service providers – essentially consolidating their portfolio of work with fewer strategic partners. The expectation of these relationships is that CCO providers will meet a larger set of client requirements through a broader range of capabilities, including process scope, geographic coverage, and industry specialization. We have already seen CCO providers responding to this shift in buyer expectations as evidenced by the number of acquisitions taking place in the market, targeting both growth in scale/scope, but also in terms of vertical industry and technology capabilities.

For service providers to hold onto their client relationships they must continue innovating their approach to client relationships, the offerings in their portfolios, and their willingness to broaden the definition of customer care services.

For more CCO insights, download a complimentary preview of our CCO Annual Report.

Photo credit: Flickr

Demand management has been the unicorn of enterprise IT – something frequently talked about but rarely seen and never captured. Every centralized IT organization would love the ability to accurately manage user demand. It would provide tremendous return if it were possible; but to date it has been largely or completely thwarted in large enterprise IT organizations. But there’s good news, thanks to the as-a-service model.

The reason demand management has been thwarted is that IT is organized on a functional basis; the data center, servers, network, purchasing, and security app development and maintenance are all defined functionally. IT leaders are held responsible for driving out cost and building capability that is shared by multiple departments. The problem is there is no relationship between demand and supply capability because business users don’t understand how to measure their usage/demand.

When IT asks business users how many servers they you use, their response is often “How many did we use last time?” Or when IT asks how many programmers will you use and why, business user typically respond with “We need 10 percent more than we had last time.” There is no relationship between actual demand and the actual demand drivers and the estimates they must provide to IT. This is a hopeless and fruitless exercise. It’s like a broken clock that is right only twice a day. This demand estimate is doomed to be wrong every day.

So what’s the answer? We need a service construct where IT is organized into service models. This construct gives business users a way to understand their usage or demand. For example, a healthcare payer understands how many people it expects to enroll. This is a metric the business can use to predict usage and the time frame in which they will need the service. IT can then manage the demand for the service it provides to the payer based on the number of enrollments.

When companies organize IT along service lines, they can translate business activities into technical consumption. The as-a-service construct attempts to make as much of its service chain or supply chain as elastic as possible. It adjusts each part of the supply chain to the usage demand. So unlike the traditional functional IT structure, business users only pay for what they use.

There are three mechanisms to make a technology or service elastic:

Typically, as-a-service providers use all three of these techniques to allow them to use their full service stack with the business metrics that the technique serves.

The as-a-service model achieves one of the Holy Grails of centralized IT – it provides a realistic demand management vehicle where the business can make accurate estimates. It also provides paying for the services only when they are used; this is the consumption-based model that the services industry is moving to.

Demand management to date has been completely illusive to centralized IT because of the take-or-pay nature of IT. This method for building capability – and business users sharing the cost to be able to use it – has no connection to business metrics that the business can control and understand how to estimate their technology capacity/demand. But the good news is the as-a-service model puts a rope around the unicorn. It creates the ultimate answer to demand management.

Latin America gains access to world-class ITO and BPO sourcing research that helps improve competitive decisions

DALLAS and MONTEVIDEO, Uruguay, SEPTEMBER 15, 2015 —Everest Group will expand its Latin American presence via a joint agreement announced today with MVD Consulting. The agreement provides regional consumers and providers of sourcing services with access to sourcing research content and insight from Everest Group.

Everest Group is a US-based global consulting and research firm, focused on strategic IT, business services, and sourcing. MVD Consulting is a leading regional business consulting firm with a focus on globalization and operational optimization for companies in the Latin American market. The agreement comes as firms operating in the region—both global and those based in Latin America—increasingly seek to boost reach and efficiencies.

Reports and other joint consulting services are available immediately by contacting either Everest Group or MVD Consulting.

The partnership will bring research offerings from Everest Group—including Market Insights™, PEAK Matrix™, Market Vista™, and customized reports—to the region via the local touch and reach of MVD Consulting. Local service providers will be able to access and consult on a variety of research topics and global data, including pricing, which will enable them to better compete in the marketplace. In turn, enterprise buyers will have access to the powerful combination of leading research insights and local advisory services to better manage their sourcing needs and current contracts.

“We are excited about our partnership with MVD Consulting, an established firm with an excellent reputation in Latin America. We believe our research can help providers and enterprises make high-impact decisions and support the continued growth of the Latin American global services market—and MVD Consulting is the right partner to deliver our insights to the region,” said Eric Simonson, managing partner of Everest Group.

“Hundreds of outsourcing providers from Latin America will be able to plan better with Everest Group’s research and MVD Consulting’s local best-in-class advisory services. Our clients will be pleased to have an additional source of information for fact-based, smart planning, as well as customized information, at a reasonable price. And those who consume sourcing services now will have stronger information to enhance their processes, costs, and forward planning,” said Martin Bouza, MVD Consulting co-founder and lead of the Operational Optimization practice.

About MVD Consulting

MVD Consulting helps companies of all sizes and their management teams achieve an agile growth, understanding and maximizing the benefits that come with globalization by working together with them in main areas like Globalization Strategies and Operational Implementation. Our team has extensive seniority and regional knowledge on both sides of the equation, helping vendors as well as consumers with a Spark of Change. We base our process on high quality research and data, add strong experience from our diverse industry practices and provide advisory actions that are real and possible to implement. We also support Government organizations and multilateral agencies that require strategic advisory to foster services industries in Latin America. More can be found at http://www.mvdconsulting.com.

“In the past, global in-house centers (GICs) were playing service delivery roles for the enterprise,” says Salil Dani, vice president of global sourcing for Everest Group. “While most of the GICs continue to play this role even now, there are some GICs that are taking ownership for digital transformation for the enterprise.” Read more.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields